Crypto Academy Season 3 | Intermediate course by @allbert –week 3: DCA to create a Portfolio

We have quickly reached the third week of Steemit Crypto Academy season 3. This day we put aside the theory and focus directly on the practical part of this exciting world.

So Let's get started.

Image edited by me in Powerpoint

Image edited by me in PowerpointIntro

I believe it is propitious to get into the matter regarding the creation of what will be the main possession that will drive our lives from here: The portfolio. A portfolio is nothing more than the set of crypto assets that we store in our wallets. The choice of assets in our portfolio will be paramount in dictating our success and failure.

So today I want to talk about some principles and strategies that I have used in choosing my portfolio, and that I know will help you in creating yours.

Fundamental Analysis

Whitepaper

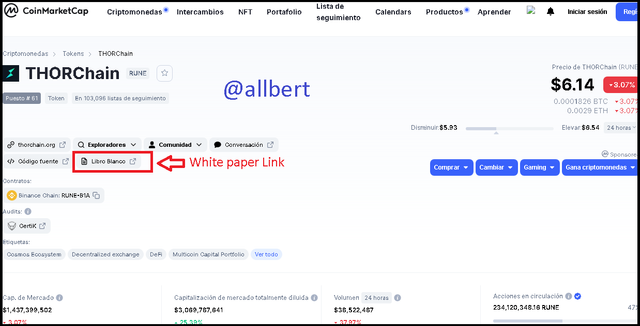

RUNE's White paper link at Coinmarket cap. Source

RUNE's White paper link at Coinmarket cap. SourceWithout the review of White papers cannot be a good Fundamental Analysis.

Solid Projects and Garbage coins

They have a real reason to exist.

They solve a problem and provide a tangible solution.

Have a good development team

Committed to invest and develop new technologies.

Have measurable objectives over time and a roadmap to achieve them.

In other words, they are emerging projects that aim to grow within a few years, which implies a good investment.

On the other hand, there are garbage coins, which are nothing more than coins created by enthusiasts, pranksters, or inexperienced people. The best known of these coins: Dogecoin. Do not misunderstand me, you can make money through them, but only on special occasions and under certain phases of the market, however, they are not good long-term investments because they do not have a project that supports them, but only the confidence and approval of the public.

You may not know this, but creating a token is very easy, and that in itself does not mean that a coin belongs to a reliable project. In fact, almost none of these Garbage Coins has a White paper with relevant and serious information. Some of them are just a joke or a MEME.These garbage coins are a real risk for the portfolio, since they are very volatile, and just as one day they can be in the clouds, the other day they can fall like a sack of lead. I repeat, the value of these garbage coins is not supported by a real project, but only by Internet news and people's speculation.

Remember that what we are looking for is to create a long-term portfolio, with solid projects that grow over time.

HODL

DCA

DCA or Dollar cost averaging, is an ideal investment strategy for novices or people who want to get started in the world of cryptocurrencies. Imagine you have the money, the desire but possess little experience with trading and information about how to read a candlestick chart, use indicators, understand supports, resistances, trends or perform technical analysis.

This is where DCA comes in, and consists of making purchases of the same crypto asset at equal time intervals (every week, every 15 days, every month) regardless of the behavior of the market at that time.

Purchases can be made by investing the same amount of money, or by dividing the total amount of investment in equal parts in markets that are down, thus seeking to reduce the effect of volatility.

In other words, in DCA we must repeat the purchasing process learned in the previous point as many times as we plan to divide our total investment, always at equal intervals.Another benefit is that it reduces the impact of making an entry at the wrong time, something that is very common among newcomers. Imagine you have 100USD which you wish to invest in a cryptocurrency. If you decide to make a single purchase, there is a risk that you make it at a time when the asset is particularly expensive, then the price could fall and you would lose your investment.

If on the other hand, you divide the 100USD into 10 purchases of 10USD each, you would be spreading that risk by making spaced purchases at equal time intervals. Since if you make the first purchase at the wrong time of overpricing, prior to a downtrend (which you do not foresee), you still have 90USD that you can spread over 9 more purchases at a lower price.

Upon completion of all trades, we would have an average purchase that can compensate for any rookie judgment errors in locating an entry.

Let's look at the following example or drill:

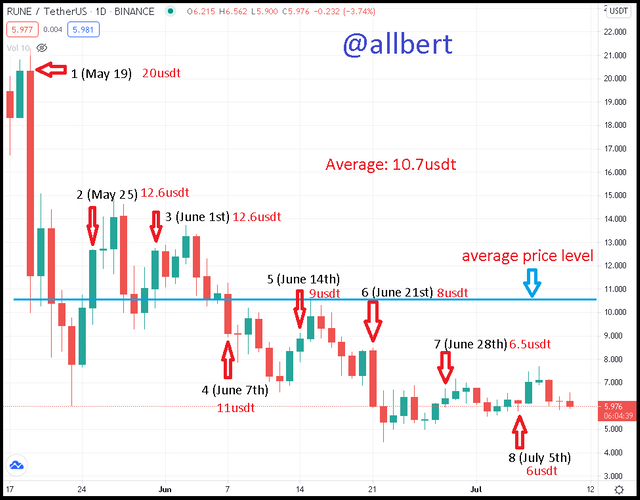

RUNE/USDT chart, 1D. Image taken from Tradingview, Source

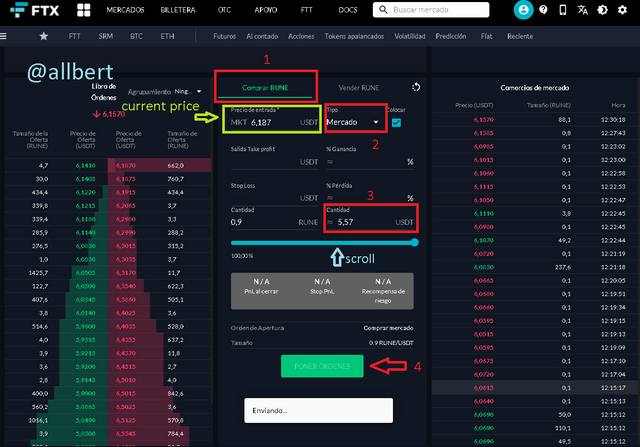

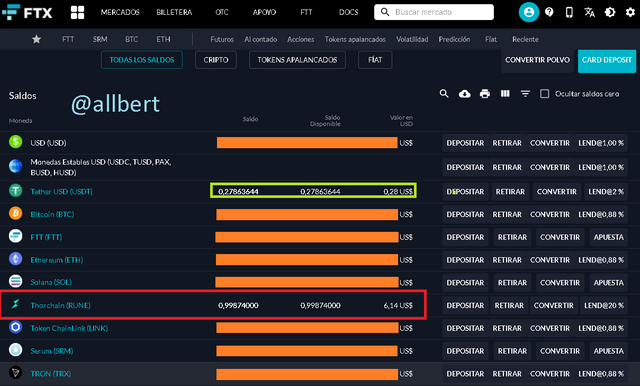

RUNE/USDT chart, 1D. Image taken from Tradingview, Source As you can see I have made 8 trades spaced at one week each. On the chart, you can see the day it was done and the approximate price of the asset at that time.

The first trade is what I call a bad entry, it was made when the asset was worth about 20usdt, however it then fell sharply, continuing to trend week after week. Similarly, week after week buy trades were made. By the end of the eighth week, we were able to average an asset value of 10.7usdt, which will be the value against which we will compare profit and loss.

In other words, this DCA strategy is similar to if we had made a single purchase at one point when the asset price was at 10.7usdt.Note this: if we had made a single investment at point 1, on May 19, what would have happened?; we would currently be facing a loss of more than 70% from the current price.

On the other hand, due to our strategy, the level of loss with respect to the current price is less than 40%, and in some cases may be much less or even be in profit... regardless of the bad run we had in the beginning.Pros

- No specialized knowledge is needed.

- Good strategy to be used in bear markets (like the current one).

- It is a mechanical and constant process where emotions do not come into play.

- It is a good saving and portfolio-building strategy.

Cons

- It is a strategy intended for the long term, so it does not yield dividends instantly.

- On some exchanges, it may carry higher fees, due to multiple trades being made instead of just one.

- It does not work in bull or sideways markets.

Conclusion

I must conclude by warning that every trading operation carries risks in itself. All the measures and strategies we adopt serve to mitigate those risks but not to eliminate them entirely.

That is why it is always recommended to possess good risk management, performing the required fundamental analysis without getting carried away by the opinions of others or trending news.

On the other hand, it is essential to understand that any investment we make must be made with money we do not need in the short term, since generally these holding and DCA operations are intended to generate long-term profits.

Homework Task (Season 3/Week-3)

1-Select two Crypto, perform fundamental analysis, and based on your fundamental analysis explain why you chose them. Exclude BTC, ETH, RUNE. Develop and justify your answer. Be original.

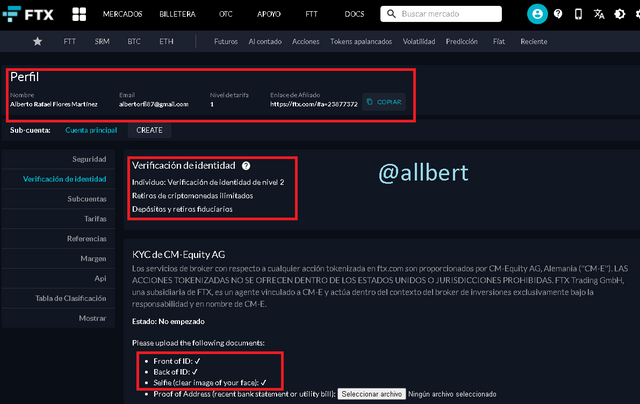

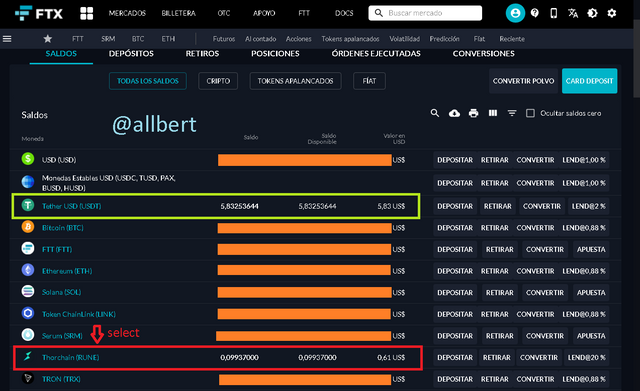

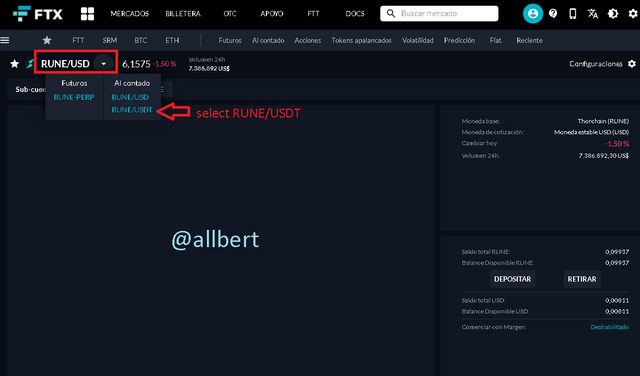

2- Through your verified Exchange account (screenshot needed), make a real purchase of one of the cryptocurrencies selected in the first assignment and explain the process. The minimum investment must be 5USD (mandatory) and must present screenshots of the verified account and the whole operation.

3- Finally, make a simulated exercise, using the DCA method to perform the purchase of two assets and present charts showing the data of days in which the operation was performed, price of purchases, average price, sell point, percentage of profit or loss. (include screenshots)

Guidelines

-Make sure you post in the Steemit Crypto Academy community.

-Your article should be at least 300 words.

-Refrain from spam/plagiarism, it won't be tolerated. This task requires screenshot(s) of your own experience. Use images from copyright-free sources and showcase the source, if any.

-This homework task will run from 00:00 July 12th to 23:59 July 17th, Time UTC. (7:59 pm hora Venezuela)

-Users having a reputation of 55 or above, and having a minimum SP of 250(excluding any delegated-in SP) are eligible to partake in this Task. (Must not be powering it down)

-Add tag #allbert-s3week3 #cryptoacademy among the first five tags in this order. You can also use other relevant tags like your country tag. Also, tag me as @allbert in any part of your post.

-Those who include the real examples/screenshots add a watermark on it with your username.

-Please don’t leave your homework link on the comment section unless your post hasn’t been graded within 48 hours.

Feel free to join the comment section if you have any doubts about Homework Task.

Hello professor I have a question for you, the second question you asked about buying a token from a verified exchange,, in Nigeria here crypto exchanges are banned you can't buy from exchange but you can buy through P2P system in this case what should be done....

Я удивлён! И поверьте, в любой точке мира можно купить криптовалюту! Главное - захотеть!

Can You Buy trought a wallet?

You can't buy or sell through wallet, crypto exchanges is banned by federal government of Nigeria....

How could you do last week's homework if Exchanges are banned?

I think you can buy using Binance exchange, and you can fund your Binance exchange using P2P.

It a simple logic..

Buy USDT or BUSD using Binance P2P, then you can use the USDT purchased to perform the transaction for the assignment.

Cc: @allbert

That's a good one I will try that out...

Great question

You can still buy crypto using p2p method on Binance.

I've been trying this with Binance and it was a great experience. I hope p2p is not yet barn over there

My homework

https://steemit.com/hive-108451/@hibbanoor/crypto-academy-season-3-week-3-homework-post-for-allbert-dca-to-create-a-portfolio

Hey @allbert I have question. In the 3rd question of this assignment you asked to demonstrate the DCA method to purchase asset at intervals. In this question we only have to show an example with explanations, right? Or do we have to make real trades?

Just, examples and explanations, because to do real DCA we'd need several days.

Thats what I thought. Thank you. My assignment is on the way

Also I can use any exchange platform for this question, right?

Yeah.

My own question is on the 3rd task

Are we to perform a real transaction on exchange, or we can make use of Tradingview site?

Same answer. But only in 3rd question. 2nd has to be real, and you must prove the account or transaction is yours and is real!!!

Hello professor @allbert

Carefully looking at this, the trades are actually spaced 6 days apart.

Kindly check it, it's once every six days and sometimes twice in seven days depending on the candle you start counting from.

Thanks for the course, I like this DCA idea. It's similar to my personal alternative for stoploss.

@jehoshua-shey, you are very observant. I also discovered that some trades were spaced 6 days apart. However, it's only two I spotted. The first is from May 19 to May 25, which is 6 days. The second is from June 1st to June 7th, which is also six days. Every other six trades apart from these two is 7 days. IMHO, I think a week description in the explanation is not out of the box.

It's okay. Thank you so much.

Thanks bro

I'm counting first day too.

You are right prof.

I'm counting first day too mate. If You have a little variation of one day it doesnt matter for much authors.

I'm my case I took an extra day in some cases in order to be in line with day marks in the chart.

Looking forward to participate

Hello sir @allbert,

Pls I'm interested in doing this homework but the 3rd question is somehow. Pls how can I get the DCA charts for my Binance account

You can get it from Tradingview if You want. Only for 3rd question. You must make 2nd in a real Exchange

Yeah, I understand the rest.

Thank you sir

Buenos días profesor @Allbert saludos, tengo una duda con respecto a la línea del precio promedio.

La pregunta es la siguiente esa línea sería como una especie de resistencia para salir o es que técnicamente se establece por algo.

No. La línea la dibujé únicamente para efectos pedagógicos. Para que se vea el precio promedio.

Lo que hice en el ejemplo equivale a qué hubiese hecho una sola compra en cualquier lugar que la línea toca el precio.

Claro está que es imposible adivinar el futuro. Por eso se hace el DCA

Perfecto amigo.

@allbert que variacion de tiempo recomiendas para realizar la compra de la pregunta 3, del metodo DCA, podria usarse, 15min a 1h? cada inversion?, (viendolo como un ejemplo), podria implementarse de esta forma para esta pregunta?.

Depende de a qué intervalo deseas hacer tu compra... Si lo quieres hacer semanal recomiendo diario.

Que sea en una timeframe que te permita mostrar las fechas y días.

Saludos prof @allbert por aquí les dejo el link de mi tarea.

https://steemit.com/hive-108451/@adriancabrera/temporada-3-de-crypto-academy-or-curso-intermedio-de-allbert-semana-3-dca-para-crear-un-portafolio-por-adriancabrera