The history of money

Money did not always exist in the form we know it today. Since the dawn of time, people have been trading. They needed something for that as a means of exchange. Something that everyone will accept and it will be useful to him. Eventually, people paid with salt, beads, skins or shells. And in some local communities, goods are still used as a means of payment.

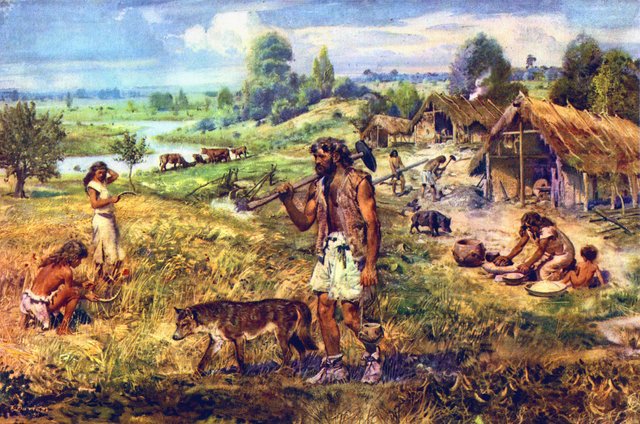

- Neolithic revolution.

The development of commodity economy was very important. In the natural economy, people led a nomadic lifestyle and did not get food in excess, so by wandering they were not able to lift everything. Each unit had an allocated department. Each man was mostly hunting but women were preparing food. They produced so many goods that they would need them for consumption. With time, the nomadic mode changed into settled. People were able to store certain goods, which resulted in shortages in some "farms". The exchange trade followed, that is, the goods for the goods.

The first means of payment is "Wages".

_from_Kostkowice,_Poland,_9-mid_X_Century_AD.jpg)

Axe-shaped grzywnas from Kostkowice, Poland.

Any historians could say anything about 150 different goods that were in the form of an equivalent. The wages were mentioned above, that is various shells, axes or salt. In various parts of the world you paid something else, for example, in China you paid silk; in Africa, shells, salt or pearls; in Poland, squirrels, canvases, salt or amber skins were used. With time, people no longer applied the commodity principle and made their lives difficult.

That is why they created "the Ore", something that people needed because it is easily portable and at the same time it was a payment function. At the beginning, the role of money was played by base metals such as iron, copper and bronze, while in the course of further evolution they were replaced by precious metals - gold and silver, as well as platinum.

In time, precious metals such as silver and gold were left alone. These nuggets were not equal, therefore each payment had to be carried out with the aid of a scale. In everyday life it was very tedious and time-consuming. Then they were turned into gold coins.

The next stage in the development of money was the appearance of coins with the seal of known rulers or kings. The value was written on the coin, so the owner was aware of how much he had in his pouch. The coins were made of electrum of gold and silver alloy.

The first coins were made in VII in. BC in Lydia (present-day Turkey). Coins were distributed in the Mediterranean by Phoenicians and Greeks. Metal money also developed independently in China and India.

Then, the paper money known to all of us arose. At the beginning he was a substitute for metal money. The appearance of the deposit receipt contributed greatly to the development of trade because the trader did not have to lug coins with him, all he needed was a receipt from the goldsmith.

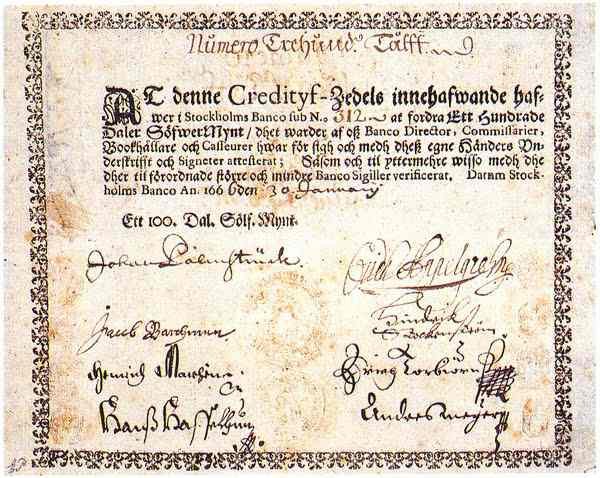

In Sweden, the oldest deposit receipt from 1666 was found here:

The first paper money appeared in China in the years 620-907.

The next means of payment was non-cash money. People have long tried to pay for something without cash. That's why checks were invented. Banks were their foundation because the checks are issued by a bank, not by a goldsmith or by a normal man. People thought that it was better to keep money in the bank and not be exposed to various thefts or robberies. Non-cash money is money taking the form of an entry in bank accounts.

With the rise of new banks, electronic money was created. With the arrival of new banks, electronic money was created. The resulting payment, credit or debit cards. Thanks to e-money, we can make a transfer, order a payment order or pay by phone, for example.

Payment cards enable payment without cash. Payment cards were not invented by banks only by store owners. The then cards were the authorization to collect the ordered goods and save the loan to the customer.

The first mention of the prepaid card appeared in the 1880s. Edward Bellamy in his book Looking backwards mentions the possibility of using such a means of payment.

The first cards, functioning on similar principles to modern cards, appeared in the United States at the beginning of the 20th century. In 1946, banker John Biggins implemented the first bank card at a Brooklyn estate. But the first card was issued by Diners Club International In the spring of 1950, a company was created that issued the first universal card allowing payments in hotels and restaurants.

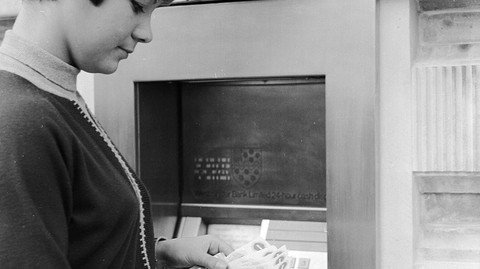

The device known to all of us is the ATM allows you to do many different functions using a payment card. The first ATM was installed in London by Barclays Bank in 1967.

The ATM has many functions such as cash withdrawal, checking account status or changing the PIN code to your account.

Each of us has heard about bitcoin, this is the last payment method for today.

It is a virtual currency independent of various banks or governments. It was introduced in 2009 by a person (or group of people) with the pseudonym Satoshi Nakamoto. The name also refers to using its open source software and the peer-to-peer network it creates. Each bitcoin is divided into 100,000,000 smaller units, called satoshi. It is based on P2P technology. Bitcoin is based on the transfer of amounts between public accounts using public key cryptography. All transactions are public and stored in a distributed database.

I apologize for my small mistakes;) I'm not very good at English and I'm just still learning :)

Sources: nbportal/Wikipedia/automatykabankowa/businessinsider.com/prokapitalizm

Photo authors: Wikipedia/Mathiasrex/James St. John /indiamart.com/Classical Numismatic Group/ the Library of Congress online collection/Peter Ruck/bitcoin.com/Lotus Head

oh yea i remember this from history lessons in highschool