Gold Market and Its Problems: A Prologue to Digital Gold Investment

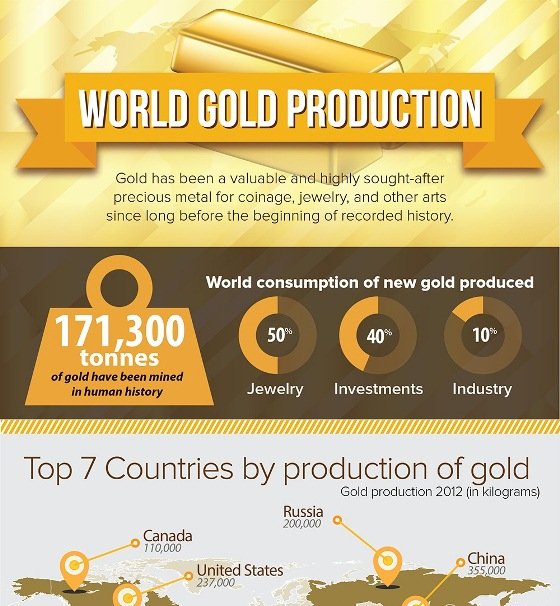

If you ask your friends, what kind of investment that they'll buy if they have $10k, most of them would probably say gold. It's no secret that gold is still, and likely will always be, a first choice investment for most people. In fact, nearly 40% of gold consumption is for investment, as seen below:

Source: Infographicszone

There is a reason why that happens. First of all, gold is scarce. It's hard to mine it and needs a lot of money to do that. Under the scarcity rule, this will put gold as a precious good. Second, it has a long history of utility. We use gold for long ago. We use it for business, price measurement, or even jewelry. Third, it has a lot of utility. Your SIM card, your computer, or your electronics, in general, use gold because it's an excellent metal for technology.

Because of that, it's no surprise if you see gold as the 2nd, 3rd, or even 1st choice of investment for most people. Below is the list of surveys or data from companies that researched people's choice of investment.

Source: https://www.phoenixpropertymanagement.biz/

Current Landscape of Gold Market

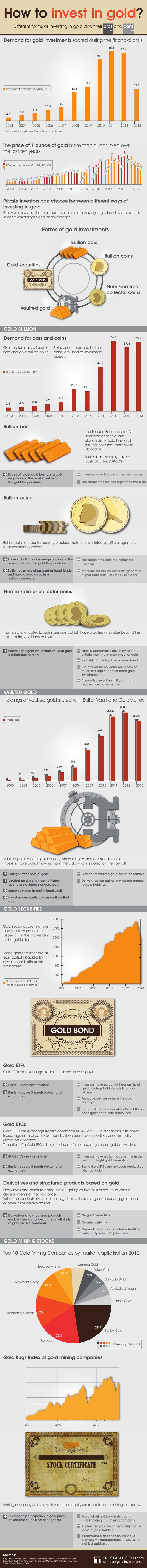

There are several ways to buy gold. Here are some of them.

| Name | What is this? | How to buy it? | How much can you buy? | Who can use this? |

|---|---|---|---|---|

| Gold Shares / Index / ETF | A commodity exchange-traded fund that tracks the price of gold in the market. | Through an exchange that provides the product, such as NYSE. | Depends on the exchange and your profile. | Anyone who can or eligible to register on a stock exchange is eligible to buy it. |

| Gold Bars | A gold bar, physical gold. | A broker, a seller in your local area, or international sellers. | Depends on the seller, the money you have, location. | Most of the time, anyone. |

| Gold Jewelry | Similar to a gold bar, but it has been crafted into jewelry. | Jewelry market. | Depends on the seller, the money you have, location. | Most of the time, anyone. |

| Gold ownership certificate/ paper | A paper that represents your ownership of gold. | Find a broker or somebody who provides the services. | Depends on the seller, the money you have, location. | Anyone who met the minimum buy requirements. |

| Vaulted Gold | Physical gold stored inside a secure vault. Similar to the gold certificate but different. | Find gold storage or vaulted gold storage seller, most of the time they also accept gold storage services. | Depends on the seller, the money you have, location. | Anyone who met the minimum buy requirements. |

Below are some detailed guide about buying gold (and the issue with it):

Source: TrustableGold

The Gold Market's Problems

While there are a lot of ways to buy gold, most of them have several problems that are yet to be addressed or impossible to be eradicated — for example, trust & anonymity issues. If you want to buy gold, you must come and give your details for the broker, or the seller, which might be a problem if you care a lot about your privacy. Other than that, you also face the availability issue because not every market can serve you, especially if you live in a remote area.

Below is a detailed list of problems of each market above:

- Gold Shares/ETF/Index

Example of the products: HUI Gold Index, S&P GSCI Gold, SPDR Gold Shares, etc.

Not available for everybody

Trust issue

Privacy issue

Need to sign up - Gold Jewellery & Bars

Example of the market: Lazada, Bullion Star, Silver Bullion, etc.

Time-consuming

Storage issue

Continuous security issue

Sometimes anonymous, sometimes not - Gold Ownership Certificate

Example of the products: UOB, Bullion Vault, One Gold, etc.

Trust issue

Not available for everyone (did not exist in every country)

Need to register

Privacy issue - Vaulted gold

Example of the products: Bullion Vault, Gold Silver, etc.

Not available for everyone (did not exist in every country)

Trust issue

Privacy issue

As you can see from the list above, nearly all the market suffer from the same issue. If you're looking for a way to buy gold with ease, a high degree of flexibility, and more importantly, without giving away your essential personal details, it's tough to find a market that suits your needs. On top of that, you might suffer from liquidity issues, and by that, it means a huge difference between the price of gold in your local area compared to the international market.

So, what now?

Time For a Digital Gold

A way to solve the problems that currently exist in the traditional market would require fundamental changes in how the market works. Introducing a blockchain technology would be an interesting way for us who want to buy gold with a high degree of flexibility. While this option is not yet popular, it seems like lots of projects are going to tackle it, one of them is Digital Gold.

In my next article, I'll discuss Digital Gold. We'll talk about their features, how it aims to solve the problem of privacy, trust issue and flexibility of buying and owning gold. Meanwhile, you can learn about them by visiting https://gold.storage.

See you in my next article, and don't forget to check out my other articles. You can also contact me on Bitcointalk (joniboini) if you want to. Ciao!

Congratulations @littlejohn16! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!