Trading Steem with the Wyckoff Method

AssalamuAlaikum & Greetings Everyone!

It's me @amjadsharif

From #pakistan

AssalamuAlaikum & Greetings Everyone!

It's me @amjadsharif

From #pakistan

I am really happy to participate in this season 20 first week Trading Steem with the Wyckoff Method. The topic I really enjoyed and the knowledge I learned was amazing to me.

| Question 1: The Three Fundamental Laws of the Wyckoff Method |

|---|

- Describe the three fundamental laws of the Wyckoff Method: the Law of Supply and Demand, the Law of Cause and Effect, and the Law of Effort vs. Result. Explain how each law can help predict the price movements of the Steem token within the cryptocurrency market.

The Wyckoff method is important in stock market and cryptocurrency trading. It was developed by Richard D Wyckoff. This method helps in understanding market behavior and predicting prices. As I mentioned it is widely used in cryptocurrency trading so this principle can also be helpful in analyzing the price movements of Steem Tokens.

There are three fundamental laws of Wyckoff:

Supply and Demand Law

Explanation This is Wyckoff's most important principle that describes the basis of any market price movement and behavior. The principle is very simple:

Demand > Supply: Prices will rise.

Demand < Supply: Prices will fall.

Wyckoff believed that an expert trader must understand and analyze the forces of supply and demand, in order to predict possible price movements.

Application to Steem If there are more people buying Steem, its price will increase and if more people are selling Steem, its price will decrease. This can be estimated by looking at the market size.

The Law of Cause and Effect

Explaination This law explains that every major movement in the market has a specific cause and is followed by an effect. Wyckoff used this law to understand and explain certain patterns in the stock market. According to this law:

A "cause" is a period during which the market is preparing to make a particular move a consolidation phase.

"Impact" is the result of this preparation, which manifests as a significant movement in price.

Application to Steem Investors can use this law to predict when and how a big move in the market is going to occur and act accordingly.

The Law of Effort vs. Result

This law describes the relationship between price and volume. According to Wyckoff the movement in the market (price increase or decrease) should be proportional to the effort (volume) put into the market. If there is a big price move but the volume is low, it may be an indication that the market will not last long. This law can be understood in three main ways:

More effort and more results: The market movement is strong and will continue.

More effort and less result: The market may change soon as the price movement weakens.

Application to Steem Steem is being bought and sold more but the price is not increasing or decreasing , so this is a sign of market reversal. While high volume and clear price movement is confirmation of the strength of the current trend.

These three principles of Wyckoff help investors and traders understand the complex mechanisms of the market and make better investment decisions. Through these principles they can identify major market forces and adjust their strategies accordingly.

| Question 2: Cause and Effect in the Wyckoff Method |

|---|

Explain how the Wyckoff Method uses the principle of cause and effect to anticipate price actions. Provide an example of how 'cause' can be quantified (such as accumulation/distribution) and how 'effect' can be expected, using Steem’s historical price data to illustrate your point.

The principle of cause and effect in the Wyckoff methods is very important for understanding price movements. This principle explains how to price movements in the market result from the actions of investors and traders.

Cause in Accumolation and Distribution

"Cause" is measured by the process of accumulation or distribution. When large investors quietly buy into an asset, it is called accumulation. When they sell, this is called distribution. Both of these stages are indicative of future big moves in market price.

Effect in Accumulation and Distribution

When the accumulation period ends, the price starts moving upwards, which is called markup. Thus when the distribution is complete, the price starts to go down which is called markdown.

Balance of cause and effect

The balance between cause and effect is important in the Wyckoff Method. If the cause is less the Effect will be less and if the cause is more the Effect will be more. Understanding This balance helps Traders make better decisions.

Example of Cause and Effect in Steem Historical Data

Taking the example of Steem cryptocurrency, if Steem Token price historical data we see that the price is moving in a limited range for a long period of time and the volume of buying is increasing, then it can be an accumulation phase.

Accumulation price range between $0.14 - $0.17 which is strong supply zone.

Effet in price after Accumulation Cause.

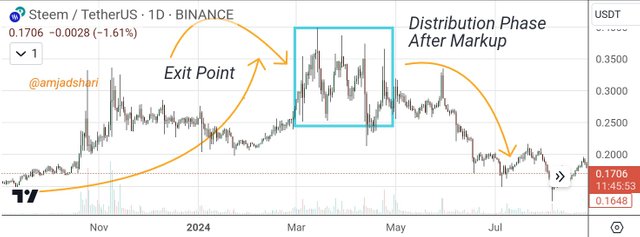

Then, a large increase in price markup can be expected, which is the effect. Conversely, if large sales are observed after a sustained price increase, this is an indication of distribution phase and a price reduction is likely a markdown.

Distribution price range between $0.25 - $0.40 which is strong demand zone.

Effect After Distribution Cause

This principle in the Wyckoff method is considered an important tool for analyzing price action, which helps traders predict market direction and trend.

| Question 3: The Law of Effort vs. Result |

|---|

Explain how the Law of Effort vs. Result can be observed in the trading volume and price movements of the Steem token. Use a real chart example where this law was evident in the Steem market, and discuss what insights a trader can derive from this analysis.

The law of Effort vs. Result

The law of effort vs. result plays an important role in the analysis to understand the relationship between price and trading volume in the market. According to this law, if the price movement and volume effort are in sync, then the price movement is considered strong. But if the volume attempts to decrease, the price movement changes.

Understanding of the Law

Wyckoff's Law of Effort vs. Result is a principle that helps to understand the relationship between trading volume and price movement. It tells us whether the price movement is commensurate with the volume of trading activity. If there is a difference in volume and price movement. So it can help to test the market.

Observing the Law in Steem Token

Let's assume that this law is evident on the chart of Steem tokens. That if a period shows a significant increase in trading volume and no significant increase in price, it indicates that volume is not accurately reflecting price movement. Observation in this situation can be done as follows.

Initial Phase: A period of high volume trading is observed, with the Steem token's volume bars noticeably larger then previous periods.

Price Movement: Despite the increase in volume, the price of Steem remains relatively stable of shows minimal upward moment.

Insights for Traders:

Possible reversal signal: If the price does not move higher despite this volume. So this is an indication that the current trend is weak. Traders should exercise caution as this could signal a potential reversal or consolidation.

Market Weakness: The Law of Effort vs. Result highlights market weakness when high volume does not push the price higher, suggesting that the buying pressure is not strong enough to sustain an upward trend that could lead to a potential correction. .

Confirmation of trends: Beside, if there is a significant increase in price with high volume.

So it is a confirmation that the market effort is giving the expected results which reinforces the strength of the current trend.

| Question 4: Key Phases of the Wyckoff Method |

|---|

Discuss the key phases of the Wyckoff Method: accumulation, markup, distribution, and markdown. Provide historical price actions of the Steem token as examples of each phase and explain how a trader can identify the current phase of the market.

The Wyckoff's principle is a method of analyzing the price trends and investment opportunities in financial markets. It consists of four key steps understanding of which helps predict market behavior and make sound decisions. These steps are detailed Markdown

- Accumulation

- Markup

- Distribution

- Markdown

If traders understand these key phase, it will be easier for them to product the market and follow the trend.

Accumulation Phase:

This is the phase when the price of a stock stabilizes below and large investors buy quietly. In this phase the market is weak and traders wait for large investors to come in. During this time the price does not move much and This is a great opportunity for buying.

Example: When the price of Steem Token reaches the lowest level in history and does not change in price for a long time, it is the accumulation phase.

Markup Phase:

This phase begins when the price rises rapidly. As market demand increases, large investors start buying at lower prices and common traders also become interested in buying.

Example: A sudden spike in the price of Steem Tokens is a sign of a markup.

Distribution Phase:

In this phase, teachers of large capital gradually start selling what they have bought. While the small or general trader is still interested in buying. Prices fluctuate during this phase and traders see this as an opportunity to sell.

Example: When the Steem Token price reaches a stable level and large investors start selling. So this begins the industry position phase.

Markdown Phase:

This is the last step. In which the price decreases rapidly and the market demand decreases. Small traders sell at a loss. While big investors keep their money safe.

Example: When the price of Steem Token suddenly falls, then this stage is called Markdown stage.

Identify the Current Phase:

Traders can gauge current market conditions by looking at chart patterns volume and price movement. If the price is stable and the volume is decreasing, it can be accumulation. A surge in price and an increase in volume indicate a markup. While a stable price and high volume can be a sign of distribution.

| Question 5: Applying the Wyckoff Method |

|---|

Outline the step-by-step process for applying the Wyckoff Method in trading the Steem token. Discuss how to identify the accumulation phase, signs of supply/demand tests, and the transition to a markup phase. Use a real example of the Steem token to illustrate entry and exit points based on the Wyckoff Method.

Following is the step-by-step procedure for applying the Brother Method to trading Steem Tokens:

Identification of Accumulation Phase:

The accumulation phase is the phase when large investors start buying tokens from the market and the price continues to move in a certain range. In this fee, the price is usually on the downside and there is less selling pressure in the market.

Example of Steem Token: If the price of Steem is low for a period of time and then stabilizes to a certain extent, this indicates an accumulation phase.

Price move between support and resistance levels.

Price move side way for certain time.

Volume increase slowly.

Supply and Demand Test:

Large investors in this fee move the price up and down by evaluating the current supply in the market. Symptoms such as springing and shakeout can be seen here. Where the price only goes down temporarily to drive weak traders out of the market. And then quickly returns.

Steem Token Example: If the price of Steem drops suddenly and quickly bounces back. So this is indicative of a test of supply and demand in the market. There may be a buying signal here as the price will move back up.

Start of Markup Phase:

When the price passes the test of supply and begins to rise steadily. So the markup phase begins. In this phase, demand exceeds supply and prices begin to rise steadily.

Example of Steem Token: The price of Steem continues to increase and the market shows a bullish trend. If it does, it is a sign of a markup phase. There is a clear opportunity to buy and you can execute profitably when the price continues to rise.

Entry and Exit Point:

Entry Point: During the accumulation phase or after the supply test when the price bounces back. And make breakout. Traders can buy here.

Exit Point: During the rally, when the price reaches a major level and the market exhibits the effects of the distribution phase, then the exit should be done.

The main objective of the Wyckoff method is to understand the price movements and to enter and exit the market at the right time to maximize profits.

Conclusion

The Wyckoff method, used for technical analysis, helps in better understanding the market structure and gives investors an opportunity to correctly identify market movements. Its main purpose is to track the footsteps of large institutional investors and trade with them.

All Screen shot taken from trading view

I invite the friends @sojib1996, @shahid76 and @riya01 to join this.

Thank You

Twitter X promotion

https://x.com/AmjadSharifWat1/status/1834981986684780654?t=XS6A_L2DXvtfRE-eTyLLvA&s=19

The three basic laws of the Wyckoff Method, namely the law of supply and demand the law of cause and effect And The law of cause and effect have been explained in great detail by you.

According to the law of supply And demand if the demand is high the price rises and if The supply is high the price falls.

The Law of Cause and Effect states That there is a cause behind major market, movements such as the increase or decrease in the price of the Steem token.

The Law of Effort vs. Result explains the relationship between price and trading volume. A market Trend is strong if the volume is accompanied by a change in price.

Likewise, in this post, you have outlined four key steps: Accumulation, Markup, Distribution, and Markdown. Historical data of Steem Token is also presented with the help of these steps to predict the current market conditions. You have created a great post and hope you get success best of luck

Very well done my friend, How things have been going on there? Haven't seen you in a while in the chat room.

Thank you, There is internett issue last few days

I hope everything has gone back to normal.

I love how you've explained the topic in a clear and engaging way. It’s always inspiring to read content that is both informative and well-structured. The way you’ve broken down the details really helps in understanding the subject and I appreciate the effort you’ve put into making it accessible for everyone. Your passion for this shines through and I can tell you’ve put a lot of thought into this entry. Good luck with the contest

Thanks friend this topic was difficult but it was easy for me, I am involved to forex trading since 2012. From 2016 or 17 I also started crypto trading and I learned about a lot of indicators, learned patterns, looked at market behavior. It took me some time to understand this method, but if you try, any method, Wyckoff's method or any other method, can be understood.

My dear friend thank you very much for participating in the contest you presented the price prediction and exit points very nicely all of which were amazing and important good luck to you I hope you participate in more contests here in the future.