Risk Management and Trade Criteria– Crypto Academy / S5W7- Homework Post for @reminiscence01

The moment a person decides to be a crypto trader, the person has already taken a risk. To some, they say it’s a 50/50 odds and they like it that way because it's either you gain or lose. I say it's ignorance because crypto entails a whole lot than just buying and selling assets. Imagine a person decided to buy shoes in bulk and sell because he thinks that he will make a profit or loss his money without taking into consideration anything.

He or she doesn’t know the number of shoe stores around the area or the fact that shoe prices have been reduced because it’s not much valued again. He/She does not even check the trends of society before, just going in to sell shoes headstrong. You’ll realize that for such a person, losses are his/her constant friend.

Losses in traditional trading might be light but for crypto trading, a trader might lose millions of dollars in only 1 minute. All of this is caused by poor risk management, in crypto trading, it’s always advisable to analyze the asset(s) which you wish to venture into.

It’s good to have a signal that you trust from your analysis, also one must use different trading strategies to find the right signal to trade on, this is called confluence trading, it also boots your profitability and reduces your losses, that’s if there’s going to be any.

The thing about risk management is the fact that it asks a trader how much he/she is willing to lose if a trade doesn’t go according to his/her plan. There’s a need to set some means in which he or she sets parameters according to how much he/she is willing or unwilling to lose and trade according to those.

From the above, the importance is self-explanatory, since crypto has to deal with volatile assets, there are always ups and downs of prices, the position you wish to take decides your profit or loss. The fact that you know losses exist gives you a sense of crises for that matter makes you take loss seriously and make you work towards reducing it by ways and means.

It broadens a trader’s knowledge, if you know that you might lose money, which is a fact, it makes you find different ways to analyze the market to boost your chances of success. Another important thing of proper risk management is the fact that you’ll always be conscious of your funds, to not lose much and earn much.

2. Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

This risk management tool mainly talks about using a percentage of your funds for a trade but not all your funds. It shows the fact that per trade, you shouldn’t lose more than 1-3% of your funds. With this tool, it shows how important losses are to be dealt with, because, at a trading position, you might lose 3% of your funds but because you have thoughts of the market going in your favor, you leave it and let it eat away your funds like cancer before you realize that the market won’t go in your favor, you might have lost 60% of your funds or worst on a single position.

To put this rule into play, you first decide which percentage you are willing to lose from 1-3 of your funds on a position. Let’s say I have $1000 and wish to use 3% of it, that gives;

(3/100) * 1000 = $30

3% of $1000 is $30 meaning that for the trade I’m to do, once I incur a loss of up to $30, I’ll close the trade. This way, I would have lost only $30 of my $1000 leaving me $970 for me to trade on other positions.

With this tool, you’ll realize that you can trade on many positions too without losing much if the market doesn’t go your way.

In crypto trading, it’s always about taking the risk so you can profit from it, but the issue is, how much are you willing to risk for how much profit? It wouldn’t make sense to risk an amount on a position and not even have a profit target or trade an amount on a position and hope to get 10% or the trade back as profit. If you risk an amount and only hope to gain less than the amount invested, it’s not worth it. The risk-reward ratio talks about gaining profits of at least what you’re investing in a position, but the ideal ratio would be to get twice or more of your investment.

To use this risk management tool, I recommend using the 1% rule in collaboration with it, such that let’s say I have $1000 and trade 3% of it which gives $30 then it using risk-reward ratio I aim to make a profit of $60 which is twice of my investment. This means I’m employing a 1:2 Risk-reward ratio.

This risk management tool talks about closing trades and taking profits, this mainly deals with where you wish the trade to exit if you’re incurring loss or where to take your profit if your predicting plays out in your favor.

Since there’re differences in which a market might move in, it’s advisable to set a closing curtain and a folding one to know your aim for trade and also have a contingency plan if it doesn’t play out.

To employ this tool, one can use market structure and other trading strategies to determine the direction of a market, such that with that information one can predict if there’s to be a trend reversal or a trend continuation so that you may place your trade indicating your stop loss and also take profit, however, a trader must also follow along with the movement of the charts to get the best results for the trade as there are sometimes miss signals.

3. Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

The following are expected from the trade.

- Explain the trade criteria.

- Explain how much you are risking on the $100 account using the 1% rule.

- Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions.

- Place your stoploss and take profit position using the exit criteria for market structure.

Bearish Trend Reversal

For a bearish trend reversal, the market makes Lower-highs and Lower-lows, with the next lower-low at any point being lower than the previous lower-low, the same applies to the lower-highs.

Entry criteria for Buy signal

To get the buy signal or the reversal of the bearish trend, I decide to trade with the SHIBUSDT pair. We make sure the market is moving in the right direction (bearish market) we then figure out where the market structure breaks from the norm and fails to make a new lower-low but instead makes a lower-high higher than the previous one.

We then wait for the break to retrace making a new lower-low, however, if it fails and instead makes a higher-low which then serves as a support. We then place a buy order at the moment there’s a bullish candlestick after the resistance.

SHIBUSDT chart:Source

Exit criteria for Buy signal

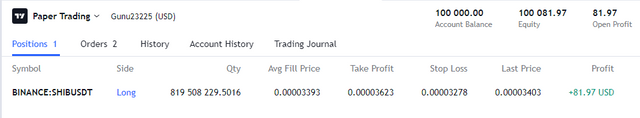

For the exit criteria, we play the stop loss below the new support and find a suitable position to place our take profit. I have decided to risk 1% of my demo account balance which is $100000, 1% of it which is $1000.

My entry point was0.000033395 SHIB, take profit at 0.00003623 SHIB and stop-loss at 0.00003278 SHIB, with this you’ll find out that my profit will be at least twice of my loss which makes it a Risk Reward Ratio of 1:2

.png)

SHIBUSDT chart:Source

Account balance

After the trade was placed, I had already made a plus $81

Balance after trade

Bearish Trend Continuation

For a bearish trend continuation, the market makes Lower-highs and Lower-lows, with the next lower-low at any point being lower than the previous lower-low, the same applies to the lower-highs.

Entry criteria for sell signal

To get the sell signal of the trend continuation, I decide to trade with the FLOKIUSDT pair. We make sure the market is moving in the right direction (bearish market) we then figure out where the market structure tries to make a new lower-high. We then wait for the lower-high to retrace making a new lower-low, then we can place our trade.

FLOKIUSDT chart:Source

Exit criteria for Buy signal

For the exit criteria, I place it right above the new lower-high form. You can also see that I made the trade such that I would be gaining at least twice my risk amount.

.png)

FLOKIUSDT chart:Source

After the trade.

Proof of trade

The fact that people go into crypto for profits sometimes makes them forget that it also has its own risks which can drain a person's account in seconds. This calls for vigilance when trading, it is a must that a person should at least try to confirm a signal with different strategies and also be conscious of how much is to be risked and gained so that even if there are losses, it wouldn't be much.

CC:-

prof @reminiscence01

Hello @abdulkahargunu, I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Thanks prof