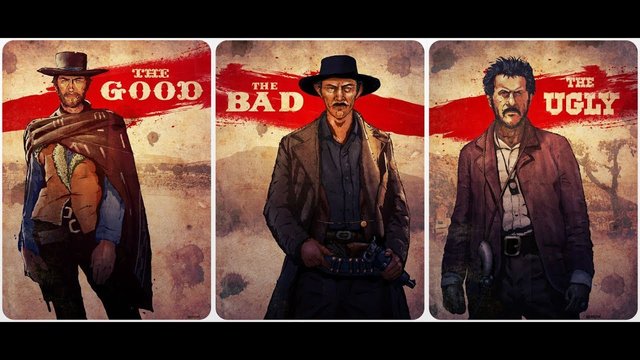

The Good, the Bad and the Ugly

There are many things we do not know about this pandemic. We don't know how long it will last or how many losses it will cause or how the world will be once this is over. But there are things we know and are pretty sure of, and it is the role that central banks are playing in printing huge amounts of money held in debt, and that governments scale this deflationary debt ratio to limits never before thought.

And in the face of such a scenario that comes our way, in my opinion, there are only three characters that, for the moment, can help us combat these economic blows that come to us in a post-covid-19 time. The good, the bad and the ugly.

Do not misunderstand me, this classification is only in name, but you will draw your own conclusion if these names are really suitable for these reservations at this time.

The good, in my opinion, gold, remains, by nature and by law, the current store of value that everyone, in moments of crisis, wants and seeks. It is not surprising that 1 in 6 Americans think about buying gold as a refuge, and if we talk about the growth that physical markets have had, ingots for the growth of reserves in large banks and the volatility of stocks in the currencies of investment (bullion), there is no definition that explains the increase in demand that you have and that you will have for a good long time. The negative, be careful with financial instruments related to gold, that role of gold is not the best option at the moment and if it can be avoided and go to hard, much better.

The bad, silver, with some of the major markets paralyzed, it is not surprising that the price of an ounce of this metal remains well below its true value as a raw material. Gold has been in the spotlight for the past few months with the financial chaos caused by the coronavirus pandemic and successive government responses, planting the obvious in gold, but silver is also worth paying attention to.

Traditionally, in crisis situations, silver does not reflect the movement of gold, but we are in difficult and uncertain times, with behaviors only comparable to the great depreciation. For the base investor, this metal is in an excellent consolidation position and given its usefulness, in a post-covid-19 facet, its demand will not wait long to become noticeable.

And finally, for many the ugly of the movie, bitcoin, which should not be associated with such a name at all, although it is true that this currency is still not trusted by many investors, it has managed to beat several excepts and that its functioning is happening, more than the environments for which it was created. Beyond a third halving, a decrease in the reward per block, and the scenario that less coins will be obtained, make this cryptoactive, an obligatory actor in the risk portfolios of many, if not all. It is marking a very good entry position. And is that the ugly, really reflects the revolution that the financial market will have and that already, many countries and central banks know.

The truth, the good only stayed in that, well, the bad, it is not so bad, just little understood of the enormous potential it has and the ugly, it is undoubtedly something inevitable, even if many do not like it, they will have to Get used.