GOLD PRICE: HEDGE FUNDS BULLISH BETS JUMP 57%

Gold advanced to an eight-week high on Monday in relatively brisk holiday trading in the US after government data showed hedge funds increasing bullish bets for the first time in nine weeks.

Gold for delivery in February, the most active contract on the Comex market in New York, hit a high of $1,208.70 in early dealings, up 1% from Friday’s close before giving up some of those gains. If the metal manages to close above the psychologically important $1,200 an ounce level it would be the first time since November 22.

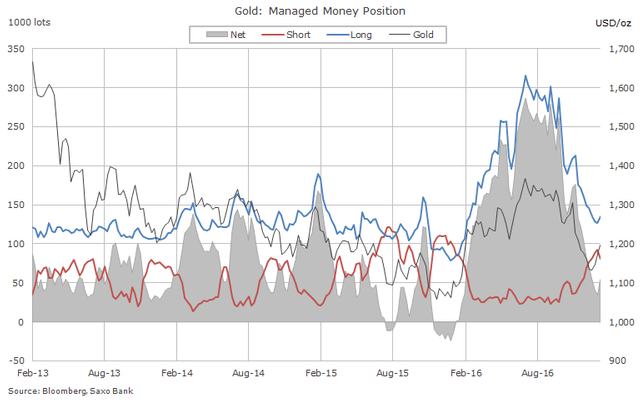

Overall bullish positioning is still 80% below July’s all-time record

Gold is up $80 an ounce since hitting post-US election lows mid-December, but remains down just under $130 from an initial but brief surge on election night as results showed a likely victory for Trump in the presidential race.

After relentless cutting back of bullish bets hedge funds or so-called managed money investors in gold futures and options grew their long positions – bets that gold will trade higher in future – by 57% last week.

Derivatives traders added to longs and cut back shorts – bets that gold can be bought back cheaper in future – lifting the net position to 5.4 million ounces from one year-lows hit at the beginning of 2017 trading.

Overall bullish positioning is still 80% below July’s all-time record of nearly 29 million ounces when gold was hitting its 2016 peak.

A change in sentiment is also evident among physically-backed gold ETF investors.

Each day since Trump’s victory investors in top physically gold-backed exchange traded fund – SPDR Gold Shares (NYSEARCA: GLD) – have pulled money out of the fund.

The losing streak was the longest on record – 43 trading days without net inflows. After dumping 138.8 tonnes since November 9, on Friday gold bulls were finally convinced to jump back in, picking up just under 3 tonnes.

GLD dwarfs other physically-backed gold ETFs holding more than 45% of the global total. GLD vaults now hold 808 tonnes or 26 million ounces; worth just under $31 billion.

That’s down more than $12 billion from the 2016 peak hit early July as the gold price retreats and investors liquidate their holdings.

Congratulations @taimoorchaudhary, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps, that have been worked out by experts?