How the Baby Boomers Generation Screwed Us and the Next Upcoming Crash (Not a FUD post)

Baby Boomers: The richest generation in the history of the human race, is about to screw us over again.

Though not deliberately, but still...

After WW2, US got 1st dibs on the kidnapping of Nazi scientists, known as project paperclip. The US soared higher than any country in the history of mankind after that.

Sure, they initially had to pay back their war expenses by stealing their citizens' gold (Gold reserve act of 1934), but majority of that was only until 1945ish. The boomers were born on 1946 - 1964, at the start of US's massive BOOM to riches. That's why they are called the boomers. Wink wink.

The boomers experienced the start of an economy boom at a massive scale unlike anything seen before.

Great Ancient civilizations like Rome for instance, had fewer population. And they didn't have the modern luxuries the boomers had. I mean, "salt" was pretty expensive in the middle ages. The common citizens didn't have soft beds, nor did anybody had plumbing and toilet bowls.

Try living for a week without plumbing, electricity and a toilet. Let's see how long you last.

This goes for any civilization before the boomers. They may seem rich in movies, but their citizens didn't have nor could they afford the modern luxuries that we take for granted now.

When the Trouble Started

The trouble started when Nixon "nixed" the gold standard for good and took the US to the path of fiat currency, or debt money.

Technically, Woodrow Wilson and Roosevelt started the path to Fiat, but Nixon sealed the deal. Ending the Bretton woods agreement for good.

The Bretton Woods was an international agreement for the world to operate in gold standard. Gold-backed currency is what enables a country to be stable because it is immune to inflation. The complete opposite of fiat (debt money) which we are on now.

Basically, a country can only print money equal to its gold reserve. The problem is, not everybody is honest. Countries were accused of secretly printing more than they have actual gold. One of the countries accused is the US.

Problem One: The US was accused of printing more money than it had in its gold reserve.

Remember, unlike decentralized, transparent blockchain, gold currency is still a centralized system. The greedy politicians can get away with it. They basically printed so much money, pretending to also have that much gold. And nobody can audit them.

The same right now where nobody can audit the Federal Reserve (where our money comes from). They basically printed so much money out of thin air and we are headed to another crash. More on this later.

Problem Two: Nation of savers

Gold-standard was meant to be stable, not "booming." For every dollar the people had, they thought it is worth that much in gold. So they became a nation of SAVERS!

Eventhough Roosevelt made it illegal to own gold until 1964 and can only own "certificates" after that. They still thought they could exchange it in the future.

This obviously caused a lot of problems for the growth of the economy. Nobody is spending, everybody's saving. The economy was bound to slow down, money wasn't circulating, companies and corporations were about to go bust.

Add to that, after their 1930s war spending, they were in economic restraint. Which means bank loans were somewhat restricted to "high-interest rates" only. This made it difficult to borrow; all the more reason for 'savers' to save! Because of this, barely any new companies and businesses are popping up because of hard-to-secure loans.

This is excellent for the savers, but not so much for businesses. This would have meant a slow economic growth and technological advancement. Silicon Valley wouldnt be what it is today if companies had a hard time borrowing money.

It would have meant a stable life for people who wanted a quiet, comfortable life. But a boring one for people attracted to big technological and economic advancement. I prefer a quiet, stable life by the way, but that's just me. But this meant though, that some other countries could have produce silicon valley, not the US.

Some other country could have produced the economic debt-based growth that spurred the US into becoming the strongest country in the history of mankind. We would still have the internet, wifi and other technological marvels; it's just that, it would come from other countries, not the US.

Like what Switzerland have done today, they created "crypto valley," based on silicon valley. Crypto is the next wave for human technology, and there is an arms-race going on for it right now. Govs are just having a hard time integrating with it because they can't control a true decentralized blockchain (ha ha).

Remember: this was only a problem for luxury-based corporations. Necessity based businesses like food companies and such were pretty stable. This is only an issue because the US wanted to be the top economy in the world.

Current winners: Savers.

Losers: Debtors.

Problem Three: US wasn't the leading Gold producer at the time.

The US had a very big of pot Gold at that time, but Russia and South America were outperforming the US when it came to mining. The US didn't want that. They wanted to be number one. This was a problem.

Problem Four: It was subject to manipulation

This was NOT a transparent system like the blockchain/cryptocurrency we have today. Greedy bankers and politicians have been known to manipulate the dollar-to-gold value many times. Powerful entities could bribe the Gov into declaring a not-so-honest value. They could basically say today, "Gold is this XXX value today," and declare "another" value the next few months.

For the record, I think Gold-standard is awesome if done correctly. It needs to be done in accordance with the principle of free markets and rule of law though. A reasonably honest free market, prudent banking laws, like the one in Canada from the late 1800’s to the 30's.

And Yes, I know this will never happen. A centralized-based gold standard where ledgers are hidden and auditing is impossible, is a very big flaw. That's why a transparent, decentralized blockchain attracted so many people to cryptos.

Nixon made a gangsta move

Nixon ended the gold-standard once and for all. And took the world to the fiat/debt-money system. More on this in a bit.

Reason One: they were "suspected" of printing more money than they had gold reserve.

Because other nations are buying US gold, the US was about to be exposed for what they have done... which was, _they've printed more money than they had in gold reserve. Note: Other nations are also guilty of this. Remember, they were only 'suspected' of this. No actual charges. Because this centralized system is hidden and can't be audited, no real proof.

Nixon and other politicians responsible, covering their tracks, made a bold, gangsta move and ended the bretton woods agreement for good. Thereby, taking the US (and the world) to debt money, fiat.

Fiat basically means, we can borrow money now and have the next generation pay it later. A ponzi scheme. As long as the next generation pays it, it's all good.

I will repeat it because it is very important: Fiat officially started in 1913 when Woodrow Wilson was blackmailed into signing the Federal Reserve act (Which enabled the biggest ponzi scheme in the history of mankind: Fiat).

Read Creatures from Jekyll Island--Excellent book if you want to understand how the world was manipulated by the elite few.

But In 1971, Bretton Woods ended and fiat became the official currency. So the Gov't printed so much money right after, making the boomers the richest generation in human history, knowing their children and grandchildren will pay for it.

Echo: knowing their children and grandchildren will pay for it.

The initial burst of money printed, set a wave of riches for the boomers.

Disclaimer: I'm not saying the boomers deliberately did this, but the Gov't certainly did. I'm not blaming the boomers. They were lucky to be born in that era and I'm not faulting them for that.

Reason two: They were about to go bankrupt.

For the love of God, they were busy spending so much money INVADING VIETNAM. This was a total scam but Im not going to delve into this because it's a rabbit hole. IF YOU DON'T WANT TO LOSE MONEY, STOP INVADING OTHER COUNTRIES!

Reason three: they wanted an economic boom

Having citizens of savers pissed them off. They want an economic boom, not a boring, comfortable life for people (lol).

And converting to fiat enabled this. With an influx of Fiat/debt money, low interest loans were possible. Entrepreneurs were able to borrow money in droves. Businesses went up. And the economic boom commenced, unlike anything seen before.

Winners: Good Debtors

Losers: Savers

The downside

It is worth mentioning: The initial influx of fiat money took us to the economic and technological marvel where we are today. But now the reaper has come. US printed so much money that they are 20 Trillion in debt! http://www.usdebtclock.org/

Who's gonna pay it? You.

That's why we had the 2008 housing crash. And a next upcoming crash that I'm going to talk about in a minute.

The problem

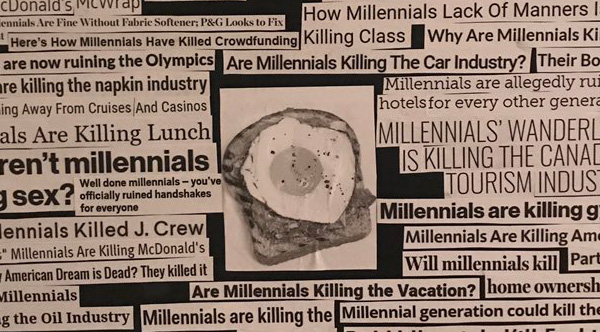

I was in a restaurant a few days back. There were these 2 older gentlemen discussing in disgust about how the millennials are lazy and entitled.

That's the problem.

They don't know that 95% of the dollar's value is gone after the 1971 Nixon shock.

It's fucking hard to make a living now. 40% Of US Workers Now Earn Less Than 1968 Minimum Wage.

Source: http://www.zerohedge.com/news/2013-08-05/40-us-workers-now-earn-less-1968-minimum-wage

Imgur

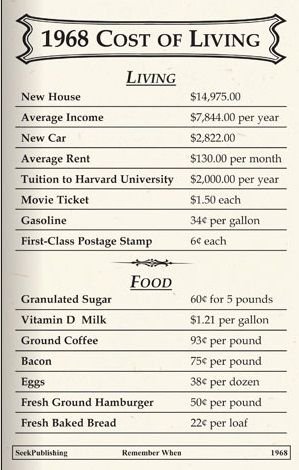

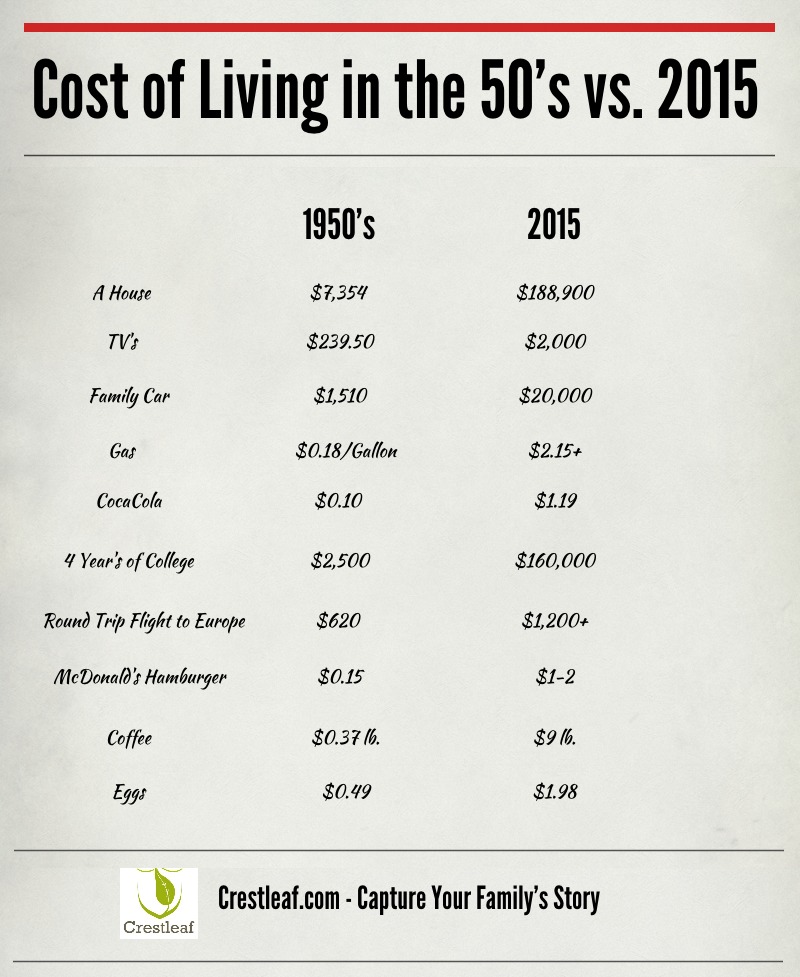

In 1968, median wage was like $7,800 - $10,000+ and houses were like $14,000 - $20,000+?

Source: https://www.census.gov/const/uspricemon.pdf

Seriously, a single family income can provide a comfortable life. Only the dad needs to work. Cars would cost $3,000. Harvard tuition $2,000. Average rent $130. Giving birth would cost you $500 in a good hospital.

Now imagine if they were a two income family.

Now, either people are on welfare or living paycheck to paycheck. Only the ones who worked on their financial education have a chance to live a good life (read: Rich Dad, Poor Dad).

Young adults today are scared of having children! Because of incredibly expensive costs!

You may see on charts now that average American household income is $60,000 and houses are $250,000 average, but the cost of living is so high now. Back then, the cost of living was so low!

After paying rent, food and bills, 1970s families were left with a lot of savings! Today, not so true.

That's because the Gov printed so much money of thin air that the value of the dollar is gone and the US just went over 20 TRILLION in debt.

This is for another post: but kids today are graduating with an average of $37,000 in student loans! they are basically fucked from the get go.

Americans owe over $1.45 trillion in student loan debt, spread out among about 44 million borrowers. That’s about $620 billion more than the total U.S. credit card debt. In fact, the average Class of 2016 graduates has $37,172 in student loan debt!

HOW THE HELL ARE STUDENTS LOANS HIGHER THAN CREDIT CARD DEBT!?

Source: https://studentloanhero.com/student-loan-debt-statistics/

This video greatly explains the millennial's workforce situation.

The Real Trouble

The social security is the second biggest ponzi scheme in the history of the human race. The first is obviously the fiat.

How ponzi schemes work

Tell Jeff you will invest 1,000$ for him, promising 50% profits.

Tell Dan the same thing.

Tell Ann the same thing.

Pay Jeff $500 profit using Dan's money. Keep the rest.

Pay Dan same profit using Ann's money. Keep the rest.

And so on and so forth.

Get it?

As long as you are able to recruit new investors, your scheme would be ok.

Obviously, Jeff and Dan would be so amazed at 50% profit that "most probably" they would invest that money back into you.

As long as they don't all withraw at the same time, you'll be ok.

What happens when they all start withdrawing it at the same time?

Ponzi Screwed

Quote: If you want to see a true pyramid scheme, look no further than social security. It was intended to be a savings plan for your future. But the money where cleaned out long ago by politicians who can’t see a pot of money without spending it, replacing it with basically an IOU from a government now trillions of dollars in debt.

And thus they have to rely on those currently working to pay back what is owed to those who have retired or will soon retire. And we’ve now reached the point where the money being paid out is more than that being collected.

Source: http://www.richardjnorrisphdblog.com/baby-boomers-and-retirement/

The problem is, the boomers are in their 70's now and are claiming Social Security money like wildfire.

And there's barely anything left.

Remember when I said, "As long as the younger generation is willing to pay for SS when the boomers start claiming it, it's going to be ok?"

Well, what happens when the younger generation is struggling with a paycheck to paycheck lifestyle and can barely pay any SS taxes?

Ponzi Shceme burst.

In 1933, there were roughly 17 workers for each retiree, and the life expectancy for men was 65 years. Today, there are only 3 or 4 workers for each retiree, and the life expectancy for men is almost 80 (even older for women).

So the original program envisioned paying benefits for an average of 3 years, but the current expectation is that benefits will be paid for 13-14 years!

Also note, because the law was only passed 1933, The initial beneficiaries (aged 62 and above) had paid almost NOTHING into the system!

I repeat, Today, there are only 3 or 4 workers paying for each retiree. How bout 5 years from now? One?

When the workers aren't able to pay for the retirees's monthly benefit anymore, they are screwed.

What will the US government do about this growing problem? For roughly 30 years, Congress has merely applied "band-aid" solutions to Social Security. In the popular vernacular, they have continued to "kick the can down the road", pushing the problem off to future Congresses. But now we have "run out of road."

It basically says, "I'll only be in congress for 4 yrs, let the next schmuck handle the problem."

According to U.S. Census Bureau data, more than 76 million individuals were born between 1946 and 1964. Roughly around 65 million are collecting SS money.

Are the younger generation be able to keep paying the 65 million retirees?

Not when they are bouncing from one dead-end job to another. Not when the 2008 housing crash screwed them over. Not when kids are graduating with (average) $37,000 student loan debt.

Basically describes the younger generation's situation right now.

It is estimated the Social Security will start running out of money in 2018 - 2020. Just like the housing-backed loans ran out of money in 2008.

This is exactly the same thing happening all over again. Another crash will happen. Just like the 2008 defaulting in mortgage loans, the economy will default the social security scam in 2018-2020ish.

Not a FUD post

What to do?

Invest in silver, rental properties and cryptocurrencies.

Silver

Silver will soar massively in the next coming years, but I will explain that in the next post, because my God... I've been at this for hours. This is a seriously long post.

Rental Properties

Technically, it can be any business, but Rental properties are a no-brainer. It has been the most consistent and dependable investment in the history of humankind. Rental properties has made MORE MILLIONAIRES than any form of investment in the history of the world.

But I guess buying rentals isn't that easy. It takes mastering the "art borrowing 'good debt'."

Read Kiyosaki books:

- Rich Dad, Poor Dad

- Cashflow Quadrants

- Guide to Investing: What the rich invest in.

- Why "A" students work for "C" students.

- And 4 hour workweek by Tim Ferris

Bonus: Rework by Jason Fried

Those are good places to start for your financial education. There are tons more, but I'll just point out good starting books to not overwhelm you.

Financial education is the key to your success.

Cryptocurrencies

Cryptocurrencies are world changing. The first ever platform that enables 'literally' anybody to invest in without needing to be an "accredited investor."

Read more about accredited investors: https://steemit.com/cryptocurrency/@everluck/hidden-history-of-sec-and-what-blocking-icos-means-for-you

I have delved a lot in cryptos in my previous posts, so I don't want to sound redundant.

The only difference in the next upcoming crash, is your preparedness.

The previous crash, only few were prepared. Very few people shorted it (Watch The Big Short. Excellent film).

And while the masses were crying, the rich bought the dip! House prices went so low and the rich went on a shopping spree! They hoarded so many houses and rented them out!

There is always a shift in wealth after every economic crash.

A lot of highly paid company men lost their jobs. But while they were crying, a lot of smart middle-class people borrowed 'good debt' and bought in the dip, ended up with two or three cheap rental properties after the crash.

But but but everluck, I can't afford a house yet.

Buy cryptos. Do your research. Read the white paper. Do more research.

If you bought cryptos 5+ years ago, you can probably afford many houses right now. NOR do you need to buy anything for that matter. The crypto millionaires who bought early can retire in the bahamas and sit on the beach all day for the rest of their lives.

Because of the nature of fiat debt currency, it is, by design, going to crash.

There's only so much money they can print before hyperinflation sets in. Take a look at Venezuela, Cyprus, Zimbabwe etc.

The average life expectancy for a fiat currency (based on history) is 27 years. Every 30-40 years the reigning monetary system fails and has to be retooled. It technically started on 1913 and retooled in 1944, and was retooled again on 1971 (Nixon), because it was about to fail.

So now our lovely fiat is over 46 yrs old. It is way passed due. It bound to be retooled, which would cause an initial crash. But technically speaking, with cryptos being a pandora's box. There's no amount of retooling they can do to save it.

It is bound to be replaced by cryptos. China is on it's way to have its own official cryptocurrency (probably Neo). Fiat is dead. Just like Ford replaced the horse carriages. Just like Craigslist replaced the newspaper classified ads industry. Just like amazon replaced bookstores and other brick & mortar stores. Just like what uber/lyft is about to do to the taxi industry.

Cryptos will replace fiat.

When the next crash comes, and it will, there's no ifs, ands or buts about it, it's only a matter of time.

When it does, your crypto portfolio is gonna explode! Are you ready?

.

.

Before you post, let me reiterate again: I'm not blaming the boomers for this. Because the Gov't did it. The boomers were lucky to be born in that era and I'm not faulting them for that. In fact, when the SS scam bursts, it is them that will be affected the most. That's why I'm writing this post, hoping it will reach far and wide. So people can start preparing and actually get richer after the dust settles.

Addendum: please don't comment about segregation and all that. I'm trying to avoid touchy subjects :(

.

.

Upvote, resteem and follow me please.... It will inspire me to write more :)

Wow! This article is beyond great!

Such a good read, with many good points! I will surely check out the books you recommended!

Thank you! It only took me two days to write lol. But was well worth it reading your comment just now! Thanks!