Peter Schiff Loves To Slam Bitcoin

Peter Schiff is beyond ridiculous in my opinion. The guy is so tunnel visioned that he misses what is taking place in the world.

Or perhaps he is so in tune with his money making system that he doesn't care about anything else.

Schiff is the epitome of a gold bug. He advocates for nothing else. Of course, the fact he makes a decent percentage selling gold on his websites could be a motivating factor.

His attacks on Bitcoin are based upon the fact that many are viewing it as an alternative to gold. This is especially true for Millennials.

The challenge he has is he is wrong, almost all of the time.

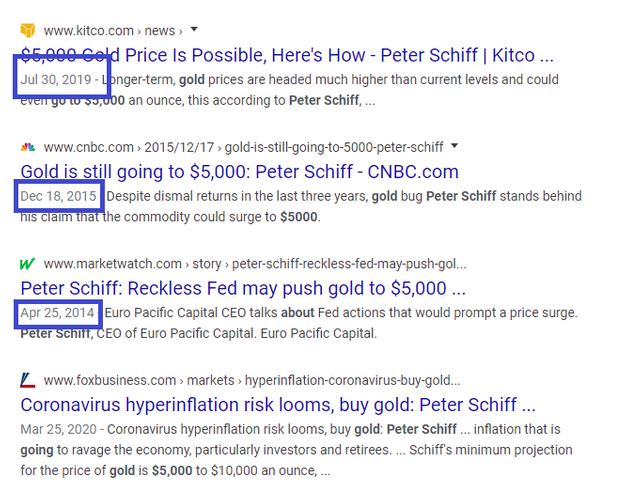

His calls for Gold at $5,000, so far, have not panned out. This is something I can remember him doing as far back as 2011.

A quick web search pulls up these results for Peter Schiff Gold $5,000.

Notice the dates and how the mantra is always the same. Perhaps, someday, Schiff will be correct. However, what does it cost in the meantime.

Sure, in this recent crisis, gold served well as a hedge. It is up for the year when most of the planet fell off a cliff. That said, some might take the position that, given the apocalyptic circumstances that we face today, gold should be faring much better.

Schiff's stance against Bitcoin mirrors that of the likes of Warren Buffett. The idea is Bitcoin (and all cryptocurrency) has no intrinsic value. In other words, on its own, it is worthless. This is the case often made against fiat currencies like the USD.

Where I differ with this viewpoint is the fact that value is based upon whatever we ascribe it to. For thousands of years, we have valued gold. Will this be the case in the future? Most presume it will be but then we must remember that aluminum was at a premium hundreds of years ago.

Both gold and the Dow might get to 5,000. I have no way of knowing. However, it is vital to remember that just because something does not have intrinsic value, that does not make it worthless.

Ultimately, it all comes down to utility.

Fiat has intrinsic value however artificial that may be. It's legal tender after all. But Bitcoin has intrinsic value as well. Gold has intrinsic value, too.

Well the fiat unit itself has no value. But that's the same with Bitcoin-- that the unit itself is just a digit. But the underlying math is what has inherent value. The mathematical property of how to pass back and forth and keep track of the ledger without anyone centrally controlling it is what has value. (And we name the network where we're using this property "Bitcoin".)

Fiat I think you could say has intrinsic value as in the bankers who keep track of everything and the military and political system who give a sense of power or stability or whatever. It's possible the intrinsic value is negative though.

Fiat has inherent value because it's overwhelmingly the path of least resistance to do monetary transactions in for any individual or corporation. Using Bitcoin as money in any country would be much harder in practice than using the legal tender of that country because if you were a business, A) you'd still have to do your accounting in the legal tender, B) pay your taxes in the legal tender and C) you'd have to accept it if a customer did not pay and you had to have the money collected and the customer offered the legal tender because if you insisted on getting Bitcoin as the repayment of that debt, the non-paying customer could simply refuse to pay. You'd have no legal recourse. That's what legal tender laws mean.

Ya I know what you mean.. I'm not sure that gives it inherent value though. That gives it practical utility for as long as we perceive it as legal tender.

The difference I think is that the mathematical discovery called Bitcoin inherently is valuable-- the world is better off and benefiting because we have this math of how to pass information back and forth without anyone controlling it.

Fiat essentially depends on perception, and then fades whenever that changes. With Bitcoin it's kind of the opposite-- It fundamentally is a thing that's valuable for the world, which over time dictates people to perceive it to have value.

So ya, there are obstacles and difficulties to using Bitcoin right now. But those would all stop whenever perception changed and Bitcoin was the ubiquitous/legal thing.

(We probably think pretty much the same. Just depends what "inherent value" means exactly.)

Good points. I do think Bitcoin's value proposition is stronger because of its decentralized protocol and a hard cap on the maximum number of tokens.

lol he's the worst with Bitcoin..

The $5000 gold call might come true, but it's funny how that's all long-term and he'd be quick to remind you that he's not saying it'll happen next week. But then with Bitcoin he's really short-term any time the day's or week's price movements are convenient to him.

(he's been a bear since about $15 so he has a long ways to go before he can really do a victory lap 👍)

It's basically his job now to bash Bitcoin.

He sees it as the enemy simply because people decided to start calling Bitcoin Gold 2.0.

We'll see what he is saying when Bitcoin is at ATH again within the year.