Crypto Academy / Season 3 / Week 8 - Homework Post for Professor @reminiscence01 / Submitted By @aizeeck

INTRODUCTION.

Good day my fellow crypto academy students and my professor!

Another great opportunity of learning is here again. Having taken time to go through the lecture on token as presented by professor @reminiscence01, I am now ready and equipped to do my homework task

Question 1.

TOKEN.

This is a virtual currency created on a blockchain as an asset that will be utilized by traders and investors. It’s a set of rules that is encoded as part of a smart contract which represents an essential digital asset for some purposes on the ecosystem. A token in crypto world is used for a variety of purposes that a trader or investor may need to do.

All token have a particular blockchain address on which it is built, for the purpose of trading, purchasing and investing. Tokens are made known or becomes publicly available by means of Initial Coin Offering (ICO). There are various types of tokens built on different blockchains.

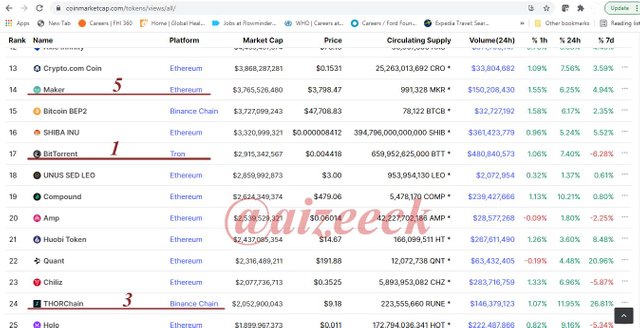

Examples of token and the blockchain on which there are built on. I will present this example in a tabular form as shown below.

| TOKENS | BLOCKCHAINS |

|---|---|

| Bit Torrent | Tron |

| Bit Coin Beps 2 | Binance Chain |

| THOR Chain | Binance Chain |

| Tether | Ethereum |

| Maker | Ethereum |

| Chain link | Ethereum |

Question 2.

- Differences in creation:

Coin is a cryptocurrency with its own blockchain whereas a token is developed on an existing blockchain.

Developing a new coin required creating a new blockchain which will not be easy whereas token can be created by anybody with little technical knowledge.

A coin required a strong blockchain that cannot easily be penetrated and this required much time, money, resources and miners whereas token is easy to create and required little time, resources and money.

- Usage or Purpose:

Coin is purely financial whereas token is a utility.

A coin is basically used for secure and fast money transactions or as a payment for goods and services whereas token is a back-up for a decentralized application, it is totally for that and works within that application alone.

- Diversity:

Coin is only used as money for transaction purposes which is possible with a single coin thereby limiting the need for other coins as well as new coins whereas token has an application(s) designed for a specific tasks as back up which will not go out of extinction provided the application have real-world users.

Question 3.

- Utility tokens.

Utility tokens are built into an already existing protocol or platform on a particular blockchain and it is designed to access the services of that protocol or platform.

Utility tokens are cryptocurrencies designed for a specific purpose, such as purchasing of goods or payment services within its specific ecosystems.

Utility token is not made for a direct investment neither does it give holders any right to the company’s profit.

The nature of utility tokens makes it the choice of investors.

- Security tokens.

Security tokens are part of assets that required full compliance with an established financial law. Although they are financial products, yet security tokens do not give holders ownership right to the company they invested rather it denotes legal ownership of an asset either digital or physical.

Security tokens are more like a currency – which represents ownership in the real-world asset.

Security tokens are tradable among traders and can be transferred between investors and it can also be used as a property interests.

Holders of security tokens look forward to getting a percentage of whatever the company made as profits.

Security tokens come in many forms: Securities, Non-equity Investments Against Capital, Digital Mutual Funds, Digital ETFs

- Equity tokens.

Equity tokens and security tokens have similar protocol in that equity token is a traditional asset just like security token.

Equity token play a prominent role in crypto world, it serve as a share which accord holders ownership right. With such right, holders are entitled to get profits.

There are various forms equity tokens such as futures, stocks, tokenized ventures, options contracts as well as tokenized real estate.

- Non-fungible token (NFT).

Non-fungible tokens represent digital object like videos, photos, audios etc, with a special characteristics which include a serial number, a name, game objects etc.

Non-fungible tokens (NFT) are different from other regular cryptocurrencies. They are unique and can not be mutually interchanged with any other digital assets because each item have it’s own value.

No two non fungible token (NFT) are exactly the same making it possible for developers to utilize non fungible token as an effective method to create individual assets on the blockchain.

Question 4.

Maker (MKR) is the main token of MakerDAO -a decentralized organization and it’s Protocol -a software platform based on the Ethereum blockchain as shown in question one which allows traders and investors to issue and manage it. This token serve as a kind of voting share for the company, even though they do not pay percentage base on interest to their holders, yet they do give the holders the voting rights towards the development of maker protocol which appreciate in value.

The maker ecosystem is among the earliest projects built on the decentralized finance stage. The idea was nurtured in 2015 by Rune Christensen but was totally launched in December 2017.

Makers special characteristics depends on the provision that it allows the holders to actively participate in governing process of DAI. In 2020, DAI was among the most popular stablecoins. It was the 25th largest cryptocurrency with over $800 million capitalization. Holders of maker tokens automatically have the power to vote on whatever changes that needs to be done on the Maker Protocol, such voting power depends on the size of maker stake.

Features

Maker is among the potentially valuable tokens as a result of it’s features. Maker holders have special opportunity to directly participate in the decision making of Dai. Holders are entitled use their tokens to vote on the following, which form the features of maker:

- the new cryptocurrency to include as an asset types for collateral.

- Adjusting the risk parameters of the cryptocurrency added as asset types for collateral

- Amending the Dai Savings Rate to enable DAI tokens holders to earn savings if they lock them in a special contract.

- Choosing the oracles which serve as tools to supply real-time data on market prices to the ecosystem.

- Upgrading the platform.

This provision for holders to participate in the decision making is what drives the demand for maker tokens thereby affecting it’s value.

Aims

The main aim of maker is to build a line of decentralized digital assets that will link to the value of real instruments like currency, gold, etc.

On the basis of the platform, it is planned to create an exchange where it would be possible to carry out margin trading of tokens on the ERC20 Protocol.

CONCLUSION.

From this week’s class by professor @reminiscence01

on understanding tokens, I have come understand tokens more better than before. The explanation on different categories of tokens have broaden my knowledge.

Thank you so much professor @reminiscence01 and your assistant @wahyunahrul for this week’

Hello @aizeeck, I’m glad you participated in the 8th week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for submitting your homework task.

Thank you too for going through my homework. I also appreciate your suggestion and will surely do that in my subsequent tasks.