GCC Cryptocurrency Market Size, Growth, Trends & Opportunity Analysis 2025-2033

Market Overview 2025-2033

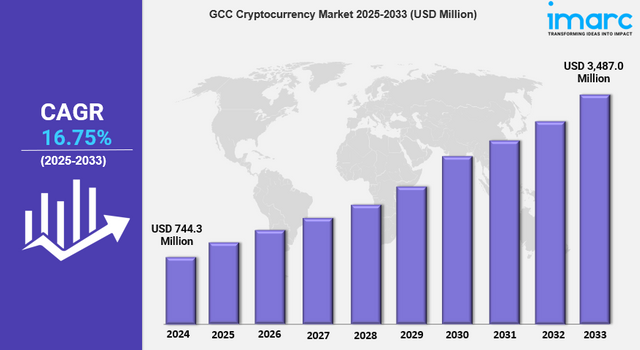

The GCC cryptocurrency market size was valued at USD 744.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,487.0 Million by 2033, exhibiting a CAGR of 16.75% from 2025-2033. The market is experiencing significant growth mainly driven by increasing digital transformation, government blockchain initiatives, and rising interest in decentralized finance. With robust internet penetration and a tech-savvy population, the GCC is emerging as a key hub for cryptocurrency adoption and blockchain technology development.

Key Market Highlights:

✔️ Strong growth driven by regulatory developments & digital transformation

✔️ Increasing adoption of blockchain technology across financial sectors

✔️ Rising interest in crypto investments and digital asset diversification

Request for a sample copy of this report: https://www.imarcgroup.com/gcc-cryptocurrency-market/requestsample

GCC Cryptocurrency Market Trends and Drivers:

The GCC cryptocurrency market is experiencing rapid transformation as governments introduce clearer regulatory frameworks to enhance transparency and investor confidence. Countries like the UAE and Bahrain are leading the way with progressive policies, granting licenses to crypto exchanges and fostering blockchain innovation. Regulatory authorities are working towards balancing market growth with security measures to prevent illicit activities such as money laundering and fraud.

By 2025, the introduction of well-defined crypto regulations across the region is expected to attract more institutional investors and fintech startups, accelerating market expansion. Additionally, governments are exploring central bank digital currencies (CBDCs) to complement the growing crypto ecosystem, further solidifying digital assets as a legitimate component of the financial sector. As a result, regulatory advancements will continue to shape the future of cryptocurrencies in the GCC, creating a more structured and investor-friendly environment.

The demand for cryptocurrencies in the GCC is witnessing a sharp rise as both institutional and retail investors increasingly recognize digital assets as a viable investment option. High-net-worth individuals (HNWIs) and asset management firms are diversifying portfolios with crypto investments, driven by inflation concerns and the quest for alternative financial instruments. In addition, major financial institutions are integrating blockchain technology to enhance transaction efficiency and security.

The UAE and Saudi Arabia, in particular, are emerging as crypto-friendly hubs, with businesses accepting cryptocurrencies as a mode of payment. By 2025, this growing adoption is expected to drive greater liquidity and market maturity, positioning the GCC as a leading region for digital asset innovation. Furthermore, the rise of decentralized finance (DeFi) platforms and crypto-based remittance solutions is attracting a tech-savvy demographic, further fueling market expansion.

The integration of blockchain technology is reshaping financial services and business operations across the GCC, offering enhanced security, transparency, and efficiency. Governments and private enterprises are investing in blockchain solutions for sectors such as banking, real estate, and supply chain management, reinforcing the technology’s long-term viability.

The UAE has launched multiple blockchain initiatives to streamline digital transactions and improve public services, setting a precedent for neighboring countries. By 2025, continued advancements in blockchain applications will strengthen the region’s digital economy, paving the way for smart contracts, tokenized assets, and Web3 innovations. This increasing reliance on blockchain is also encouraging cross-border collaborations, positioning the GCC as a strategic hub for global crypto and fintech developments. As industries adopt blockchain at an accelerating pace, the technology will play a crucial role in shaping the region’s economic future.

GCC Cryptocurrency Industry Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Type:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Analysis by Component:

- Hardware

- Software

Analysis by Process:

- Mining

- Transaction

Analysis by Application:

- Trading

- Remittance

- Payment

- Others

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145