Assignment Steemit Crypto Academy Season 3 Week 4:-Trading The Dynamic Support & Resistance[@cryptokraze]

This is the second week for me and last week's assignment experience was really amazing and this one is also going to be very informative. The professor taught about the Buy/Sell opportunities based upon Dynamic Support Resistance that how you can get entry and ride the trade for the max profit.

1 - What do you understand about the Concept of Dynamic Support and Resistance? Give Chart Examples from Crypto Assets. (Clear Charts Needed)

There are two types of support and resistance we can see in Trading and in this assignment I will share my understanding with the dynamic support and resistance. Whenever we trade we see that sometimes the price is stuck or bounces from a certain diagonal level, not the horizontal one it could be because of the Dynamic Support/Resistance. Moving averages are the perfect example of Dynamic Support and Resistance.

There are two types of moving averages-

1. Simple Moving average- It is calculated by the Mean average price of the previously given candles. Suppose if we need to find the SMA of 5 days and the prices are like $10,$20,$5,$40,$20 so the average would be (10+20+5+40+20)/5= $19.

2. Exponential moving average It is similar to SMA but the main difference it gives priority to the latest data and moves faster than SMA.

I will be using the Exponential Moving average here since it is fast and give priority to the latest price action. Here is the some of the example.

This is the chart of BTC in 5 min timeframe.

.png)

.png)

This is the chart of Link in 15 min timeframe.

.png)

.png)

2 - Make a combination of Two different EMAs other than 50 and 100 and show them on Crypto charts as Support and Resistance. (Clear Charts Needed)

I am going to use 20 and 200 EMA.

Here is the entry criteria on the basis of these two EMAs. We can plan for the long if the price is above the 20 & 200 EMA and if the price is below 20 & 200 EMA we will look for a Sell opportunity. We will keep the SL below 200 EMA in case of buy and above 200 EMA in case of sell.

You can see in the chart that the 20 EMA is working as a support/ resistance for the price. The price is taking support from the 20 EAM and also getting rejection in case of a downtrend.

.png)

.png)

3 - Explain Trade Entry and Exit Criteria for both Buy and Sell Positions using dynamic support and resistance on any Crypto Asset using any time frame of your choice (Clear Charts Needed)

Here is the chart of LTC for Buy/Sell signals in 5 min timeframe.

.png)

.png)

.png)

Here is another example of Link on 15 min timeframe.

.png)

.png)

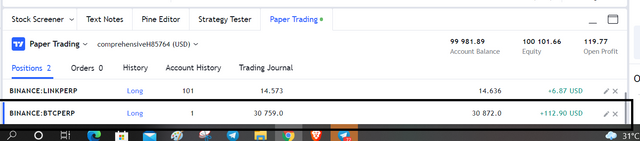

4 - Place 2 demo trades on crypto assets using Dynamic Support and Resistance strategy. You can use lower timeframe for these demo trades (Clear Charts and Actual Trades Needed)

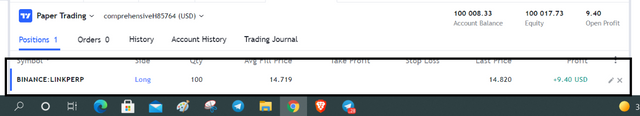

Second Trad: I got a buy opportunity in Link on 1 min timeframe. I was looking for the buying opportunity as it was trading above 20 & 200 EMA and took the trade once it was bouncing upside after taking the support from 20 EMA.

Entry Price- 14.719

Target Price- 14.84

Stop Loss- 14.60

First Trade: I got a good buy opportunity in BTC on the basis of 50 and 100 EMA that was explained in the lecture by the professor. In this trade, I got more than 1:1 Risk n Reward.

Entry Price- 30759

Target Price- 30869

Stop Loss- 30590

.png)

Second Trade: I got a buying opportunity in Link. I was looking for a long opportunity as it was trading above 20 & 200 EMA and as soon as it was bouncing after taking support from 20 EMA I entered.

Entry Price- 14.719

Target Price- 14.84

Stop Loss- 14.60

.png)

Conclusion

The session was really full of knowledge and I enjoyed learning things in the simplest way and also implementing in live trades. I use SMA and EMA in my daily trading too and it is a very easy to use yet very powerful tool. I will look forward to getting more knowledge on it and am also excited about the next session.

Dear @amar15

Thank you for participating in Steemit Crypto Academy Season 03 and making efforts to complete the homework task. You got 8.5/10 Grade Points according to the following Scale;

Key Notes:

We appreciate your efforts in Crypto academy and look forward for your next homework tasks.

Regards

@cryptokraze