In-depth Study of Market Maker Concept-Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

Q1:- Define the concept of Market Making in your own words.

Market making is the process by which the traders provide liquidity to the market. I would like to emphasise one point that, either the buyer or seller can act as a market maker. Buyers are not to be confused for market makers and sellers as market takers as I used to do so a few months ago. Market makers place limit orders in the market on either the buy-side or sell-side and wait for the execution of orders. As long as it takes the price to match the limit price, the placed order is available as a liquid reserve in the market and when the limit price is reached the same market makers act as market takers. Market makers are usually the brokers or financial institutions who place large volume orders in the market. Retail traders can also act as market makers but their orders being low volume do not make any significant impact on the price of an asset. Market makers are benefitted from the bid-ask spread.

Let's suppose broker A places an order for X number of token B for 10$ each and places a sell limit order for 10.05$ per token, it means broker A is creating a bid-ask spread of 0.05$ per token. As brokers place high volume trades let's presume broker A had purchased 1 Million tokens on selling 1M tokens at a bid-ask spread of 0.05$ it would amount to $50k.

To put it simply we can say that the market makers have positive as well as negative impact on the market. They provide high liquidity to the market and by that our trades get executed quickly at the same time they can manipulate the market, where small investors fall into a trap and loss their funds.

Q2:- Explain the psychology behind Market Maker.

Market making is a part of trading and the sole purpose of trade is to benefit from the market. The psychology behind market making is to benefit from the bid-ask spread. As market makers place buy limit orders at lower prices and sell limit orders at a slightly higher price thereby creating bid-ask spread in the market. The fraction of cents when mounted together on large volume orders provide a handsome profit to the brokers as exemplified below.

Suppose broker A places a sell limit order at 0.1 cents higher than the buy limit order for 1 lakh tokens bought at 1$ each. The bid-ask spread would make a profit of 1000 cents for the broker.

Secondly, the market makers prevent the devaluation of assets by providing liquidity to the market. we know that liquidity refers to the ease of doing trade without altering the intrinsic price of an asset. Therefore the brokers or the financial institutions have the capability of manipulating the market in a way that suits their interests. if market making is not carried out ethically the retail traders may get ruined.

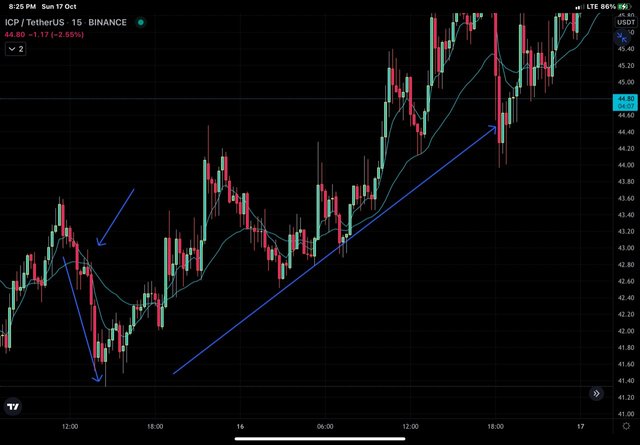

In the chart above we can see a zone of consolidation as marked by a rectangular box. Applying the general principles of trade here, stop loss can be placed just below the lower margin of the rectangle. we can see that the huge volume of sell orders placed by brokers hit the stop loss level and took away the funds of retail traders and accrued benefit out of price hike created due to pushing of high volume by trades.

Q3:- Explain the benefits of the Market Maker Concept?

By providing liquidity, market makers facilitate the ease of doing trade and therefore have a greater role in retaining the traders. Liquidity can be correlated to user retention by looking at the Huge user base of centralised exchanges then the decentralised exchanges.

Market makers determine the price of an asset in the market. By placing high volume trades in the market they can push the price of an asset high and similarly by placing high-volume sell trades they can push the price of an asset down.

By creating the bid-ask spread in the market, they provide opportunities for traders to participate in the trade and benefit from the price dynamics of the market.

The success or failure of newly released tokens is determined by large-cap market makers to a great extent. Having bagged a huge number of tokens by participating in ICOs they can manipulate the market by altering the supply-demand dynamics of the market.

4:- Explain the disadvantages of the Market Maker Concept?

Large-cap market makers have the potential to manipulate the market according to their interests at times the retail traders are ruined despite following proper risk-reward management strategies.

By pushing huge volume trades in either direction, the retail traders are screwed and their funds are drained despite following all trading rules.

Unregulated market makers are least concerned about trading rules. They are self-centred and more concerned about their interests and therefore disrupt the harmony of the trading ecosystem.

Large-cap market makers have the potential to influence the liquidity of the market which in turn govern the trading interests of medium and small-cap traders.

Q5:- Explain any two indicators that are used in the Market Maker Concept and explore them through charts.

For this task, I will be using exponential moving average and relative strength index to explain the concept of market-making.

Exponential Moving Average.

Every trading principle that’s known to retail investors is also known to large-cap market makers too therefore they can manipulate the market to suit their interests. I will be using the long and short exponential moving averages to explain this concept. we know that the general principle of using exponential moving averages is that when a short moving average crosses the long moving average from below upwards it indicates the forthcoming bullish momentum in the market. On the other hand, when the short moving average crosses the long moving average from above downwards, it indicates the forthcoming Bearish momentum in the market. These principles are known to all the traders however the capability to alter the market is possessed by the large capital market makers only.

In the chart above, the long moving average crosses above the short moving average giving a sell signal. Most of the retail investors either sell their holdings or their stop loss would be hit and market makers thereafter push the heavy volume to buy traders in the market and drag the price of an asset up and therefore involving more and more traders to participate in the market and gain the advantage from that market.

Relative Strength index

RSI is a momentum indicator that is used to measure whether an asset is overbought or oversold based on the magnitude of the price and arbitrary value. An arbitrary value greater than 70 indicates that the asset is overbought and gives a sell signal in the wake of forthcoming Bearish momentum on the other hand and arbitrary below the 30 indicates that the asset is oversold and gives a buy signal in the wake of forthcoming bullish momentum, these principles are known to all the traders. Let us see how large-cap market makers turn the table.

In the chart above we can see that the RSI of greater than 70 is followed by a small bearish momentum downwards and therefore most of the retail users sell their assets but we can see the manipulation carried out by large-cap investors thereafter pushing the price up to and gain profit after kicking retail investors with a minimum profit or no profit at all.

Conclusion.

Market making is an act of providing liquidity to the market that is usually done by large-cap investors by placing heavy volume buy or sell limit orders in the market. By market-making, markets are kept liquid and therefore facilitate trades easily without altering the intrinsic value of assets. The psychology behind market making is to benefit from the bid-ask spread. This concept has pros and cons as discussed above. The indicators that are used for carrying out trades are known to all the traders in the same way but the ability to influence the dynamics of the market is possessed by large-cap market makers only and therefore they alter the dynamics of the market to suit their interests wherein retail investors are screwed.