The Real Price of Missing Out on Hex

The Gold Standard of HEX Staking Strategies

In this article we will explore the true cost of not buying Hex and waiting too long to get involved in Hex to setup a perpetual passive income device that will pay out lifelong if you design it right.

Opportunity cost is defined as, “in simple terms, the benefit not received as a result of not selecting the next best option” among a set of possible choices.

My goal is to convince you the best time to acquire shares is now, and why you need to act now in order to secure your position in Hex which you can use to leverage over a lifetime, so that you may earn more trustless interest in the long run by buying shares sooner vs later. And I mean especially prior to an event that is known as BPD (Big Pay Day) where the #WeAreAllSatoshi Bonus is credited to the staker class, currently a lump sum payment of 183.7B HEX.

I believe Hex is the best opportunity that exists at the present time for people looking to preserve and grow wealth via a system that rewards trustless interest by essentially locking capital through the smart contract for a certain period of time up to 15 years in fact. Hex is nothing more than a blockchain-based time deposit. It is the simplest most elegant idea made into a cryptocurrency, the first of its league, to effectively and cleverly monetize time.

There has never been an invention such as Hex. It is the first of its kind.

We will examine the consequences of not investing in Hex for three different classes of people, for people who can only afford certain amounts of Hex, supposing they choose they want to invest in Hex, but need information on how to best deploy their capital to monetize the next 15 years of their lifetime most effectively and productively.

The way I will analyze the true opportunity cost of missing out on Hex for each economic class I will outline is by assuming one is intelligent enough in the first place to utilize Hex to create a perpetual passive income monthly ladder. This way you have a payout every month and you won’t be needing to try and time the market and for many other reasons besides.

Current price of Hex to calculate results below = $0.0034

Class A : Those folks who can afford to buy enough Hex to cover a 10k Hex / Month staking ladder going out 15 years (180 months). 10,000 HEX * 180 months = 1,800,000 HEX. At current prices, that is $6,265.

Class B : Those folks who can afford to buy enough Hex to cover a 50k Hex / Month staking ladder going out 15 years (180 months). 50,000 HEX * 180 months = 9,000,000 HEX. At current prices, that is $31,328.

Class C : Those folks who can afford to buy enough Hex to cover a 100k Hex / Month staking ladder going out 15 years (180 months). 100,000 HEX * 180 months = 18,000,000 HEX. At current prices, that is $62,656.

Now that’s just covering the cost to buy the Hex initially required to create a monthly passive income ladder for each class. Once we have acquired the necessary amount of Hex for each group to establish a monthly income ladder, we need to calculate how many shares each class will have by setting up their ladders Now versus Later when the shareprice is far higher, actually beyond 2x higher after Big Pay Day on November 19th, 2020.

Nov. 19th, 2020 | The shareprice for each Hex spent to purchase shares 2x’s. 90 million / hex -> 45 million / hex

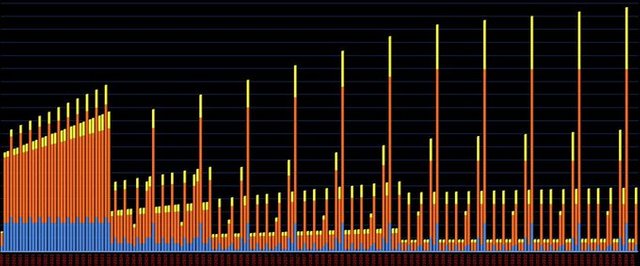

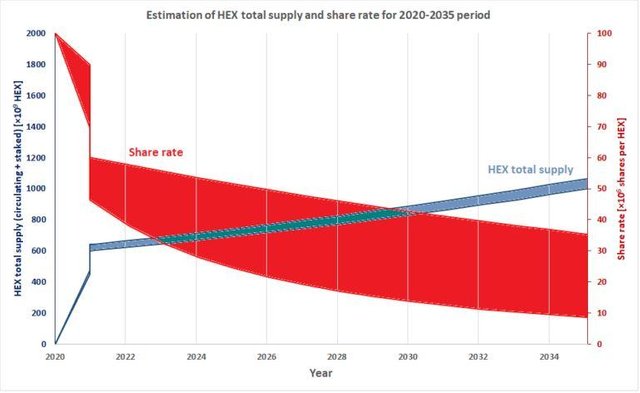

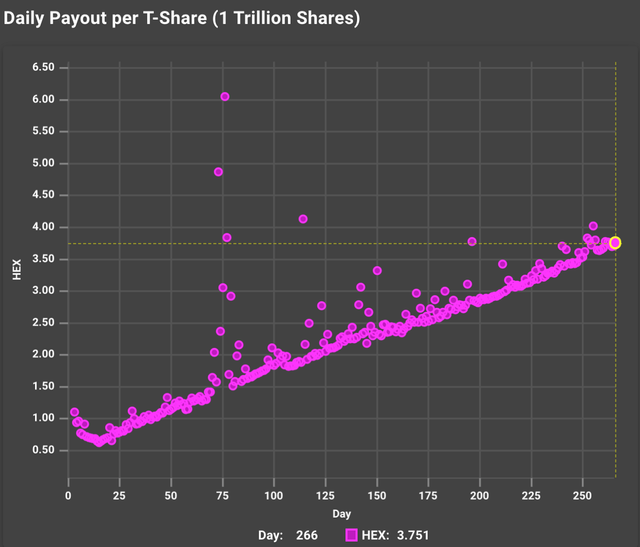

The real opportunity cost I’m speaking of by missing out on Hex has to do with the shares. You must secure your shares for as cheap a price as possible, which is always today. Everyday the shareprice goes up. Analyze closely the chart displayed above.

So what is the share price right now this day 25th of August of year 2020?

You can check for yourself here : https://go.hex.com/stake/

10,679 HEX / T-Share is the current share ratio.

This means that it will cost 10,679 HEX to purchase 1 Trillion Shares (T-Shares for short.)

This ratio is increasing everyday somebody has a stake maturing establishing a new all time high ROI in the system. This is how it was designed to ensure exponential interest is rewarded to stakers who lock up for bigger and longer, and also to make sure one cannot recompound short term stakes trying to outdo the profit of a singular long term stake in attempt to “game the system”.

There is an audit proving this here.

https://blog.coinfabrik.com/hex-financial-audit/

“CoinFabrik was asked to audit the contracts for the HEX project. In particular, we were asked to verify that longer stakes pay better than shorter re-compounding stakes. This document discusses the issue and provides an insight into why longer stakes are better than short re-compounding stakes when using the same resources.”

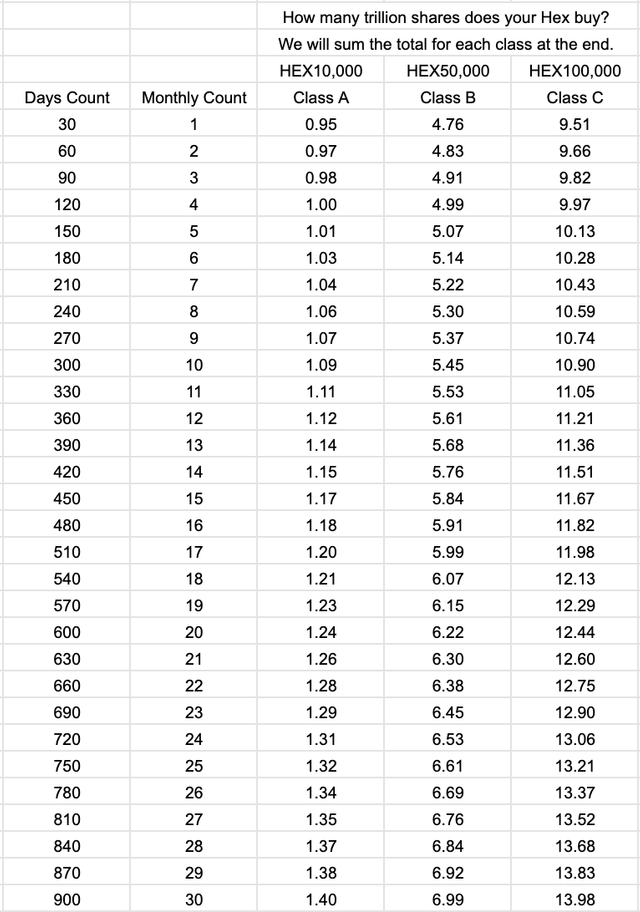

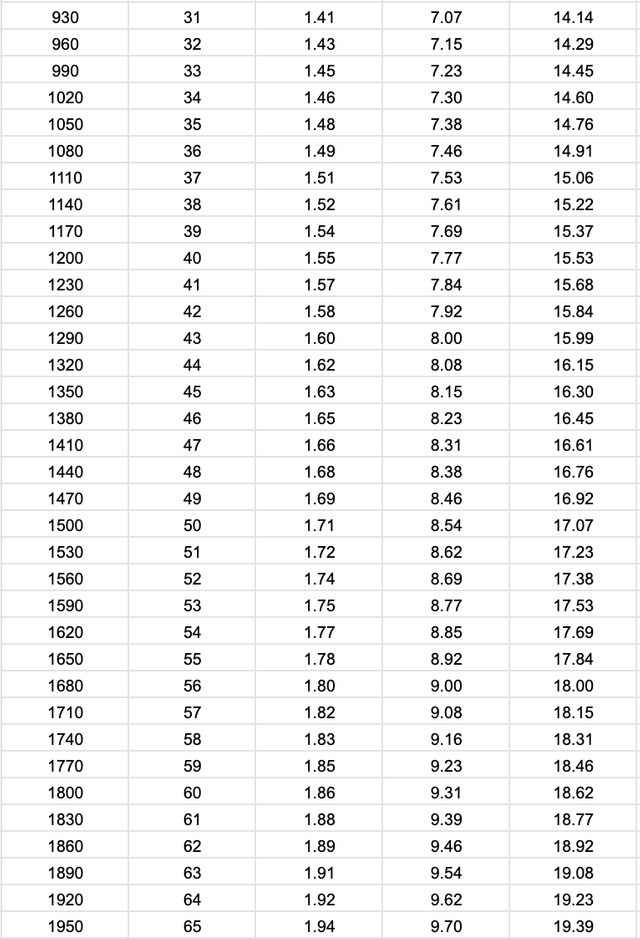

Anyways, now let’s analyze how many shares given today’s rate each class I’ve outlined could have by buying the hex and then creating the monthly ladder.

Today’s Share Ratio = 10679 HEX / T Share (or 1,000,000,000,000 Shares)

[Divide each side of equation by 10,000]

1.0679 HEX / 100,000,000 Shares

[To derive exact share price meaning how much can 1 hex buy in terms of shares, divide 100,000,000 Shares by 1.0679 HEX.]

93,641,726 / 1 HEX or 1 HEX / 93,641,726 Shares = ShareRate

This means for each 1 HEX you are buying 93,641,726 shares when you create your stake for each month. And if you stake 10,000 HEX a month, you multiply 10,000 HEX * 93,641,726 shares to get the total amount of shares your hex can buy at today’s ShareRate.

We will do this calculation for each month for each class to evaluate how many total shares each class can get at today’s ShareRate by acting now to create the ladder.

Later we will realize the true cost of postponing creating such a monthly income staking ladder as the shareprice always goes up, and you need more hex to get same shares you could have bought before for cheaper. 2x cheaper before BPD vs afterward as a matter of fact.

By leveraging Longer Pay Better Bonus for each monthly stake going out further and further in time, you get more shares for your hex, this is what is called “effective hex”. This is why you get slightly more shares each month that you stake for even though you’re staking the same amount of HEX for each month.

In our scenario with the monthly figures of HEX we are using as an example, the Bigger Pays Better Bonus is pretty much negligible and doesn’t apply here. The figures reported below were taken manually by using go.hex.com to calculate the numbers. I’ve done the hard work to figure out the numbers using a spreadsheet so you don’t have to. You’re welcome!

Take note that after 10 years or 3641 days, you’ve maxed out the amount of shares per hex you can buy taking advantage of LPB to its limit, 20% more each year, capped at 10 years.

Notice shares max out after 3641 days (10 years)

What league would each class put you in after monthly staking ladder is completed?

Evaluate by taking each class’ total shares staked and divide by total system shares.

Total System Shares = 9.89E+18

Class A | 3.93E+14 Your Total Shares

Class B | 1.96E+15 Your Total Shares

Class C | 3.93E+15 Your Total Shares

Respective % Ownership of System Total Shares and League for Each Class :

Class A | 0.0040% Swift Squid

Class B | 0.0199% Dolphin

Class C | 0.0397% Bigger Dolphin

🏅 HEX Leagues ( How your league is determined | visit hex.live! )

🔱 Prosperous Poseidon (> 10% of total shares)

🐳 Winning Whale (> 1% of total shares)

🦈 Super Shark (> 0.1% of total shares)

🐬 Dabbing Dolphin (> 0.01% of total shares)

🦑 Swift Squid (> 0.001% of total shares)

🐙 Oily Octopus (> 0.0001% of total shares)

🦀 Cool Crab (> 0.00001% of total shares)

🦐 Shy Shrimp (> 0.000001% of total shares)

🐚 Silent Shell (~0% of total shares)

We are nearing the end of the article. If you’re with me still, you will soon see why it is crucial to create one’s monthly staking ladder prior to and not after the BPD event on November 19th, 2020.

Final Question : What is the price of waiting to create the monthly ladder until after BPD on November 19th, 2020?

Well we know the shareprice will practically 2x.

So lets compare shareprice now vs shareprice post-BPD.

BEFORE

Today’s Share Ratio = 10679 HEX / T Share (or 1,000,000,000,000 Shares)

[Divide each side of equation by 10,000]

1.0679 HEX / 100,000,000 Shares

[To derive exact share price meaning how much can 1 hex buy in terms of shares, divide 100,000,000 Shares by 1.0679 HEX.]

93,641,726 / 1 HEX or 1 HEX / 93,641,726 Shares = ShareRate

AFTER

Post-BPD Estimated Share Ratio = 21,358 HEX / T Share (or 1,000,000,000,000 Shares)

[Divide each side of equation by 10,000]

2.1358 HEX / 100,000,000 Shares

[To derive exact share price meaning how much can 1 hex buy in terms of shares, divide 100,000,000 Shares by 2.1358 HEX.]

46,820,863 / 1 HEX or 1 HEX / 46,820,863 Shares = Post-BPD ShareRate

Now what are the implications of this radical change in shareprice?

The answer is it will cost you twice the hex to acquire the shares you could have bought before BPD after BPD. And what if the price is 10x higher by then? It means you would be paying [ 10x (USD Price) * 2x (doubling in shareprice post-BPD) ] = 20x more expensive to buy the same shares as you could before (like right now) to create the same monthly staking ladder possible to create (right now) 85 days before the Big Pay Day on Nov. 19th, 2020.

So in SUMMARY, let’s Review.

Current price of Hex = $0.0034

Consider which class you are in economically speaking and decide what you are willing to sacrifice in the short term to secure a long term 15 yr monthly laddered staking plan to provide for you perpetual passive income.

Class A : 10,000 HEX * 180 months = 1,800,000 HEX. At current prices, that is $6,265.

Class B : 50,000 HEX * 180 months = 9,000,000 HEX. At current prices, that is $31,328.

Class C : 100,000 HEX * 180 months = 18,000,000 HEX. At current prices, that is $62,656.

For each class as we have shown after setting up the staking ladder you will have acquired at today’s rate these amount of shares. To convert your total shares for each class into T shares simply divide your total shares indicated below by 1,000,000,000,000.

Total System Shares = 9.89E+18

Class A | 3.93E+14 Your Total Shares | = 393 T-Shares

Class B | 1.96E+15 Your Total Shares | = 1,960 T-Shares

Class C | 3.93E+15 Your Total Shares | = 3,930 T-Shares

Now that you know your T-Shares, which represents your ownership of a certain % of the Total Stake Shares of the System, then you can calculate your Daily Hex Interest Earning Power.

Now it’s very easy to see how much HEX interest you are earning every day on your 180 monthly distributed stakes, which is seen as one holistic device, or perpetual passive income generating machine, crediting your ladder of stakes hex interest on the daily according to the current days Daily Payout Per T-Share. I call this our Hex Interest Earning Power. You should strive to maintain your Hex Interest Earning Power lifelong! So you can effectively live off the interest forever!

So for each class we can easily calculate the Daily Hex Interest Earning Power.

Which notice has ~ 4x’d since Day 1 of Launch. This kind of trend will only continue. So you can imagine how valuable your shares will be as they are what are responsible for generating you interest, the more shares, the more interest, and as shareprice rises, the more it will cost in HEX to purchase shares. You get it now?

Current Daily Payout Per T-Share = 3.75

Select your machine below. Keep in mind that all figures are dependent on the Daily Payout Per T-Share rates today and that is liable to change and increase in the long term. In 5–10 years your stakes could be generating 10x the interest per day per T-Share than is indicated below. Also keep in mind the price of Hex itself is a variable, and if it goes up 100x in coming years, then that too increases your daily yield figures by a tremendous amount.

Perpetual Interest Machine Device A | = 393 T-Shares

Interest Earning Power = 393 T-Shares * 3.75 = 1,473 HEX Daily Yield.

At current prices = $0.0034 * 1,473 HEX = $5.00 Daily Yield.

This means that Class A having staked a ladder worth 1,800,000 HEX or $6,265 over 180 months is actively generating 1,473 HEX or $5.00 every single day. That’s the power of trustless interest.

Perpetual Interest Machine Device B | = 1,960 T-Shares

Interest Earning Power = 1,960 T-Shares * 3.75 = 7,350 HEX Daily Yield.

At current prices = $0.0034 * 7,350 HEX = $24.99 Daily Yield.

This means that Class B having staked a ladder worth 9,000,000 HEX or $31,328 over 180 months is actively generating 7,350 HEX or $24.99 every single day. That’s the power of trustless interest.

Perpetual Interest Machine Device C | = 3,930 T-Shares

Interest Earning Power = 3,930 T-Shares * 3.75 = 14,737 HEX Daily Yield.

At current prices = $0.0034 * 14,737 HEX = $50.10 Daily Yield.

This means that Class C having staked a ladder worth 18,000,000 HEX or $62,656 over 180 months is actively generating 14,737 HEX or $50.10 every single day. That’s the power of trustless interest.

HEX is the King of true DEFI.