Forex EURUSD - German election, to play or not to play

Tomorrow, Germans are headed to vote for the federal election, which Angela Merkel is currently poised to win, letting her keep her role as the German Chancelor.

Important points:

Polls indicate Merkel's Center-Right Christian Democratic Union will lead the election with a comfortable 36% of the votes.

"Chancellor Angela Merkel has enjoyed a comfortable and stable lead in the polls for several months. It would need a miracle or wrong polling for her not to win the elections.

Merkel has been a strong leader for Germany for the past few years, leading the country to be a strong actor on the European and Global seen.

Although it won't be long before we know who came on top at the election, it might take some time until a coalition government is formed, especially with Germany's rightwing AfD party making a late jump in the polls and taking the third place behind CDU and SPD with 12%.

If AfD receives 12% of the votes as the polls suggest, the party will secure 50 seats in the parliament and their presence in the German government might hurt the shared currency in the near-term. However, the negative effects could fade away quickly as Merkel would have a chance turn to other parties to form a coalition. "...the recent polls show that the Alternative für Deutschland may emerge as the biggest opposition party in the Bundestag. This might reel markets, but keep in mind that they are then expected to suffer the same fate as the Dutch Freedom Party, i.e. political isolation,” Rabobank analysts explain.

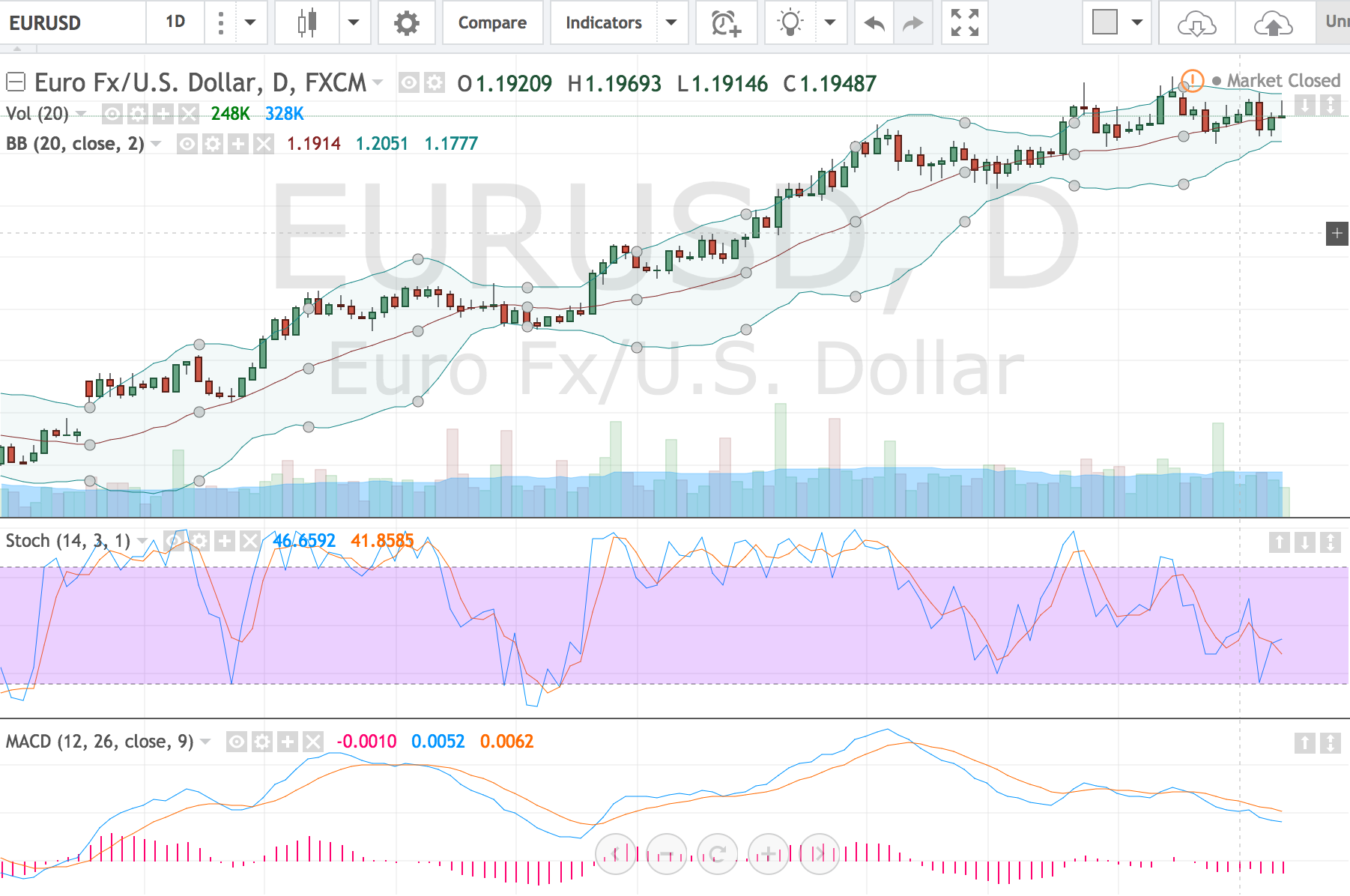

On the other hand, if AfD fails to come in third on Sunday, the euro is likely to rise modestly against its peers amid a relief rally. The EUR/USD pair could try to extend its gains above the 1.20 handle, but the pair's overbought-ness and the FOMC's hawkish stance could cap the upside. 1.2090 (Sep. 8 high) could be the next target, and the German election outcome by itself might not be significant enough to carry the pair above that level in the short-term. On the downside, the pair could edge lower towards 1.1860 (Sep. 20 low) and 1.1770 (Aug. 25 low) if there are uncertainties regarding the structure of the coalition after Sunday.

Good luck everyone!

I just upvoted this post. I don't do analysis anymore, I'll rather fold my hands and let the experts do the heavy lifting. I use Kapxo trade copier https://kapxo.com/ , My account yields more than 50% every month.