Thoughts on the Decentralisation of Money 3: The Bretton-Woods Agreement

In my previous post on the history of modern monetary systems, I examined the gold standard regime that underlined international trade between leading world economies in the second half of the 19th and early 20th century. I will continue my historical investigation with the analysis of the Bretton-Woods system that established new norms and institutions, which governed financial and monetary relations between USA, Western Europe, Australia, Canada and Japan after World War II (WW II).

The Bretton-Woods Agreement, signed in 1944, was based on the acceptance of the gold backed US dollar as a world reserve currency: the US committed to tie the dollar to gold at a fixed rate of 35$ per ounce, and all other countries were to peg the exchange rates of their currencies to the dollar within a margin of 1 %. On the basis of shared experience of calamitous currency wars, which contributed to the outbreak of WW II, the contracting parties agreed upon the need to establish an orderly fixed exchange rate regime that would facilitate unrestricted international trade, free of unforeseen currency fluctuations, isolated trading blocks and aggressive protectionist policies. The agreement envisaged the establishment of two international institutions – the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD) –, commissioned to assist underdeveloped economies and countries with current account deficits with conscientious economic policies.

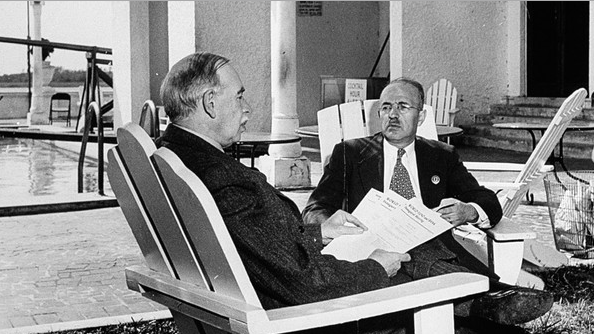

For the most part, the Bretton-Woods Agreement was an outcome of painstaking negotiations between the delegations of the UK, headed by the famous economist John Maynard Keynes, and of the US, led by the US Treasury official, Harry Dexter White. The balance of forces betwen the negotiating parties clearly favoured the US as the strongest industrial power in the world with substantial current account surpluses, that emerged unharmed from WW II, holding around 65 % of world’s gold reserves. The UK, conversely, witnessed the demise of its empire and the devastation of its domestic economy by the WW II, from which it emerged highly indebted and in desperate need for reconstruction funds that could only be provided by the US. The undisputed economic and political supremacy of the US, led to the adoption of the agreement that was mostly in accordance with White’s vision. Nonetheless, some of Keynes’ recommendations were incorporated into the arrangement as well. Keynes’ emphasis on the need to curtail speculative financial flows – conspicuously expressed in his plea for “the euthanasia of the rentier” – by means of strict regulation of interest rates by central banks, became a crucial feature of the Bretton-Woods system. This was also a feature that decisively distinguished the Bretton-Woods system from the former gold standard regime, based on unhindered capital flows. In the classical gold standard regime, national economies primarily relied upon the flexibility of domestic labour markets to carry the weight of adjustment to external competitive pressures by means of wage depreciation, whereas in the Bretton-Woods System, national economies primarily resorted to financial capital controls to deal with competitive pressures from abroad.

The Bretton-Woods System accelerated international trade and investment, but in a rather selective manner. It facilitated free movement of commodities by abolishing many tariffs and quotas on imported goods and encouraged Foreign direct investment (FDI) directed in manufacturing. However, it simultaneously encouraged national central banks to limit capital flows directed towards bond and currency markets. In accordance with the Keynesian economic doctrine, the leading Western countries restricted speculative capital flows and mostly adopted expansionary growth-oriented domestic fiscal policies – deemed as essential to surpass the lack of effective aggregate demand – and restrained themselves from using deflationary measures – deemed as leading to a self-defeating recessionary spiral. As opposed to the former gold standard regime, which closely followed the liberal laissez faire doctrine, the Bretton-Woods System thus established an international framework that encouraged a wider scope of governmental interventions.

The architects of the Bretton-Woods System also agreed that an automatic mechanism for stabilising foreign trade imbalances, which characterised the classical gold standard regime, is inadequate, and stressed the need for deliberate and internationally coordinated intervention of the leading nation states. For this purpose, the IMF was established in 1945. The initial idea behind the IMF was to establish an international institution that would advance affordable loans to countries with current account deficits, and thereby spare them the need to resort to deflationary measures. The creation of the IMF was accompanied with the formation of the IBRD, the principal agency of the World Bank Group, commissioned to advance loans for post-war reconstruction and development purposes. However, it soon turned out that the limited credit facilities of the IMF and IBRD were inadequate to resolve the colossal balance of payments disparities between Western Europe and the US: after the war, huge current account surpluses of the latter mirrored immense current account deficits of the former. On the long run, the state of affairs was not detrimental just for the Western European and other competitor states, whose export sectors were lagging behind that of the US, but for the US as well. Namely, if immense dollar reserves were to continue pilling up in the US indefinitely, other nations would run out of funds to buy US exports.

For this reason, the US deliberately initiated a deficit-oriented foreign trade policy, with the aim of redirecting the flow of dollars from the US to the rest of the world. A well-known example of such a policy was the so-called Marshall Plan, initiated in 1848, through which the US granted Western European countries nearly $140 billion (in current US dollar value) of financial aid for post-war economic reconstruction. From the late 40-ies to the late 50-ies, the US facilitated the outflow of dollars in order to provide the international economy with necessary liquidity. Consequentially, by the late 50-ies, the US started to run ever higher current account deficits. The resolution of the post-war balance of payments crisis thus turned out to be a preface to another crisis of the same kind, but this time, the role of the patient with mounting negative net sales abroad, belonged to the US. In 1960, the long-term untenability of the Breton-Woods System was highlighted by Robert Triffin, a Belgian economist who formulated what later came to be known as Triffin’s Dilemma: if the US ceases to run current account deficits, the international system will run out of liquidity and eventually collapse. But if the US keeps mounting deficits until further notice, the confidence in the dollar as the world reserve currency will erode and ultimately result in the breakdown of the system as well.

Due to the emerging balance of payments crisis and the erosion of confidence in the dollar, the fixed ratio between gold and the dollar was ever harder to preserve. This led to a series of coordinated multilateral measures by the US and leading Western European countries, aimed at preserving the dollar/gold ratio, starting with the establishment of the London Gold Pool in 1961: its role was to safeguard the fixed exchange rate between the dollar and gold, by selling its stock of gold in the case when market gold prices exceeded $35 per ounce, and buying back the gold when gold prices dropped. Moreover, many unilateral measures by the US were implemented in order to curb its deficits and the depletion of its reserves, such as Kennedy’s tax reform in 1963: large scale tax-cuts were intended to spur the US export sector and curb the current account deficits. During the 60-ies, many consecutive attempts by the US to balance international trade and restore the role of the dollar as a trustworthy world reserve currency, turned out to be insufficient. By the mid 60-ies, Western European economies and Japan gained a competitive edge, experienced faster economic growth, higher levels of trade than the US and accrued reserves that in total already exceeded those of the US. The US, conversely, topped its balance of payments deficits with large public deficits – skyrocketing due to the costly Vietnam War – and struggled with rampant inflation. The dollar was evidently overvalued, while the German Mark and the Japanese Yen were palpably undervalued.

The erosion of the Bretton-Woods System was enhanced by the simultaneous rise of transnational capital markets. Initially, the Bretton-Woods agreement was based on the commitment of the contracting nations to restrict speculative capital flows. However, by the 60-ies, practically all the Western economies loosened the restrains on financial capital and investment flows, and the corporations and investment banks started to expand their operations overseas. Parallel with the flow dollars from the US to Western Europe, and later on, to the rest of the world, transnational financial markets were flourishing. Of particular importance was the so-called Eurodollar market (the term Eurodollar refers to US dollar denominated deposits at foreign banks or foreign branches of American banks: originally these dollars were deposited almost exclusively in Europe – hence the name Eurodollar –, but were later also held in other offshore locations around the world). The Eurodollar markets that circumvented regulatory measures of the Federal reserve and other central banks, swiftly became an attractive source of cheap credit for private investors. The supply of dollars on the Euromarkets eventually exceeded the supply of money of all the nations except for that of the US. In the late 60-ies, even the central banks and nation states, including those of the Eastern bloc, regularly resorted to Eurodollar markets to obtain low interest-rate loans for financing domestic development. However, the expansion of transnational dollar markets came at odds with the formal framework of the Bretton-Woods System. The outflow of dollars all around the world gave birth to transnational dollar markets that side-stepped the regulatory framework of the FED. The FED, in turn, could not efficiently control the nominal value of the dollar, which also made it increasingly difficult to preserve the fixed dollar/gold exchange rate.

The balance of payments crisis and the rise of transnational capital markets eventually eroded the very foundations of the Bretton-Woods System. After continuous failures of the US to restrict the depletion of its gold reserves – the total share of global gold reserves, held by the US, fell from 65% at the end of WWII to 22% in 1970 –, the Nixon administration unilaterally announced the devaluation of the dollar, and thereby abolished the fixed exchange ratio between the US dollar and gold. After the so-called Nixon shock in 1971, all the main Western European countries and Japan unpegged their currencies from the US dollar by 1973. The subsequent collapse of the Bretton-Woods System introduced a new era of fiat currencies and floating exchange rates, about to be analysed in my next post.

References

- Barry Eichengreen (2008), Globalizing Capital: A History of the International Monetary System. Princeton University Press: Princeton and Oxford.

- Peter M. Graber (1993), The Collapse of the Bretton Woods Fixed Exchange Rate System: http://www.nber.org/chapters/c6876.pdf.

- Yannis Varoufakis (2013), The Global Minotaur: America, Europe and the Future of the World Economy. Zed Books: London.

Congratulations @stefanfurlan! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @stefanfurlan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!