Crypto Academy week 6 season two - Homework Post For [@kouba01]- Trading with MACD indicator.

This is @AizazGhumman, here I am going to share my homework post on topic " Trading with MACD indicator. " given by respected professor @kouba01

.jpg)

1.What is the MACD indicator simply? Is the MACD Indicator Good for Trading Cryptocurrencies? Which is better, MACD or RSI?

MCAD stands for Moving Average Convergence Divergence. MACD (moving average convergence/divergence) is a trading indicator developed by Gerald Appel in the late 1970s for technical analysis of stock prices. Its purpose is to reveal changes in a stock's price trend's strength, direction, momentum, and duration. It is

an indicator of a relationship between two moving averages of the price of a

security. The two moving averages are taken as 26-period EMA and 12-Period EMA.

When we subtract 26-period EMA from 12-period EMA, the result is referred to as

the MACD line. The indicator is used to determine the momentum of stocks or

cryptocurrencies and their trends. This aids the traders In speculating the right

trends.

The MACD indicator is very reliable for crypto trading because it gives very strong trading signals and is very simple to use.

According to many experts, the RSI indicator gives fewer false results and is technically more correct. RSI measures the momentum of the market in terms of highs and lows in the past. If used together, MACD and RSI indicators give the best results.

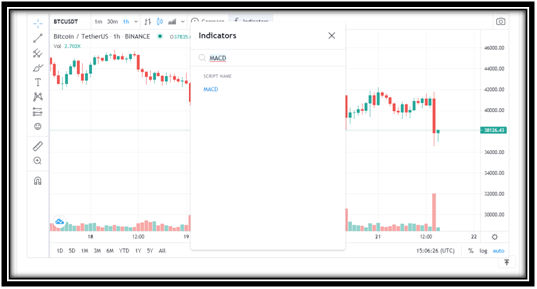

1.How to add the MACD

indicator to the chart, what are its settings, and ways to benefit from them?

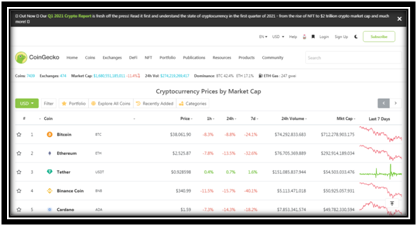

1.I used CoinGecko.

2. i opened their website . and select bitcoin from the currency

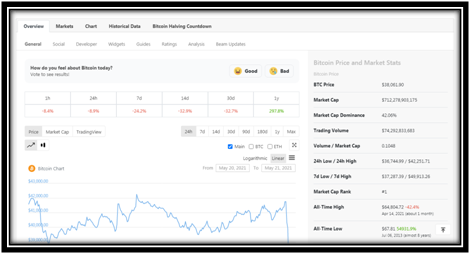

3.And then,

on the top, I clicked on charts.

4.After that,

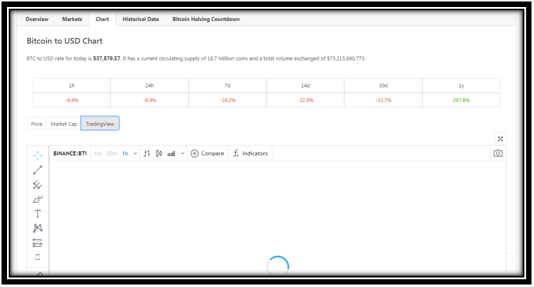

I selected the trading view.

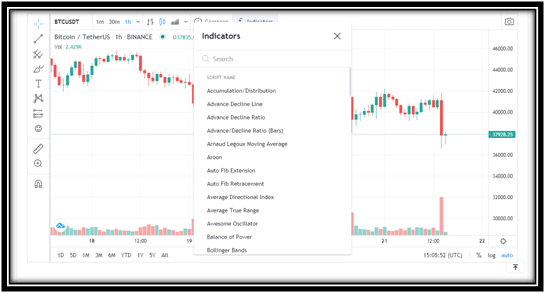

5.From the

above toolbar, I clicked on indicators.

6. I typed the

MACD indicator.

7. The MACD indicator was added to my chart.

Settings: The default

settings of the MACD indicator is set to 12, 26, and 9. 12-period EMA tracks

the trends of the past two weeks, 26-period EMA track the trends of the past

month, and 9-period EMA track the difference between the two and tells the

trends of the past week and a half. You can also change these settings like

various traders use a combination of 5, 42, and 5.

Benefits: These

settings are very flexible and can

be adjusted according to the traders' suitability. The benefits of the default

settings are that, as almost all traders around using these

settings, it's easy to understand what

indicators others traders will follow. In this way, the price moves according

to the indicators.

2. How to use MACD with crossing MACD line and signal line?

And How to Use the MACD with the crossing of the zero lines?

.png)

In a MACD indicator, the red line represents the signal

line. The blue line is the MACD line. The zero line is the line along which the

candles move up and below.

The MACD line helps us to understand the upward and downward market trends. The MACD line is studied in a comparison of the MACD line and the signal line. When the market picks up momentum, the two lines diverge from each other, and when there is a drop in the momentum, the two lines converge.

To put it into simple words, we can say buy when the MACD

line crosses the zero line and goes above it when the MACD line crosses the

zero line and goes below it sell the assets.

3.How

to detect a trend using the MACD? And how to filter out false signals?

You

can detect a trend using the blue MACD line. You can see an interaction between

the blue, red, and zero lines in the below image. The red line indicates the

signal line. The blue line has gone below the red line in areas where the trend

has changed to the downside (green arrow). And in areas where the blue line is

above the red line, the market's trend has shifted to the upside (red arrow).

.png)

MACD can not be considered as a way to understanding how the market will behave in the future. However, when a MACD line crosses above the signal line, the price of the underlying security declines. This can be termed as a false positive signal. Visually when the two lines give shallow indicators in the form of shallow crossovers (blue arrow). Or when there are very small candles formed, it is a false signal.

To understand clearly, we can look at the histogram. When

the candles move above the zero line, it is an ideal time to buy, and when the

candles grow below the zero line, it's time to sell.

4. How can the MACD indicator be used to extract points or support and resistance levels on the chart? Use an example to explain the strategy.

Drawing support and resistance lines is like creating a

channel on a MACD indicator. It offers a clear picture of the momentum of the

market. The support channel can be drawn to decide about buying or selling. The

support channel is drawn below the zero lines on the histogram, whereas the

resistance channel is drawn above the zero lines. Below is an example to

explain the channeling.

.png)

5.Review the chart of any pair and present the various

signals from the MACD.

Below is the chart for BTC/USD. If we take the trade as the

crossovers of the MACD line, we can buy the asset when the MACD line is above

the signal line, and we can sell or short it when the MACD line is below the

signal line. When the next cross occurs, the previous trade is closed or is

taken off the table. I have roughly indicated two trades, for instance. One was

ideal for buying and the other for selling.

.png)

Cc:

@steemitblog

@kouba01

Hello @aizazghumman,

Thank you for participating in the 6th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 3/10 rating, according to the following scale:

My review :

An article with poor quality content, your writing style lacks a clear methodology, so we find ideas scattered with no links and what makes your answers inaccurate. Try doing more research and improving your writing style by reading some good articles.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01