Concerning power asymmetries and governance structures

tl;dr: Skin in the Game is the alignment incentives and risk.

Recently I have been reading Nassim Taleb's latest book (Skin in the Game) and I am stuck by how many ideas apply to key topics in blockchain. A lot of Taleb's work is related to governance and decision making which has been a hot topic in the blockchain community in recent months. In this post I'm going to focus on ideas from presented in his latest book. This isn't a book review, but rather I'm picking out some of the relevant parts and relaying them here.

In this piece I don't tell you what governance model is best, but rather outline characteristics of governance structure which can help or hinder governance.

A small intolerant group may have great influence

Intransigent minorities (as Taleb calls them) are intolerant sub-groups which hold strong beliefs. Such a phenomena can be negative when the sub-group are unsupportive of propositions that have a net benefit to the majority of a group. The problem is worse should the small group have a formal veto, and worse again if a veto is held by a single entity.

The extreme case of a sub-group that has total power is that of an autocrat: i.e. a single entity with the greatest amount of power over the majority. It isn't necessarily the case that a stubborn sub-group has to be malicious. One of the key points in Taleb's recent book is that most decisions in history have come from an inflexible and stubborn sub-group (the intransigent minority), these people are the largest influencers or power holders, but obviously it isn't the case that all decisions in history have been harmful to humanity.

The rule by an intolerant sub-group can be a problem for all governance systems that rely upon consensus. It isn't that a malignant sub-group prevent consensus being found (finality of a proposition), but that their influence may be proportionally greater than by design (e.g. one person one unit of power). Clearly, it depends on the power they are given and their ability to influence the larger populace.

This consideration is restricted to "within group" governance: intolerance of an outside group that is independent of the system of governance would be out of scope here.

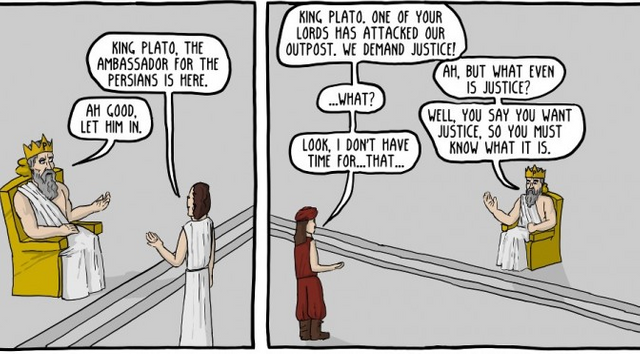

From philosopher kings to democracy

A benevolent dictator would be a centralised power holder who has the wisdom not to cause great harm to the majority. Minor harm (up to a threshold) is tolerable, provided the actions are good on aggregate (Cf. Plato's philosopher kings). In the absence of philosopher kings, a decentralised power structure should necessitate that neither a single entity or a small sub-group have all of the power.

An autocracy is the most extreme example of an intransigent minority where power is entirely centralised and there is no assumption of finding consensus (e.g. by voting). Democracy is at the other end of the spectrum where it is expected that each entity has equal voting power and therefore an equal amount of influence on the determination of the outcome of a resolution. Democracy is therefore an example of a decentralised power structure, but it isn't without its weaknesses.

In reality these assumptions break down and stubborn sub-groups can still dominate. There is perhaps an acceptance that democracy is at least less centralised than an autocracy.

Variance of outcomes

Why decentralise? Rarely, are we able to have a benevolent dictator. Systems which are ruled by minority entities display a fairly centralised power structure and are more likely to produce black-and-white resolutions with little in the way of variation. Furthermore, they are inflexible to outcomes that greatly different from their band of tolerance. On the other hand, a decentralised system can allow for greater incoherence in opinion and hence is better able to handle a larger variation of outcomes.

I think the implication here is that the failure of a stubborn sub-group within a decentralised system doesn't result in the complete failure of the system; however, in a heavily centralised system the collapse of the stubborn sub-group would lead to the collapse of the system as a whole. In the latter case the enforcement of governance would disappear for some time.

Random market participants still allow for smart resource allocation on aggregate

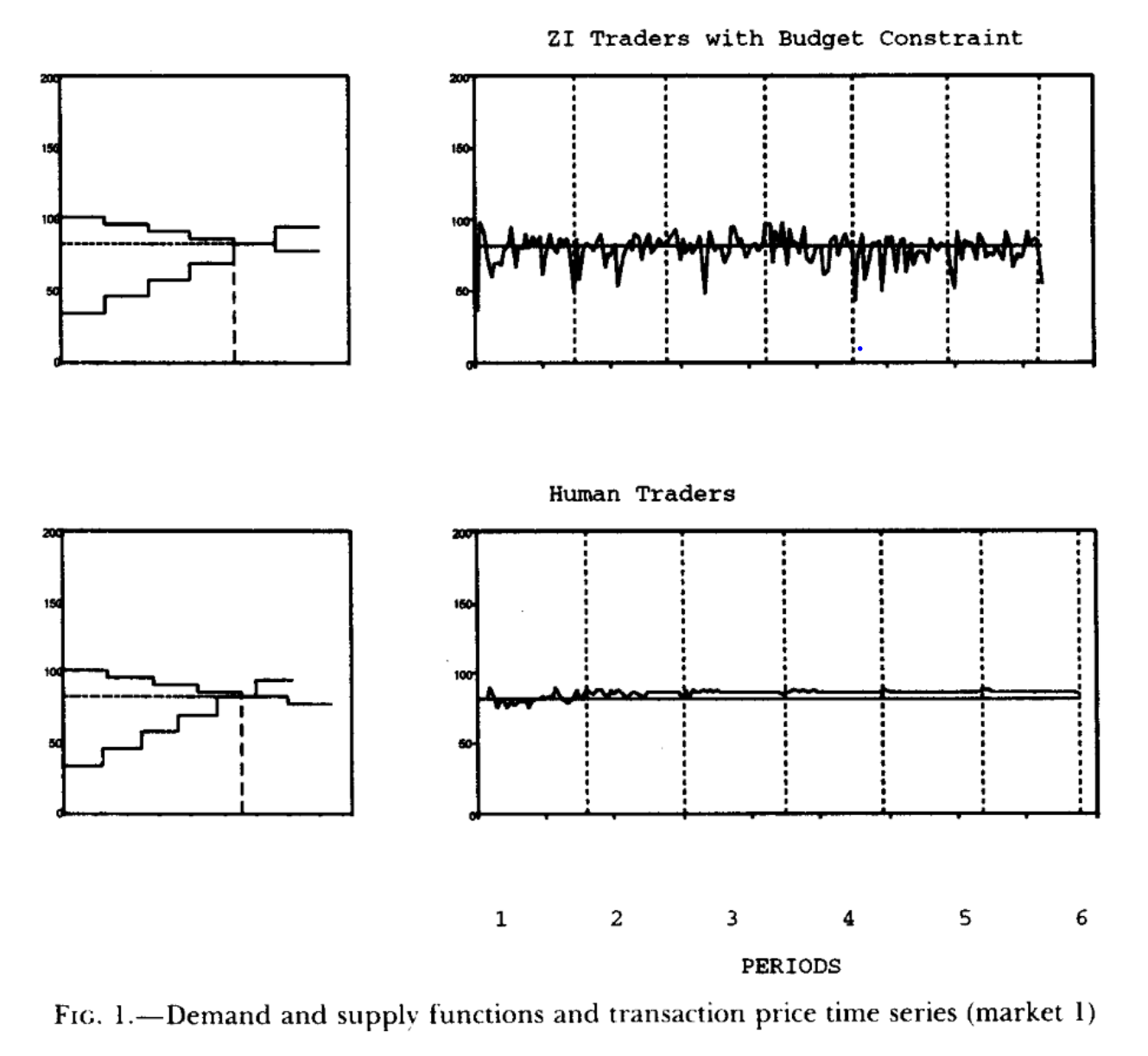

A further interesting example from the SITG book: markets can function even when the participants are idiots. The observation is that randomly buying and selling (irrational transactions) does not cause a market to malfunction provided it has the right market structure. That is to say, that provided the market has correct functional rules then it won't result in a total failure even if the actors are idiots. The right market structure is one with a proper matching of transactions.

Taleb cites a study by Dhananjay Gode and Shyam Sunder written in 1993: "Allocative Efficiency of Markets with Zero-Intelligence Traders: Market as a Partial Substitute for Individual Rationality". I did manage to find a free PDF copy.

The figure below comes from the publication and shows a key finding: zero-intelligence traders with budget constraints versus human traders. The left side is supply and demand schedules while the right side shows transaction price.

That's a powerful result and I'm wondering if it generalises: it is more important to have a well functioning governance structure than it is to have a knowledgeable voter base. Otherwise stated as: idiotic / irrational voters are not a problem for democracy when their actions are close enough to random. The caveat in there will preclude entities trying to double-vote.

Part of the 'magic' here is that the specific choices of a single entity tell us about the behaviour of the system on aggregate. Neither does phenomena contradict the effects caused by an intransigent minority. Observe:

- Markets: single entities in the market can invoke panic and enact a wild price move.

- Democracy: inflexible voters can sway the thinking of flexible ones.

In both systems, outcomes are found by consensus. There is no assumption here of having an excessive rule set, only that the rule set have some form of proper functioning.

Cryptoeconomics - incentive alignment

While I'm not a huge fan of the term 'cryptoeconomics' since it sounds like a term used by neophytes, I can admit that cryptocurrencies provide a clear illustration that it is beneficial to incentivise entities within a system to act correctly. Whether this was invented with cryptocurrencies is another debate (I'm not convinced). Entities within a cryptocurrency network are incentivised to be honest: this forces the alignment of interests under the promise and expectation of reward.

There have been example of alternative cryptocurrencies which have failed because the incentive was not great enough to prevent a malicious actor from disrupting and altering the network. Who remembers BBQ coin? It looks like it may have suffered an attack by troll miners. It certainly isn't out of the realm of possibility: there wasn't enough mining power acting towards securing the networks.

If incentive is poor then the power holders will not necessarily act in the interests of the greater good. There is probably some point where the expectation of a future reward is so poor in value that power holders give up and revolt.

Miners who were keen to secure the Bitcoin network in the early days did so because of the expectation the value of the rewards would be worthwhile, while the miners in the BBQ network didn't care and wanted to cause havoc because the expectation of the value of the reward was poor.

Skin in the Game - risk alignment

What's clearest in Taleb's most recent book, and wasn't quite so clear in earlier work, is that alignment of incentives by itself is not enough. Alignment of incentives has to be balanced with alignment of risk.

Before mentioning risk consider that the fact that the alignment of interests does not necessitate that the proportionality of rewards is equal for all entities within a system. The difference in proportionality results in some entities having greater care for the system than others. Those with greater investment in a system stand to lose more if it fails.

An example: if I get paid a commission for recommending that you buy a stock of cryptocurrency then our interests are aligned while you are making money. I got paid some commission which is good for me, and you made money while the asset was appreciating. Our interests are aligned but clearly not proportional. Furthermore, should the asset price crash then I would suffer none of the financial burden: essentially none of the downside.

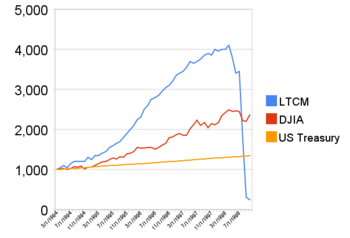

In numerous places around the Internet you may suggestions that the loss of reputation is a risk and equivalent to having skin in the game, but reality shows this isn't true. Reputation being harmed has not proven to be enough of a deterrent which is why we still have economics academics telling us how a market should function and how an economy works. They risk some humiliation for being wrong but they don't lose their job....

... and perhaps worse, are given another chance to do it all over again: Saga - Cryptocurreny I'm dubbing it "Long Term Cryptocurrency Management". Really not sure what Emin Sirer is doing there either.

Interestingly, had you listened to a pump-and-dumper and bought when they bought then both of you would have aligned interests and aligned risks (provided they were honest). Naturally, this doesn't preclude different levels of investment and risk.

Finally, the alignment of interests and risks does not begat an infallible system of governance which only produces good outcomes but rather the inherent accountability caused by exposure to risk means that good governance is more likely.

Conclusions

- Majorities can be influenced by minorities.

- Majorities can be coerced into accepting an outcome because of an intolerant / inflexible minority.

- A stubborn minority is able to make good decisions, but this is never guaranteed.

- Decentralisation doesn't guarantee good decision making, nor does it necessitate the least harm to the majority, due to the proportional amounts of influence that each entity has. One vote per entity does not say anything about the ability of a single entity to influence the vote of another entity (which is only possible in simulations or games).

- Systems that have a decentralised power structure can suffer great incoherence of opinion without collapsing.

- Alignment of interests can lead to good outcomes, but this is never guaranteed.

- Alignment of interests and risks ought to lead to better outcomes than the alignment of interests alone, but this is never guaranteed.

Taleb also mentions something that he refers to as Soul in the Game where you assume a lot of downside with minimal upside due to the belief of some greater good, but that's for another time.

Disclaimer: This article is all my own work. None of the opinions expressed in this blog are that of a past, present, or future employer.

Great summary - not too comfortable with the term cryptoeconomics as well! I've just finished the book recently, and like your conclusion, I've found they're converging with the ideas put forth by Daniel Kahneman's Thinking, Fast and Slow. Just pretty much different framing. If markets are largely anchored then they're ultimately unpredictable and not necessarily resultant from this thing called "wisdom of the crowd", and functions best with decentralisation / antifragility.

SP for me is very skin in the game, and it's quickly becoming soul in the game lol.

As for scaling consensus and discussion, Tauchain seems to be addressing this the best, out of anything else I've seen. Waiting for its alpha release :)

Thanks for the feedback! Kahneman's book is also a favourite. I wasn't entirely surprised that there was alignment between NNT and DK given the overlap in what they say. I had suspected that before NNT praised DK in a previous book.

SP? Steemit Power?

Will check out those links. I just completed a piece on scaling summaries (for technical solutions) for Ethereum. It is an official employer piece and there was a lot of help from the W3F and Giveth teams behind the scenes: ScalingNOW! — Scaling Solution Summary

Yes it's Steem Power. It has been an experience using it for the past 2 years!

Nice! I've been out of the know on eth architecture scaling for sometime now and it's really quite coincidental that I came across your account then. Gonna have a read and update myself, thanks!

Just double checking SP was steem power and not some theory from DK or NNT that I couldn't remember. :-)

Sometime in the near future I'm going to work on creating a spreadsheet containing as many scaling solutions as I can ( / as reasonably possibly) and include those which might be a couple years away.

Without a doubt, we live in times different from the previous ones, the variables that you mention, nowadays are global thanks to the advanced communications that reign in our planet. The changes can be produced by a social spark in a distant place. Or the impositions of fashion or ideology. Finally, good analysis and more of these contents are very educational and give rise to reflection. Greetings from Argentina

Yeah, that's something I've touched upon more in previous posts (some not on Steemit): global communications is so easy now. An influencer can have global reach even from their own bedroom. The underlying symmetries of the structure haven't changed but the communication latency between nodes has greatly decreased suggests that the emergent behavior of people on aggregate is evolving.

Thanks for the comment. :-)