Steemit Crypto Academy Season 2: Week2 | Homework Task( Cryptocurrency Contracts For Difference (CFDs) Trading) by @adnanyassin

Hello everyone!

i am @adnanyassin and i am going to answer the homework that is given by @kouba01 .

source

source

Question No 1.

What is a cryptocurrency CFD?

CFDs are sophisticated financial instruments that enable you to bet on an asset's valuation. They are often available via online portals.CFDs are often sold with leverage, which ensures you just have to bring down a small part of the gross investment value. Leverage, on the other hand, magnifies the effect of market increases on gains and losses. This ensures you might lose a lot of money in a short period of time.

CFDs on cryptocurrency encourage investors to bet on the price of a cryptocurrency like Bitcoin or Ethereum changing.A cryptocurrency is a digital asset that is not distributed or guaranteed by any country or central bank. They've had a lot of market fluctuations over the last year, which, when combined with debt, puts you at risk of losing a lot of money.CFDs are attractive to day traders who can use leverage to trade assets that are more costly to buy and sell. CFDs can be quite risky due to low industry regulation, potential lack of liquidity, and the need to maintain an adequate margin due to leveraged losses.

Question No 2.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

All the trade is legit. IT is suitable in an investment when does not have a requirement to own actual crypto currency. Traders in the crpto CFds speculate the fall or rise in the price of digital asset. The contract can be closed at anytime. The range of trade is determined by broker’s margin requirement.

Question No 3.

Are CFDs risky financial products?

Contracts for distinction (CFDs) are inherently technical financial instruments and can only be used by seasoned traders and holders. CFDs may be profitable for others, but if you're not seasoned, you might lose a lot of money quickly. We've gone into the dangers of CFD trading as well as how CFDs operate.

CFD Trading is a High-Risk Investment.

Trading CFDs entails a large degree of risk and is not ideal for all buyers. CFDs are over-the-counter derivatives with a large degree of leverage. You could risk a lot more than your original deposit, and your liabilities could be limitless.

Dangers.

CFDs, like all other commodity involving capital markets, are potentially risky. Since CFD investing is leveraged, it will result in higher yields on smaller deposits while still allowing you to risk more than the initial investment. Although stop losses may be assigned to each trade, they are not necessarily assured to be filled at the amount you specify in volatile markets due to market gapping or slippage. Investors should therefore consider the cost of commission, since certain CFD suppliers charge a fee.

Keep in mind

Everything you invest in should fulfil your investment objectives and be appropriate for your circumstances. CFDs are risky by default since they are leveraged products.

CFDs are not appropriate for all investors. My advice to clients is to avoid contracts with discrepancies if you don't appreciate them.

No one can guarantee a financial product's success. If something goes wrong, you might lose all of your money or much worse.

If you bring all of your capital into one kind of investment, you're taking a big gamble (for example, trading CFDs). Diversification (spreading the funds through various forms of investments) lowers the chance of losing everything.

Notice of disclaimer

This information is not intended to be financial product recommendations and does not take into consideration your investment goals, financial condition, or specific requirements.

Question No 4.

Do all brokers offer cryptocurrency CFDs?

No, not all brokers offers cryptocurrency CFDs. Here are some best brokers which offered cryptocurrency CFDs.

- eToro is the best platform for social trading.

- Gemini is the best sign for ease of use.

- Coinbase is the best choice for new investors.

- iTrustCapital is the only place to invest in gold.

- CryptoRocket is the best choice for high-volume Forex traders.

- Altrady is the best choice for accessibility.

- Voyager is the best choice for many exchanges.

When looking for Bitcoin brokers to deal with, there are a few things to consider. One of these factors is the broker's protection and transparency; hopefully, the broker would be supervised. We still search at things like responsive customer service, cutting-edge technologies, and features like smaller spreads.

Question No 5.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

In terms of exchange, Bitcoin has been a huge success. It has been heavily traded since it first appeared. Its value has also skyrocketed. Although most Bitcoin trading takes place on specialized platforms, online brokers encourage traders to bet on the market fluctuations of crypto assets instead of needing to purchase the underlying commodity, which may be dangerous. Cryptocurrencies are risky and costly to acquire, which is why the crypto trading industry has grown to be a success storey.

A risk-free day trading demo account is a great way to learn the ropes. We've curated a list of the strongest forex, CFD, and spread betting sample accounts. We've received input on everything from no-registration training profiles to MT4 simulators for evaluating strategies. You should check out various brands without risking your investment to see if day trading is right for you.

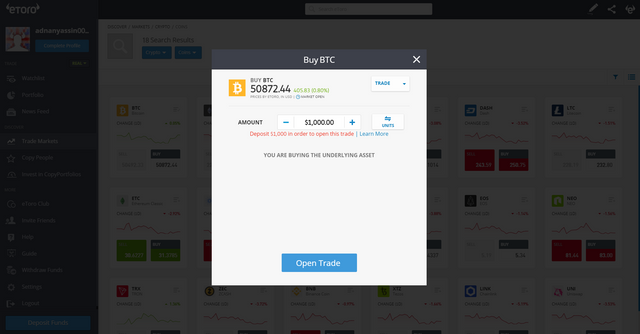

I'll demonstrate how to swap cryptocurrency CFDs with a visual demonstration. I opened an account with eTORO broker firm since it is a leading cryptocurrency broker platform that provides cryptocurrencies such as the top-rated Bitcoin and Ethereum, as well as equity investment.

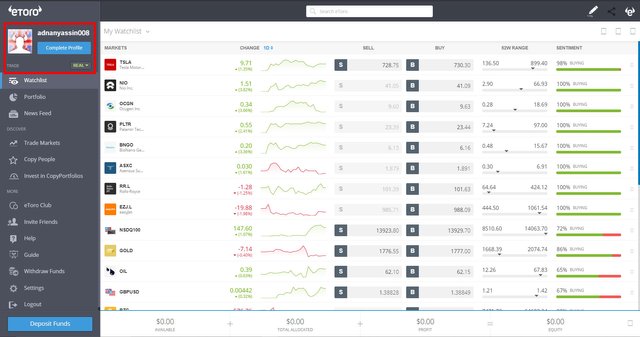

This window appears when I log into my account.

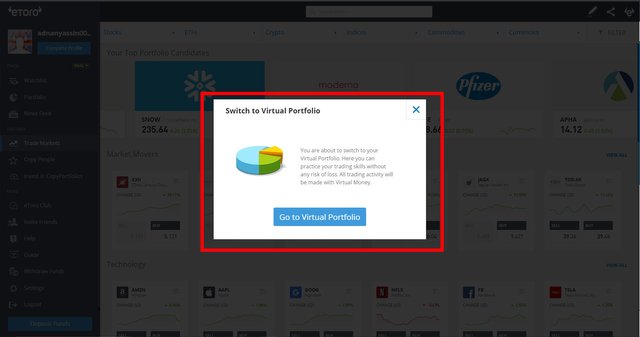

Real Portfolio and Virtual Portfolio are the two modes available. I use Virtual Portfolio because it allows me to hone my trading skills without risking any money.

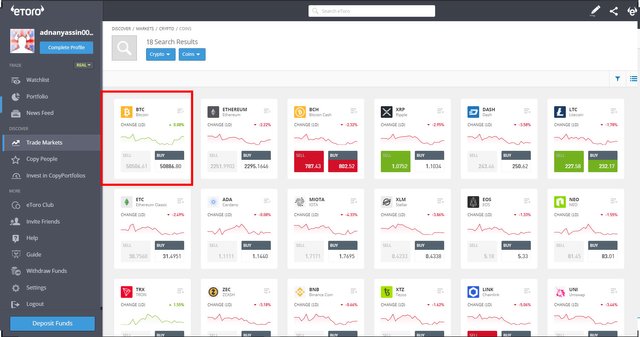

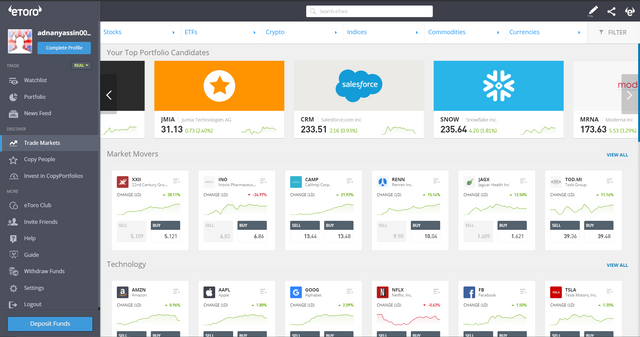

Now I will go to Crypto, you can see below it below the search bar.

Here you can see cryptocurrencies that are being offered. I choose Bitcoin and I will buy now.

You will see this window. Set your amount how much you want to buy according to the value of crypto.

The market is now free, and if Bitcoin rises to $50872.40, it would be considered a success. I'll let the money.

Conclusion

CFDs on cryptocurrency encourage investors to bet on the price of a cryptocurrency like Bitcoin or Ethereum changing. Risk is equal to the volume of the exchange. There are good chances of making large profits if one is experienced at purchasing and selling strategies such as Future Price forecasting and research. To take risks, I assume one must have strong nerves, but it is best to take computed ones.A demo account, also known as a practise account, is a kind of trading simulator that enables

Hello @adnanyassin,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 6/10 rating, according to the following scale:

My review :

Acceptable content, you had to delve deeper into answering some questions and analyze your thoughts.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

thank you Soo much sir.next time i will try my best