3 Reasons Why a Gold or Silver Standard is a Bad Idea

I continue to hear from many individuals, whether they are silver and gold owners, subscribers to the Austrian school of economics, libertarians, conservatives, etc., that the U.S. and other countries should return to a silver and gold standard. In the past, I felt the same way. However, I've since come to believe that, although a gold or silver standard would be a better monetary system that than what the world runs on now (fiat), it still runs into a few problems. Understand that, in this article (and video), I'm playing devil's advocate. Here are a few reasons why a return to a gold or silver standard would be a bad idea:

(Note, I am not addressing a silver or gold backed cryptocurrency, which is decentralized, but rather, a centralized government created currency)

(also, feel free to watch the video, or read on below)

I would not trust governments to be honest, and neither should you

Simply put, one of the biggest reasons a silver and gold standard is a bad idea, is because I do not trust government. In the creation and maintenance of any monetary system, there is a great deal of power to be wielded for either good, or evil. This power and wealth tends to breed dishonesty, corruption, and actions that are in the best interest of the few, not the many. There are two major problems with trusting the government with this power. First of all, they could loot the silver or gold vaults. Many today, suspect that this has happened with the current gold reserves in Fort Knox and elsewhere. The other problem, is that the government could print too many paper currency, essentially acting in a way similar to fractional reserve banking. Example: One dollar is issued for each ounce of gold in the government's vaults. In a time of economic turmoil, or in order to prop up the economy for political reasons, the government prints extra dollar bills. There are now more paper dollars in existence than there are ounces in the vault. At first, this might be hardly noticeable. However, inevitably, the ratio of ounces to dollars would spiral out of control. Simply put, I don't trust the government. I don't trust them to be honest, and I don't trust them to audit themselves honestly.

A gold standard would be rewarding bad behavior

What do I mean by bad behavior? I'm talking about central bank's efforts to inflate away the fiat currencies of the world. If we returned to a gold standard, these central banks and governments would once again have the power that is slowly slipping out of their grasp. Essentially, these large governments and central banks have enormous gold reserves (allegedly, though I have my suspicions). After they bring us to the brink of a monetary apocalypse, they would once again wield the power of monetary policy, because of the massive gold reserves they hold.

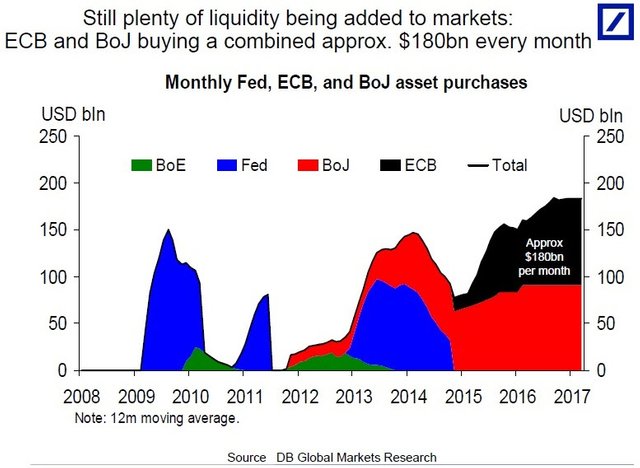

What monetary destruction looks like

Gold and silver coins are simply not efficient enough for the 21st century

As awesome as it would be to go to my local Walmart, and buy some groceries with silver coins, it's not going to happen. If you think silver and gold coins, rather than paper bills, are the answer, I'm sorry to tell you that it simply isn't efficient enough. Perhaps it would work for transactions like the one above. However, trade as we know it, and the electronic financial system as we know it, would not work. We would need some sort of paper or digital currency backed by this gold for such commerce, and then we run into the problems listed above. Silver and gold coins would eliminate some chances for dishonesty, but they would also bring world trade to a screeching halt.

In my eyes, silver and gold will always be money. They will always be a store of real wealth. However, I don't see a return to a gold or silver standard in our near future, and I'm not sure it would be a good idea. Of course, some economists would say that a gold or silver standard would be bad, because it limits money printing by governments, making business cycles more extreme. I think that's a hilariously misinformed statement, considering we're currently seeing the side effects of runaway money printing around the world. However, I think are some other very legitimate reasons as to why a return to a gold or silver standard, is a poor idea. I have no idea what will replace the current fiat system when it collapses, but I'll continue to hold my silver even if I don't think it will be recognized as legal tender, simply because I know it will always have real value, and it will always be a real store of wealth.

Probably should have put this at the beginning...

Image sources: https://docs.google.com/document/d/1J8rti2At5EIk5OFoXagGQiMCgOF2GB9tD99dAeyqPGQ/edit?usp=sharing

A good read, thank you.

One which a may agree with, but what happens when you get a crypto currency backed by gold? eg. One Gram which comes live in a couple of months? Best of both worlds?

Probably will be the topic of a future article/video. I've checked out One Gram as well, and I might buy a gram or two. It's better than a government created one, and it might be better than a non-backed crypto. Although, cryptos should be decentralized, and OneGram requires a level of centralization, since the gold is stored in a vault. It still requires a certain amount of trust as well, trust that they have all of the gold they say they have.

Agreed, again. If you don't hold it, you don't own it. At some point you may have to trust someone.

haven't heard of one gram I don't think. I'll buy a gram . lol

Is it really backed by a gram of gold? Do you pay melt? premiums? I'm interested.

Very interesting article/video. Really made me think a little outside the box especially when it comes to the word trust associated with our government. You know me I don't trust them in the least XD lol

Haha right? I don't know the definitive answer, but in the mean time, I'll be my own bank.

Nothing like being your own bank.

Goverment love paper.

People must keep money Gold to themselfs.Became y own bank.

This ☝

I remember overpopulation fears, the '70's? There's enough precious metals for this to work for everybody. Gold, Silver and Copper. Yeah copper too. Even though I believe the penny is obsolete. Maybe copper nickles.

With this belief, all metals would be at true market value. I can see Gold over $5,000 an ounce and Silver over or close to $500 an ounce.

Paper Gold and Silver certificates can work too, on a yearly independent audit of a Government's so called PM's supply.

It can work.

Great video mate found it hard to disagree with any of the information, but I think something has to change they should not be allowed to keep doing what they have been doing putting us all and the future generations in constant debt who knows what the answer is . Great article thanks

very good article, thx silverfortune. it's makes me stop and think...