Why gold is the currency of the free

Money – the curse of our times

The modern system of money and banking is a loathsome beast that impoverishes and enslaves. It has made possible wars that should never have happened, it has made the gap between rich and poor almost irretrievably large and it has facilitated the waste and malinvestment that so has raped the earth.

In this essay, I consider some of the benefits of abandoning it and using gold as money once again.

The poet Ezra Pound once said, ‘In our time, the curse is monetary illiteracy, just as inability to read plain print was the curse of earlier centuries.’ We need to understand what money was and now is, and how we got where we are today if we are to appreciate how the current system persecutes us all.

But let us first consider: do we need money at all?

Why barter doesn’t work

Many of us have dreamt of a society without money. Barter is a wonderful system, and among its many beauties is the fact that it is hard to tax, so it excludes intrusive governments. But barter relies on what is called the ‘double coincidence of wants’ – you have to want what I am offering at roughly the moment I want what you are offering – so it is, mostly, impractical on a day-to-day basis.

Let’s say you are an erotic masseuse and I am a plumber, both admirable professions offering services none of us can do without. In a society without money, for any transaction to take place between us, I am going to have to want an erotic massage within roughly the time frame that you need some plumbing done. What’s more, the value of our respective services must also tally. There will be occasions when these coincidences occur, but they will be infrequent, and so they limit potential exchange. What is needed is some means of storing the value of the work one of us has done for the other, which can then be used at a later stage to buy other goods or services.

There are numerous barter websites that are currently thriving and giving some kind of resurgence to barter, but they all rely on some way of storing the value of the work you have done or goods you have sold that can later be exchanged for other goods or services. In many cases they use a points system. All these boil down to is a money equivalent, a different form of money. Like it or loathe it, a society can’t function without money. Even the most primitive developed some kind of payment system, be it commodity- or debt-based.

A short history of money

Shells, cocoa beans, various metals, even feathers and whales’ teeth have been used over the years as money. At one stage Roman soldiers were paid in salt, from where we derive the word ‘salary’ and the expression that someone is 'worth their salt'. We call such early forms of money ‘commodity money’. The use of commodity money has continued into modern times. Cigarettes, cognac, even watches, for example, might be used in extremis.

The most widely and successfully used form of commodity money was metal: gold, silver, nickel and copper. There are good reasons for this. Metal has intrinsic and universal value. It is standardised and constant – copper or gold don’t change, they’re copper or gold wherever you are. Metal is durable, divisible and its value is almost all-encompassing. Different things have different costs – not only can metals be divided (one ounce buys you four times as much as a quarter-ounce and so on) but different metals have different value. Gold is worth more than silver, which is worth more than nickel, which is worth more than copper. So, copper and nickel were used for low-value transactions (and still are today) while silver and gold were used for more expensive trades.

The casting of metal coins, a practice believed to have begun in the eastern Mediterranean around 700 BC, certified the weight and purity of the metal content. This added what monetary historians call ‘surety’ to transactions and so oiled the wheels of trade.

The names of most modern currencies reflect their metallic roots. Many are named after a unit of weight. One ‘pound sterling’ meant a pound of sterling silver. Lebanon and Syria’s money is also called the ‘pound’, or ‘lira’ in Arabic. ‘Lira’, once the currency of Italy and still the currency of Turkey, means the same. A French franc was one ‘livre’. The Spanish ‘peseta’ and South American ‘peso’ also mean weight. The Arabic ‘dirhem’ was a unit of weight, known to the Romans as a ‘drachm’, a derivation of the Greek word ‘drachma’ which means a handful. The dollar derives from the world ‘thaler’, an ounce weight of silver originally coined by Count Schlick in the sixteenth century. Even the Thai ‘baht’ and the Hebrew ‘shekel’ were units of weight.

The Chinese ‘yuan’ and Japanese ‘yen’ both mean round shape – referring of course to the shape of coins. The Scandinavian ‘krona’ refers to the crown, the issuer’s stamp. The German ‘mark’ and the French ‘franc’ are also words that denote the authenticity of the issuer and thus the metal content of the coin.

The Dutch ‘guilder’ simply means golden. UK government bonds are known as ‘gilts’, which has the same root.

The words ‘silver’ and ‘money’, meanwhile, are interchangeable in some ninety or more different languages: ‘argent’ in French, ‘plata’ in Spanish and, of course, the English ‘sterling’.

But commodity money was not the sole means of making and receiving payment. As David Graeber explains in Debt: The First 5,000 Years, there are early examples of traders using accounting systems to record credits and debts.

There are also early examples of ‘fiat’ currencies, meaning currencies whose worth is declared by some ruling diktat or law, rather than on the underlying value of the metal. ‘Fiat’ means ‘it shall be’.

One system in Sparta, somewhere between 750 and 415 BC, used iron disks; another in Athens was based on copper; one early Roman system somewhere between 700 and 150 BC, was based on bronze tablets. In each case the purchasing power of the coin – i.e. the face value stamped on the coin – was a lot higher than the value of the metal in it.

And there are early examples of paper money – ‘representative money’. In ancient Mesopotamia and Egypt, receipts were issued for stored grain. When the receipt changed hands, ownership of the stored grain changed hands too and people began to trade these receipts in the marketplace. By about 300 BC in Egypt, the various grain banks had evolved into a network, with the centre – where all the accounts were recorded – in Alexandria. That might be seen as the first example of a central bank.

In the East, use of paper money began in seventh-century China under the Tang dynasty. By the eleventh-century Song dynasty its use had become widespread. Kublai Khan – the first emperor of China’s Mongol dynasty – issued paper money known as the ‘chao’. The thirteenth-century Italian explorer Marco Polo famously marvelled that these pieces of paper were issued with as much ‘solemnity and authority as if they were of pure gold or silver’. By the time of the Renaissance paper money had made its way west to the ‘banche’ (benches) of Florence, where the money changers sat and where the word ‘bank’ was born.

People stored their gold and silver in the vaults of their local goldsmith, who would issue a receipt in the form of a certificate – in the UK these were known as ‘running cash notes’ – and over time people began to use these certificates in the marketplace as if they were the gold itself.

World trade was slowly moving from commodity to representative money.

Monopoly money

It is at this stage in money’s history that what many see as the ‘fraud’ of modern banking crept in. Seeing that few depositors ever removed their actual gold, instead using their receipts for trade, goldsmiths realised they could make money by lending out receipts against depositors’ gold. Despite the inherent duplicity in the scheme – lending what is not yours to lend – it worked. The depositors did not lose anything, as long as there was no run on gold. In fact, gradually this process became the norm. The goldsmith, now effectively a banker, paid one rate on deposits and then lent at a higher rate. Jacob Fugger, regarded as the richest man that ever lived, was one of the great early practitioners. In fact, the practice became so central to his activities he successfully lent on the Pope to repeal the sin of usury.

But, gradually, bankers then began lending out many times the amount of gold they had on deposit. In 1694 the Bank of England was formed to raise money for King William III’s war against France. Its way of doing this was, simply, to encourage people to store their gold with the bank and then issue more paper money than it had gold in its vaults. Something like £1.2 million of gold was deposited in ten days, while the bank issued some £16 million in paper. At first, the scheme was considered a huge success – the war was funded. But it would then lead to a period of monetary turmoil and inflation. Prices doubled in three years and it wasn’t until Sir Isaac Newton’s work at the bank (he became Master of the Royal Mint in 1699) began to take effect that things began to settle.

Gradually, the practice of banks being able to lend out more money than they had gold on deposit was legalised and regulated. The large volumes of credit the system made possible was irresistible. They had accelerated European commercial expansion. Bankers agreed limits on the amount of money that could be lent out. Usually the ratio was nine to one. In other words, for every ounce of gold you had in your vault, you could lend out nine ounces. This, in its essence, is fractional reserve banking, where banks need only hold on deposit a fraction of what they lend out.

It was also arranged that, in the event of a run, central banks would support local banks with emergency gold. Only if there were runs on a lot of banks simultaneously would the bankers’ credit bubble burst and the system come crashing down.

Critics of the system – advocates of ‘full reserve banking’, where a bank may only lend out as much money as it has on deposit – argue that it exacerbates the boom–bust cycle. There might be £1 millon of gold in an economy but with fractional reserve banking that £1 millon of gold might mean there is £9 millon of money. So prices will rise to a level which reflects there being nine times as much money in the market prices. In other words, they’ll overheat. If lending suddenly tightens, prices risk falling by much more than they would if only £1 millon had been in the market in the first place.

Critics also argue that the system benefits those who are closest to the issuance of new money, especially those who work in and around banking, at the expense of those who are furthest away. More on this later.

The monetary system was moving from ‘representative’ to ‘debt’. But, as Publilius Syrus said, ‘Debt is the slavery of the free’.

Both Christianity and Islam regarded lending, or ‘usury’ as it was called, as a sin. Judaism did not have such restrictions and this enabled the Jews to thrive in these sectors – one of the reasons the traditional stereotype of the Jewish money-lender exists.

Before mass media, religion was the primary means to govern, educate and control. Many of the practices that are promoted or chastised, from not eating pork to not killing to not doing any work on the seventh day, were done so for a specific and sensible practical purpose. One must consider why both Islam and Christianity had this aversion to usury.

In 1844 the UK Bank Charter Act declared that no bank other than the Bank of England could issue paper notes. Commercial banks were deprived of their power to do so. As well as giving the Bank of England an effective monopoly on the printing of new notes – on money creation (an enormous power) – the act restricted the number of notes in circulation. At any given moment during the nineteenth century, the Bank of England only had gold to back about 25 per cent of the paper money it had put out. Towards the end of booms and periods of commercial expansion this went as low as 15 per cent. During contractions the figure went as high as 50 per cent.

By the twentieth century, this fractional reserve system, where you need only hold a fraction of the money you lend out, became the dominant money system of the world. But simultaneously, another more ominous problem was developing: the amount of gold backing the paper money steadily shrank.

When money lost its independence

The British came off the gold standard in 1914 because they needed to print money to pay for World War I. The French and Germans would do the same.

‘Coming off the gold standard’ means that those pieces of paper money issued by the central bank could no longer be swapped for gold. Now it was the law, rather than gold and silver, which gave money its value. You had to accept this paper as payment. Because it was now just paper, money had a minimal cost of production.

It’s amazing to think that, had those countries remained on the gold standard, the First World War could not have gone on for anything like as long as it did. There was not the gold to pay for it. Only the change in the monetary system made it possible. Thirty-seven million people died, and another 50 to 100 million from the Spanish flu that followed.

In 1925 Winston Churchill put the UK back on to the gold standard in an attempt to restore Britain’s place as a centre of finance. But he did so at the pre-WWI rate, which did not reflect the amount of money that had been created since 1914. The result was a deflationary slump in the UK and a boom in the US – one that by 1929 would get quite out of hand. In 1933 in the UK the gold standard was abandoned once again.

Meanwhile, with the US now deep in depression, President Franklin D. Roosevelt made it a criminal offence for Americans to own gold, even though the dollar was on a gold standard. Executive Order 6102, which Roosevelt signed in April 1933, forbade ‘the hoarding of gold coin, gold bullion, and gold certificates within the continental United States’. Any American individual, partnership, association or corporation was required to hand over their gold. They were given $20.67 an ounce in exchange.

Eight months later, via the Gold Reserve Act, Roosevelt revalued gold to $35 an ounce. He, effectively, stole twice from his citizens. First, taking their gold, then devaluing the money he had given them in exchange. This was his strategy to deal with the Great Depression.

But, overseas at least, the dollar was still redeemable for gold.

By 1944, the USA and Switzerland were the only major nations left with a currency backed by gold. The Bretton Woods agreement of that year, which established monetary order between the major industrial countries at the end of World War II, saw the dollar became the global reserve currency. It was pegged to gold at $35 an ounce.

Throughout the sixties, however, Presidents Johnson and then Nixon allowed many more dollars to be issued or printed than they had gold to back them. They needed to pay for their new, expensive welfare systems and for the war in Vietnam. Seeing what was going on, the French, under Charles de Gaulle, began demanding gold in exchange for their dollars at the agreed fixed rate of $35 per ounce. Initially, the US coughed up, but eventually, in 1971, as the run on the dollar sped up and faced with the rising cost of the Vietnam War, President Nixon removed the dollar from the gold standard altogether.

This move was a direct breech of the US Constitution which clearly states that nothing but gold and silver should be money. Article I, Section 10, Clause 1 reads: ‘No State shall … coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debt’. It is believed by many that America’s Founding Fathers, having had their own currencies collapse, wrote this clause with good reason.

Nevertheless, after 1971, for the first time in history, with the exception of the Swiss Franc, no currency on the planet, nor any small fraction of any currency, was backed by anything tangible. The basic nature of money had changed again. We were now in an era where money was money by fiat – by government command, by the law.

Effectively, governments had granted themselves the right to create money for nothing, a right they did not previously enjoy. Wherever gold was abandoned and fiat embraced, the state would grow. Eventually, it would reach the bloated size of today.

In the past, people had the choice to refuse privately created bank credit notes, but now legal tender laws declare that citizens must accept this government-edict money – fiat currency – as payment. The value of each government currency is determined by how they trade against other fiat currencies on international currency markets. The status of the money is protected by the fact that the governments demand that tax be paid in that currency. Without that legal backing, your five-pound note or computer digit that represented a five-pound note would be pretty much meaningless.

The status of the dollar was also protected indirectly by the US military and by the fact that oil was bought and sold in dollars. (Did you know that shortly before the US invaded Iraq, Saddam Hussein had pledged to sell oil in euros? Some say the US invasion had more to do with protecting the hegemony of the dollar than anything else.)

Did you also know …?

The US Founding Fathers never intended Americans to be taxed on their income. What they worked for should be theirs and no one else’s. This was changed in 1913 – coincidently the same time that the US Federal Reserve Bank, regarded by many as the most villainous institution in the whole of the global monetary system, was formed – with the Sixteenth Amendment to the United States Constitution, which read, ‘The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration’. _

What right does a state have to take from you, under threat of prison, what you have fairly worked for, argue the detractors? All that state offers in exchange are dubious services of a dubious quality which you’re never given any choice over. You have to pay protection money to the Mafia or you will be kidnapped or beaten up; you have to pay taxes to the government or you will be arrested and locked up. What’s the difference?

I’m in favour of consumption tax, by the way. Instead of being taxed on what you produce (your work), you are taxed on what you consume, whether it’s the land you use or the things you buy. Surely it’s more sensible to reward and incentivise production rather than consumption. Production breeds wealth. Consumption leads to debt. It is also infinitely better for the soul to produce rather than consume, just as giving is more satisfying than receiving. Other beneficiaries of a consumption tax would be the environment (less consumption means less rape of the earth) and freedom (less debt means less control). There’s plenty more on that subject in _Life After the State.

The latest twist in an ever-evolving story

Over the last thirty years there has been another evolution. People have stopped using government pieces of paper. Money is now mostly electronic – it only exists in digital form. The process began with the move to electronic banking in the early 1980s. And thanks to electronic banking, private banks have once again engineered for themselves a power that was taken away from them in 1844: the power to create money.

Let me explain.

There is currently about $1.3 trillion in existence in the form of bills and coins. Some are held in banks, some by companies, and some by individuals. But those $1.3 trillion of printed notes equate to just 8 per cent of all US dollars. As many of those printed notes have been lost or destroyed, and between half and two-thirds are estimated to be abroad, it is now thought that just 3 per cent of the US dollars in circulation physically exist in the US.

In the UK, the story is the same. Research by think tank Positive Money shows that just 3–4 per cent of money in banks and building societies actually exists in physical form.

Governments have coined or printed the 3–4 per cent of money that is physical cash. But the remaining 96–7 per cent of money has almost all been created by private banks. Banks create money when they make loans.

Here’s an example.

When you take on a mortgage to buy a house, the funds for that mortgage do not come from investors or the deposits of others. The money never previously existed. The bank creates the money in the process of lending it out. It then takes the deeds of the house as collateral. That money then goes into the economy and is spent.

Modern money is created when loans are made. Of course, governments create money through such processes as quantitative easing, but, even so, most money is lent into existence. It might be through commercial or residential mortgages, corporate debt, government debt, private debt or leveraged bets on financial markets – there are a million ways credit is created and sold.

There is an idea that successful business ventures create money. They generate revenue, yes, but they don’t actually create money, unless some kind of borrowing takes place – taking on loans to expand their business, perhaps, or customers borrowing money to buy their goods.

New debt creates new money.

I thus define modern money as ‘electronic debt-based fiat currency’.

But the result has been this incredible amount of money that now exists today – and that has had all sorts of consequences.

How our system of money causes the wealth gap – a brief rant

This power to ‘create’ money through lending is what has made the worlds of banking and finance so large, powerful and rich – so disproportionately large within our society. It is what has allowed governments worldwide to become so bloated. It has given birth to the crony-corporatist society in which we now live and, as I argue at great length in my book Life After the State, caused the wealth gap.

Let us imagine a pyramid – a money-issuing pyramid. Banks and governments are of course at the top. They have the power to create money. They haven’t had to do anything productive; they just create money. Corporations who borrow large sums and are able to issue their own debt are close by. Those on lucrative government contracts for new ventures, banks’ associate companies and partners, those that borrow early and at low rates, the banks’ senior employees – these are all examples of people close to the creation of new money.

Those companies and individuals that benefit from newly created money can spend it before the prices of the things they want to buy have risen to reflect the new money in circulation. In other words, they get services, products and houses cheap.

But prices soon rise, so holders of houses, such as shares or houses, will then see gains without there necessarily being any improvements to the company or house in question. Prices are simply rising to reflect the new money in circulation.

But what about those at the bottom of the pyramid? Those on fixed wages or incomes, those who live in remote areas or those with savings? By the time this newly created money has filtered to them the prices of the things they want to buy have increased; their savings buy them less, however, and their wages remain largely unchanged.

In many cases they have to take on debt just to be able to afford things they were previously able to buy, which means they have to go back to the banks.

In reality, this process of creating money only redistributes wealth from the bottom to the top of the pyramid. And thus that ever-increasing gulf between rich and poor gets bigger and bigger and bigger.

Is it any wonder the financial sector of our economy has grown so disproportionately large?

I once made a video about it all which you can watch here:

This passage from Life After the State (which I also quote in Bitcoin: The Future of Money?) describes the way our system of electronic debt-based fiat currency combined with fractional reserve lending perniciously redistributes wealth from the many to the few:

Imagine a tiny economy. There are twenty people in it. Of these, ten each have $1 in cash, so there is $10 in the entire economy. The other ten people each have a house – these are the only houses in the economy and are each priced at $1. People quite happily buy and sell these houses for $1 each. If more houses appear in this economy, but the amount of money stays finite, the cost of houses will fall. But let us assume for now no new houses enter the economy.

One person – Mr King – is suddenly able to magically create another $10 from nowhere. He decides to go out and spend some of this new money. He buys a house for $1, which the vendor is happy to sell because, based on the knowledge the vendor has, that is the fair market price. Except that it isn’t because there is no longer $10 in the economy, but $20. At $1 the vendor has sold his house too cheap – and he has received devalued money in exchange.

Mr King then decides to outbid the others and offers $1.50 for another house. This vendor is delighted, sells, probably feeling rather clever, and makes off with $1.50, but even he has sold his house too cheap. Mr King, meanwhile, is becoming house rich. The other vendors hear houses are now trading for $1.50 and now expect that price, which Mr King is happy to pay. In other words, house prices are gradually rising to reflect the new money in circulation.

There are some big losers in this process – the people who each had $1. The purchasing power of their money is now no longer enough to buy a house they were previously able to buy. Ultimately, their purchasing power will halve because there is twice as much money in circulation. They haven’t acted imprudently in any way – they haven’t even acted – yet they are made poorer by this process of other people creating new money.

What about the people holding the houses? How have they done? Eventually, house prices in this economy will rise to $2 – there are ten houses and $20 in circulation. The price of their houses should rise to reflect this extra money in circulation, so – as long as they didn’t sell – they come out even. They might think they are richer because their house now costs $2, but this is a delusion: it is the same house. They have just survived the inflation, nothing more. If, however, they were one of the early vendors who sold for $1 or $1.50, now they cannot afford to buy back the house they previously sold. They are ‘priced out’ and poorer.

Meanwhile, Mr King has done extremely well. He benefits, of course, as the recipient of a load of newly created money. But he was also able to buy houses for $1 and $1.50, before they rose in price to reflect the new money in circulation, so, with his houses now valued at $2, he profits from the house-price inflation too. Wealth, which was originally spread evenly through our tiny economy, has insidiously transferred from cash-holders and those who sold their houses early to Mr King.

As a consequence of this process not only has wealth transferred, but those operating in our tiny economy no longer focus on making things. Instead they look for signs of future money creation and speculate on those signs, because there is more money to be made that way.

Leaving aside all the inequality it creates, here’s the intrinsic problem with the money system: when debt is repaid, money is destroyed. This leads to a shrinking money supply and probably deflation i.e. falling prices. But falling prices, particularly house prices (houses, companies, bonds and so on) will often lead to a situation in which the value of those houses is less than the debt that is taken out against them. Then mass default and capitulation becomes a systemic risk.

This is almost what happened in 2008. The opportunity arose then to fix the system – or let it fix itself. Instead, through all the various manipulations of money that went on, they found new ways to keep it going. Quantitative easing and zero interest rate policies brought down the cost of debt, and so the day of reckoning was postponed. The low cost of debt has meant that more of it can be – and has been – taken on. The never-ending bubble of expansion was further inflated.

But the more debt that is taken out, the more vulnerable the whole thing becomes.

We are living through the greatest credit bubble in history – greater than the South Sea Bubble, than the Dutch tulip bubble, than John Law’s Mississippi Bubble which brought about total economic collapse in France. The question now, as I see it, is: will all this debt matter? There are schools of economic thought that say it won’t. There are many who say it will.

There is a finite amount of gold in the world. With gold as money, such expansion would never have been possible because there would not have been the gold to pay for it. But with modern money that can be endlessly issued, there was no such restriction. As the link between gold and money has grown more distant, so debt has grown exponentially and there has been nothing to stop it.

Many wonderful things have happened over the past forty years such as incredible advances in science and technology that have made our lives much more luxurious. But the last forty years have also brought with them the greatest rape of the earth and the draining of its resources ever seen, the longest working hours, some the worst working conditions, the most wars, the largest, most invasive state, the smallest families, the most broken homes, the highest divorce rates, the greatest frauds, the most bubbles, the most malinvestment and so on. I believe this all to be no coincidence. There is a link between sound money and a sound society.

Governments worldwide are trying desperately to keep the system going by encouraging more and more lending (how often have you heard the expression ‘We will do whatever it takes’ – or variations of it?). The question is whether what they do will work and whether their efforts are doomed.

George Bernard Shaw once said, ‘You have to choose, as a voter, between trusting to the national stability of gold and the natural stability and intelligence of governments. I advise you, as long as the capitalist system lasts, to vote for gold.’

Why you should vote for gold

The received wisdom is that money has three uses: to be a medium of exchange, to be a store of wealth and to be a unit of account.

A successful form of money must have two main qualities. It must, first, be portable and, second, have a purchasing power that lasts (so it can be used at a later stage to buy goods or services). Enough people have to believe in its value for it to function properly. As long as it has these qualities, money can, in theory, be virtually anything. Money is what society agrees is money. It is a social construct.

So, to gold.

Gold’s rarity gives it great value. A great deal of worth can be stored in a single gold coin. So much so that it is not so good for day-to-day transactions but better for larger purchases. Silver, being less rare and thus less valuable (it is fifteen times more common in the earth’s crust) – and indeed nickel and copper – are more practical. Now people prefer the ease of paper money and digital money to metal.

But, such is technological evolution, this drawback is no longer the case. We have digital gold (and silver): gold is stored in vaults and ownership of that gold can be transferred digitally as transactions take place, just as debit cards work today. There are also gold-backed cryptocurrencies and technologies whereby ownership of gold can be transferred via bitcoin, so all the revolutionary benefits of this financial technology can be enjoyed side-by-side with the traditional benefits of gold.

Money’s other function is to be a store of wealth. Spandau Ballet sing, ‘Gold, you’re indestructible’ and indeed gold is. It is immutable. It doesn’t tarnish. As the recent discoverers of Iceni gold buried in Norfolk found to their delight, you can dig up a gold coin buried in the ground a thousand years ago and it would be more or less intact, unoxidised and unblemished.

Just as gold lasts over time, so does its purchasing power. There is the wonderful observation that an ounce of gold would have bought a Roman Senator a jolly decent toga and perhaps a pair of sandals; today the sterling equivalent (£750) would buy your member of parliament a very respectable suit and shoes.

There is another story from the Old Testament where King Nebuchadnezzar of Babylon was able to buy 350 loaves of bread with an ounce of gold. If a loaf now costs £1.50, 350 loaves would cost about £525. An ounce of gold costs about £750 – so gold buys you more bread now than as it did in the Old Testament, as you would expect with improved technology.

Similarly, according to the Koran, a gold dinar would buy you a lamb. The modern equivalent still does today.

Measured in gold, the oil price is – give or take a few per cent – the same as it was ten, fifty or 100 years ago. In 1972 a barrel of oil cost 0.06 ounces of gold. That’s not far off what it cost in 1942 or 1902 either. In early 2015 a barrel of oil cost 0.04 ounces of gold. The oil price has actually fallen in gold terms. The price of oil does fluctuate if you measure it in gold, but it stays within a range – from about 0.16 ounces to 0.04 ounces.

So gold buys you as much bread, meat, clothing and energy as it ever has. Its purchasing power is – on a relative basis – unchanged over millennia.

Compare that with the modern pound or the dollar. A five-pound note would not last ten years buried underground. Think how much less it buys you now than it did ten or twenty years ago. What is the point of saving money if it will buy you less in the future?

The price of oil was $3.50 a barrel in 1972. Having been as high as $147 in 2008, it’s now around $55. That’s almost a 1,500 per cent rise.

Modern fiat money is estimated to have lost over 90 per cent of its purchasing power since the early 1970s. Again I quote from Life After the State

In 1971, I could have taken my son to the FA Cup Final for £2 (now over £100). The Mars bar I bought him at half-time would have been 2p (now 60p). The beer I bought myself would have been 11p (now over £5 a pint at Wembley). The gallon of petrol I needed to get me there and back would have been 33p (now £7). And the house we went home to would have been something like 40 times cheaper.

Average earnings have increased too, but by far less. They have risen from around £2,000 in 1970 to about £25,000 today. The differential has been covered up by more debt, longer working hours, more women in the workplace and so on (no, I am not against women working).

Purchasing power declines as more money is created.

Gold’s stability makes it a far better store of value than fiat currency. That same stability makes it a more effective unit of account. An ounce of gold is an ounce of gold the world over and throughout history. There will be places and times where it buys you more or less than other places or times. But that is the whole point of a unit of account – it is to measure relative value. And gold is constant.

How much better for global trade would a stable global currency be, rather than businesses being subject to the vagaries of the foreign exchange markets!

This relative constancy of gold is due to its rarity, to the fact that there are limits to how much metal you can mine. So, the supply of money is constrained. The same cannot be said of electronic, debt-based fiat money.

Gold – the money of the free

Governments are, at best, incompetent and, at worst, corrupt. Their role should be to organise essential services such as rubbish collection (if indeed they should even be doing that). They should not be in charge of money and its creation. It gives them too much power. There is the famous 1790 quote by banker Mayer Amschel Rothschild, ‘Let me issue and control a nation’s money and I care not who writes the laws.’ Government has too much power already. Look what they’ve done with that power – from wars to the creation of intergenerational welfare state dependence. The same goes for banks. Look what they’ve done with their power. The best way to stop the misuse of power is to spread it as widely and equally as possible. We must take away from government and banks the power to create money. The independent money that is gold does that very thing.

Politicians make silly promises in order to get elected. Then they somehow have to meet these promises. To do so, they will often print the money they need, run up deficits or manipulate interest rates. There is very little to stop them. Money is a political tool. I argue that politicians have no right to interfere with what is yours while pursuing their own political agenda, which you may or may not agree with.

What gives the government and bankers the right to print and create money? The more money in circulation, the lower its value. If you have £100 which you have earned fairly and government creates another £100, or pushes interest rates down so that banks are encouraged to lend another £100 into existence, the value of your £100 has just been interfered with and diminished, because there will be another £100 chasing the same goods and services. They should not be able to interfere with what you have earned and paid your tax on.

Governments’ response to the financial crisis of 2008 has been to bail out the banking system, the car industry, anything they can. They have already spent, even in inflation-adjusted terms, many times more than was spent on the whole of World War II. ‘Where has the money come from?’ many are asking. They have printed it, or rather they have entered digits into a computer somewhere and issued bonds and gilts. The money has effectively, as US Congressman Ron Paul is so fond of saying, been ‘created out of thin air’. The only reason this has not resulted in global Zimbabwe-style hyperinflation is that governments have not been able to print as fast as credit has contracted, while the money they have created has not made its way into the real economy. Instead it has propped up the prices of certain assets (government bonds, London houses, stock markets and so on).

Ben Bernanke, chairman of the US Federal Reserve Bank until 2014 – effectively the most powerful banker in the world – wrote in 2002, ‘the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.’ The printing press is what he and his UK counterparts have resorted to. It is immoral. Companies that have acted irresponsibly should be allowed to go bust. It may be painful, but the hole they leave will be filled by another company that has behaved responsibly and prudently.

The amount of gold in circulation is limited by the amounts newly mined. There is no such limit on unbacked modern money, be it pounds, dollars or euros. It’s modern alchemy.

The falling purchasing power of modern money, the pressure of debt, the way it enslaves and the need to keep afloat breed this culture of spending and speculation as well as this obsession with work at the expense of other, more important, areas of our lives.

Gold’s lasting purchasing power means you have your money. You leave it safely stored, perhaps buried or in the form of jewellery about your wife’s person, confident your wealth is preserved for you or your descendants. And you are free to pursue whatever it is you wish to pursue.

As anyone who has ever handled gold bullion will vouch, gold is not only beautiful, it has an indefinable, magical, captivating power. It is real money, tangible wealth. It is said that gold about your person is actually good for your health.

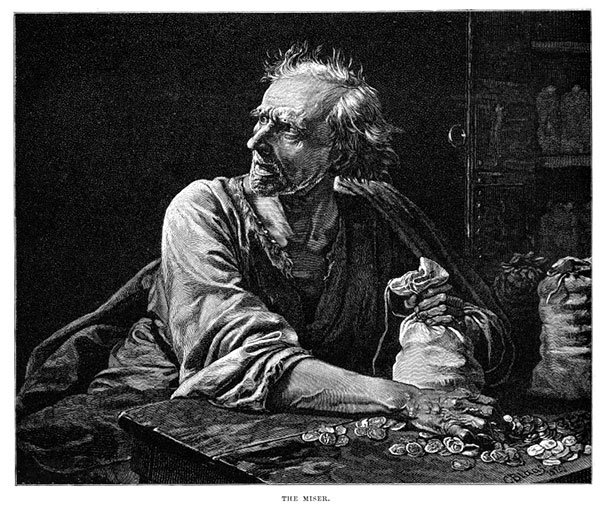

The image of the old miser counting his gold was a PR stunt wrought by the same people who today tell you to go shopping, to buy things you don’t need with money you don’t have and persuade you that somehow this will make you happy and save the economy. Nobody gets rich by spending money they don’t have on things they don’t need. The way forward is to go back to a culture of real production, rather than redistribution – of growing stuff, mining stuff and making stuff – rather than consuming stuff. We will be more productive, more empowered, less reliant and happier for it.

Just as a handwritten letter is preferable to an email (though infinitely less practical), so is a beautifully engraved gold or silver coin infinitely more desirable as payment for their endeavours to some intangible digital currency paid via bank transfer, on which everybody takes their cut.

Apart from in a few rare electronic applications, gold has absolutely no industrial use whatsoever. In fact almost all the gold that has ever been mined still remains in the world today, unconsumed. Gold’s only use is as money, as a means to store wealth. That is even the function of jewellery – to store and display wealth.

You could even argue that it is natural money. Newly mined gold increases world inventory by about 3 per cent per year – the same rate as the population grows. The idea that there is not enough gold to go round is nonsense.

A lot of environmentalists despise gold miners because of the damage they do to surroundings and workers. This may be so in some cases, although practices have vastly improved. But the damage done by gold miners is nothing compared to the rape of the earth caused by the endless expansion of debt, and the malinvestment and waste it creates. Damage to the Amazon by gold mining, for example, is a tiny fraction of that caused by logging.

A hard-money, sound-money world

Now imagine a world where at both a national and personal level you could only spend what you have and you don’t have the power to print money. You can only spend as much gold as you have. Once you’ve spent it, that’s it. It’s gone.

All those ridiculous government spending programmes would disappear instantly. Neither the UK nor the US would be able to pay for its, some would say, illegal war in Iraq. There wouldn’t have been the money to bail out the banking system or the ability to waste money in any of the other innumerable ways it has found to blow it. Efficiency and competence would suddenly become essential; waste would become less possible. Looking back, World War I could never have happened. Neither the British nor the Germans had the gold to pay for it. We both came off the gold standard to print the money. The subsequent German reparations, which gave rise to Weimar hyperinflation and then to Hitler, would never have happened. The endless expansion of debt and its enslavement of millions would never have happened. I can go on ad infinitum. All those horrendous crimes that are committed in the name of law and order – from war to fascism-through-political-correctness – would not be possible.

But the current system of money imposes no such discipline. People are blaming the ‘free market’ for the current economic woes. But it is not a free market while issuance of money remains in the hands of governments and banks. It is only a free market when you have free money, beyond the control of any body of people. There are calls for more regulation. We have enough regulation already. We do not need any more. It’s just a further attack on freedom and it’s taking us on the road to serfdom and totalitarianism. Regulation absolves people of moral and individual responsibility. With regulation you can say, ‘We were only obeying orders’. At present deficits don’t matter. Governments can print what they like, spend what they like, and that means they have almost unlimited power.

Professor Walter E. Spahr, professor of economics at New York University, sums up: ‘What is the meaning of a gold standard and a redeemable currency? It represents integrity. It insures the people’s control over the government’s use of the public purse. It is the best guarantee against the socialization of a nation. It enables a people to keep the government and banks in check. It prevents currency expansion from getting ever farther out of bounds until it becomes worthless. It tends to force standards of honesty on government and bank officials. It is the symbol of a free society and an honorable government. It is a necessary prerequisite to economic health. It is the first economic bulwark of free men.’

Anyone can mine gold, anyone can mint it, anyone can issue gold receipts. With gold, control of the money is taken away from government. Gold is true. It is incorruptible. It is independent. You can’t print it. It is a rare, useless, inanimate object, but it is constant, immutable and nobody else’s liability. Gold imposes a discipline on people and governments, which means they can’t spend it recklessly. Spending, no matter how well intentioned, creates problems and distortions in the economy. Gold is a restrictive monetary system, but it is a fair, free and honest system.

It all starts with money. Values, morals, behaviour, ambitions, manners, everything. Money must be sound and true. At the moment it is neither. Society is corrupt as a consequence. As Dorothy is repeatedly advised in The Wizard of Oz (an allegory about the monetary system and the fraud that is the dollar, ‘The Emerald City’) the time has come once again to ‘follow the yellow brick road’.

@frizzers aka Dominic Frisby is a financial writer from London.

Great post! I really wish more people who take an interest in monetary policy and money in general. Once this system implodes it will be imperative that we return to some form of sound/decentralized money or liberty, freedom and financial security will continue to suffer. Keep up the good posts.

Thank you. A long one, written a while ago, but I never published it properly anywhere. Thank goodness for this new site

Yes. Very cool alternative to facebook, etc.

Are you the same Dominic Frisby who wrote "Life After the State"?

Yes

I am so pleased you are contributing on Steemit! I also enjoyed your Bitcoin book. You should post a full introduceyourself post with links to other established social media platforms. I'm sure you can pick up lots more followers that way...

A full introduceyourself post from Dominic would be great.

Long but good article. I posted a philosophical essay on the understanding of money a few days ago. I mention gold too...fyi :-)

An interesting way to invest in gold and silver, see details in my reply post here>

https://steemit.com/gold/@seafarer124/investing-in-gold-and-silver

Just shared on twitter. This is great post and happy to up-vote. Following and looking forward to reading more of your posts. I joined STEEMIT a few weeks ago and I have seen a remarkable increase in the quality of posts like this. Recently I posted a couple of articles/TARGETS on GOLD and SILVER. You may find them interesting to read. Your article is now on Twitter✔. Cheers. Stephen

This is a great article - took a while to read though ;) Voted up!

I am also slowly coming to this subject - for now just at history of Capitalism if interested:

https://steemit.com/philosophy/@conspi-theorist/why-global-crisis-is-inevitable-part-2-the-biggest-problem-of-capitalism