Free Bullion Investment Guide Newsletter • February 2025

This Newsletter was originally sent to subscribers on February 5, 2025.

Blog Post made on February 12, 2025.

Hello,

I hope you and your family are doing well.

Thank you for subscribing to receive this newsletter from the Free Bullion Investment Guide.

Note: This newsletter is best viewed on a desktop computer, not a mobile phone.

Updates to the Guide

The Free Bullion Investment Guide is undergoing a full overhaul, focusing on preserving the good while re-editing or rewriting all other content.

Below is the latest group of updated pages.

Latest Updated pages:

PAMP refiner

Inflation...explained

Online Bullion Dealer (practices)

1st Quarter - 2014

2nd Quarter - 2014

3rd Quarter - 2014

4th Quarter - 2014

1st Quarter - 2015

The quarterly pages serve as archive pages for bullion news links that were originally posted on the homepage. Additionally, they provide price charts to show how the precious metals fluctuated during those quarters. In some cases, the links no longer work; however, the headlines offer a glimpse into how the market was moving at that time.

Revamping the Free Bullion Investment Guide is far from done, there is much more to come.

My Take on the Markets (Gold and Silver)

Fundamental Outlook

The rise in gold and silver over the last month has been mostly blamed on Trump's tariffs. I blame the hype on tariffs, the War in Ukraine, the conflict in Israel, and other economic uncertainties affecting the world's economy.

Personally, I think the hysteria over tariffs is pure nonsense. Tariffs encourage internal solutions for a nation's economy; they encourage internal manufacturing, a.k.a. (edit) Buy "Made in the USA," a.k.a. America First. It is turning the utopian views of Free-Trade on its head. All the Free-Trade agreements that Bush Sr., Clinton, Bush Jr., and Obama made over the last 40 years have brought this country huge trade deficits, and we've seen manufacturing leave this country in droves. I used to think Free-Trade (No Tariffs trade) was good, I don't anymore.

Remember this, if nothing else from this newsletter - "A country that doesn't manufacture anything is beholden to other countries for its existence, and it is wrong."

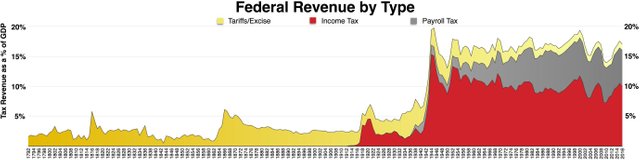

The chart below shows that, prior to 1912, tariffs were the primary source of income for the Federal Government of the United States. At that time, tariffs did not lead to inflation, and there is no indication that they would cause such issues now.

Federal Revenue by Type (1792–2016)

Click this link for a larger version of the chart above

The media's crying and yelling over these tariffs will end when they don't cause hardship and inflation. Furthermore, we may see gold and silver calm down as they constantly move higher so fast, but I still expect the two precious metals to move higher because of the other uncertainties in the world.

Technical Outlook for Gold and Silver

I think Gold will likely continue to go up as long as there is a lot of uncertainty in the world, technically, it looks like gold may consolidate around the $2800 level and then move higher.

Gold Chart

Click this link for a larger version of the chart above

Silver looks like it may try to move above $35.00; however, if it doesn't break that resistance level, I expect to see silver's price consolidate between $31.60 and $35.00 in the weeks to come. Then after it consolidates, silver's price may break above $35.00 and stay above it.

Silver Chart

Click this link for a larger version of the chart above

Note: If there happens to be a Large Broad-Market Correction or Crash in the next four weeks, gold and silver have always, and likely will again, drastically fall in price as traders scramble for liquidity and will sell anything to find it. Although the prices of silver and gold are usually the quickest to recover after such events.

Note: All the charts and commentary in this newsletter are in no way an incentive for how you should invest or divest.

One Last Thing...

Need Help? No matter what age you are or what problems you're dealing with, the best thing you can do is to get right with God. The only way to God is through Jesus Christ, the Son of God.

Jesus said to him, “I am the way, the truth, and the life. No one comes to the Father except through Me." John 14:1-6

Truth is found through the understanding and acknowledgment that Jesus Christ (God Incarnate) shed his perfect blood and died on the cross as the perfect sacrifice to free humans from sin. Then, after he was entombed for three days, Jesus Christ was resurrected from the grave, giving those who believe in these truths eternal life in heaven with Jesus and his Father.

And Jesus came and spoke to them, saying, “All authority has been given to Me in heaven and on earth. Go therefore and make disciples of all the nations, baptizing them in the name of the Father and of the Son and of the Holy Spirit, teaching them to observe all things that I have commanded you; and lo, I am with you always, even to the end of the age.” Amen . Matthew 28:18-20

I encourage you to learn more about Jesus Christ by reading the New Testament of the Holy Bible. Talk/Pray to him like you would your best friend, and end your words with "in Jesus name, Amen" because there is power in his name.

When you believe in Jesus Christ, You'll see him move mountains in your life.

Until next month, Thank you for your time and for your support.

Take Care & God Bless,

Steven Warrenfeltz

www.free-bullion-investment-guide.com