East Continues Stacking Gold While The West Stacks Paper Illusions

East Continues Stacking Gold While The West Stacks Paper Illusions by Rory - The Daily Coin

We see that another month passes with the usual suspects acquiring gold by the truck load while the paper/digital lovers are watching blips-on-a-screen. Tangible versus illusion is how the cookie crumbles.

It seems our world is on the precipice of creating a divide that which we may not be able to repair.

The Federal Reserve Note (FRN), U.S. "dollar" has been in existence long enough for the world to now fully comprehend what it was designed to do, not only to the American economy, banking system and government, but to any other nation that it infects. As the world reserve currency the FRN has infected a great many nations around the world.

When the FRN was born it replaced gold as both currency and money. This changed our nation and we are now dealing with the end result of 104 years of corruption, propaganda and moral bankruptcy.

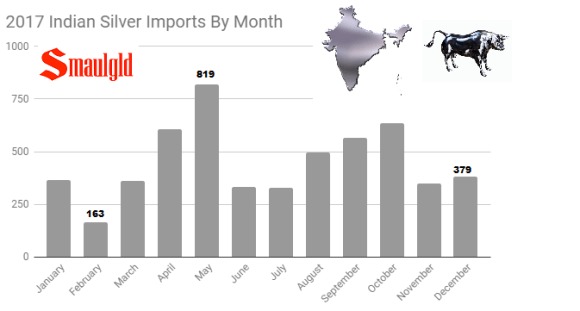

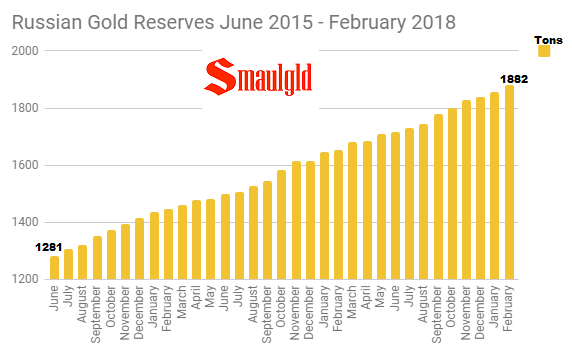

What we have witnessed over the past two decades is Eastern nations, like China and Russia, show great interest in the worlds money - gold. These nations have made it policy to continually accumulate physical gold and, as we recently learned, physical silver. Not only are these two major global economies acquiring gold and in Russia's case they are apparently acquiring massive amounts of silver, other nations within the Eastern "developing" nations are following suit and beginning to acquire as much physical gold as possible at the Central Bank level.

The chart below - courtesy of smaulgld.com - shows the Central Bank of Russia’s Gold Reserves by month with tonnage rounded to the nearest metric ton.

It is well known, within the gold community, that China has been encouraging their citizens to acquire gold to protect their wealth from the ravages of having the FRN as a major part of the Chinese economy. We recently learned that other, much smaller, nations are following China's lead and now we have several countries gathering gold at both the national and individual levels. This is going to put additional strain on the gold market, especially if there are no new mines to come online in the very near future.

On the other side of the world, the so-called "developed" Western world, Central Bank level gold is questioned as to wether it actually exist and where ti does exist it is being repatriated by the nations that once trusted the Western banking system to protect their gold. This trust is now in question and, beginning with Venezuela, nations have been stepping up and demanding their gold be returned. Germany is most famous as the problems with their repatriation program are now akin to mystery novel.

Another major difference between the East and West is physical gold, physical silver for the East and paper/digital GLD, paper/digital SLV illusions of gold and silver. While the custodians of these paper/digital illusions are not even required to produce an audit to guarantee the physical gold and physical silver actually exist in the quantities they promise, Russia has invited a news agency into their vaults to photographically detail the how their gold and silver is stored, weighed and accounted. This is in stark contrast to the U.S. having the last full audit of Ft Knox in 1953 and only one "peek-a-boo" event since, conducted in 1974. Treasury Secretary, Steve Mnuchin and his wife did stop by Ft Knox long enough for Mr. Mnuchin to "tweet" that "Glad gold is safe." If the statement were any more vague it would be nonexistent.

Here's a view of Russia announcing "gold is safe"

Oh, and let's not forget, "silver is safe" as well

While no Western Central Bank has provided the world with an audit of their gold holdings for decades the Russians are providing photographic evidence from every corner of, what appears to be, the Central Bank vault.

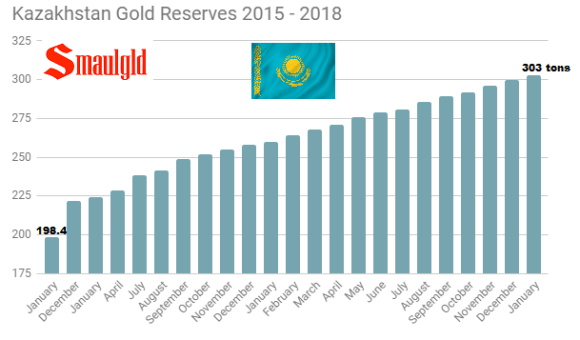

The other point of separation is the smaller nations, like Kazakistan and Kyrgyzstan are now encouraging their citizens to acquire physical gold. It is well known the citizens of India have roughly 20,000 TONS of physical gold and other nations, like Pakistan, Iraq, Iran, gold is part of their heritage, part of their culture. The citizens of these nations understand the importance of physical gold as wealth; they understand the significance of physical gold from the spiritual aspect.

As of January 2018, the Central Bank of Kazakhstan has added gold to her reserves 64 months in a row!

There is a great divide brewing. Trump is now taking the currency war to the next level - trade war. Throughout history this progression leads to the next level - shooting war. When nations no longer trust one another nor wish to conduct business on a level playing field the banks want to continue getting "their cut" from both sides of the trade. This has always lead to shooting wars.

As this current scenario continues to unfold we will continue to see nations and people around the world gathering physical gold and physical silver. These have always been money and currency and it appears that is not going to change anytime soon. If you don't believe me, explain why Indian, Kazakistan and Russia all imported massive amounts of physical gold in February.

Our friend, Louis Cammarosano, Smaulgld, updates us each month on the movement by some of the larger, and smaller, players in the physical gold community. These nations, and citizens, aren't acquiring all this gold for their health. There is a reason that a nation (Russia) would continually add an average of 20 tons of physical gold to their reserves each and every month for the past several years. There is a reason silver imports into one of the most populace nations on the planet (India) would jump by more than 50% during one month. There is a reason the nation that creates a portion of the border between Russia and China (Kazakistan) has shown a 50% increase in their gold reserves over the past 5 years. These same reasons are the driving force behind citizens doing the same.

Monthly Indian Silver Imports by Month in 2017