Story 18-22 June 2018: BoE And SNB Meeting, Powell's Speech, Draghi, Carney

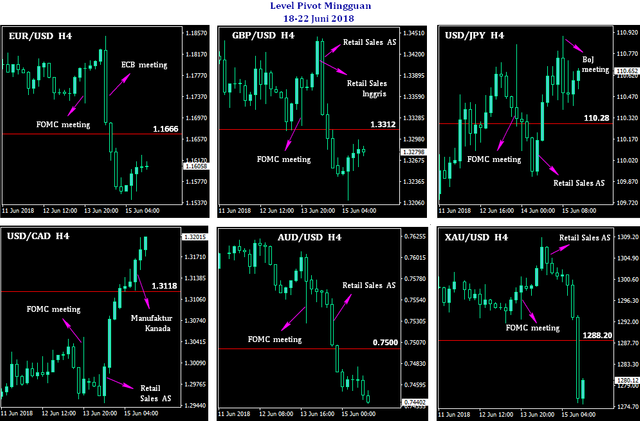

Last week the greenback rebounded versus all major currencies and gold. The key US fundamental data released last week underwent significant improvements. Annual inflation in May rose 2.8%, the highest since February 2012, PPI rose 0.5%, above the 0.3% forecast and May retail sales rose 0.8%, the highest in six months. Important factors that cause the greenback to hold high levels are the hawkish FOMC statements, and the successful meetings of Trump and Kim Jong Un presidents.

Fed Chairman Jerome Powell is very optimistic about the outlook for the US economy. In addition to raising the June interest rate by 0.25% to 1.75% to 2.00%, the Fed will raise interest rates 2 more times this year. On economic projections, the FOMC raised its GDP forecast this year to 2.8% from 2.7%, and lowered its unemployment rate projection to 3.6% from 3.8% earlier.

Powell also announced that starting in 2019, the FOMC will hold a press conference at each meeting. However, the hawkish of the Fed does not necessarily make the USD strengthen sharply. Significant USD spikes occur only when retail sales data is released.

This week's market focus is the BoE and SNB meetings as well as the ECB Forum in Portugal which will be attended by central bank leaders from various countries. Just as the ECB still holds interest rates, the BoE is also expected to stay at + 0.50%. It's just that the ECB has announced a reduction in the size of the stimulus and will end this year, while the BoE still has not hinted at tapering or termination of the stimulus program.

The issue of trade war will also return to concern after the US imposes tariffs on products from China, and China responds to retaliation. However, the effect is not significant because it is still negotiable.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes