Steemit Crypto Academy | Season 3 Week 8 || Homework Post for Professor @yohan2on || RISK MANAGEMENT IN TRADING by @a-lass-wonders

Entire Question

1)Define the following Trading terminologies.

2)Practically demonstrate your understanding of Risk management in Trading.

- Briefly talk about Risk management

- Be creative

- Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

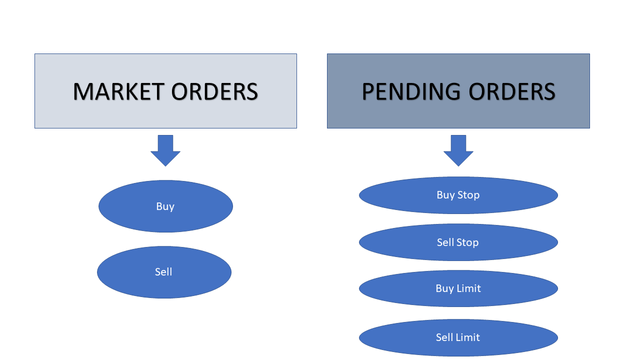

Basically, we have two different trading orders.

- Market orders

- Pending orders

WHAT IS MARKET ORDER?

It is an order to BUY or SELL at the best available price at the current market. After we put our buy or sell market order, the trading platform will execute the order instantly.

WHAT IS PENDING ORDER?

I can categorize this order basically into four types.

BUY STOP ORDER

In this trade type, we will put a buy order request with the ask price which is equal to or higher than the current market value. Usually, traders using this method with the anticipation of security price will increase to some certain level and after the asked value it will keep rising.

SELL STOP ORDER

In this trade type, we will put a sell order request with the bid price which is equal to or lower than the current market value. Usually, traders using this method with the anticipation of security price will increase to some certain level and after the bid value, it will keep falling.

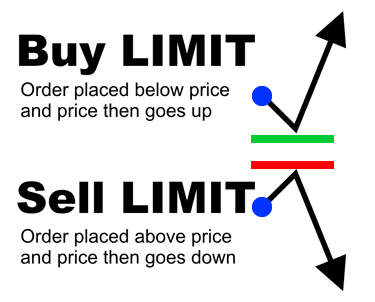

Limit order is an order to either buy below or sell above the current market price.

BUY LIMIT ORDER

In this trade type, we will put a buy order request with the ask price which is equal or lower than the current market value. Usually, traders using this method with the anticipation of security price will go down to some certain level and will rise again.

SELL LIMIT ORDER

In this trade type, we will put a sell order request with the bid price which is equal to or higher than the current market value. Usually, traders using this method with the anticipation of security price will increase to some certain level and will fall again.

RECOMMEND USING LIMIT ORDERS AT??

I would like to recommend using this trading terminology when you are not in hurry to sell or buy. This order type will not be executed instantly as a market order. This terminology will wait till your requested value is reached. I mean if it's a selling order it will wait till the asked price is reached and if it’s buying order it will wait till the bid price achieve.

WHAT IS TRAILING STOP LOSS?

As we discussed above, we know that stop loss is a good strategy to manage the risk of a trade by specifying a place to stop and exit the trade when the market is not favorable to the traders.

Now let’s focus on trailing stop loss. The concept of this market order type is to LOCK IN PROFIT or LIMIT LOSSES. This market order type allows traders to set a pre-determined loss percentage instead of using a single value. As per the industry expert’s opinion, the best percentage is to use either 15% or 20%. However, this order also marks the stop loss at a place below the current market price.

Since we are assigning a percentage, the STOP LOSS will trail the market price as the market moves every time.

Industry experts will recommend using this order when trading a highly volatile currency. We can mitigate the early triggering of our STOP LOSS due to high volatility. According to all these facts, my opinion is this market order can manage the risk very efficiently and have the ability to provide the protection to profits.

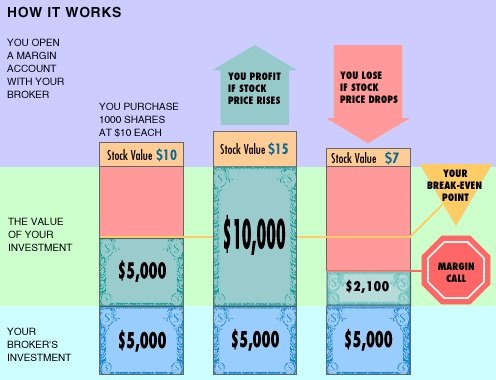

WHAT IS MARGIN CALL?

First of all, we should have an idea about what is the meaning of MARGIN. Simply, I can say that this is some sort of a loan.

So, a margin call is a situation where basically a loan has spun out of control, and the broker who has made the loan to you demands additional capital or securities. Usually, there is a maintenance margin in every margin account which means minimum equity that every investor must hold in their own margin account. Brokers will issue a margin call to bring the margin account up to the minimum maintenance margin. This means we won’t receive a margin call if we don’t have a margin account.

There are several strategies we can use to manage the risks when we are trading.

There are lots of trading platforms usually giving virtual cash to a user account to practice trading. Anyone can get this as an opportunity to develop their trading skills and find their own way to trade and become a successful trader in the future.

This is not valid only for trading. Preplanning will help to achieve the targets smoothly. So, when it’s come to trading, the trader must have an idea about his expectations which simply means the trader must have at least a basic idea about stop loss and take profit levels.

Every day is not a good day for traders. There may be bad days too. Some traders will try to get lose money by increasing willingness to lose percentage. This will tend to heavy losses on the trader’s unlucky day. As humans, psychologically this is a normal situation, but this is not acceptable in risk management. We must observe the 1% rule as a trader.

As mentioned earlier, setting the stop loss and take profit level in the correct places can help to reduce the trader’s risk and get the maximum profit.

You can find below images in which I set these levels accurately.

USE A MOVING AVERAGES TRADING STRATEGY ON ANY OF THE CRYPTO TRADING CHARTS

Buy Stop Order

Sell Stop Order

Buy Limit Order

Sell Limit Order This is the end of my homework task and finally, I would like to give my gratitude to professor @yohan2on for giving us this valuable lecture. Frankly, I was able to gather perfect knowledge in this regard.

GOOD LUCK AND HAVE A NICE DAY!!

- My achievement 01 post: here.

- My achievement 02 post: here.

- My achievement 03 post: here.

- My achievement 04 post: here.

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content though you left out the moving averages and the demonstration of the stop loss and take profit on the charts.

Thank you so much professor @yohan2on for rectifying my home work task.