Steemit Crypto Academy Week 3 || Homework || Cryptocurrency Exchange Coinbase Files to Go Public

Digital currency trade Coinbase has recorded with the Securities and Exchange Commission (SEC) to open up to the world by means of an immediate posting. The organization's IPO recording happens during a period of expanded interest and costs for the digital money biological system. Bitcoin (BTCUSD) has valued by over 73% this year and as of late crossed $1 trillion in market capitalization. All the more critically, standard organizations like Tesla, Inc. (TSLA) and Square, Inc. (SQ), and institutional financial backers are inclining toward the digital money, utilizing it as a supporting apparatus against macroeconomic flimsiness.

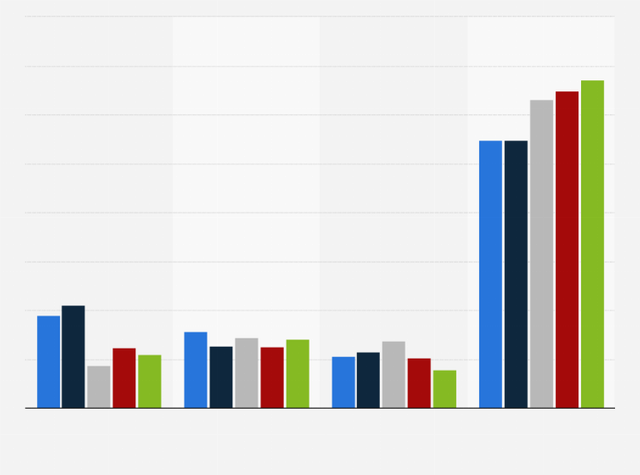

Coinbase, which is North America's greatest cryptographic money trade by exchanging volume, has a monetary record that reflects ongoing instability in crypto markets. It procured net gain of $322 million on incomes of $1.14 billion out of 2020, a critical improvement from its 2019 exhibition of $30 million in misfortunes on income of $483 million.

As indicated by business data stage Crunchbase, Coinbase has raised more than $547.3 million from financial backers since dispatch. Ongoing reports have proposed that it was esteemed at more than $100 billion in private business sectors. Coinbase is among a large number of innovation organizations that have selected to open up to the world through direct posting – in which financiers are not included and new offers are not made – rather than an IPO. The organization will list on Nasdaq and will exchange under the ticker image COIN.

Crypto Markets Come of Age

The Coinbase IPO addresses a transitioning for the beginning crypto economy. Bitcoin, which was dispatched over 12 years prior, has to a great extent been situated as the absolute opposite of existing monetary framework, and Coinbase is its most noticeable image. The organization involves a noticeable spot in the crypto biological system. It was among the main cryptographic money trades on the planet and has a higher number of clients – in excess of 43 million as per its recording – than The Charles Schwab Corporation (SCHW).

Coinbase has likewise profited by the personality shifts for digital forms of money throughout the long term. Different symbols have been foisted onto digital currencies, from their being a mechanism for retail exchanges to a device for monetary strengthening. Every one of these movements created news and rustled up extra interest in Coinbase and its items. All the more as of late, the value instability of crypto markets has discovered kindness with financial backers looking for benefits in a period of low loan fees.

To that degree, Coinbase's income is intensely subject to exchange expenses created from exchanging on its foundation. The organization's recording states that 96% of its income comes from exchanging exchange expenses. While retail merchants actually represent a significant lump of clients for Coinbase, the organization's financial backer blend on its foundation has widened to incorporate institutional financial backers. The 2017 run-up in digital currency markets carried a deluge of such financial backers to the organization's foundation, expanding their numbers from more than 1,000 on Dec. 31, 2017, to 7,000 toward the finish of a year ago.

Cc: