I Got Margin Called on HERO Today. Things Don't Always Go Up.

source

We human meat bags like to share our success stories on social media in a "Look at me, I'm awesome! You should be part of my tribe to be awesome too!" sort of way. What I personally enjoy is genuine, "Yeah, I'm an idiot too sometimes" perspectives.

Today I lost 16,126.97 BitShares.

Let me tell you the story so you can hopefully avoid a similar fate.

I've posted many times on how fantastic it is to short the USD using BitShares and bitUSD:

- Playing in the Margins: bitUSD and BitShares on Open Ledger

- A Simple Example of Shorting the U.S. Dollar With BitShares

- 9 Day bitUSD Loan Result: 19,821 BitShares and 199 ZAPPL for Free

- Are you Shorting Fiat Currency yet?

A really important thing to keep in mind is this only works if the price of BitShares is going up compared to USD. An additional hard lesson learned today was that being highly collateralized is not a guarantee you won't have your margin called.

I've been playing around with HERO lately which is a pegged asset based on a formula. I won't go into the details here, but you can follow @stan's blog to learn more. For the most part, it moves along with bitUSD. It's also new, speculative, and has comparatively low liquidity (for now). They are supposed to trade for around $156 (based on the peg and the formula). I used my BitShares as collateral to create 50 HERO (much like the articles above describe creating bitUSD). There were two different times I could have sold some BitShares to close out my HERO margin and make a small profit. But... I didn't. I held on believing in larger future rewards.

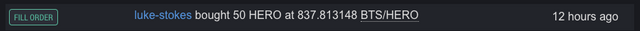

Today, I was surprised to see this:

Ouch.

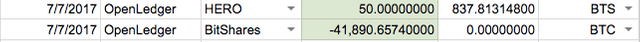

Even at more than a 5:1 collateral ratio, my margin was called. The 50 HERO I had sold for 25,763.69 BitShares was just automatically purchased back for 41,890.66 BitShares. I essentially lost 16,126.97 BitShares in the process (which was worth over $5k not too long ago).

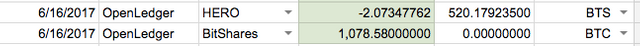

Here are the purchases of BitShares I made using the HERO created from margin:

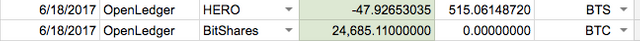

And the resulting carnage today:

The BitShares Margin Positions work as smart contracts by not only liquidating your position if your collateral falls too low (I believe 1.5:1 is the breaking point, but this page is too confusing for me to fully understand), but also by liquidating your position if someone requests settlement and you happen to have the lowest collateral ratio on the network.

This can happen even if you have a 5:1 ratio or better, like I did.

The BitShares and OpenLedger wallets have a slider you can use which only goes up to 6:1:

I found out the hard way, if you want more than that, you have to manually enter in a higher number in the Collateral box.

Today, when I saw the price of BitShares tanking against HERO, I considered updating the ratio but figured, "Surely 5:1 will be fine." I was so wrong.

I hope this helps some others avoid a similar fate. If BitShares drops 30% or more like it did today and you're not highly collateralized, you may be forced out of your position at a terrible time. My previous posts on this topic make it sound like you can make free, easy money shorting the USD with BitShares. For the most part, you can, if the price of BitShares is going up. Today's post also demonstrates how you can lose big.

Be safe out there, kiddos. Crypto trading is a wild ride, especially if you include margin trading.

I'm still up in the long run, but I might take a little break from playing the margin game. I've enjoyed the process of learning, even if the tuition cost is a little steep at times.

If you're looking for a way to keep track of your crypto holdings and trades, check out The Cryptocurrency Bank Spreadsheet I created a few months ago.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com

I'm down close to 35K BTS, had shorted around 600 HERO at an average of 550 BTS/HERO, primarily based on Stan's 4th of July kickoff - I, like many others, assumed that when the HERO contest started there would be some serious and well organized market action to spike BTS and drop HERO, thereby creating the initial pump "Look at all of these people that are making a fortune with HERO, be like us! FOMO, away....!"

I still believe in HERO and it is a much needed asset in both fiat and crypto economies (imagine if you had 20-30% of your crypto in HERO prior to this crash, and now were able to go shopping!), but damn, if Stan is going to hype like he did there has to be some action to follow through.

We are all following Stan in Telegram and it sounds like he is making things happen, but there is a large misalignment between the hype and the reality. Hopefully his wealth investors are now taking huge short positions in HERO and getting ready to ramp BTS... for real this time.

You can get called without dipping bellow the minimum collateral ratio. When a settle order executes, if it cannot be satisfied by the order book, it will start eating the least collateralized debt positions until it is satisfied. Settle orderes delay execution by 24 hours, so it is best to keep an eye on the books for their appearance, and adjust collateral accordingly.

I got called on bitUSD the other night this way. I saw the settle order earlier in the day, checked other debt positions and adjusted my collateral so there were sufficient positions lower than mine that I would be safe. Then the price took a dip, and some of the positions bellow mine either increased their collateral and were called, pushing me back within the settlement order's reach. Lesson learned - just because 12 hours ago you were safe does not mean you still are.

Someone really ought to make a bot that can monitor your collateral ratios in their relation to settlement orders and other debt positions, and send xmpp notifications if action needs to be taken to avoid these situations. I would do it myself if I knew how, but unfortunately I haven't had the time to teach myself so far.

How do you do that? Is there a list of all debt positions somewhere?

I agree, a bot like that would be very useful. I do remember seeing a 500 HERO settlement at one point and thinking, "Dang, some people are going to get called on that one." My biggest fail was not realizing I could just put in numbers directly instead of using the slider. And thinking I was "safe" just because of my high ratio.

Normally you can look up smartcoins on cryptofresh and view all the debt positions there, but it has said "Chain reload in progress... we'll be back in a few minutes!" for over 12 hours now - I've withdrawn my vote for its operator as a witness, at least until I see an explanation for the downtime. Bitshares-explorer.io is still in early phases of development and lacks useful information for now, but should become available at some point in the future.

This is a good source: http://cryptofresh.com/a/HERO

(Currently down for chain reloading.)

Cool. I've used this before but didn't think to look up an asset. I'll check it out when it comes back online.

We need a more stable (or mirrored) block explorer. Cryptofresh is often down when I want to check the list of shorters and see where the least collateralised position is.

If I could find source code for a block explorer,I would self-host a mirror and make it publicly available. There's a github page for cryptofresh, but the last commit was 2 or 3 years ago...

That is a horrible move mate...The risk of playing in that margin. I couldn't say that has never happened to me. Happens to the best of us.

Thanks for the honest update. I really appreciate getting some on-the-ground knowledge outside of the sycophantic comments on Stan's HERO posts.

"My previous posts on this topic make it sound like you can make free, easy money shorting the USD with BitShares."

This is exactly what everyone of Stan's posts sound like. They basically sound like salesmen (at best), with their Yogi bear pictures and their numerous Star Trek references. Not to mention MichaelX aka "Murderistic" on stage, with the "Banx" scammer running the Heronomex show behind the scenes. Love his falsely inflated statistics - the only concrete, fact-checkable thing he said in the video was a 5x understatement of Jamaican average salaries to attempt to make his point stronger. (He claimed it was under $40/month)

If you think I'm slinging mud, just check this thread. Michael has a legit breakdown and Stan responds to very valid observations about surrounding himself with (the appearnace of, at least) scammers and terrible attitudes repeatedly by simply ignoring the valid points, telling someone "You'll see" or "Just wait", then closing with a smiley emoji and a signature disclaimer not to listen to anything he says.

https://bitsharestalk.org/index.php/topic,22957.0.html

Every time I ask in a HERO thread "how is a freely traded asset guaranteed to appreciate at 5% per year" they either ignore me or refer me to some Smart Coin definiton that states "In all but extreme times of illiquidity, these coins are programmed to do X". Then they go back to talking about how many degrees faster Star Trek Warp Speed is than a horse.

Of course, the only time you really need them to do what they are designed is exactly when things get illiquid. As you, unfortunately, appear to have found out.

I think a lot of people are going to get stopped out on this, and the idea of increasing BTS from a point where their $666,666 dollar prize is worth a billion is a pretty laughable claim. Well over 1000x gain.

I wouldn't touch a thing made by a group making these claims this way, and I have less than zero faith in any part of this team other than Stan. It's all really a shame because the idea is appealing, the technology should be there to make it work, and Stan "should" be more competent and confidence-inducing than this.

Even if you ignore everything I've already said above, there is no getting around that all Stan really ever says about the Hero is that it will make you rich and "everyone is going to use it, forget crypto enthusiasts and geeks, we will have mass adoption".

This is a shame. Very sorry to hear about the margin call. I think logic was fine here and you just have to attribute it to bad luck. Best of luck in the future.

Having a margin account to trade cryptos, WOW, that's precarious. Sorry you got dinged, but you were playing it like a real Wall Street Banker, smelling the fruits of his derivatives. Sucks.

What does Buffett say of derivatives, "financial weapons of mass destruction"?

Although, in the case of bitshares, derivative are also the means of smartcoin production.

The more I think I know about the alt coin market, the less I know.

That is misunderstanding. On BitShares DEX there is not a real margin account where you can trade more than you have. It is contrarily. You have to tie at least 2x more value of BTS to lent bitUSD.

Thanks for the clarification. That's how I thought it worked.

Wow, this is great advice. People often get too confident in their positions and think things will always go their way or forget to check them. I've learned from this as well and it's not fun. Always have your stops set so you lock in any profit that you may have. Thanks for sharing!

Damn! Take care Luke! There has been better days in crypto!

Oh man - that never feels good. Props for sharing the war stories as well man!

I got a margin call once in my life many years ago. I was loaded up to the til doing a covered call play. Well, it's not so covered when the stock market crashes. Learn my lesson 15 years ago, have avoided margin calls since..lol,

Nice. I'm still up though, I just got limited by the UI in this case. Now that I know how to cover things beyond 6:1, I feel a little better about the process.