OnChain Metrics part-3 - SteemitCryptoAcademy S4W5- Homework post [sapwood]

This is my submission for the Assignment provided by Professor @sapwood. This session was the extension of the previous session Onchain Metrics and I have participated in the last Assignment Homework as well.

(1) How do you calculate Relative Unrealized Profit/Loss & SOPR? Examples? How are they different from MVRV Ratio(For MVRV

Relative Unrealized Profit/Loss:-

RUPL is an On-chain metrics indicator that will help us to identify how much profit/loss exists in the overall market with respect to the market cap and it also helps us to identify the Top-Bottom in the bull cycle. Let's suppose there is an Investor who bought BTC in Jan 2021 at the price of $31000 which is Realized price actually and stored in the wallet (Last Spent price). If the market price is greater than the Realized price (UTXO when it was last spent) then it is considered as Profit and if it is lower than the Paid price (UTXO when it was last spent) then it is in the loss.

We use the same concept to calculate the aggregate value for the overall market with the help of UTXO values to identify whether it is in profit or loss. So if we can keep subtracting Realized Price from the Market Price and get the summation of all such UTXO and divide it by the Current Market Cap then we can a value. If the value is Negative then it is in Loss or if it is Positive then it is Profit.

Interpretations: -

- If the RUPL value crosses above 0.75 or 75% then the entire market is in the Profit zone and we may see Profit booking in the future.

- If the RUPL value crosses below 0.00 or 0% then the entire market is in the loss zone and we may see the Bottom for the cycle and Reversal in the current trend.

Relative Unrealized Profit/Loss= (Market Cap- Realised Cap)/Market Cap

Example:-

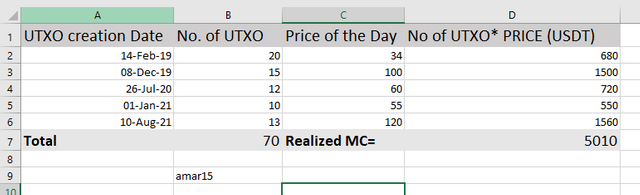

- Realized Market Cap(RMC) = The sum of each UTXO * last movement price

- Market Cap (MC)= Current Price * Total Supply

Let's suppose there is an Asset named A which is having a Max supply of 100 however 30 coins are locked from the time of its creation to the team. Rest coins are spent as per the below sheet-

Let's assume the current price of the asset is $650,

Market Cap= Current Price * Total Supply

Market Cap= 650 * 100= $65000

Now let's Relative Unrealized Profit/Loss= (Market Cap- Realised Cap)/Market Cap

RUPL= (65000- 5010)/65000= 0.92 or 92%

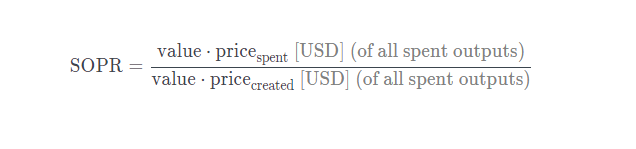

SOPR(Spent Output Price Ratio):- This is On Chain metrics data that help us to identify Local Tops and the Bottom of the Bull/Bear Cycle. it is simply calculated by dividing the Realised value by the value at Creation (UTXO).

- If the value of SPOR is greater than 1 then it is considered as the Investors are in profit

- If the value of SPOR is less than 1 then it is considered as the Investors are in Loss

Example:- Let's suppose there is a Coin named "A".

Total Spent Price = (2 * 800)+(5 * 1100)+(3 * 1200)= 1600+5500+3600= $10,700

Total Created Price= (2 * 1200)+(5 * 800)+(3 * 500)= 2400+4000+1500= $7900

SOPR= Total Spent Price/ Total Created Price

SOPR= 10700/7900= 1.354

As per the above data, it shows that the Investors are in Profit and we are likely to see a Local Top then correction in the market.

How are they different from MVRV Ratio MVRV is the ratio between MarketCap and Realized and it helps us to identify the potential Tops and bottoms in the market.

- The MVRV is the ratio between MarketCap and RealizedCap where RUPL is calculated by dividing the difference between MarketCap & Realized Cap with MarketCap.

- RUPL helps us to identify Cycle Top and Bottom over the year

- RUPL is a leading indicator and tells at the initial stage before profit booking.

(2) Consider the on-chain metrics-- Relative Unrealized Profit/Loss & SOPR, from any reliable source(Santiment, Glassnode, LookintoBitcoin, Coinmetrics, etc), and create a fundamental analysis model for any UTXO based crypto, e.g. BTC, LTC [create a model to identify the cycle top & bottom and/or local top & bottom] and determine the price trend/predict the market (or correlate the data with the price trend)w.r.t. the on-chain metrics?

Well, I wanted to use Glassnode to do my analysis however they are asking for a premium account trial. lol.. I would liek to talk about the running Bull Cycle (2018-till now).

Relative Unrealized Profit/Loss:

In the Given chart the Blue line represents the Price and the red line denotes the Unrealized Profit/loss value. We can categories RUPL value in the below phases-- If the value is 100% or 1 then it in Europhia Phase or Extreme Greed/Profit zone.

- If the value is 75% or 0.75 then it in Greed Phase

- If the value is between 30-50% or 0.3-0.5 then it in Optimism/Daniel Phase

- If the value is between 0-29% or 0.00-0.29 then it is Hope Phase

- If the value is below 0% or 0 then it is in Capitulations

.png)

Observation:-

As we know when the value of RUPL is below 0.00 or 0% then the entire market is in the loss zone and we may see the Bottom for the cycle and Reversal in the current trend this is exactly what happened in March 2018. The value of RUPL reaches -0.41 or -41% and the bottom is created at $3250.

After this bottom creation the price started moving up and touches $12k, reaches in Greed zone then started coming down to retrace 5k level and at that time the value of RUPL -12% and another bottom is formed there.

Once 5k is created the price started moving up and the value of RUPL reaches the peak of the greed zone that is 75% and at that BTC made a New All-Time High of 64k USD. After this new ATH BTC started showing corrections and reaches 29k USD almost 55% correction till now and it is the bottom of the second phase of Bull Run. Currently, the value of RUPL is laying in Optism Phase which can be also interpreted as the indecision phase.

Prediction:- As we can see on the chat the RUPl is between 0-50% which shows BTC still has the potential to go for another bull cycle and we will see a New All-Time high very soon. The technicals also state the same. Once RUPL will go above 0.75 then we may expect some profit booking from the Investors who entered at $29000 and there will be a good correction.

Spent Output Price Ratio(SOPR):

If the value of SOPR is greater than 1 then it is creating a Local top where if it is below 1 then it makes Local Bottom..png)

In the Bull Cycle 2018 to till now we can see BTC made All-time low of $3250 in December 2018 when the value of SOPR was near 0.95 then it started moving up and made a high of $13000 in June 2019 which is considered as the Local Top

After this local top, the price retraced to 5k level and created a Local bottom at that time the value of SOPR was 0.915 and it can be considered as double bottom formation too. Again BTC started going up and made another Local top at 40k then made a new All-time high 64k USD which can be considered as another Local Top as the Bull cycle is not finished yet and we may see a new All-time High in the upcoming months.

Prediction:

In the SOPR chart, you can see the value of SOPR is not too much also it made a Local Bottom and we may expect it to create a new All-time High in Bull cycle 2018-2021 and after that, there will be profit booking. As per the historical data we have seen whenever a local bottom is formed, it will next target to make a new Top.

(3) Write down the specific use of Relative Unrealized Profit/Loss(RUPL), SOPR, and MVRV in the context of identifying top & bottom?

MVRV, RUPL, SOPR all are the On-Chain metrics tool that helps us to Analyze any UTXO like BTC, LTC etc based asset for the long term basis. It helps us to predict the future price momentum also represents the performance of the currency over years.

MVRV Ratio= (MarketCap/RealizedCap):

MVRV is the ratio between MarketCap and Realized and it helps us to identify the potential Tops and bottoms in the market. Here is the cheatsheet to read the MVRV ratio-

a) If the MVRV ratio is more than 1 or above 100% and also creating High Highs then it signifies Uptrend.

b) If the MVRV ratio is exactly 1 then it would be considered indecision or breakeven.

c) If it is below 1 or 100% and also creating Lower High then it signifies Downtrend.

d) If it is above 2 or 200% then it will be considered a strong uptrend or greed in the market.

Relative Unrealized Profit/Loss:-

RUPL is an On-chain metrics indicator that will help us to identify how much profit/loss exists in the overall market with respect to the market cap and it also helps us to identify the Top-Bottom in the bull cycle. It seems quite similar to MVRV Ratio however there is a slight difference between these two one is the way they are being calculated and RUPL is a Leading Indicator and help us to predict the future price momentum early.

Spent Output Price Ratio(SOPR)-

In the Otherhand SOPR help us to identify Local Top and bottom in the existing Bull/Bear cycle as in the example you have noticed btc made two bottoms on is in March 2018, 5k level then it made high of 64k in April 2021 then it took the correction till 29k level.

- If the value of SPOR is greater than 1 then it is considered as the Investors are in profit we may see a profit booking or top creation.

- If the value of SPOR is less than 1 then it is considered as the Investors are in Loss we may see reversal and bottom creation

Conclusion

On-chain metrics is really an amazing tool that will help us to know the insight of the asset and what's going on in the market and sentiments. RUPL, SOPR are very useful to identify the Cycle Top/Bottom and they work really great in the long-term analysis. They are leading indicators and help us to aware of future price momentum. The session conducted by the professor was really awesome and I enjoyed doing this assignment.