Yield Farming - Yearn Finance || Crypto Academy - S5W3 || Intermediate Course by @imagen

(1.) Describe the differences between Staking and Yield Farming.

Yield Farming

Profits in cryptocurrency are not earned through trading only but there are multiple options for traders or more like investors to earn profits one of such options includes the “Yield Farming” method. The term is coined by two different means Yield and Farming the yield part simply means to invest whereas farming is not different than traditional farming but here instead of crops crypto assets are grown.

The yield farming is carried out by traders investing their assets tokens in liquidity pool of decentralized finance’s (DeFi’s) which assist with liquidity and the yield farmers earn their profit through interest which is calculated via an annual percentage of yield of the token pool and distributed based on the contribution of every investor the profit is earned through the transaction of users using assets which yield farmer invested plus he also gets reward through his investments.

STAKING

Staking was an alternative for mining introduced by proof of stake consensus algorithm to solve the issues faced by using proof of work mechanism such as high computational power. In staking users stake their assets to become validators to carry out the verification of transactions the more the assets are staked the more chances are of being selected as a validator.

Let’s have a look below to know the difference between the two.

Staking

Investors here invest to support the blockchain by taking part in verifying transactions as validators.

Profit in staking is fixed and is earned through staking your assets in blockchain through interests made on coins invested based on the number of coins staked which users get in the shape of the same coins they invested with

Staking is carried out on a platform that has a proof of stake algorithm as their fundamental algorithm.

One cannot retrieve their staked coins immediately and must be staking their coins

Staking wouldn’t cost lasting loss to investors

Yield Farming

- This is pure profit-generating scheme users invest here to gain more of what they invested through interests or rewards for lending.

- Profit in yield farming is earned through an annual percentage of yield which is divided among all the yield farmers of the pool based on the number of tokens they invested also as yield farmers lend their assets so they earn lending rewards too.

Platforms that optimize AMM are the ones that are providing yield farming options.

In yield farming users are not restricted to time limitations where they need to lock their tokens in the pool for a specific time.

- Yield farming holds chances for lasting loss to investors.

(2.)Login to Yearn Finance. Explore the platform completely and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, and available options) Show screenshots.

Before we get into depth the Yearn Finance is Defi built on Ethereum Founded by Andre Cronje launched in Feb 2020.

This platform allows users to carry out lending and borrowing crypto assets and helps users to get their profits from yield farming.

Yearn Finance

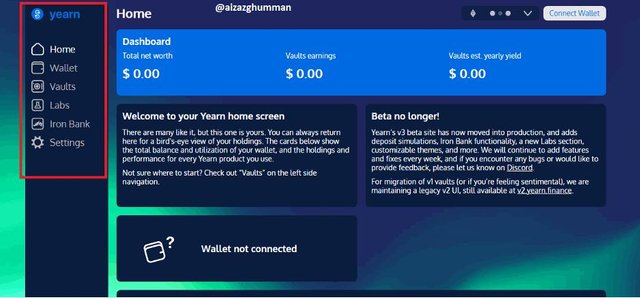

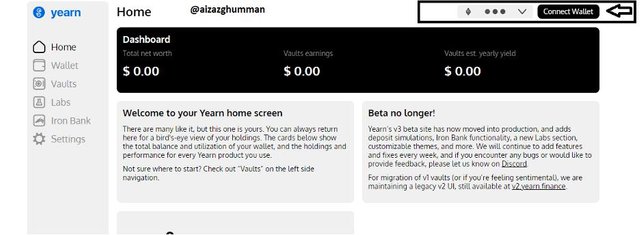

Let us see the screenshot down below that is of the homepage of this platform i.e. https://yearn.finance/#/home here we can see in the marked part the platform has apparent four functions such as vaults, wallets, labs, and iron banks let’s discuss them in detail.

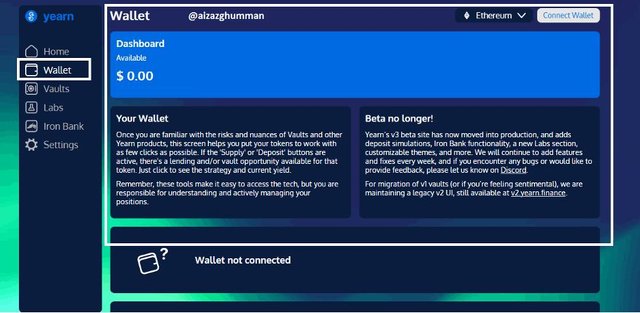

The first function of Yearn Finance I’ll be discussing is Wallets

Wallet of this platform is used for the same purpose we use our traditional wallets i.e. for keeping our money secure.

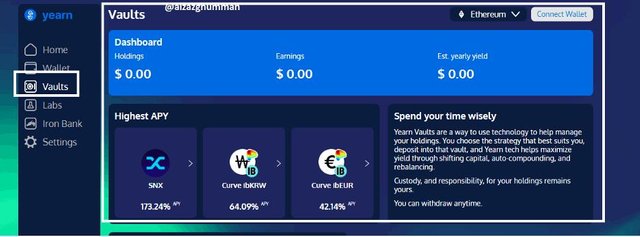

Secondly, the Vaults here on this Defi are used to contribute to pools offered by this platform and earn profits through investing in particular pools which are listed here based on the worth of their annual percentage yield rates and users can retrieve their assets back anytime unlike staking.

Now the third function of this Defi is of Labs which facilitates users of this platform with the latest emerging strategies.

Now the last function of this Defi Iron banks that is my favorite feature this is the place where users can borrow from pools or be a part of the pool however if the user doesn’t find a pool according to his requirement he can lock his assets in this iron bank alone that would also generate his interests.

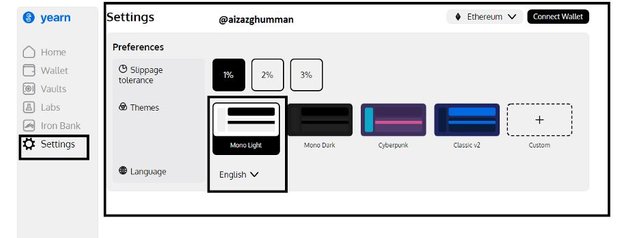

Now the last option setting here on the interface is related to interface apparent changes such as themes, language, etc. As u can see in the screenshot below I have switched my theme to moonlight for demo purposes.

Steps to Connect a Wallet

Here’s how we can connect our wallet to this platform

- For this first we will go to the homepage of this Defi here in the screenshot down below you can see the option of “connect wallet” marked. This is where we will be clicking.

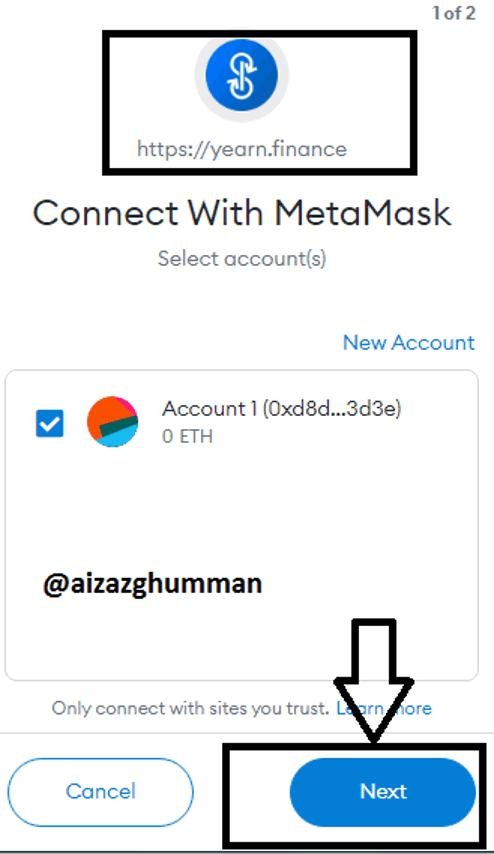

- After that you will be asked which wallet we are aiming to connect here I’ll select metamask you can select your desired option.

- Now after selecting we’ll get a popup screen from metamask asking for confirming the connection between the Defi “Yearn Finance” and wallet here I’ll tap on the “Next” button that will help me to connect the Defi with my wallet.

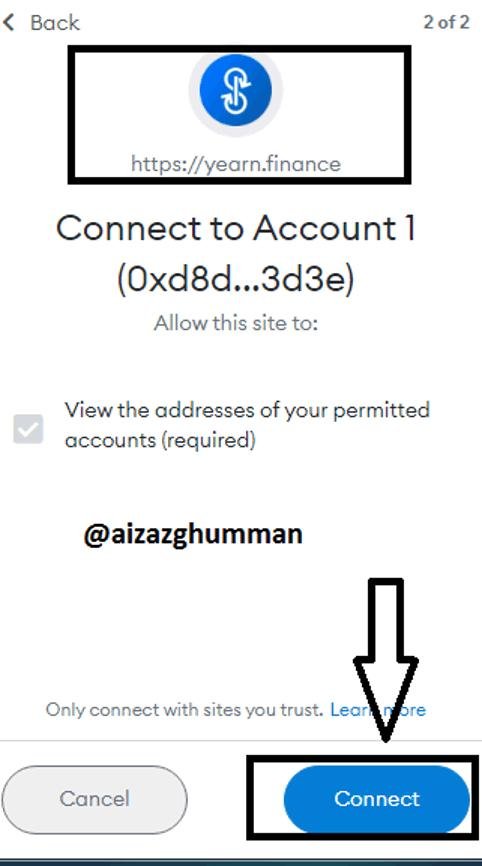

- Now you’ll be asked to connect the two finally

- In the final screenshot you can my metamask being connected to Yearn Finance.

Steps for Locking Assets

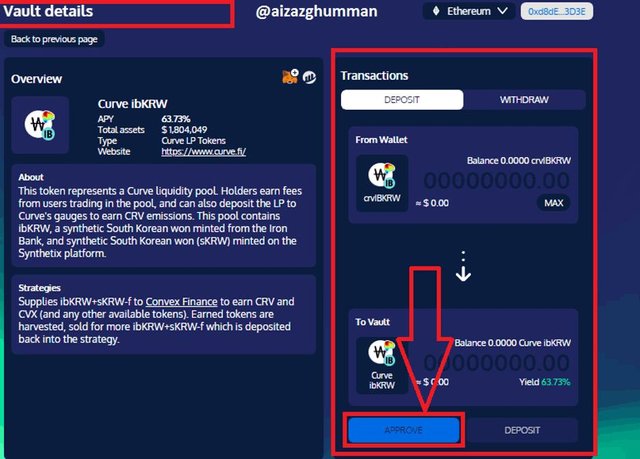

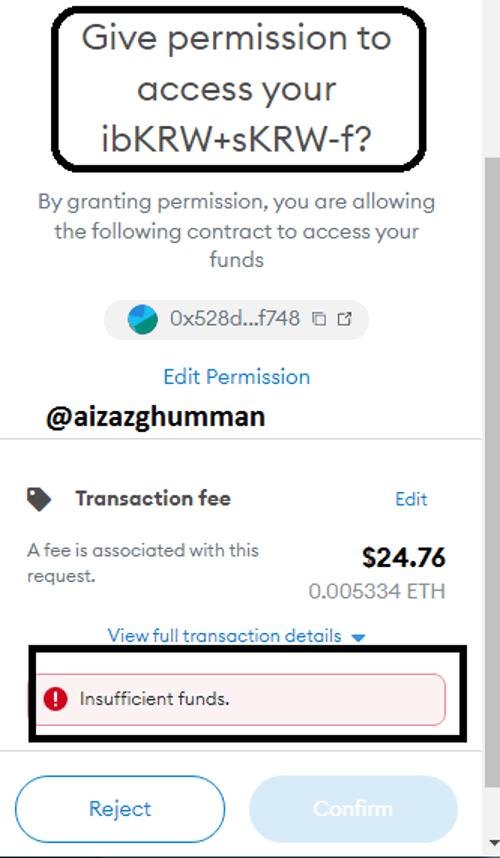

- For this First you select the pool you want to lock your asset from the lab's function in my case I will be selecting Curve ibKRW.

- Now here you click on the approve button to carry out the locking of assets.

- Lastly, you will be asked to confirm the access permission on my metamask which I cannot proceed with because of not having enough balance however, in general, we approve the smart contract and proceed with d the depositing process in the pool of your choice.

What is collateralization in Yield Farming? What is a function?

In traditional banks or organizations to take a loan the borrower must give something as security to the lender which makes him allow loaning you that can be physical cash or property ownership papers or precious jewels of the gold or diamond same thing happens if one takes load in these digital decentralized finances or platforms.

In these defi's the borrower must provide any of the crypto assets that are more in quantity than that of the asset they are borrowing as security that if the borrower fails to pay the loan back then the lender can get his loaned sum back by using that security. Now, this security that the borrower provides in any shape (a crypto asset in this case) is called collateral and the whole process is called collateralization.

In yield farming the collateralization is optimized to give loans to borrowers now note that the collateral sum is always more than the amount user want so that liquidation can be ignored hence termed as over-collateralization. In case of a borrower not being able to pay the load back the lender then owns the amount the borrower gave as collateral and the whole collateralization simply protects the lender's investment.

t the time of writing your assignment, what is the TVL of the Defi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

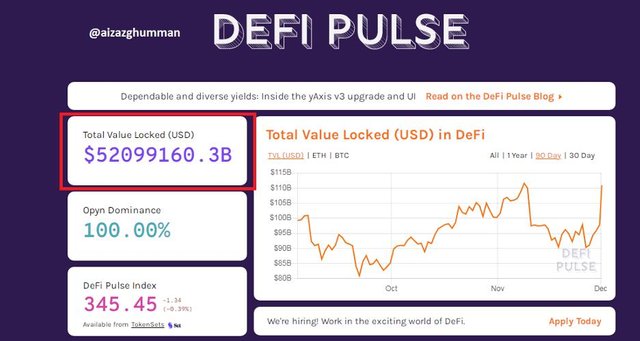

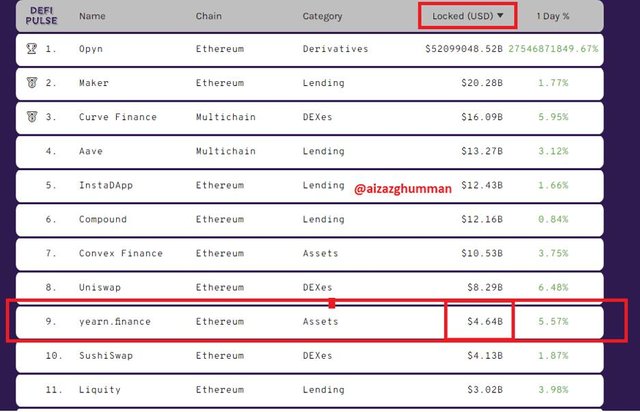

At the time of writing of this homework post, the TVL (Total value locked) of the entire Defi Ecosystem obtained through the DeFipluse platform is $52099160.3 B

The total value locked of Yearn Finance protocol at the time of writing this post is $4.13B

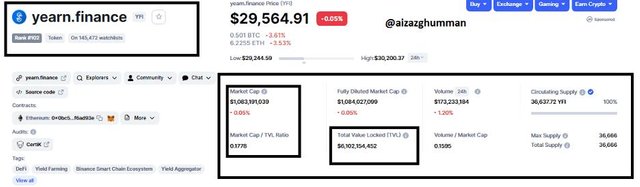

Now for the market cap value of the YFI token and its total value locked ratio, I’ll be using the coinmarketcap platform, and here’s what I got from it.

TVL RATIO: $6,102,154,452

Market Value: $1,084,704,208

Market value and TVL Ratio: 0.177

**The YFI token, is it overvalued or undervalued? State the reasons The YFI token currently is undervalued as we can see from the **

information provided above the total value locked and market cap ratio is less than i.e. 0.1778 as the coins having TVL and Market value ratio less than one is said to be undervalued. However, if we see the YFI token neutrally we can observe it is an important token being a native coin for yearning finance it will be optimized for investing in yield farming on the platform.

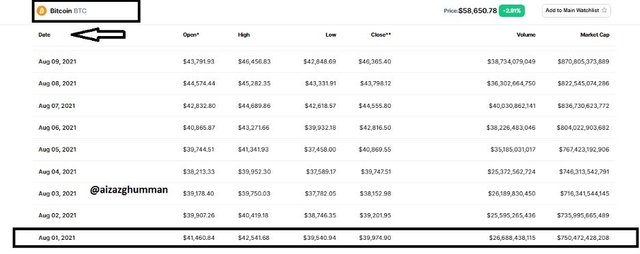

(5.) If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons. For BTC:

The price of BTC on the 1st of August was $39,974.90 that upon rounding off will be $40, 000, and 00.

Meanwhile, the BTC price at the time of writing this post on 1st Dec is: 0.0125 BTC = $ 731.22

Return of Investment

=$462.11 - $500

=$-37.89

=$-37.89/ 500

=$-0.07578

= $-0.07578x 100

=-7.578%

The total return investment yielded from YFI is -7.578% ($-37.89)

Total return of investment = Return of investment of BTC + Return of investment of YFI

ROI= $212.70 + ($-37.89)

= $212.70 - $37.89

= $174.81.

In % = 42.54% - 7.578%

= 34.962%

Overall my return of investment would be $174.81

In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

RISK FACTORS

Yield farming is carried out through smart-contract and if in case of bugs in the smart contract of the particular pool it can crash the pool making it vanish.

If someone got the access to admin key smart contract of the pool he can make changes in the protocol of the pool.

The high gas fee of the platform can reduce the profits of investors.

As we discussed above collateralization is carried out to secure the lender's assets however in case of liquidation that can be defined as the value of collateral to decrease less than the value of the loan. That’s why the collateral is always more than the value of the loan

•When the market is reversed and the value of the asset used by an investor to invest is decreased this may cause yield farmer to non-refundable loss if the price may decrease lower than the amount of asset he initially invested.

Conclusion

Yield farming is one of the strategies used by investors to yield profits through their crypto assets where they invest their tokens in the pool which can be further used for borrowing and lending. However, to secure the lender's assets over-collateralization is carried out i.e. the collateral for a loan is higher than the amount loaned by the borrower. Here comes an end to my homework post so I’d like to mention the lecture helped a lot in making this assignment easier so, much appreciation for the professor for his efforts hopefully I met his requirement.