FOREX CANDLESTICKS

An Introductory Guide for Forex Traders

Forex trading using candlestick charts provides a forex trader a lot of details about currency price movement to trade all markets and formulate a sound trading plan.

Forex charts gives a trader an idea of the past; the relative price movement between two currency pairs which is used to predict future price movement. -link

Candlestick charts differ from the other types of forex chart: line and bar chart, because proper usage gives a forex trader the psychology to determine trend directions, entries, exits and so much more.

In addition forex traders should possess a vast knowledge of candlesticks and how to analyze them . Candlesticks often combine individually to form identifiable patterns. After gaining the knowledge of candlestick patterns, forex traders often find they can notice all sorts of currency price action effortlessly compared to using other types of bar charts.

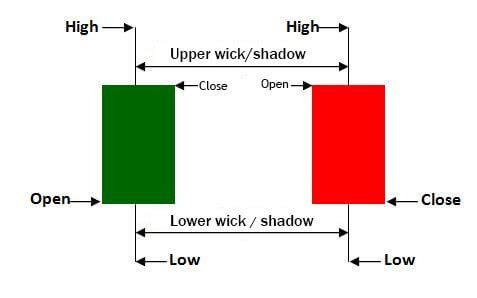

Anatomy of Candlesticks Explained

The structure of a candlestick; the open, the close and the shadow/wick. If you have your forex chart on a monthly setting each candle represents one month the open price being the first traded for the month and close price traded last for the month. For a bearish candle the open price is above the close price while a bullish candle the open price is below the close price.

open price: This is termed as the first price traded during the formation of a candle.

close price: This is the termed as the last price traded during thr fotmation of a candle.

High price: This is the termed as the 'top' of the upper shadow/wick of a candle.

Low price: This is termed as the 'bottom' of the lower shadow/wick of a candle.