The Hash Rate As An Indicator Of Bitcoin Value

From the historical analysis of the values of the hash rate, from August 2010 to the present, together with the number of unique addresses and the total transactions of the Bitcoin network, the entrepreneur in cryptoactives Hans Hauge , made three predictions of the market of bitcoin capitalization based on those parameters.

Although the three indicators show a high correlation with the market capitalization of the BTC, the hash rate, hashrate or processing rate, was the parameter with the greatest predictive power.

Scarcity is one of the characteristics of bitcoin that contributes to the appreciation of its market value. Although the generation of the first bitcoins almost a decade ago, could be done in a personal computer, the fact of incorporating, by design, the increasing difficulty to generate new blocks is one of the factors that contributes to maintaining that shortage in time . It does not matter if the computing power of the mining equipment grows due to the appearance of faster processors, or if more miners join the search for the coveted bitcoins, the increasing difficulty will periodically add more steps, to guarantee a constant rate in the generation of these cryptocurrencies , about 1,800 per day, approximately.

For scholars of the evolution of the price of bitcoin or its market capitalization value, there are many parameters to consider that could have, alone or in combination, a predictive value of that price.

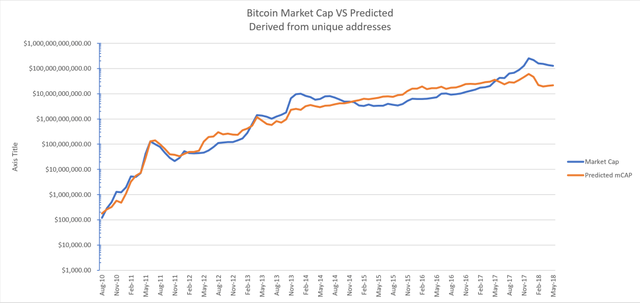

In a series of articles published on the site aimed at investors Seeking Alpha , the entrepreneur in cryptoactives Hans Hauge , active in the mining business and investor in BTC, reviews the capitalization market relationship of that cryptocurrency and three parameters: the addresses unique, transactions and the hash rate, taking a monthly average value for each of them from August 2010 to the present.

MULTIPLE CORRELATION

Hauge first analyzed the correlation of Bitcoin's unique addresses - payment directions with a positive balance - and the capitalization market of the BTC, since August 2010, when this value was established for the first time.

Hauge found a strong correlation between the unique addresses and the bitcoin capitalization market (0.9693) , although the market capitalization value predicted by the regression analysis for the first of June of this year was six and a half times below the real value. Hauge's prediction was $ 21.99 billion, while the capitalization market that day was $ 131.77 billion.

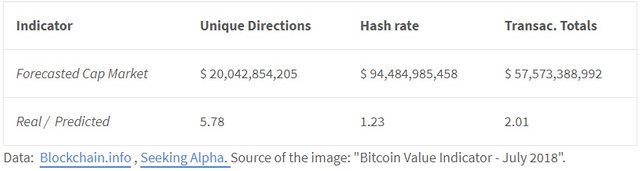

Subsequently, Hauge repeated the analysis for the first of July, but included a similar study with two other parameters for the study of the capitalization market correlation of the BTC with the hash rate and with the total transactions.

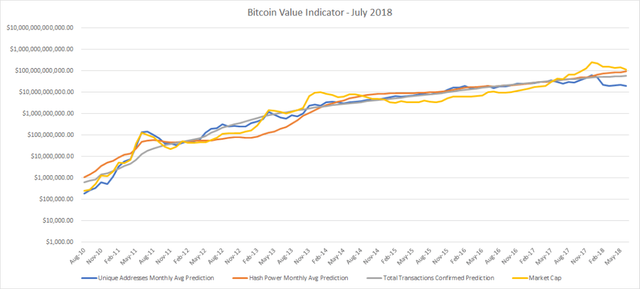

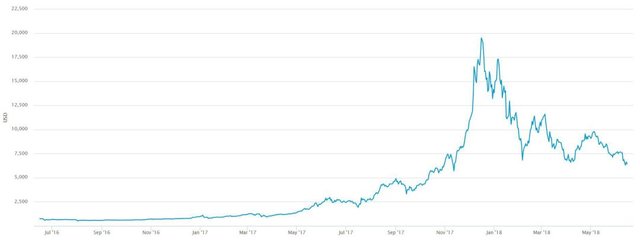

The following graph shows the three predictions of Hauge together with the actual market capitalization from August 2010 to July 2018:

As can be seen, the market capitalization value (in yellow) has been at times above the value predicted by the hash rate (in red) and at other times it has been below.

Precisely for the moment of the analysis, the hash rate is better as a prediction mechanism, since it is only 23% below the real value , while the unique addresses show a value almost six times lower and in the case of total transactions , the predicted value is half of the real one.

For his part, Steve Gleiser argues that while the BTC is booming, it is very clear - and logical - the relationship between an increase in the hash rate and the increase in the price of that cryptocurrency. But when the price of the BTC drops, there does not seem to be an explanation for the increase in the hash rate.

Gleiser says that managers of a mining infrastructure acquired when the price of BTC is booming - more expensive equipment - can not afford to stop when the BTC lowers its price , even if the return period of the investment is made higher. If the price of the BTC goes down, says Gleiser, profitability does not drop instantly. There is a delay between the time when mining equipment prices tend to decrease, and the time when an additional infrastructure becomes cheaper.

The large mining companies, on the other hand, have an incentive to invest in mining equipment when they go down in price because by increasing their share in the total hash rate, they leave small miners out of the market. The result is, as we see in the hash rate graphs, a constant growth of this variable.

The total hash rate currently fluctuates around 35 million Tera hashes per second (TH / s), or 35 Exa hashes per second (EH / s), equivalent to trillions of hashes.

Source

This content is copy/pasted off a "Google translated" website without a significant contribution of original content.

Copy/pasting content without consent of the original creator is potentially illegal. Moreover, posting it on Steemit with the intention to make money of it is highly unethical.

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. (quote from steemcleaners)

Repeated copy/pasting, plagiarism or tag abuse is considered spam. Spam is discouraged by the community and may result in action from steemcleaners or other users. (based on a quote from steemcleaners)

On Steemit, you get paid for creating valuable original content, i.e. your own work, not for copying the existing work of others. This is the very essence of what keeps the Steemit economy strong and keeps the Steem currencies from devaluation by inflation. By posting copy/pasted content, you are contributing to the destruction of the very basis of the Steemit economy.

If you feel like this warning is in error, please respond with proof that you are the original creator of this content or an explanation as to why your post represents a significant contribution of your own original content over the original work and proof that you are allowed to use the original work.

Megalosaurus original content rule violations:

[C C-I C-GT P S O]Congratulations! This post has been upvoted from the communal account, @minnowsupport, by alfonzo5 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Congratulations @alfonzo5! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @alfonzo5! You received a personal award!

Click here to view your Board

Congratulations @alfonzo5! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!