Steemit Crypto Academy Season 4 Week 1 Assignment Post for Professor @awesononso | The Bid-Ask Spread by @allan.fakeer

Properly explain the Bid-Ask Spread.

Before going to discuss Bid-Ask Spread we discuss the Bid Price and Ask price. After that we easily understand Bid-Ask Spread concept. Bid price and Ask price are very common terms in crypto trading. Market is run on the bases of these terms.

The highest price that a trader willing to pay for buying asset is called Bid price. The lowest price that a sell willing to sell his asset is called Ask price. Crypto market is running on these Bid and Ask prices.

Bid-Ask Spread is a difference between the Ask price and Bid Price. We can indicate this difference as Spread. Mathematically we can write

Bid-Ask Spread = Ask Price – Bid Price**

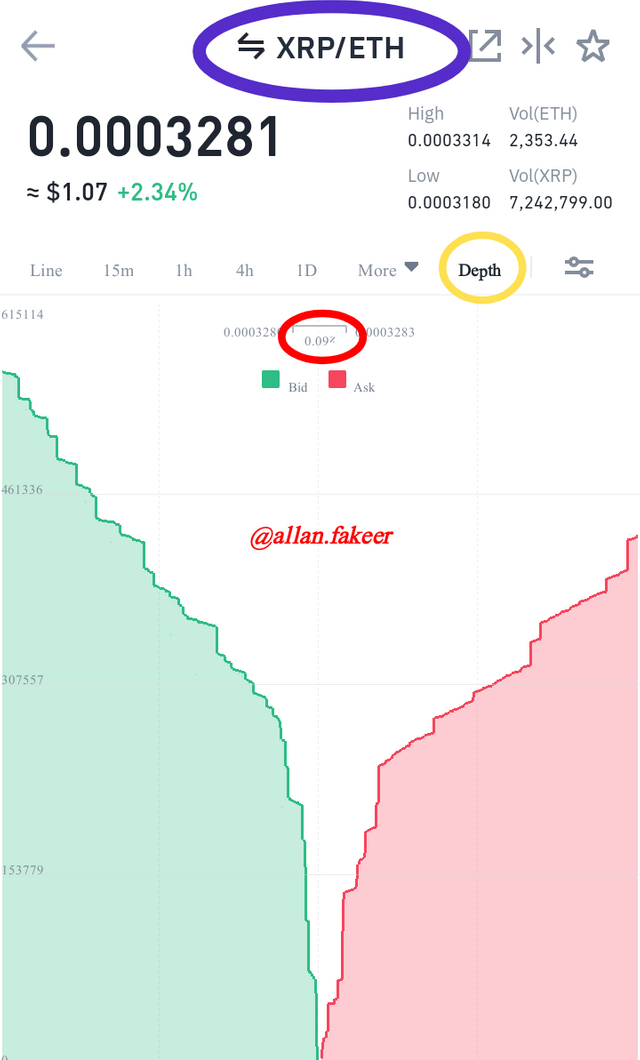

In the following figure you see the chart of XRP / ETH. In this chart we can see that the difference between the Bid price and Ask is not enough. It is only 0.09%.

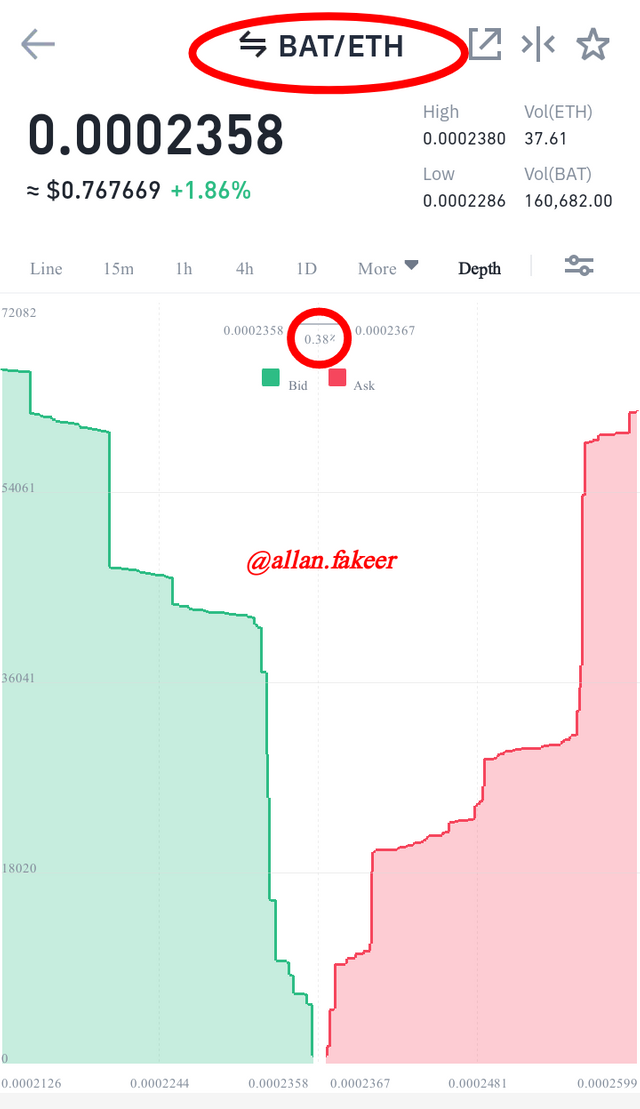

Here is another example of Bid Price and Ask price. Here the pair is BAT/ETH. In this figure you see that the Bid-Ask Spread ration is higher than the above figure. In this pair Bid-Ask Spread percentage is 0.38%.

Why is the Bid-Ask Spread important in a market?

Bid-Ask Spread is very important in Crypto market. Because overall market is running on the bases of Bid and Ask price. Success of a particular asset pair is depended on difference between the Bid Price and Ask Price.

If the Bid-Ask Spread is high it means the market is less liquid and order are not frequently executed. If the difference between Bid and Ask price high then it means that buyer and Seller of this particular asset pair are not enough.

If the Bid-Ask Spread is less then means there are many sellers and buyers present in market for buying and selling this particular asset pair. It increases the liquidity of market. The order face ease in execution.

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Spread Calculation Formula

Spread = Ask price - Bid price

- Bid Price = $5

Ask Price = $5.20

Bid Ask Spread = Ask - Bid

Bid Ask Spread = $5.20 - $5

Bid Ask Spread = $0.20

Spread Calculation in Percentage Formula

Spread in Percentage = (Spread/Ask Price) x 100

- Spread in Percentage = (Spread/Ask price) x 100

Spread in Percentage = (0.20/5.20) x 100

Spread in Percentage = 0.0384155 x 100

Spread in Percentage = 3.846%

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

- Calculate the Bid-Ask spread.

- Calculate the Bid-Ask spread in percentage.

Spread Calculation Formula

Bid-Ask Spread = Ask price - Bid price

- Bid Price = $8.40

Ask Price = $8.80

Bid Ask Spread = Ask - Bid

Bid Ask Spread = $8.80 - $8.40

Bid Ask Spread = $0.40

Spread Calculation in Percentage Formula

Spread in Percentage = (Spread/Ask Price) x 100

- Spread in Percentage = (Spread/Ask price) x 100

Spread in Percentage = (0.40/8.80) x 100

Spread in Percentage = 0.0454546 x 100

Spread in Percentage = 4.545%

Question 5

In one statement, which of the assets above has the higher liquidity and why?

Asset X has higher liquidity because the Bid-Ask spread percentage is less than the Y Bid-Ask Spread.

Explain Slippage

Slippage is occurred in that market which not enough liquid. When we get unexpected rates of our trades then it is considered to be a Slippage. If we place an order at a particular price. When market is not liquid and order and rarely placed then our order is not matched exactly with other orders. Our other is executed with little bit up and down price. The Slippage are two types, positive Slippage and Negative Slippage.

Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive Slippage

In this concept trader gets an extra price on the behalf of trade due to non-liquid market. Sometime trade is executed above our Bid price. It is happened in both Buying and Selling. In the Buying we get less price from expected price. And in Selling we get high price with respect to our Selling Bid price.

Example:

Buy Order

Trader B place an order of $18 for buy. But due to non-liquid market the order is executed at $16. In this way trader get more favorable price for buying the asset. The positive Slippage of that order is;

Sell Order

Trader B place an order of $20 for Sell. But due to non-liquid market the Sell order is executed at $21.5. In this way trader get more favorable price for Selling the asset. The positive Slippage of that Sell order is;

Negative Slippage

In this concept trader get less price on the behalf of trade due to non-liquid market. Sometime trade is executed below our Bid price. It is happened in both Buying and Selling. In the Buying the order is executed on high price from expected price. And in Selling we get less price with respect to our Selling Bid price.

Example:

Buy Order

Trader A place a Buy Order of an asset for $12 dollar. But this order is executed in $13. This executed price is higher than our buying bid price. This is negative Slippage that also occur due to less liquid market. The negative Slippage of this order is

- ##Sell Order

Trader A place a Sell Order of an asset for $89 dollar. But this order is executed at $87.4. This executed price is less than our Selling bid price. This is negative Slippage that also occur due to less liquid market. The negative Slippage of this Sell order is

$89-$87.4 = $1.6

In this lecture we have learn about Bid Price and Ask price. The highest price that a buyer is ready to pay for particular asset. And Ask price is highest price that a sell is ready to pay. The difference between the Bid price and Ask price is indicating the Bid Ask Spread. Market liquidity is observed by examine the Bid Ask Spread. Market orders are executed on Bid price and Ask price. I have learned in the lecture that how market is run and how the orders are executed. Slippage is occurred in non-liquid market. It may be positive and may be negative. Due non-liquid market trader not get the expected order rate.

Hello @allan.fakeer,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.