Part Two - History of Bitcoin Scalability

And The Debate Continues

Part Two - Bitcoin Scalability. And the debate about Bitcoin's scalability continues. In the previous article, we already know, that in the early days of bitcoin was first introduced, there has also been a debate.

In the second part of Bitcoin's History of Scalability, it will begin to connect with Blockroad start bitcoin, ideas about Sidechain, Segwit, and the encircling debate.

Controversy Blockstream - 2014

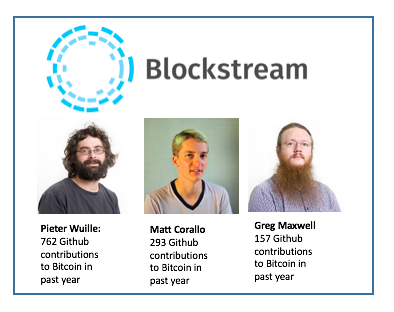

Blockstream, is a blockchain-based startup founded by Adam Back in 2014. Adam Back, assisted also with Gregory Maxwell as CTO, as well as Austin Hill. Initially, the founding of this company is expected to specifically find funding for the Bitcoin Core developer team.

The people behind Blockctream can be people who have been in the crypto world for a long time. Call it Adam Back, before Bitcoin, he is the originator of HashCash. While many others, is also derived from Bitcoin Core developers, such as Grex Maxwell, Pieter Wuille, and also Matt Corallo.

In no time at all, Blockstream managed to raise about 76 billion dollars from several companies. Some companies are investing in Blockstream like Horizons Ventures, Mosaic Ventures, Khosla Ventures, as well as from Reid Hoffman (LinkedIn Founder).

So many companies are interested enough to provide the investment, of course feel quite confident with the ranks of the people who are behind him. Individuals within Blockstream, have also contributed significantly to a number of non Bitcoin groups such as IETF, W3C, Linux Foundation, as well as Hyperledger.

As a result, Blockstream does provide many new innovations in blockchain technology. As we have heard so much about Sidechains (October 22, 2014), Segregated Witness (commonly called Segwit), and many others.

With the open source project Bitcoin character, it makes many feel that only certain people have access to change, or try to get approval for some things on Core Bitcoin.

In addition, many perceptions assume that experiments for the development of the Bitcoin protocol seem to be untouchable for several years later. Then, start assuming the unclear position on the people behind Blockstream, for many things that should be done for further development of Bitcoin.

Adam Back himself, explains that the connection between Blockstream and Bitcoin Core are two different entities, although many people from Bitcoin Core developers are in Blockstream. However, the outline, developer Bitcoin Core is a group of independent developers who are more focused on making the best choice that suits the Bitcoin ecosystem.

Because not many do many essential changes, then the people of Blockstream then considered as anti big block. From here, then will appear other branches of the Core as well as Segwit, Bitcoin Classic, to Bitcoin Unlimited. Outline, feel the development of Bitcoin seemed felt stagnant. Meanwhile, on the other hand, quite a bit of bitcoin core developers perception, more focus on Blockstream than for Bitcoin Core.

Not to mention, in further developments, there will be further controversy between some Blockstream people, with the administrators of some large Bitcoin communities. Themos, known to be a bitcointalk administrator and also Reddit Bitcoin, feels like to build another forum software called Epochtalk.

Throughout 2014 to 2015, the debate over Bitcoin's scalability persisted, no differences existed, each distinct, as if forming two major groups, between the pro and the big block, with the large anti-block Doing extreme changes of bitcoin basic protocol). Until then, Blockstream released a Sidechain whitepaper.

Sidechain "The Altcoin Killer" - Blockstream October 22, 2014

Sidechain is pioneered by the Blockstream startco bitcoin. Then Sidechain whitepaper was released on October 22, 2014. Compiled by Adam Back, Matt Corallo, LukeDashjr, Mark Friedenbach, Gregory Maxwell, Andrew Miller, Andrew Poelstra, Jorge Timon, and also Pieter Wuille.

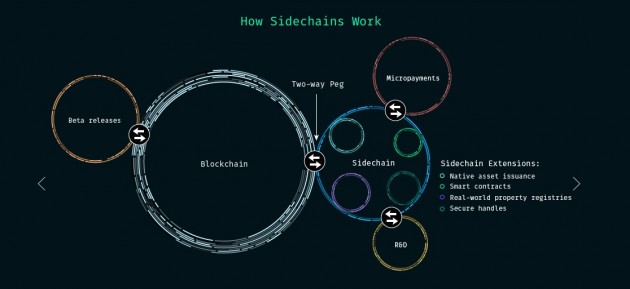

The outline, with Sidechain, will be the link between two different networks. Furthermore, with the characters who will be able to connect each other two different networks, of course, will be able to sharpen the cryptocurrency space. Many people then refer to Sidechain as "altcoin killer". Of course, if Sidechain is implemented successfully, then it means that two blockchains coming from different networks will be interoperable. Thus, the assets between the two can also be exchanged.

Sidechain, is structured with an ideal infrastructure to be deployed in Bitcoin. Although it will take a lot of time for implementation and experiments that must be done. However, Blockstream is pretty sure that later, Bitcoin will pretty much provide bright colors in the future.

Based on the Sidechain whitepaper, the concept offered is called "Pegged Block", which will be able to interact two different networks. This pegged block, connected to a special output equipped with proof of certifying on the number of bitcoins that are to be exchanged for other assets. Meanwhile, the "two-way peg", as the executor between two values of the two different assets.

While the necessary implementation for Sidechain can run smoothly, requires merge mining. It is necessary, for the proof of certifying process, because of course, two different networks will require different proof of work from different networks. One of the things to consider, is because of the potential fraud, if until later it will impact the centralization of Bitcoin mining ecosystem.

When this starts to be implemented, of course the miners will probably need a larger cost, because later Bitcoin network will also be more support for blockchain from different networks.

Clearly, if more operational costs are to be incurred by miners, only large miners will be most likely to continue running the mining ecosystem. This, of course, will further narrow the space of the miners, and increase the risk of centralized mining ecosystems.

As a result, since the whitepaper was released, the crypto community gave two different big opinions. Some argue that this idea, will provide much innovation for the world of cryptocurrency especially Bitcoin. While others will have a bad effect because of the risk of centralization that may occur as an implication. The rationale that responds negatively to the Sidechain idea, hoping that the innovation of the Bitcoin ecosystem, does not necessarily have to be associated with altcoin.

Initially, this Sidechain will also be used as a proposal in BIP (Bitcoin Improvement Proposal). Blockstream party also plans to release this Sidechain source code. But it turns out, on May 9, 2016 and then, the Blockstream just register the patent Sidechain.

This idea seems to generate a lot of negative potential for bitcoin ecosystem, then the scalability debate continues. Until then came a proposal about Segregated Witness at the end of 2015.

Segregated Witness - December 7, 2015

At the end of 2015, precisely at an event titled Scalling Bitcoin held in Hong Kong on December 7, Pieter Wuille as Co-Founder Blockstream submitted a proposal on Segregated Witness.

Since the event, segwit began to be much discussed. There are so many benefits that will be taken if later segwit capable of activated on Bitcoin protocol. Because by enabling segwit features, then a number of other breakthroughs become possible to do, as does Lightning Network, as well as Sidechain.

In bitcoin transactions, may include one or more input transactions. Input this transaction, explaining where a number of bitcoin is derived, to be able to establish the history of the transaction. Meanwhile, one or more output transactions, also states where a number of bitcoin will be transacted. In order for transactions to run, then required a digital signature, which can only be executed by the legitimate owner only.

In the case of the transaction, in segwit, the digital signature will be separated, as it will no longer be part of the transaction, then retrieve the transaction data, and put into the merkle tree, until it becomes a transaction input component.

That is, there are some parts that can no longer be read by the miners, as well as the size of the transaction potentially becomes smaller, because the digital signature has been generated into one in the input transaction. Lately, many assumptions that segwit, it would require a larger block size. Because even though the digital signature is not done in a single transaction packet, the digital signature data is still added to the block header. Furthermore, an explanation of this will be discussed elsewhere in the continued development of the bitcoin scalability debate.

In addition, segwit is believed to minimize fraud transactions. That's also because digital signatures are not included in the transaction. So the third party also will not be able to modify again, and also change the transaction ID.

But again, there are a number of potential negative needs to be of more concern. The activation of the Segwit feature, also considered to have an impact on the mining ecosystem. There are several parts of the bitcoin ecosystem, which still utilizes the details of transactional information. The party who feels the most about it, Coinbase, feels their service will be pretty much disturbed.

The reason, with Segwit, then the block header later, will also have detailed transaction information, other parts of digital signature data that has been generated separately. They assume, this will cause a significant effect on software mining that will be used.

Meanwhile, the main part of the debate about Segwit's proposal, is whether the road will be implemented. Because, Segwit implementation is most effective if run with hardfork. While the Bitcoin ecosystem, so far enough trying not to take the option hardfork.

Different opinions, then many emerging about segwit. Especially, on whether the mechanism will have to use Segwit. The debate also increasingly tapered if the developers Bitcoin dare take hardfork step or not. Meanwhile, the pressure to increase the limit block is also increasingly profusely.