"SBD and Stablecoins: Challenges, Opportunities, and the Future".

AssalamuAlaikum & Greetings Everyone!

AssalamuAlaikum & Greetings Everyone!

It's me @amjadsharif

From #pakistan

From #pakistan

Q.1 - Understanding the Role of SBD as a Stablecoin

Analyze how SBD functions as a stablecoin within the Steem ecosystem. Discuss its benefits and limitations in comparison to other stablecoins like USDT or DAI.

SBD as a Stablecoin

Introduction

Steem Blockchain Dollar (SBD) is a decentralized dollar asset created for the community of the steem Blockchain. Unlike other cryptocurrencies, SBD has the potential to constantly be valued at near its dollar equivalent by design. This stability thus offer a good utility to the users within Steem platform thus allowing them engage in economic activity without having to worry much about the drastic swings in the price of the currencies.

Functions of SBD as a Stablecoin

SBD is developed in order to be used as a part of the Steem blockchain’s reward system. Both content creators and curators earn SBD, STEEM, or Steem Power (SP) depending on a number of factors. In the essence of designing SBD, the vital objective was to create both a means of exchange and a medium of value within Steem.

Pegging Mechanism:

SBD is intended to maintain a 1:1 peg with the US dollar. It is almost similar to other stablecoins but its peg is not as fixed as USDT or DAI for instance. Value of SBD is determined by supply, demand and external demand on cryptocurrency exchanges.

Conversion Feature:

Unlike Bitcoin, which users can exchange to other currencies using a conversion interface, STEEM uses an internal method where users are able to exchange SBD to STEEM. Regarding this issue, Steem blockchain collects witnesses’ median price feed, which fairly calculates its conversion rate.

Interest Payments:

Previously, SBD holders have claimed interest payments to increase holding period measured with h. But for now this feature has been turned off for a long time, making it an unattractive tool for investment.

Numerical Advantages of SBD as a Stablecoin

Platform Utility:

Steem is the most tied in with stage for SBD and is used for tipping, rewards, and transactions. This makes it fit well to be used when making very small transactions which may be prevalent in the site.

Decentralized Nature:

While centralized stablecoins such as USDT are anchored to central cryptocurrencies such as Bitcoin and Ethereum, SBD is the only stablecoin with the Steem blockchain. This does away with dependence on a central control point thereby improving the levels of trust and openness.

Content Monetization:

SBD acts also as the direct monetization of the equitable creation in which contributors are renumerated with relatively steady value of their contributions.

Liquidity Options:

Similar to other cryptocurrencies, SBD can be sold at various crypto exchanges which give transactions flexibility when converting it for other cryptos or to fiat currency.

Comparison of SBD with Other Stablecoins

Volatility Issues:

Nonetheless, SBD was designed to be permanently tied to the US dollar, so SBD can easily soar and fall dramatically in value due to the associated high risks brought by low market turnover and freewheeling buying and selling. This lessens its stability relative to very liquid stablecoins like USDT and DAI more so than before.

Lack of Widespread Adoption:

While Steem is more or less exclusively associated with SBD, other stable coins such as USDT and DAI can be used in various blockchains and decentralized applications.

No Collateral Backing:

While DAI is backed up by crypto assets with a large margin of overcollateralization, SBD leans entirely on the Steem’s core functionalities. They lack this collateral backing making their stability relatively frail in the face of market shocks.Limited Use Cases:

SBD has the primary utility within the Steem ecosystem. Other stablecoins including USDT are applied in other uses including lending, staking and providing liquidity for Decentralized Finance (DeFi).

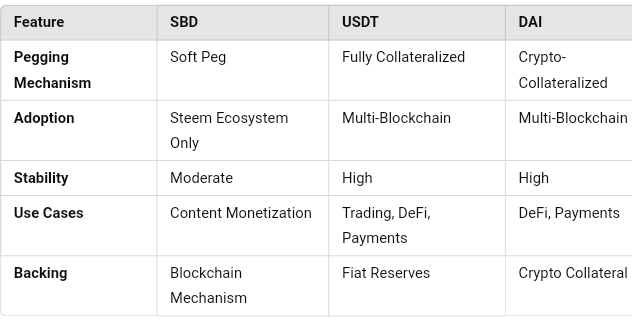

Comparative Analysis: SBD vs. USDT and DAI

SBD is an integral component of Steem due to acting as the stable value backstop for the more volatile Steem Dollars while facilitating optimal stable value trading among users. It has some advantages such as decentralization and platform utility but it has drawbacks which limits its usage more than other stablecoins like USDT and DAI. However, in order to extend Steem’s advancement even further, future developments of SBD which stable and wider application will be the key.

Q.2 - Addressing SBD’s Stability Challenges

Evaluate the challenges SBD faces in maintaining its stability. Propose solutions to strengthen its peg and ensure reliability in volatile markets.

Stability Challenges in SBD

Source

Stablecoins like Steem Backed Dollars (SBD) are designed to maintain a 1:1 peg with USD in order to have a stable asset amid highly fluctanting cryptocurrency markets for traders and investors. Nevertheless, these sources have never been consistent with SBD’s stability, leading to a problem in the reliability of the evolution. Challenges are discussed below with the possible solutions.

Stability Management Difficulties

Price Fluctuations of the STEEM token

That is, the value of SBD is dependent with the price of STEEM, which is the asset that backs it. Fluctuations in market price within STEEM bring about instabilities which makes SBD to be far from the peg value.

We have limited collateral mechanisms

SBD depends on STEEM for backings. As evident when STEEM’s market capitalization reduces, collateral that supports SBD can become inadequate and benchmarking happens.

Absence Of Riskless Gains Portfolio

It can be seen that limiting the arbitrage mechanisms would make it difficult for the traders to bring SBD back to its peg of $1 when it is trading above or below this price.

Market Liquidity Issues

SBD is not immune to low trading volume issue in exchanges which largely hampers it from managing volatility and retain its peg.

Speculative Trading

People can pump or dump SBD creating more fake demand or pushing down the price of its peg even more.

Proposed Solutions

Higher Security Level

Propose more of a mixed collateral model, including other stablecoins like SBD backed by other stable formations such as Bitcoin or Ethereum. It can offset risks associated with the price of STEEM since this diversification opens up different service revenue sources.

Dynamic Supply Adjustment

Stabilize the supply and its adjustment mechanism so that SBD tends to peg effectively and the supply of SBD increases or reduces with the help of a better mechanism as per the market demand.

Incentivized Arbitrage

Encouraging arbitrageur agents to operate when the value of SBD is other than $1. It could be minor traxactions fee cuts or bonus incentives for getting the price back to peg.

Market Maker Programs

Create and build relations with market makers to enhance the depth and quality of exchange order to ensure that SBD effect the peg as wanted.

Intersect with Decentralized Finance (DeFi)

By exploring new segments within DeFi where SBD can be employed, the primary would be to make the token popular again and create new mechanisms of dealing with SBD price volatility – lending and borrowing.

Public Enlightenment Programmes

Raise awareness about the ecosystem for SBD and discourage people from reselling to avoid getting Illectric Spa heirs again.

Q.3 - Expanding SBD’s Utility

Suggest innovative ways to increase SBD’s utility beyond the Steem ecosystem. For example, explore its integration into DeFi protocols, e-commerce platforms, or cross-border payment systems.

Expanding SBD’s Utility Beyond Steem Ecosystem

Steem Backed Dollars are the main stablecoin in the Steem ecosystem and are backed with US dollars. Although at the moment it is primarily applied to the Steem platform, the possibilities for its application elsewhere are vast. Here are some ideas meant to expand the utility of SBD beyond what is present in the confines of its structure:

Integration into DeFi Protocols

The expansion on Decentralized Finance (DeFi) provides a great way to increase the usefulness of SBD going forward. With SBD integrated into the platforms directly associated with DeFi, the token can be used as collateral to borrow or be staked for income generation. This would not only grow the demand for SBD, but it would also place SBD at the center of the decentralised financial system. For instance, integrating SBD with DEXs means that the users can swap the token with other cryptocurrencies, more so the process would not be associated with high transaction costs.

Adoption in Electronic Business Environment

Cryptocurrencies are currently quickly gaining popularity within e-commerce since they are fast and have fewer charges. Extending the feasibility of using SBD as a payment method with the given MOE&P partnerships can greatly boost its effectiveness. It also means that SBD holders can easily find stores and online marketplaces that would allow to make payment secured and fast. Business players on their part will be able to enjoy the lower transaction costs than when using the normal methods such as credit cards. This integration can help make SBD a reality not just for bulk transactions, but for frequent ones as well.

Cross-border Payments

One of the principal concerns on international transactions is the use of cost and time-consuming traditional systems. As SBD is stable and related to cryptocurrencies, they can become an ideal solution for making cross-border payments. It can be especially useful in those emerging markets that still have very low levels of financial inclusion. By operating with remittance companies or establishing SBD-based independent platforms for international transactions, it can be used in international trades as well as individual remittances.

Reward Schemes and Frequent Buyers Club

More companies are now seeking to incorporate crypto currencies in their companies’ incentive programs and reward based systems. A material’s stability is desirable in such applications, and SBD provides this property. SBD can be distributed as incentives to customers by various companies such as airline companies or retail chains and hospitality services. Users can use these rewards within the Steem ecosystem or sell them as other cryptos so it is a mutually beneficial system to consumers and businesses.

Relations with Local Concerns

Also, the increased popularity of cryptocurrency in certain geographic location necessitates the development of a commercial relationship between SBD and local business enterprises. People can use SBD to buy foodstuffs and other products such as clothes, from cafes, restaurants, grocery stores and other shops. From this initiative, business entities can have a less conventional payment approach to their clients which the public will be encouraged in accepting use SBD in their daily lives.

*

Inclusion at Freelancing Platforms

Other interrelated payment options are SBD, which freelancing platforms can allow freelancers and clients to use. A stable value of SBD would give freelancers a stable and reliable income guider, and or clients would be able to make payments faster and at low cost. It would be so integration that will present SBD to a global workforce, and therefore expand its scope.

Sequencing Authentic Resources

SBD can be applied to other areas such as tokenizing other valuable pieces of the real world like property, art or commodities. SBD can be used as a steady currency to pay for goods and services, or for the trading of tokenized assets in block marketplaces. This would see SBD being associated with the physical world assets which would make it more attractive to investors as well as companies.

Through the exploration of these unique opportunities, SBD can likely obtain greater usage and potential contributions to the international crypto space.

Q.4 - Adapting to Exchange Suspension of deposits.

Discuss strategies to adapt to this act from centralized exchanges like Upbit. Highlight the role of decentralized exchanges, peer-to-peer trading, or community-driven liquidity pools.

Exchange Suspension of Deposits

Source

Sometimes, such as when Upbit is pursuing more regulation or avoiding hacks, it may suspend deposits so that users are forced to trade on a centralized exchange. Such circumstances often negatively affect trading operations, or at least cause inconvenience for those who are highly dependent on large marketplaces. Nevertheless, it is possible to reduce such disruptions, factor that allows traders and investors to carry on their activities, using specific approaches.

1. Let’s know about decentralized exchanges also known as DEXs!

DEX is an exchange that does not require the services of any central management authority; rather, its operations go directly from one wallet to another. As you will recall, since DEXs provide a decentralized form of trading, they do not stand the risk of experiencing deposit suspension. These are Uniswap, PancakeSwap, and SushiSwap, which offer many tokens available for trading and set up for automatic exchange. By working DEXs into your trading practice, you get an option that is immune to external limitations introduced by a centralized exchange.

2. Utilizing Peer to peer Trading

Direct deal platforms for cryptocurrencies to provide users with the ability to trade with each other without third party involvement. Platforms such as Binance P2P and LocalBitcoins let individuals exchange crytocurrency by directly dealing with each other. In a time of deposit suspension, getting to P2P trading can provide a means to access liquidity to buy or sell an asset safely. It is effective if you deal with trusted and trustworthy merchants or use the sites employing credible escrow services.

3. Liquidity Pools to be Driven by the Communities

Liquidity pools are an inalienable part of the infrastructure of DeFi. When trading in decentralized tokens as we saw earlier, every trader would need the liquidity to either put up a price and find a taker or take another trader’s price and give them their assets, this liquidity is provided by participating in or using the lending and borrowing from existing community pools on various platforms such as Aave, Compound, or Curve even if there are restrictions placed by CE’s. These pools are based on smart contracts and as such have less dependence of a centralized control system.

4. This Has Been Made Possible Through the Preservation of Diversified Assets

When it comes to Flexibility, it is very important to have your tokens spread in different wallets and exchanges. Spread out your wallet’s by occasionally using both centralized and decentralized ones to cut on the number of your exchanges. That way, no single platform will completely bar you from accessing your funds or investment, should there be a suspension.

5. Staying Updated

It is good practice to closely follow announcements made by such exchanges as Upbit. Having an understanding of when a bank might suspend bank deposits and the likely time needed to resolve such suspensions, you will be better placed to act in a logical manner. Very often it is possible to find information and get different solutions on such occurrences using twitter, telegram or reddit involving the communities of crypto enthusiasts.

The fact is that deposit suspensions by centralized exchanges may be nothing more than slightly inconvenient. Through decentralized exchange, P2P markets, and liquidity pools, the trader can always remain agile and always have access to the market. And there you have it; diversifying your portfolio and being updated also help to ensure that you are ready to meet such tests. Foresight and versatility are the two most important features to consider since the market of cryptocurrencies is rather volatile.

Q.5 - Future Prospects for SBD

Reflect on the future of SBD in the evolving crypto landscape. How can the Steem community ensure its relevance and growth amid increasing competition from other stablecoins?

Potential Future of SBD and OTC Trading of Cryptocurrencies in the Developing Environment

Source

According to the research, as the cryptocurrency market evolves, stablecoins are stepping up to act as one of the cornerstones of the financial industry. Another particular case here is the relation of the stablecoin Steem Blockchain Dollars (SBD) which exists within the Steem ecosystem. However, it has become very important for Steem community to begin looking at how they can sustain SBD given the fact that USDT, USDC, and DAI are much bigger and more popular stabelcoins.

Present Position and Development Task

SBD was also intended to give users on the Steem blockchain some reliability or stability. This gives content creators and curators the opportunity to be compensated in a stable digital currency, against the unpredictable character of most cryptocurrencies. However, SBD faces certain challenges:

- Limited Use Cases:

However, most of the attractiveness that SBD has is in the systems of Steem. However, it has not realised the levels of usage of other stablecoins that are deeply integrated into trading, lending and other DeFi activities.

- Market Stability Issues:

SBD is fixed at 1 USD and although it operates as a floating currency, its value may sometimes change often attributable to low trading volume and demand.

- Competition from Larger Stablecoins:

Due to strong competition, popular stablecoins backed by strong ecosystems and partnerships put pressure on SBD to stand out and be significant in the wider crypto space.

Growth and Relevance Management Techniques

To ensure the future relevance and growth of SBD, the Steem community can adopt several strategies:

1. Expand Use Cases

For SBD to be accepted by many other people it needs to go beyond the Steem community platform. The community could come up with initiatives and especially in the use of the technology that is as follows: Buying and selling on the internet, money transfers and global payments. Actually, many independent merchants and/or service providers, and payment gateways can also contribute to increase the adoption.

2. DeFi Project Interoperability

The sector of Decentralized Finance or DeFi is one of the most dynamically developing ones in the crypto space. Having developed the use of SBD to the basic DeFi applications for lending, staking, or becoming involved in liquidity pools, there is potential to identify additional niches in which it may be employed. This will make SBD more appealing to many people that use cryptos but are not in the Steem system.

3. Make Stability Mechanisms Better

To win the confidence of users, SBD cannot afford to float carelessly with a very low value attached to the USD. And, having higher authorities or better outline of some reserve assets or automatic exchange rates providing system may help in maintaining fixed price. These mechanisms will create more credibility of SBD as a stablecoin in the market.

4. Advertising and Social Responsibility

Another promotion factor is the active community of Steem responsible for the bombardment of SBD. If it becomes a collective effort that tries to educate the public through marketing campaigns, teaching how to set mining tutorials and the like, then more people will start getting involved and investing in bitcoins. The goals of SBD may be emphasized in the simplicity and speed of transactions and minimal fees compared to other similar services.

5. Strategic Partnerships

Through partnerships with other blockchain based projects as well as exchanges and financial entities, SBD can grow demand and use cases. I have mentioned, establishing SBD on global exchanges can enhance the liquidity, joining partnerships with payment solutions as a way to reach more typical end-users.

6. Build Stronger Ecosystem Utility

Improving the abilities of the parent Steem blockchain will also be a way to help SBD. As more works, projects and applications are developed on SBD, more of it will be traded across the globe as a transational currency.

Conclusion

SBD’s future remains uncertain, with the area’s prospects for development and growth contingent upon SBD’s success in the constant evolution of the cryptocurrency market proper. Some of the ways which SBD can remain relevant and competitive include extending its use cases, incorporating it in DeFi, stabilizing its price and more importantly partnering with other projects. The following are the strategies for introduction of SBD: In order for the community of Steem to adopt these strategies the ecosystem needs to be active and growing with the robustness to support SBD.

In the rapidly growing market of stablecoins, sustainability and relevance coupled with development and partnership opportunities are crucial for SBD to remain useful to its user base as well as the Steem blockchain.

Invitation:> @shabbir86, @paholags, and @wuddi

Thank You

X promotion https://x.com/AmjadSharifWat1/status/1877688516068376790?t=soCIzL_DeFrIOG6vZZ_tpw&s=19