Exchange Coins || Crypto Academy - S5W1 || Intermediate Course by @imagen

This is @aizazghumman; here I am going to share my homework post on the topic "Exchange Coins " given by respected professor @imagen

1.) Perform a complete analysis of the currency of some exchange. Not allowed: BNB, KuCoin, Cake and Uniswap.

GATE IO

The Gate Io was developed back 8 years ago by Han Lin from the coin market cap this exchange is on 11th rank at the time of writing this homework assignment and is among one of the popular exchanges of the crypto world. On the 4th of April on the 8th anniversary, the founder in his reminded the purpose of this exchange i.e. to provide users with a safe trading place.

The gate Io currently has 1000+ currencies being exchanged on this platform and a total of 1300+ trading pairs and the exchange has hit a total of 80+M users globally. The exchange doesn’t support fiat currency yet however maybe in the future it starts allowing the transfer of fiat currency. The exchange is built on Gatechain technology and the website can be switched to three different languages i.e. English, Chinese, Italian etc.

Traders of different types can get facilitated with this exchange as it assists with quantitative trading, liquidity mining, spot trading, leveraged trading, futures trading, gold to earn interest, etc. hence serving all kinds of traders.

Like every other exchange, the gate Io has a native currency of its own called Gatetoken or GT.? The gate token is ERC-20 standard tokens. Holding this token gives voting rights to the individual using this exchange. Also, the transaction fees on this exchange are paid through gate tokens also used to supply gas to power the exchange. Also, users here can hold their coins to earn interest on a monthly or weekly basis.

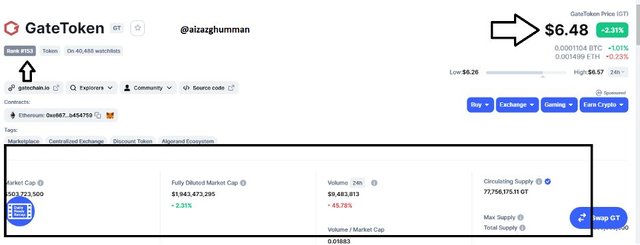

Currently according to data collected from coinmarketcap the live GateToken price today is $6.48 USD with a 24-hour trading volume of $9,483,813 USD. We update our GT to USD price in real-time. GateToken is up 2.31% in the last 24 hours. The current CoinMarketCap ranking is #153, with a live market cap of $503,723,500 USD. It has a circulating supply of 77,756,175 GT coins and the max. supply is not available.

The exchanges where the gate token can be purchased are Houbi global, hot coin global, HitBtx, Ftx, etc.

2.) Make a purchase equal to at least US $ 10 of the currency you explained above. You must make some movement with that currency within the exchange that created that currency. Show screenshots and explain in detail the steps to follow. Example: transfer of funds, Staking, participation in a Launchpad, trading in futures, etc. Indicate the reasons why you chose that option (operation) on that platform.

PURCHASING

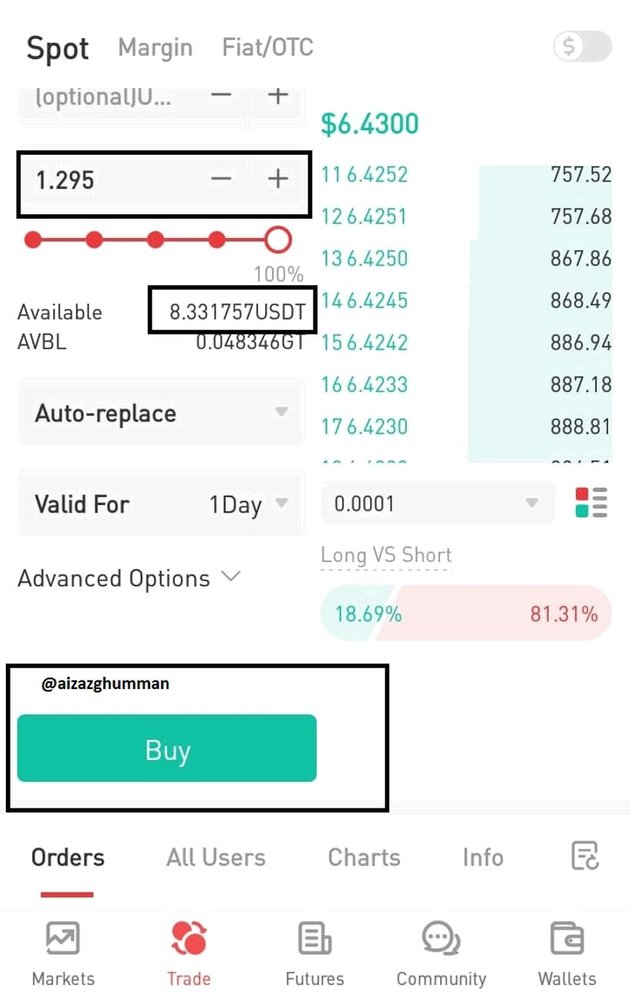

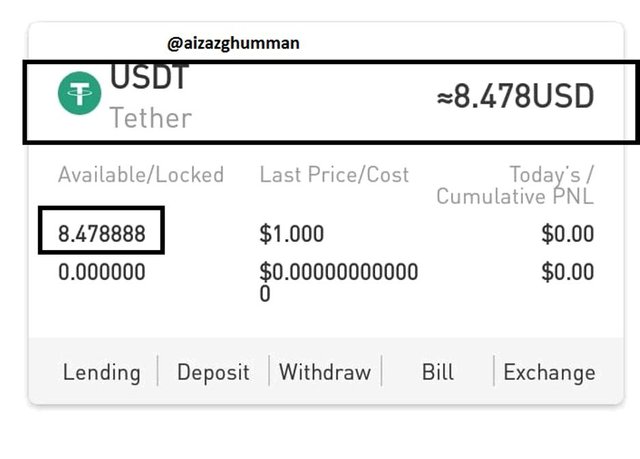

I had almost $16 in my gate io account $8 of which were USDT and the rest were BTC I had a few issues in converting the BTC into USDT hence I’ll be purchasing GT Token with $8.33 USDT I have in my gate. Io wallet the screenshot below shows my order details.

Now the Screenshot down below shows my gate Io wallet it can be seen from $8 USDT I’ve got a 1.29 GT token.

Now for moving this token in exchange

here are many options I can continue with by holding GT on this platform such as staking, launch pool, liquidity mining, future trading however but almost all these requires the heavy sum of these coins and I do not have much experience with this exchange other than spot trading Lastly I use this exchange to perform my homework tasks only hence I am unable to invest here for performing any of the above-mentioned activities.

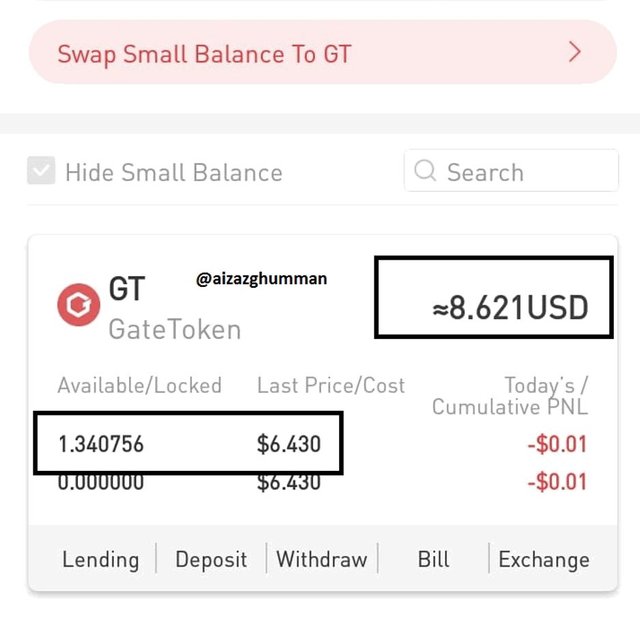

However, for moving the token within the exchange I converted my 1.34 GT tokens back to USDT. The screenshot below shows the detail of my selling order of this currency back into USDT.

As you can see I now have received $8.478 upon exchanging GT token with USDT.

3.) Show the return on investment in time frames of 0, 24, and 48 hours from the moment you bought. Take screenshots where you can see the price of the asset and the date of capture.

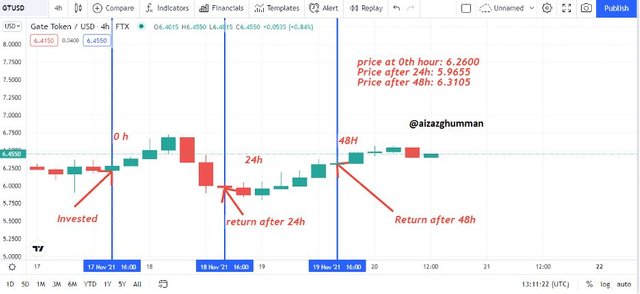

Since the week had been very busy for me so I wasn’t able to track the price movement nor I wasn’t attentive with screenshots and lost the some I took so Thanks to the trading view through which I’ll be able to show the return of my investment in the timeframes mention in question i.e. 0th hour, 24th hour and 48th hour.

At 0th hour it can be seen in the screenshot given up where I have mentioned the price at which I invested i.e. $6.2600 and after the 24th hour, the return of my investment can be shown i.e. the price went from $6.2600 to $5.9655 however being patient which is the key of success of trader I still waited for 48th hours to pass for the sake of homework and here which had been fruitful as he price at 48th hour raised to $6.3105 which earned me a profit of $5.3105.

3.1) has the asset's price acted independently or does its price strictly follow the correlation with Bitcoin?

You can add the information you want, creativity will be taken into account.

None of the crypto members is unfamiliar with the concept of relating an asset’s price with bitcoin to estimate its move since the bitcoin is the very first cryptocurrency ever generated and most of the time the altcoins price movement corresponds with this father crypto asset. Now coming to the question we know I’ve been working on GT token in this homework however to see the correlation of BTC and GT token we can use the different platform I’ll be using coingeck.com

The screenshot below shows the correlation of bitcoin and gate tokens from 17th of Nov to 19th of Nov

One can see the price had acted exactly how BTC moved in the selected period so one can say the price of gate coin acted as being dependent on BTC and followed the BTC price strictly. However, there are times where prices fluctuated however in general it can be said that the gate token Io partially or almost completely acted correspondent to BTC price.

4.) What are futures trading?

As the name implies future trading involves buying assets in the future but then what makes this feature hype? Well, future trading is a trade where you purchase assets on a predefined rate settled in the future. The traders can get benefitted by both ways either selling or buying an asset through future trading,

In future trading, traders predict the price which could be more or less than the current price, and if the price went according to traders' prediction then users' trade would be in profit however if the price went contrary to the prediction then the user might face loss. The act of buying is called “Long” in future trading terms and selling an asset includes “Short”. Let us understand this through an example:

Let’s assume MR X did some technical or fundamental analysis and came up with results that the price of BTC is about to increase hence he’ll make future trade and if the price went higher it will allow the user to earn double or more of what he invested but when the BTC didn’t go according to what he assumed he’ll lose his investment. The users take out their profits using the leverage feature of exchanges i.e. you can earn double or more or whatever the exchange offers through making predictions of an asset however wrong predictions can cause you loss.

5.) What is the margin market?

The margin market is one of the types of crypto trading here the user traders through purchasing assets on borrowed funds. The traders first get themselves a margin account where a third party lends him funds or assets through which he further invests in a quantity more than he could afford.

Margin trading is not something I prefer as it’s highly risky among many types of trading’s It requires an excellent command of price movement analysis though one cannot rely entirely on it as markets can be very volatile at times and loss here can make a trader lose entire sum he invested.

There are certain amounts a user must possess in his account to lend from a middle man and also a trader must possess a specific sum of an asset in his trading account to carry out margin trading. The middle man acting as the broker has the right to use funds of the lender if his margin account goes lower than the minimum requirement and the account passes the due date of its maintenance.

Coming to profits to this type of market the margin trading generated user massive profits if carried out properly and can be more fruitful than our daily trading. With a good knowledge of this traders can earn a profit when the price either goes up or down,

6.) What happens to the cryptocurrencies of exchange when they suffer from a hack or it turns out to be a fraud? Present at least 2 real-life examples.

The currencies in crypto exchange upon hacking go through the same thing that our traditional markets go through after being robbed i.e. they are stolen from the exchange. There are 12+ cryptocurrency exchange hacks I have studied on some of these were said to be intentional hacks planned by developers while some of these were real hackers attacks. The exchange which is quite popular or the newly build exchange aiming to grow more compensate the developers and ensure them their security back. However contrary to this some of these exchanges might not be able to survive hackers' attacks and can be gone forever.

However, most of the exchanges even though survive hacking but hacking attacks can be very destructive for the reputation of these exchanges and can cause a massive price downtrend of native assets of that exchange.

For example, I’ll be discussing the hacks of one of the most popular exchanges i.e. Binance and Kucoin hack.

BINANCE HACK

The binance exchange was hacked back in 2019 on May 7th. The hackers stole around 7000 BTC which makes it at least $40 million loss here’s the transaction link in which hackers did their job:

https://www.blockchain.com/btc/tx/e8b406091959700dbffcff30a60b190133721e5c39e89bb5fe23c5a554ab05ea

According to binance exchange, the hacker carried out this transaction normally hence they couldn’t detect it however once carried out the exchange received strange alarms after which they stopped the rest of the transactions of exchange.

The binance claimed to refund investors' loss using its SAFU funds.

Another bad news for users was the restriction of depositing or withdrawing assets on this exchange as some of the accounts were still held by hackers as they stole 2FA codes, API keys, and a few other things. The binance exchange referred to this incident as a “Large scale security break”.

KuCoin HACK

The KuCoin exchange hack took place in September of 2020. The exchange faced to lose of $250 million however a massive amount of hacked tokens were restored soon. The exchange initially felt some withdrawals of BTC, ETH, and other coins of exchange upon noticing the withdrawal and depositing requests were stopped on exchange but allowed later on. Many projects operating on exchange switched their smart contract exchanging robbed tokens with an updated version of tokens. The speedy recovery of exchange has helped it maintain its reputation and is still among the leading exchanges on the coin market cap.

Here in this link, we can see what the exchange had today on the hack:

https://www.kucoin.com/news/en-kucoin-security-incident-update

Conclusions

Here I’ll be concluding the things we covered in this homework post firstly we were asked to explain the currency of some exchange and then purchase it and use it for performing some of the suggested actions. Next to that, we talked about the relation of BTC with the currency of select exchange i.e. GT TOKEN of Gate Io. Lastly, we were told to explain the margin market, future trading, and what happened to currency when the exchanges are hacked.

The crypto exchange provide traders a platform to carry out multiple types of trading, every new exchange has its uniqueness however some of the major exchange is Binance, Houbi Global, etc. However, the exchange wallets aren’t safe to store assets hence one shouldn’t use the exchange to hold their assets are they are prone to hacking attacks.

Hope I completed the assignment up to the expectation of the professor, if not I aim to do better next time.

Thank you.