Gold vs fiat vs bitcoin: why do any of them have value?

In 2016, the price of 1 bitcoin finally reached parity with 1 Troy oz. of gold. Since then, debates have proliferated over whether gold or bitcoin is the better replacement for fiat. For example, gold-investor Peter Schiff has debated Eric Vorhees at the SoHo forum over this issue, and other gold-investing experts such as Keith Weiner and Michael Swanson have criticized bitcoin as a false alternative to gold. At the same time, some advocates of bitcoin have argued that gold has no intrinsic value and therefore is no better than bitcoin.

In this article, I want to step back from this debate and consider a question that is more fundamental: why does gold, fiat, or bitcoin have any value in the first place? Once we know the answer to this question, I think it will shed some light on the “gold vs bitcoin” question.

Why does gold have value?

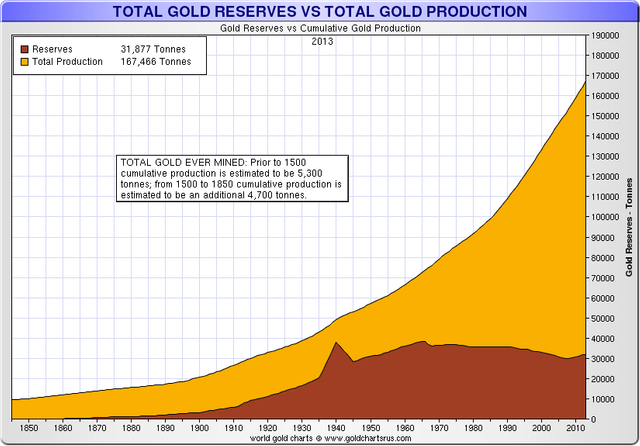

When people imagine gold being used as money, they often think of it as if there is a static quantity being swapped back-and-forth over time. This an illusion, as the following chart of total gold supply shows:

Source: goldchartsrus.com via goldbroker.com, https://www.goldbroker.com/news/above-ground-gold-stock-how-much-is-there-why-does-matter-546

Source: goldchartsrus.com via goldbroker.com, https://www.goldbroker.com/news/above-ground-gold-stock-how-much-is-there-why-does-matter-546

The supply of above-ground gold constantly grows, and it has been increasing at a faster and faster rate over time, especially since petroleum-based mining was developed in the early 20th century.

Compare this to the value of gold in terms of oil:

Source: Macrotrends, https://www.macrotrends.net/1380/gold-to-oil-ratio-historical-chart\

Source: Macrotrends, https://www.macrotrends.net/1380/gold-to-oil-ratio-historical-chart\

This chart begins in 1950 and ends today. Although the amount of oil one can buy with an ounce of gold has varied over time, the long-term trend is sideways, with an average value of about 15-16 barrels. Therefore, since each barrel of oil produces approx. 1,699.41 Kwh, this means that an ounce of gold has been “worth” an average of around 26,341 Kwh.

Even though the supply of gold is rising exponentially, it’s value in terms of energy is staying range-bound. This implies that the desire to swap energy for gold must also be rising exponentially. Why are people willing to swap ever greater amounts of energy for ever greater amounts of gold? Don’t we have enough gold already? Why does gold have value?

The motivation to own gold

Gold has been worn as jewelry for thousands of years, so it might appear that people are buying more and more gold because they want to wear it. However, most gold jewelry is locked up in safes, jewelry boxes, and other safe places, and is hardly ever worn. Also, if jewelry owners simply wanted to look nice during special events, they could buy it before these events and then sell it back afterwards. Therefore, adornment cannot be the primary reason that people are willing to accumulate gold.

And in one sense, it shouldn’t appear strange that human beings pile up gold with very little thought as to why we are doing it. We do the same thing with many other types of objects. Wealthy people often keep fine art in rooms where hardly anyone ever goes, comic books are often kept in sleeves and stuffed into drawers, and trading cards often pile up in cardboard boxes in a person’s closet.

These things have utility. We can read comic books, play games with trading cards, and look at fine art. But we often lock these things away and don’t use them. Their primary value is not from their use, but from collecting them. In the same way, gold has utility. We can wear it. But its primary value is in collecting. We want gold mainly because we want to own it, not because we want to use it for anything.

Gold mining and the economics of gold

Now given that human beings want to own gold, how can we determine the proper price for it?

Gold costs energy to produce. In ancient times, it cost hours of human labor to produce gold from panning in streams. Running an underground mine was even more difficult. It involved many hours of hard labor for animals and people. These animals and people had to be fed and given clothing and shelter or else there would be no gold produced. If gold collectors refused to pay a proper price for this labor, the miners would refuse to work.

In today’s society, mining is performed more efficiently by using petroleum and other energy products. But still, gold collectors must be willing to pay for the energy required to produce gold. If they do not, the mines will be shut down and mining output will fall.

What happens if gold miners shut down?

Now let’s imagine what happens if mining output falls. The first consequence is that there is less gold available for collectors to buy. This creates a rising price in terms of energy - as gold collectors compete with each other by offering their own labor-hours, products, assets, and other things that have energy-value to miners in exchange for gold. At the same time, the quantity of gold demanded will fall as the energy-price rises - until the gold demanded equals the smaller mining output.

It might appear that the above analysis is mistaken because it doesn’t take into account current holders of gold. If the price of gold is rising, won’t current gold-holders sell into the rally and push the price down? The answer is that they may do this temporarily. But then they will end up with more energy-products then they can use. And no one wants to collect energy.

What happens if gold miners have huge profits?

Now let’s imagine what happens in the opposite scenario. Let’ say that demand for gold rises so quickly that the amount of Killowatt hours or equivalent labor-hours, assets, etc. that can be traded for 1 ounce is far above what it costs to produce it.

This will lead to higher profits for gold-miners in terms of energy. As a result, more firms will move into the gold-mining business. This will result in an increase in mining output. As more gold-miners dump gold onto exchanges, the price will fall. The falling price will increase the quantity demanded until it is equal to the higher mining output.

Similarly to the previous example, it could be argued that current gold holders will simply bid up the price by buying all of the extra output from miners. However, this would result in gold collectors not having enough energy for their current needs. And you can’t power machines (or your own body) with gold.

The energy-value mechanism

This explains why the energy-value of gold (as shown through the oil-gold ratio) is so stable over time. It also explains why the above-ground gold-stock has increased so much throughout the 20th and 21st centuries. As the world has become exponentially more energy-wealthy, human beings have attained exponentially more energy to mine gold with. This has allowed the above-ground gold stock to grow exponentially without changing the price.

This also explains why gold has value and has been used as money for thousands of years. Yes, it is beautiful and useful. But more importantly, there is an economic mechanism inherent to gold-mining that causes gold to retain its energy-value over time.

Why does fiat have value?

It is fairly simple to explain why fiat has value. Within a country’s domestic economy, the country’s national currency has value because you can legally contract debts denominated in it.

No one is allowed to set up a gold bank and lend out gold, so that is not an option. But you can use your gold to buy the national currency. Or, to put it another way, you can “sell your gold” for fiat. Once you’ve done this, you can lend your fiat out in exchange for interest payments. You can also borrow fiat and pay it back using fiat later.

Finally, you can invest your fiat in a company and earn dividends from the investment. You cannot legally do any of these things with gold. This is why national currencies have value within the borders they are issued in.

This still leaves the question of why fiat has value internationally. In other words, why don’t people use gold in trade between countries, leaving national currencies to be used only for domestic purposes? The answer is that most national currencies have international value because they are backed by foreign-exchange reserves held in the form of U.S. dollars. The U.S. dollar, in turn, is backed by military power.

The U.S. has the largest military of any country in the world. And it uses this military to offer protection to the Saudi Arabian royal family. In return, the Saudis agree to buy all of the dollars produced by the U.S. government. In order to buy these dollars, the Saudis produce oil and exchange it with any country that holds the U.S. currency. Furthermore, they agree to lend any excess dollars they do not need to the U.S. government at a rate of interest set by the Fed.

The exchange rate between dollars and oil is not fixed. The Saudis do not agree to supply a certain amount of oil for each dollar. However, if the Saudis fail to produce enough oil, the price of oil in dollars will rise. This will cause the prices of all products in the world to rise, since all consumer-products require energy for their production.

As a result, the Fed will be forced to raise interest rates, crashing the global economy and ending the inflation. This threat has so far kept the dollar from collapsing, although for how long remains to be seen.

This is why fiat has value. Like gold, it is a collectible. But instead of its value being held up by the energy-cost of mining, it is held up by the point of a gun.

Why does bitcoin have value?

Having explained both gold and fiat, bitcoin is left.

Many bitcoin advocates say that it has value because it is a new form of money. They say that it has utility because it is a decentralized way to make payments. However, critics respond by saying that it isn’t a very good payment system. It takes ten minutes to confirm a transaction, fees are rising, and the network is congested. These critics also argue that bitcoin’s market-cap has no relation to the number of transactions on the network. Therefore, this cannot be the reason bitcoin has value.

Other bitcoin investors have admitted that it is a “store of value” and that they don’t care much about whether it works as a payment system. Of course, this is true. What gives a bitcoin its value is not its use as a payment system anymore than gold is valued because one can wear it.

Like gold, comic books, fine art, and trading cards, bitcoin is valuable because people like to collect it. They like to open their desktop wallets and see all of the bitcoins they own. That’s it. If they like to collect bitcoins, they don’t need any justification for doing so except that they like to do it.

Having said this, we should explore what determines the price of bitcoin. Some bitcoin investors have claimed that it is a kind of “digital gold” or “safe haven” whose value is dependable. So what is the relationship between bitcoin and energy?

Bitcoin mining and the economics of bitcoin

Bitcoin costs energy to produce. The amount of energy required to produce it is determined by two factors: the difficulty of the hash problem and the size of the block reward. The greater the block reward, the lower the cost of producing bitcoin. The greater the difficulty, the higher the cost of producing bitcoin.

When Bitcoin first began, the block reward was 50. This means that Satoshi Nakamoto was able to mine 50 bitcoins every ten minutes for as long as he was the only miner on the network. This is 300 bitcoins per hour or 7,200 bitcoins per day. In order to produce this number of bitcoins, he had to keep his computer running all day and all night.

This cost him a certain amount of electricity. To make matters simple, let’s say it cost him $1/day. In this case, the cost of production for Bitcoin was $0.000138888889 per coin or 1 cent per 72 bitcoins.

Now let’s consider what must have happened when a second person got on the network. When a second person joined, the first result was increased hash power. This increased power resulted in faster block confirmation.

However, this didn’t last very long. After 2016 blocks, the difficulty adjustment algorithm kicked in and increased the difficulty of the hash puzzle until the block-confirmation-time went back to ten minutes. This was done by the software to prevent blocks from being confirmed simultaneously and causing the blockchain to fork.

At this point, we had two miners, each spending $1/day to mine bitcoin. However, the block reward was still 50 bitcoins. This meant that each miner only produced 25 bitcoins every ten minutes on average or 3,600 bitcoins a day. This meant that the cost of producing a bitcoin was now $0.000277777778 per coin or 1 cent per 36 bitcoins, twice the cost when there was only one miner.

Once there were four miners, the cost of production rose to 1 cent per 18 bitcoins. With eight miners, the cost was 1 cent per 9 bitcoins. With 128 miners, the cost was 1 cent per .55125 bitcoins or about 1.8 cents per bitcoin. The more miners that joined the network, the higher the cost of producing a single bitcoin became.

While this rising cost of production meant that bitcoin collectors (miners) were able to collect less and less bitcoins over time, it also meant that the intrinsic value of the bitcoins they had already mined kept rising.

A new miner who had just joined the network had to mine at the higher cost of production. If the new miner wanted to collect bitcoins at a faster rate than he could mine, he would have needed to buy bitcoins from an old miner who had started collecting them earlier.

However, he would have had to do so at a much higher price than what the old miner had paid to produce them, since the old miner could only earn his bitcoins back at the new cost of production. This explains why the bitcoin price started rising almost immediately after it was invented.

In addition to the rising cost of production driven by rising difficulty, bitcoin’s price also rose because of the falling block reward. The Bitcoin software was designed to have a block reward that falls by 50% every four years. And in November, 2012, it fell from 50 to 25. This meant the cost of producing a single bitcoin doubled all at once.

Over the course of the following year, the price of bitcoin rose from $100 to over $1,000 (10x). It then fell to $400 soon afterwards, a 4x gain from the price it had before the block-reward halving. In November, 2016, a halving occurred again. This time, bitcoin went from $643 to $17,547 over the course of the next year. It then fell to $5,500 by today, a gain of 27x as of today’s price.

The economics of gold-mining vs the economics of bitcoin mining

It should be clear from this explanation that the economics of bitcoin mining are quite different from that of gold. The cost of mining gold does not increase as more companies mine it, nor does the amount of gold that comes out of each deposit fall over time. The cost of mining gold is set by nature. It is not the product of a software algorithm.

On the one hand, this makes bitcoin a much more exciting collectible than gold. Gold cannot go up in energy-value over the long run. Its only economic value to a collector is that it protects savings from depreciation. Bitcoin, however, can increase in value substantially.

On the other hand, bitcoin is far riskier than gold to own. Bitcoin can only sustain its value if the number of miners (or hash power of the network) doesn’t fall faster than the block reward.

If the number of miners and hash power of the network stays steady until November, 2020, the price of bitcoin should rise dramatically over the course of 2021 as the halving event occurs. If the hash power of the network increases, it could even rise before then.

But if miners decide they would rather mine a different cryptocurrency, solve cloud computing problems, or perform some other task with their computers, or if they sell off their computers and employ their capital elsewhere, the price of bitcoin could fall dramatically. It could even fall to pennies per coin or worse.

The bottom line is this: which currency you use; gold, fiat, bitcoin, or something else; is up to you. But they are very different assets, each of which has value that is held up by different forces. It’s important to understand these forces, and to not confuse them with each other.

Therefore, we shouldn’t be having debates about “bitcoin vs gold.” They are different assets that perform different roles for savers and investors.

I hope you’ve enjoyed this article. If you’d like to read more like this, please click “follow.” And comment if you have questions or thoughts.

Images:

"American Gold Coins" by Portable Antiquities Scheme, CC BY 2.0, combined with two other images, https://www.flickr.com/photos/finds/5201263036

"Money" by Pictures of Money, [CC BY 2.0] (https://creativecommons.org/licenses/by/2.0/), combined with two other images, https://www.flickr.com/photos/pictures-of-money/17123251389

"Round Gold Colored Bitcoin," by David McBee, CC0, combined with two other images, https://www.pexels.com/photo/round-gold-colored-bitcoin-730557/

"Money" by Pictures of Money (second image with the same name), [CC BY 2.0] (https://creativecommons.org/licenses/by/2.0/), combined with two other images, https://www.flickr.com/photos/pictures-of-money/17121925920

"Bitcoin" by Satoshi, CC0,

Congratulations @tomblackstone! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: