Learning Forex "Lot and Volume"(Episode-5)

Welcome again everyone,

This is 5th consecutive article on the Forex learning. I am starting to enjoy to write about this topic. Hope, you guys also find its interesting. For the people, who just got here today, this is my successive article on Forex learning. This one is the "Fifth/5th"one. Here the previous ones-

2.Learning Forex

3.Learning Forex

4.Learning Forex

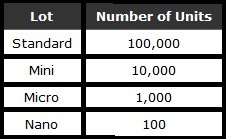

Lot is a lot easier. But when you go as a unit, you will find it complex.In the past, spot forex was only traded in specific amounts called lots, or basically the number of currency units you will buy or sell.

The standard size for a lot is 100,000 units of currency, and now, there are also a mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units respectively.

As you may already know, the change in currency value relative to another is measured in “pips,” which is a very, very small percentage of a unit of currency’s value.

To take advantage of this minute change in value, you need to trade large amounts of a particular currency in order to see any significant profit or loss.

Let’s assume we will be using a 100,000 unit (standard) lot size. We will now recalculate some examples to see how it affects the pip value.

USD/JPY at an exchange rate of 119.80: (.01 / 119.80) x 100,000 = $8.34 per pip

USD/CHF at an exchange rate of 1.4555: (.0001 / 1.4555) x 100,000 = $6.87 per pip

In cases where the U.S. dollar is not quoted first, the formula is slightly different.

EUR/USD at an exchange rate of 1.1930: (.0001 / 1.1930) X 100,000 = 8.38 x 1.1930 = $9.99734 rounded up will be $10 per pip

GBP/USD at an exchange rate of 1.8040: (.0001 / 1.8040) x 100,000 = 5.54 x 1.8040 = 9.99416 rounded up will be $10 per pip.

Your broker may have a different convention for calculating pip values relative to lot size but whichever way they do it, they’ll be able to tell you what the pip value is for the currency you are trading is at that particular time.

As the market moves, so will the pip value depending on what currency you are currently trading.

We can get profit from every pip movement in Forex market. That means, if the price ranges from 1.1710 to 1.1720, we will get 10 pips profit or loss. Through the lot / volume, we will determine how much profit or loss we have when every pips are favorable or incompatible.

We divided the Forex brokers into 3 categories releasing Nano.

Standard Lot Broker

Mini Lot Broker

Micro Lot Broker

Standard lot broker 1 lot = $ 10 / pips. But 1 lot = $ 1 / pips in mini lot broker And 10 lots in micro lot broker = $ 1 / pips

So, if you open a trade with 1 lot in Standard Lot Broker and 10 pips suit your end, your profit is $ 10x10 = $ 100. If the movement against you,the loss is $ 100.

However, if you open a trade with 1 lot in the mini-lot broker and 10 pips are appealing to you, then your profit is $ 1x10 = $ 10. Same for the loss is $ 10.

And if you open a trade with a lot of 1 lot in a micro lot broker and 10 pips suit you, your profit is $ 0.1x10 = $ 1. Same for the loss is $ 1.

Standard lot brokerage

1 standard lot = $ 10 / pips

0.1 standard lot = $ 1 / pips

0.01 standard lot = $ 0.10 / pips

10 standard lot = $ 100 / pips

Mini Lot Brokerage

1 mini lot = $ 1 / pips

0.1 mini lot = $ 0.10 / pips

0.01 mini lot = $ 0.01 / pips

10 mini lots = $ 10 / pips

Micro Lot Brokerage

1 micro lot = $ 0.10 / pips

0.1 micro lot = $ 0.01 / pips

0.01 micro lot = $ 0.001 / pips

10 micro lots = $ 1 / pips

Surely you understand the difference between Standard Lot, Mini Lot and Micro Lot. Brokers decide the size of lot as their convenience.

Most brokers will allow you to trade in the lowest 0.01 lot. That is, you can take the minimum pip value in standard lot broker 10 cents. But in mini lot broker you can take a minimum pip value of 1 cent. And with Micro Lot Broker you can take the minimum pip value 0.1 cents. So if your capital is low, then you can trade in a mini lot or a micro lot broker with a low risk.

Not only that, you can trade in 1 lot, 0.1 lot or 0.01 lot, if you want 2.5 lot, you can trade in 1.3 lots like this type of custom lots.

You can trade on micro-trading in the trading point micro-account. InstaForex, Hot Forex, Light Forex etc. Brokers are the Mini Lot Broker. FBS, F. X Optimizer etc. Brokers are standard lot broker. If you do not know your brokerite micro lot, mini lot or standard lot, then ask the broker's live support question. Many times their website is also available. Or open a demo account with them and open a trade with 1 lot. If you see that profit or loss is $ 10 dollars per pips change, then it will be considered standard lot broker. And if you see that changing $ 1 dollars, then it will be a mini lot broker. If you change by 10 cents, it will be a micro lot broker. But some brokers have different lot size in each account type.

Well this is all for today! I am not going to put any more in it. Let's talk about the later part in the next one. Feel free to leave a comment, if you have any queries. I will try my best to give you the desired answer.

You got a 2.67% upvote from @emperorofnaps courtesy of @shuvomahfuz!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!

In Forex trading, a lot refers to the standard size of a trade. It represents the number of currency units you buy or sell. There are three main types of lots: standard, mini and micro. A standard lot represents 100,000 units of the base currency, a mini lot represents 10,000 units, and a micro lot represents 1,000 units. Lot sizes determine the potential gains and losses on a trade, as well as margin requirements. Volume in forex trading is the number of lots traded in a given period of time, so says fbs bonus. It gives an idea of the liquidity and market activity of a currency pair. On trading platforms, volume is often displayed as a histogram showing the number of lots traded at different price levels. Analyzing volume patterns can help traders identify significant price movements and potential trading opportunities.