If You Don't Hold It - You Don't Own It - Repatriation Movement Disintegrating the Euro?

If You Don't Hold It - You Don't Own It - Repatriation Movement Disintegrating the Euro? by Rory - The Daily Coin

The precious metals community adopted the saying "if you don't hold it, you don't own it" long before I arrived on the scene. This phrase makes perfect sense when one is discussing their wealth, money or finances. Think about the digital-blips-on-a-screen, what are they, where are they and how easily can a person convert those blips into something tangible in a pinch? Never mind a serious problem, what about some drunk that drives a dump truck into an electrical transformer station that knocks out power for the next several days/weeks to the area you live in? What about the more than 100,000 people in Puerto Rico still without power 6 months after a hurricane shredded the island?

European nation states have been questioning their gold being held outside their borders for several years now. The questions grow louder and from a variety of nations. When Germany asked for a small portion of their gold to be returned the world took note as the response from the U.S. was it would take 7 years to return a very smallish 300 tons of German gold! The problem with this response is the gold was suppose to be sitting in a vault labeled "Germany". One would presume a phone call and an official request from the German central bank would be sufficient to get your property back straight-away. In this case one would be wrong. This is one reason, among others, why other European nation states are now requesting the return of their gold from being held outside their borders. It's time to bring the gold home.

The latest trend among European countries of bringing home their gold reserves has been raising concerns in Brussels. RT talked to Claudio Grass of Precious Metal Advisory Switzerland to understand what’s behind that trend.

According to Grass, the process means disintegration, which usually comes with instability, unrest, more government intervention and control.

“The central banks started the repatriation already a few years ago, meaning before we had Brexit, Catalonia, Trump, AFD or the rising tensions between the Politburo in Brussels and the nations of Eastern Europe,” he said. Source

The Euro, the most used currency in the world, was born of greed by a handful of bankers during one of the annual, private, Bilderberg Meetings. The Euro was sold to European nations as a single currency that would eliminate situations like what lead up to World War II - this would never happen again with a single currency. This lie is now being exposed. It was also sold to the European nations as being an economic stabilizing mechanism. Not only has this lie been exposed it has become quiet clear the exact opposite has happened and we find nations like Portugal, Ireland, Italy, Greece and Spain (the PIIGS) being economically unstable and in some cases completely bankrupt due this draconian currency.

"Times up" is what several nation states are proclaiming

Grass explained that these are all symptoms that are evident today and “therefore the central banks might have seen this coming long before the public realized it.”

He said it is fair to say that the world is moving away from a centralized system.

“If we follow this trend, it should be obvious that the next step should be an even bigger break up into smaller units than the nation states. With such geopolitical fragmentation comes also the decentralization of power.”

Analysts have pointed out that EU countries see gold as insurance in case they end up returning to their national currencies. According to Grass, only a fool believes you can create wealth out of nothing, and use that as a basis for a sustainable system. Source

Mr. Grass is 100% correct, "only a fool believes you can create wealth out of nothing"; which begs the question, what are those blips-on-a-screen? Nothing - thin air - promises from a government and interest paid (taxes and inflation) to the bank that creates this nothing currency.

“Our system is based on 7 percent paper notes and 93 percent digital units backed up by nothing other than central bank promises to pay back the debt in the future through inflation and taxation.”

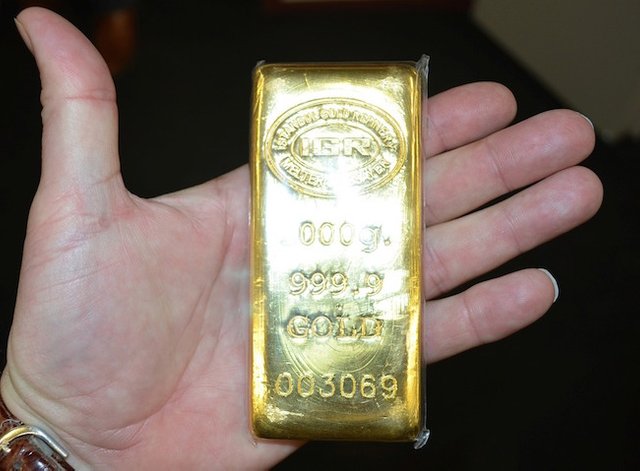

People are awakening to this nonsense and theft by the banks and, while there is still little understanding of gold, among the masses, or how gold works people know in their soul gold has value. Physical gold is real wealth and if you don't hold it - you don't own it. But don't take my word for it, ask the European nation states requesting the return of their physical gold.