GBP / USD Still Bearish Ahead of UK CPI

The pound slightly reduced the losses in the trading session this morning (13/06), in line with the House of Commons which rejected the amendment of the Brexit Act through Voting 324 results against 298 votes. The amendment is intended to grant more authority to Parliament in the determination of the Brexit strategy set by the British Prime Minister. Nevertheless, the GBP / USD struggle has now stalled, as the recent Price Action of the currency pair indicates a further decline.

Prime Minister Theresa May has successfully overcome resistance from pro-EU lawmakers in his party. This success also prevents the UK from the threat of large-scale political crisis. Now, the spotlight is a reward for the defection of the defectors and the possibility of another resistance that is still stretched in the future.

At the same time, the UK CPI data release will also be the focus of market attention. Projection for Core CPI in May was relatively stable. Promising price growth signals could further convince the Bank of England (BoE) to normalize its moeneter policy by 2018.

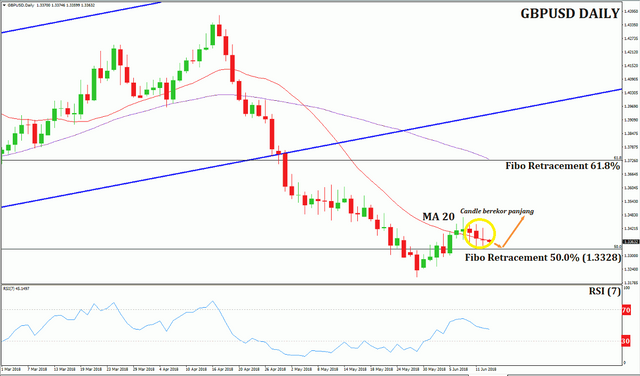

At the Daily Chart below, the ACY is projecting a short-term GBP / USD Outlook that continues to lead to the downside, with the downwardly lower MA 20 line appearing to weigh on the price, and the Relative Strength Index (RSI) extending bearish formation from the formation earlier this year.

On the other hand, Oulook ACY for GBP / USD in the medium and long term is not too negative. Failure Close price below 1.3328 (Fibo Retracement 50.0%) will leverage Rebound opportunity, and the rally potential is supported by some previous candlestick signal that has a long tail. The candle formation typically signifies the creation of a strong support level below the price.