MTL/USDT Trade Review: Sticking to the Plan (A Simulated Trade Example)

Disclaimer: This is a simulated trade review and does not constitute financial advice. Please conduct your own research before making any trading decisions.

This blog post takes a look back at a recent paper trade on the MTL/USDT pair, executed about three days ago. It's a simulated trade, but it allows us to explore some important concepts in cryptocurrency trading: risk management and the importance of following your trading plan.

Entering the Trade:

We anticipated a potential price increase for MTL, so an entry alert was set at 1.1 USDT. Once the price hit that mark, a buy order was automatically triggered at 1.11 USDT.

Profit Target and Stop-Loss:

Before entering the trade, we had a clear plan in place. The profit target was set at 1.54 USDT, aiming to capture a good price movement if things went our way. To limit potential losses if the price went down sharply, we also placed a stop-loss order at 0.93 USDT.

Managing Risk:

As the price rose to 1.12 USDT, we used a technique called trailing a stop-loss. This means adjusting the stop-loss price upwards as the price increases. This helps lock in profits while still offering some protection in case the price suddenly reverses.

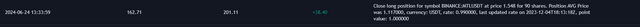

Trade Conclusion:

The price eventually climbed to around 1.67 USDT, which was higher than our initial profit target. However, we stuck to our plan and closed the trade at 1.54 USDT, following the discipline of our pre-defined strategy.