12 Reasons To Own Gold And Silver In 2016 (Central Banking Endgame / Global Currency Reset)

I originally posted this on my blog back in March 2016 and since then the case has only gotten stronger for gold and silver: http://michaelpole.com/12-reasons-to-own-gold-and-silver-in-2016-central-banking-endgame-reset/

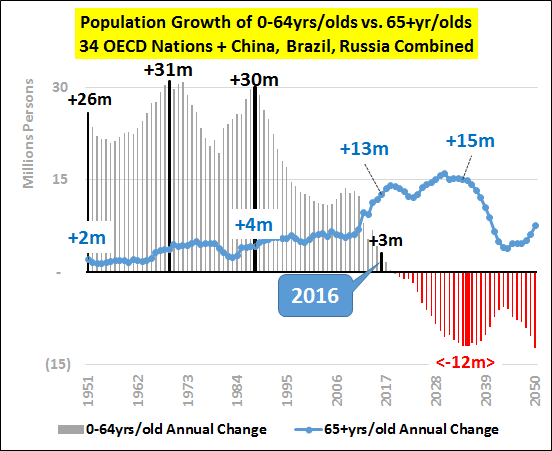

#1: Global working population growth (0-64 yrs/old) has been slowing since the 1980s, and is about to turn negative in OECD + BRICS countries (represents ~80% of global wealth and purchasing power): http://econimica.blogspot.com/2016/02/why-financial-and-economic-systems-are.html

At the same time, population growth of old people is through the roof, putting huge strains on pension systems and stock markets as older people draw down on their savings for retirement.

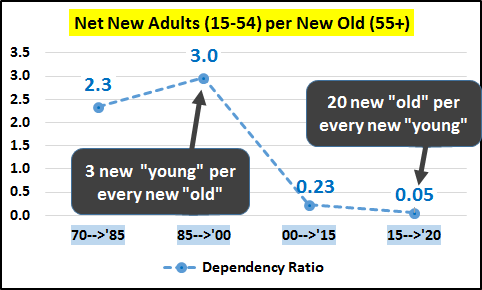

There are now 20 new “old” people for every 1 “young” person, so pensions will disappear and taxes and retirement age will go up to compensate: https://www.armstrongeconomics.com/world-news/taxes/lagarde-wants-to-raise-retirement-age-taxes/

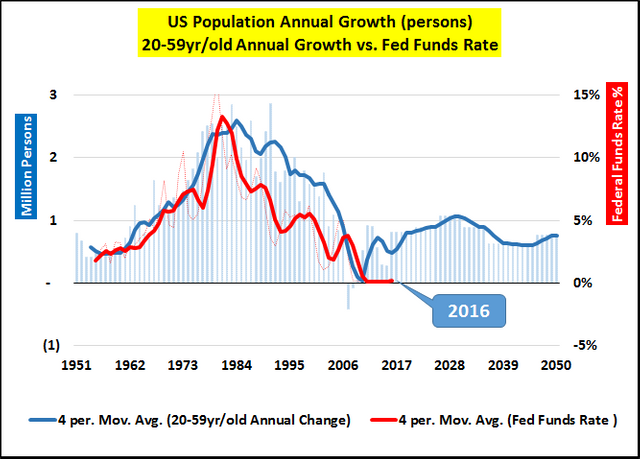

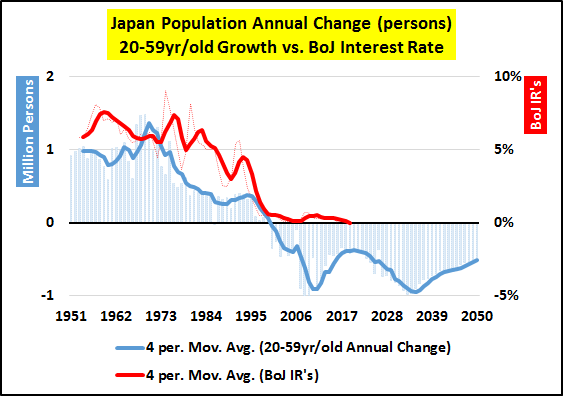

#2: To offset this declining demand and natural economic contraction, governments lowered interest rates to encourage borrowing and substitute real growth at all costs with debt and credit creation: http://econimica.blogspot.com/2016/02/central-banking-for-dummies.html

#3: This cheap credit and obsession with growth at all costs has fueled larger and larger global asset bubbles – in 2000 (stocks), 2007 (stocks + property), and 2015 (stocks + property + bonds).

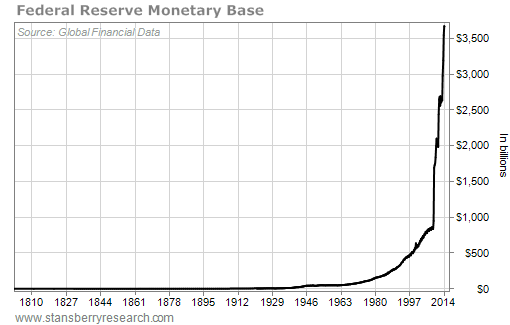

When US and European banks collapsed under bad mortgage debt in the 2008/09 crash, central banks and governments stepped in with zero interest rates and QE to recapitalise the ‘too-big-to-fail’ banks so they could continue lending.

#4: Western banks never really recovered, as the debt was never written down they couldn’t afford to lend again in size.

So China stepped in to restart global growth by adding $21 trillion in new debt from 2007-2015, but they only got $5 trillion lift in new GDP (4:1 debt to GDP growth is obviously not sustainable): http://davidstockmanscontracorner.com/chinas-monumental-debt-trap-why-it-will-rock-the-global-economy/

China’s numbers are going exponential now, with $520 billion debt added in just 1 month (January 2016) to hide non-performing loans and avoid a hard landing: http://www.zerohedge.com/news/2016-02-15/china-created-record-half-trillion-dollars-debt-january

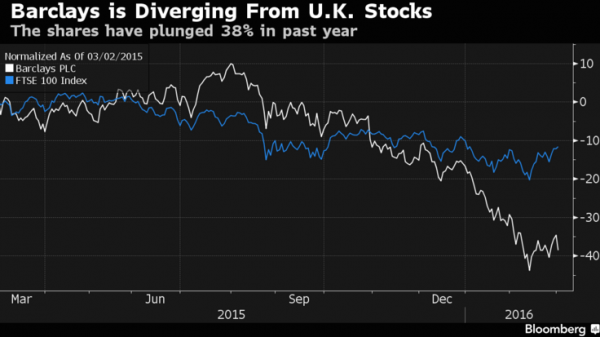

#5: Major European bank stocks like Deutsche Bank and Credit Suisse are now at or below their 2009 lows, and the rest like Barclays are down 30-40% since the start of 2016:

Clearly they are still insolvent, so after billions of wasted taxpayer dollars nothing was fixed, and we are on the verge of another banking crisis.

No coincidence then that new bail in laws went into effect 1st January 2016, so that EU retail bank account deposits will take the hit next time a la Cyprus: http://www.telegraph.co.uk/finance/economics/12076186/Europes-trillion-euro-bank-bail-outs-are-over.html

#6: Central banks and governments are at the limit of monetary stimulus after 7 years of zero interest rates and trillions in QE, so capital controls and negative interest rates are all they have left to encourage consumption and disincentivise savings:

They can’t go too far negative yet, or banks and people will start hoarding physical cash (withdrawing deposits and causing a bank run), which is already happening in Germany, Switzerland and Japan.

#7: Still not realising their stupidity, the central banks’ latest solution to encourage consumption and growth is to ban cash, so they can erase your savings and go full retard on negative interest rates without causing a bank run i.e. you spend it or you lose it: http://davidstockmanscontracorner.com/bank-runs-in-the-age-of-nirp-home-safes-jumping-off-the-shelves-in-japan/

#8: Gold has been on a serious bull run since 2000 in all fiat currencies, basically as a hedge against government stupidity and lack of confidence in central bank omnipotence.

Because gold is often quoted in the media against US dollars as the world’s reserve currency, (which has been very strong the last 2 years due to debt deleveraging and the anticipation of FED raising interest rates), it’s performance hasn’t been obvious to many.

However since the FED finally hiked in December 2015, gold has broken up against the US dollar and is the best performing asset of 2016:

#9: In my opinion, the price of gold has been obviously manipulated downwards to maintain the illusion of stability and confidence in the US Dollar as the world’s reserve currency.

If the big banks can rig the forex, interest rate swaps and LIBOR markets, it’s not that hard to believe they could rig gold – former FED chairman Alan Greenspan even implied it.

Somehow, despite the Russian and Chinese central banks scrambling to build their physical gold reserves since 2009 (they’ve run the numbers and they know what’s coming), this has not been reflected in the price (yet):

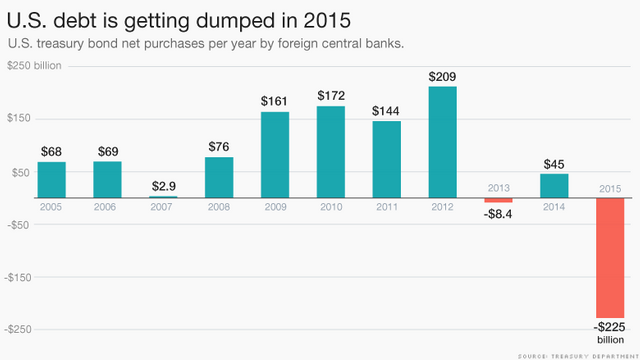

#10: China began dumping their $4 trillion in US reserves in 2014, along with other central banks who badly want to convert them into real assets before they become worthless:

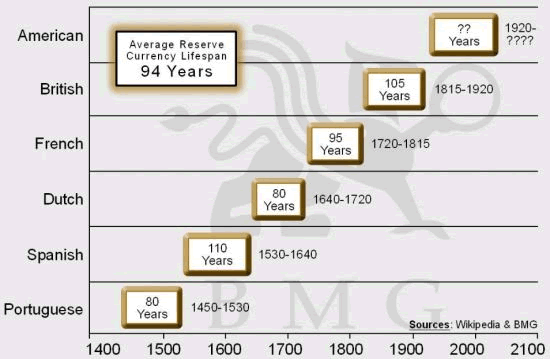

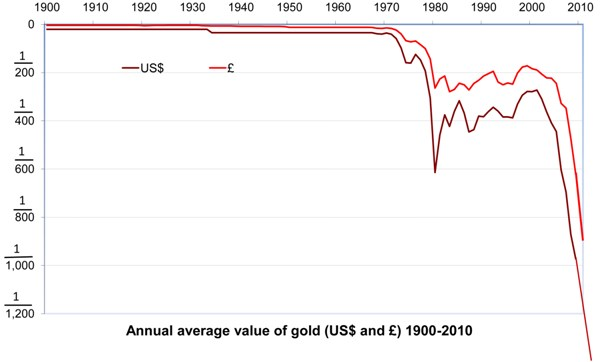

#11: The average life span of a world reserve currency is ~90 years, and the US is pretty far down the road having lost 98% of its value since 1900: http://pricedingold.com/us-dollar/

“Since 1999, the dollar has fallen in value from about 123 mg of gold to less than 21 mg today – a drop of more than 80%. Overall, from 1900 to 2010, the dollar fell from 1500 mg to 25 mg, losing over 98% of it’s purchasing power.”

Official central bank gold reports show that US still has 8,000 tonnes of gold, however there has been no independent audit of the FED since 1953 to confirm this, and the real number is likely much lower.

#12: In summary, no one knows exactly what will be the trigger or timing for outright fiat currency failure, but it’s reasonable to expect more currency devaluation and desperate central bank measures in the meantime, in their attempts to stimulate the economy with more debt.

With physical cash being hoarded, Comex running out of deliverable gold vs paper claims, and the world’s second largest gold ETF freezing new issuance of shares last week (presumably they can’t get their hands on the physical gold required, at an acceptable premium, to issue more shares), it’s safe to say we are getting close.

I expect that gold will have to be revalued much higher to liquidate current central bank debt, and it could well be an overnight revaluation like we had in 1934 and 1967.

Prudent investors like Ray Dalio have come out recently and said to hold 5-10% of your savings in physical gold as insurance.

Personally, I am holding 5-10% of my savings in cash, and most of the balance in physical gold and silver. Right now I am more concerned about return of capital than return on capital.

P.S. Silver is even more undervalued relative to gold, with a current ratio of 80:1 vs historical GSR of 10-15:1 .

Just make sure you’re holding physical so there’s no counterparty risk.

I hope you found this useful and I’ll do a follow up post as we get more news!