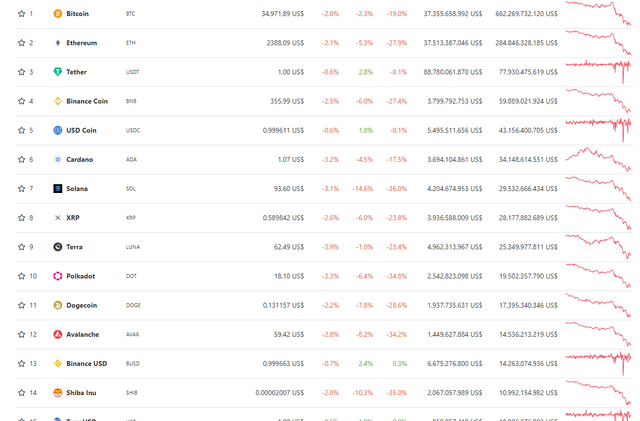

Bitcoin would drop below $30,000 if it doesn't retake previous support, analyst says

If the price of bitcoin (BTC) does not recover above $40,000 (USD) in the short term, it could fall back to between $25,000 and $30,000, according to market analyst Juan Rodríguez.

In his most recent explanatory video , Juan Rodríguez spoke about the BTC price correction that occurred yesterday, January 21, which has left it at a value of USD 35,200 according to the BTC price calculator .

According to their data, during the last 2 days, between 600 and 800 million dollars of BTC would have been sold at a loss , meaning that investors sold this amount of BTC at a lower price than they bought it.

Rodríguez stated that in the global macroeconomic environment there could be reasons to think that the price of BTC will not recover in the short term , and that they could have caused the break of the support of USD 40,000

The analyst mentioned the proposal to ban cryptocurrencies by the Central Bank of Russia, which we reported in this medium , and which could have triggered sales by the so-called "whales" of BTC.

.png)

In the macroeconomic sense, Rodríguez pointed out that the risk markets are down , as is the case of the S&P 500 index, which has had a 10% reduction in its value from Thursday, January 20 at night until Friday 21 January 2022, which could also drag down the price of BTC due to the fear generated in the markets.

On the other hand, if we review the Fear and Greed Index, which takes into account various parameters to measure market sentiment, at this time it signals extreme fear among BTC and cryptocurrency investors.

This somewhat corroborates that investors might not be quite sure what to do at this point in time regarding their strategy regarding Bitcoin and cryptocurrencies.

Some forecasts have not been fulfilled, but Bitcoin holders have faith

.png)

Although Rodríguez asserted that 2022 might not be a good year for the price of BTC , it may not have to wait until after the next halving (the halving of the reward of Bitcoin miners) to see BTC again exceed the USD 60,000 in its price.

He says this based on the fact that, theoretically, the year after the halving usually brings substantial increases in the price of BTC, but this did not happen in 2021 compared to 2020, when it was the last reduction that left the reward at 6.25 BTC per block.

However, Rodríguez points out that the whales still hold a considerable volume of bitcoins to sustain the price of BTC in the long term , although for now it is not enough to boost its price as some investors would like in the short term, but this saving gives it a certain stability to grow later in 2022 and even 2023.

“If we go to the addresses that accumulate BTC, the ones that make that frequent saving in BTC, we see that it continues to increase. As long as this remains this way in the medium and long term, we have to recover, "he said in reference to the holders and new savers who are progressively buying BTC.

Upvoted! Thank you for supporting witness @jswit.

You got a 11.52% upvote from @dkpromoter!

Get Daily Return by delegating to the bot and earn a passive income on your spare SP while helping the Steem Community

500 SP 1000 SP 2000 SP 5000 SP 10000 SP 20000 SP