GLOBAL DEBT, GDP ...and Unfunded Future Liabilities..!!

DERIVATIVES, DEBT, GDP, GOLD & SILVER

Earlier on today I posted a slide titled "Global DEBT .....we are here..!!"

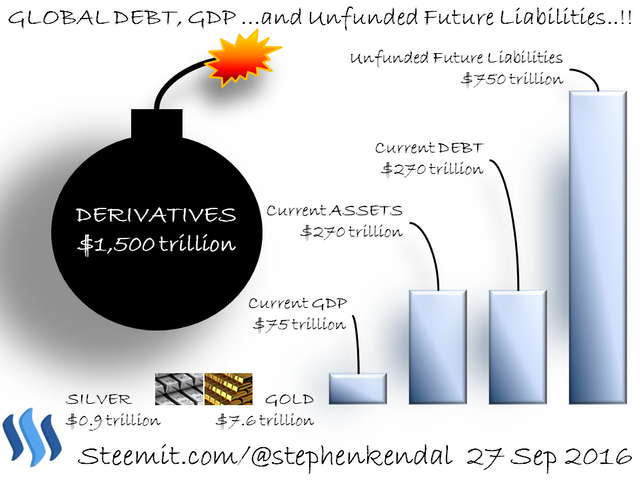

Above I wanted to show the relationship between DERIVATIVES, DEBT, GDP, ASSETS, UNFUNDED LIABILITIES and their relationship to GOLD & SILVER.

Global Valuations are approximately as follows...

DERIVATIVES = $1,500 trillion.

UNFUNDED LIABILITIES = $750 trillion.

DEBT= $275 trillion.

ASSETS = $275 trillion.

GDP = $75 trillion.

GOLD = $7.6 trillion.

(175,000 tonnes* = 5.6 bn ounces)

Current Price = $1,350 oz.

SILVER = $0.9 trillion.

(1,450,000 tonnes* = 46.4 bn ounces)

Current Price = $19.50 oz.

*All the Gold and Silver available on the Planet, above and below ground, mined and to be mined.

I have tried to scale the slide the best I could, but unfortunately due to the relative size of the DERIVATIVES in comparison to the total valuation of GOLD and SILVER the chart is for representation purposes and not to an accurate scale.

The purpose of the exercise was to demonstrate should ALL Unfunded Future Liabilities as of this date be backed by GOLD on the basis that all GOLD both mined and un-mined, used and un-used, was available the price of GOLD would need to be $133,223 oz.

Should the same calculation be done for SILVER the price of SILVER would need to be $16,250 oz.

It is therefore not surprising then at $1,350 oz and $19.50 oz respectively both GOLD and SILVER are currently WAY UNDERVALUED.

Due to current Global Financial pressures and an unprecedented growth in Global Debt, matched by an Unfunded Liability Exposure I am sticking firmly to the following Price Targets set to be achieved by 2021.

GOLD = $27,000 oz.

SILVER = $700.00 oz.

Thank you for reading and please feel free to share.

Stephen

Very interesting and alarming deserve an upvote...

Thanks I appreciate it. Stephen

These numbers seem off. Is this world GDP? US GDP is only 17.

Where did u get these numbers from?

Also I think future liabilities are not too relevant since they don't have to be paid.

The other issue I see is that currently gold is unlikely to become currency again as such your entire business case makes only sense if there would only be one choice.

You would have to factor the %age of the likelihood in there somehow.

But thanks for these numbers, again could u let us know where u came up with them?

Thanks for the reply. These numbers are GLOBAL numbers, not just the US. As for the Future Liabilities when you say that they won't have to be paid, try telling future Pensioners your theory when they are lining up for their Social Security Pension, or anyone lying on a bed in hospital, or debt payments, or keeping the lights on in the streets..........etc. If any of these don't need to be paid for then this will drastically reduce the Unfunded Future Liabilities but I think Pensioners would start rioting in the streets waving their walking sticks and zimmer frames if the can't buy their horlicks..!! Stephen

Ok that makes sense.

I understand your point of the Future Liabilities. I am just saying that politicians often overpraise and under deliver and that applies to laws that promise saving and services in the future and then often get changed.

The main issue I have with doing this math however is that i think equating gold with all money in the world assumes that we are going back to a hard gold standard, which I find not very realistic, given how gold cannot be used as money in a modern society very well. Maybe I am wrong on this one though.

"politicians often overpraise and under deliver ". Very true but shortly this will come to an end. Soon BLOCKCHAIN will be applied to Government and that's when the real fun will begin. In the future there will be no Central Banks and Governments will look NOTHING like they do now. GOLD will return as the Global Benchmark. 100%. Stephen

Hi Stephen, can it be understood that, put your money anywhere now would probably be better than holding fiat?

Thanks for the reply. Holding FIAT has always been a liability more so since the 1980's and certainly now is probably the worse time in history to hold FIAT. When the Unfunded Future Liabilities of $330tn are talked about in the same conversations as the $20tn Current US Debt that is when the penny will finally drop. These are serious times. Stephen

Its hard, not to imagine how bad things will be when all of these gets real. Its starting to get tough, especially for guys like me in the 20s. I'm hoping that my career as a cryptocurrency manager will boom with all these impeding looms approaches. Thanks again Stephen.

Thanks for the reply. Over the last 60 years there has always been one potential game changer and investment that pays off. Today that is Crypto Currency. For my generation it was Property in the '80s. When you could buy your first home for £9,000 while earning £11,000 at the age of 20 it was easy. Now it's a whole different ball game. £9,000 in the right Crypto Currency will be more than todays equivalent of £200,000 in 30 years time..!! Stick with Crypto you won't go far wrong. Stephen

Thanks Stephen, at least i'm more confident in what i'm doing now.