Crypto Academy Season 3 | Intermediate course by @allbert –week 5: Psychology and Market Cycle.

Image edited by me in Powerpoint

Image edited by me in PowerpointINTRO

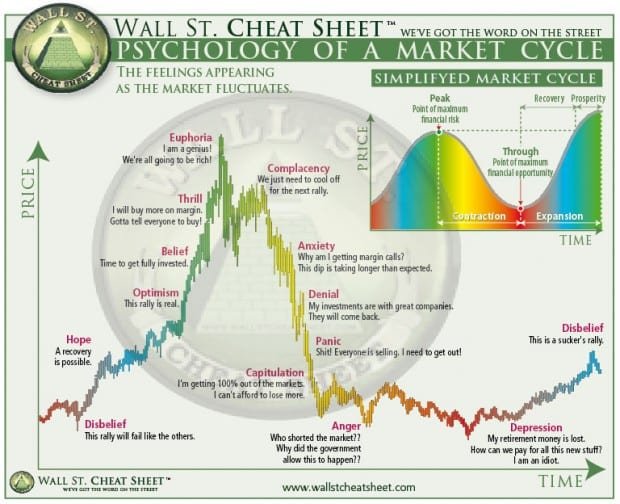

Cycle of market emotions

Psychology of a Market Cycle chart. Image taken from Source

Psychology of a Market Cycle chart. Image taken from Source- For the purposes of this example We will start at "HOPE": occurs prior to the start of the bullish rally, where after a long period of decline you start to see signs of recovery in the market.

- Optimism: Signs of recovery are more evident, the bullish rally becomes real.

- Belief: This is where some of those who were following the asset begins to invest motivated by the green candlesticks on the chart and the hope of increasing their money.

- Thrill: This is where people mortgage the house, sell the car, the dog, the mother-in-law, all in order to obtain more capital to invest. In turn, they spread the word with friends and neighbors about this wonderful cryptocurrency that is going to change the world.

Let's pause here, as I said before price and orders are intimately linked, this is why a bullish rally forms at the beginning of the cycle... when whales buy an asset, the price goes up, this, in turn, makes people seeing the value increase want to participate.

When the public gets involved, their buying drives the price of the asset even higher, this again makes people look to buy more... which in turn further inflates the value of the asset again. Do you follow me? it is a kind of vicious cycle. However, all rallies must come to an end. Let's continue.- Euphoria: This is the peak of the cycle where people believe they are invincible and are driven by a single emotion: Greed. At this point, it usually marks the moment where whales and large institutions begin to withdraw their profits thus generating the beginning of the bearish phase.

- Complacency: It occurs right at the normal price retracement at the beginning of the bearish phase. At this point, the whales usually end up withdrawing their profits. Contrary to this fact, most people believe that the price will recover and therefore hold their position.

- All other emotions are simply the natural result of fear over the falling price.

Let's pause again here. When whales sell an asset, the price falls, this, in turn, causes people seeing the value fall to feel fear and want to get out as well.

When the public sells their positions, their selling causes the price of the asset to fall further, this again causes people who hadn't sold to do so... which in turn further knocks the price back down. Finally, the price hits a low where the feelings that dominate are anger and depression. The interesting thing about this chart is not the market cycle itself, (you already know it), but it shows the emotions linked to each phase of the cycle. If we are analytical, then we can interpret two things. The general sentiment of the public in a certain phase, which in turn can help us interpret what phase of the market is in and what movement is most likely to occur next. This cycle is based on the theory that although the market is unpredictable, on the other hand, emotions and human behavior are very predictable. There are two basic emotions that define us: Greed and fear; and because of them, there are big reactions in the market.

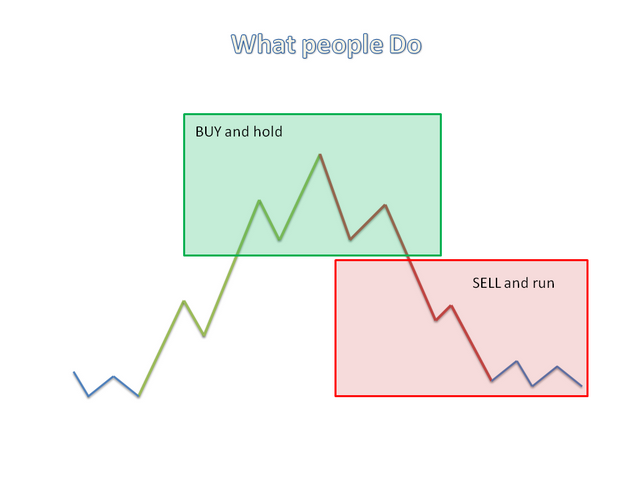

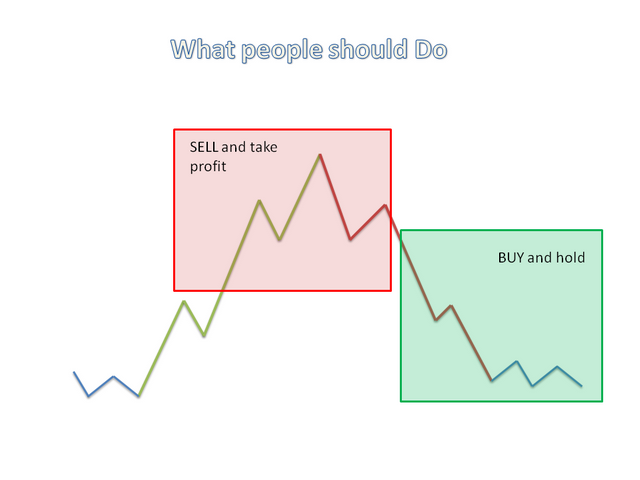

Incorrect mentality

Image edited by me in Powerpoint

Image edited by me in Powerpoint Image edited by me in Powerpoint

Image edited by me in Powerpoint

FOMO

FUD

Buy red, sell green

CONCLUSION

Remember, this is not about going against the market trend, but going against the general sentiment of people versus market prices.

Don't be one of the crowd, one of those who accumulate when there is a need to sell and one of those who sell when there is a need to accumulate.

Homework Task (Season 3/Week-5)

1-Explain in your own words what FOMO is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

2-Explain in your own words what FUD is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

3- Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases

4- Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (mandatory), add screenshots of the operation and the validated account.Guidelines

- Make sure you post in the Steemit Crypto Academy community.

- Your article should be at least 300 words.

- Refrain from spam/plagiarism, it won't be tolerated. This task requires screenshot(s) of your own experience. Use images from copyright-free sources and showcase the source, if any.

- This homework task will run from 00:00 July 26th to 23:59 July 31st, Time UTC. (7:59 pm hora Venezuela)

- Users having a reputation of 55 or above, and having a minimum SP of 250(excluding any delegated-in SP) are eligible to partake in this Task. (Must not be powering it down)

- Add tag #allbert-s3week5 #cryptoacademy among the first five tags in this order. You can also use other relevant tags like your country tag. Also, tag me as @allbert in any part of your post.

-Those who include the real examples/screenshots add a watermark on it with your username.

-Please don’t leave your homework link on the comment section unless your post hasn’t been graded within 48 hours.

Feel free to join the comment section if you have any doubts about Homework Task.

Hi @allbert Here is my submission

https://steemit.com/hive-108451/@chimzycash/steemit-crypto-academy-season-3-week-5-post-for-allbert

This is my Homework post for this week

POST LINK

Informative lecture professor @allbert

I've one question though

What does correct market cycle here mean?

Thank you

Hello my friend. According to what we saw in class, the market moves in cycles. When we study the price charts we realize that some sectors of that cycle are not good to make asset purchases, others are.

The study of the cycle and emotions will be done in question 3. Then in question 4 You have to determine the best time and make the purchase. Don't rush, you have almost a whole week to choose the best time.Thank you Professor @allbert for the guidance.

I'll take your suggetion into consideration

Noted

I love this leason my professor, thanks for this knowledge am so grateful...

You are welcome my friend. My greatest wish is that all the knowledge will lead you to build your portfolio.

my professor is very confused with question number 3, explain in which emotional phase of the cycle it is and why. Must be different phases.

sorry I asked too much, please enlighten professor

Hey @daiky69 if you go through this lecture attentively you'll find theres are various emotional phases of the cycle. There are some phases which are good for trading oppurtunity. Some phases which are not

When you'll attempt question number 3 you'll have to do the study of the cycle and emotions in it. And in question 4, you'll have to determine the best time/phase and place the trade.

bullish and bearish phases are just cycles that hold a lot of emotion or some bias that affects trading psychology, but I don't quite understand the question.

Ok I will try to explain the emotional phase of the current cycle.

This is what confuses me

Hello my friend, To understand this question you should look at the first graph I posted in class, the Wall Street graph. There are 13 emotions or moods. You must compare it with the graph of the crypto assets you choose and draw your conclusions.

Then you must explain in your own words and convincingly, why that specific emotion occurs in that part of the market cycle.

Try to make a good analysis, it is not just about mentioning which of the 13 emotional phases you think it is.

Thanks professor

Dear Professor @allbert so does we have to do our analysis regarding our approach that what we get from the market by using that chart phases right? (13 emotion phases). not necessarily we can get all the factors? Might be some factors are effected us.

good lesson prof 👍

Thanks mate. I hope You can use it

Gracias por la lección, profesor. Es realmente importante no dejarse influencia por las emociones, hay que ser inteligentes al momento de hacer compras

https://steemit.com/hive-108451/@daiky69/crypto-academy-season-3-week-5-homework-post-for-allbert-or-or-intermediate-course-psychology-and-market-cycle-or-or-by-daiky69

This is My homework post professor.

Hi Professor @allbert, it was a great lecture and I learnt a lot

Here is my submission entry

https://steemit.com/hive-108451/@ononiwujoel/crypto-academy-season-3-week-5-homework-submission-post-for-professor-allbert-psychology-and-market-cycle-by-ononiwujoel

Good day my professor @allbert this is my home work assignment link

Link