The Amazing Harmonic Pattern Trading Strategy

The Amazing Harmonic Pattern Trading Strategy will give you a whole new understanding of the price action. Know the geometric patterns that can be found in nature. The same anomalies can be found in the financial markets, such as in harmonic patterns. This ability to repeat and create these intricate patterns is what makes the Forex harmonic patterns so incredible. We also have training for the fractal trading strategy.

Harmonic patterns are complex patterns in the Forex market. If you want to start with a simpler price action pattern, we recommend the Head and Shoulders Price Pattern Strategy.

We can distinguish six basic Forex harmonic patterns:

Gartley Pattern

Butterfly Pattern

Crab Pattern

Bat Pattern

Shark Pattern

Cypher Pattern

There are many benefits of harmonic trading. For example, if you become an expert in one of the Forex harmonic patterns, you’ll know how to trade it on certain pairs. You’ll be able to know when the best time to trade is and when the market is going to react in a certain way. You’ll become an expert in Forex harmonic patterns. A useful tool for trading this strategy is a harmonic pattern scanner or a dashboard that shows all the patterns on different instruments. However, we recommend that you learn the patterns well before using a scanner or dashboard.

Our favorite time frame for the Amazing Harmonic Pattern Trading Strategy is the 1h, 4h or the Daily chart. For simplicity’s sake, we’re going to refer to the Amazing Harmonic Pattern Trading Strategy as the AHPT trading strategy. We don’t want to go to lower time frames because, after extensive backtesting, we discovered the Amazing Harmonic Pattern Trading Strategy works best on higher time frames. If you want quick profits, check out our favorite day trading strategy, the Best Stochastic Trading Strategy- Easy 6 Step Strategy. It might be more suitable for your own needs. This strategy performs the same and is suitable for trading other asset classes like stocks, futures, options, etc.

Throughout this article, you’ll learn the effectiveness of this pattern the strengths and the weakness. You'll also learn how to efficiently trade the Forex harmonic patterns. This ability to consistently repeat makes the Forex harmonic patterns attractive for our team at Trading Strategy Guides. We also have training on how to trade with the Gartley pattern.

Before we get started, let’s look at what indicators we need to successfully trade the Harmonic Pattern Trading Strategy:

If you aren’t that great on geometry most standard Forex trading platform comes with a harmonic pattern indicator. This can help you spot and measure the Forex harmonic pattern. The Forex harmonic patterns use the Fibonacci numbers to define accurate trading points.

The harmonic pattern indicator allows you to call market turning points with a high level of accuracy. Check out the Price Action Pin Bar Trading Strategy if you don’t have prior knowledge of how a reversal trading strategy looks.

Let’s now jump into the rules of the AHPT trading strategy.

Note*: Moving forward, we’ll be focusing on the Butterfly harmonic pattern. This is one of the most common Forex harmonic patterns.

What is the Butterfly harmonic pattern?

In technical analysis, the Butterfly harmonic pattern is a reversal pattern composed of four legs. A leg is a swing wave movement that connects and is composed of a swing high and a swing low. Here is how to identify the right swing to boost your profit.

Butterfly harmonic pattern rules summary:

AB= 0.786 or 78.6% retracement of the XA swing leg;

BC= minimum 38.2% - maximum 88.6% of AB swing leg;

CD= minimum 1.618 – maximum 2.618 of AB swing leg;

CD=minimum 1.272% - maximum 1.618% of XA swing leg;

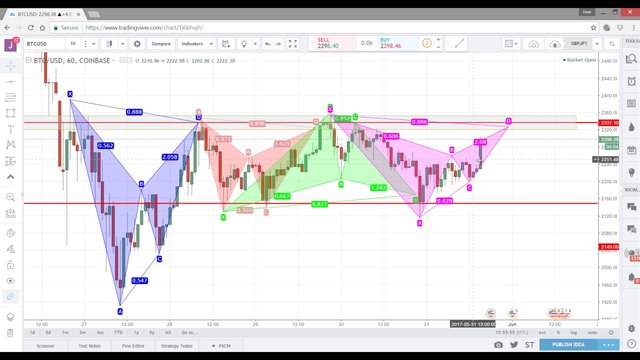

harmonic patterns forex

Defining the Butterfly harmonic pattern.

The Butterfly harmonic pattern depends upon the B point. It defines the structure and sets up the other measurements within the pattern to define the trade opportunities. To the Butterfly pattern the B point, it must possess precise 78.6% retracement of the XA swing. Other rules that redefine the structure further includes the BC projection that must be at least 1.618 measurements.

Also, the Butterfly pattern must include an equivalent AB=CD pattern. It’s a minimum requirement. However, the alternate 1.27AB=CD is more common for this structure.

The 1.27XA projection is the most critical number in the potential reversal zones. And, finally, the C point must be within the range of 0.382-0.886 retracement.

You can start drawing the butterfly pattern as soon as you have the first two legs of the pattern. Once you have the points X, A and B, you can begin monitoring the price action. You can look for confirmation that the wave C conforms to the Butterfly pattern rules.

The Amazing Harmonic Pattern Trading Strategy Rules

Now it’s the time to reveal the Amazing Harmonic Pattern Trading Strategy rules. We’ll start with the most exciting part. This is always the entry point and continue down with the rules for the stop loss and take profit orders.

There is one important thing that we need to learn before to actually define the Harmonic Pattern Trading Strategy rules. This is to give you indications on how to apply the Harmonic pattern indicator.

Step #1 How to apply the Harmonic Pattern Indicator

I would walk you through this process step by step. All you need to do is to follow this simple guide. See figure below for a better understanding of the process:

First, click on the harmonic pattern indicator which can be located on the right-hand side toolbar of the TradingView platform. In the MT4 terminal you can locate the harmonic pattern indicator in the Indicators library.

Identify on the chart the starting point X, which can be any swing high or low point on the chart.

Once you’ve located your first swing high/low point you simply have to follow the market swing wave movements.

You need to have 4 points or 4 swing high/low points that bind together and form the Forex harmonic patterns. Every swing leg must be validated and abide by the harmonic pattern strategy rules as presented above.

Now, we’re going to give the entry rules for the bullish Butterfly harmonic pattern.

See below…

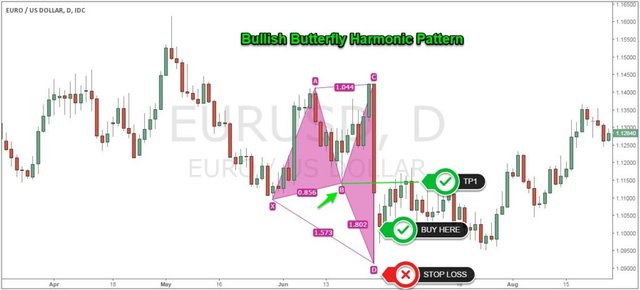

Bullish Butterfly Harmonic Pattern – Buy Entry

Ideally, as a trader, you would like to enter at the completion of point D. As we established earlier, the point D of the Butterfly Forex harmonic pattern can develop anywhere between 1.27 – 1.618 Fibonacci extension of A leg. Since the market is not a perfect place, we’ll initiate a buy order once the markets hit the 1.27 Fibonacci extension.

In the above example, we entered at 1.272 Fibonacci extension, but we can already see point D extend to 1.573 Fibonacci extension. This is still inside the 1.272 – 1.618 range that validates the bullish Butterfly harmonic pattern.

That’s still a great entry level.

Where to place your protective stop loss is the next logical question.

Bullish Butterfly Harmonic Pattern – Stop Loss

For the Bullish Butterfly Harmonic Pattern, you normally want to place your protective stop loss below the 1.618 Fibonacci extension of the XA leg. That’s the logical place to hide your stop loss. This is because any break below will automatically invalidate the Butterfly harmonic pattern.

So far, we defined the proper entry point and the stop loss location for the Harmonic Pattern Trading Strategy. Now, it’s time to switch our focus and define where to take the profits.

Bullish Butterfly Harmonic Pattern – Take Profit

Adding multiple take profits with the AHPT trading strategy will enhance further your trading experience. and will influence the expected profitability because this will almost guarantee you’ll bank in a profit. The Forex harmonic patterns, while they are a reliable pattern, you want to be very aggressive with your profit target.

As the saying goes: “No one has gone broke by taking a profit”

So, where do you take your first partial profit?

See figure below:

The Amazing Harmonic Pattern Trading Strategy has a more conservative first partial profit target established at Point B. Normally this is the place where you will expect to find some resistance on the way back up because it’s an important swing point.

We want to close the second part of our trade once we hit the 0.618 Fibonacci retracement of the CD leg. You can even aim for a retest of point A. Although that can be your next target once you become more experienced with the harmonic pattern indicator.

Have a look at the chart below:

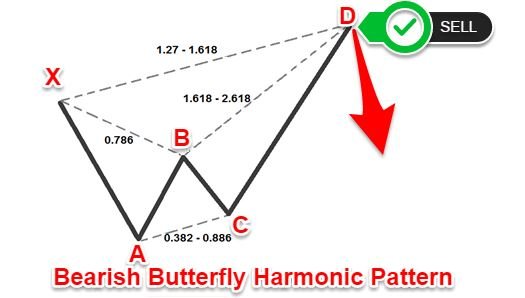

Note** The above was an example of a BUY trade using the Bullish Butterfly Forex Harmonic Pattern. Use the same rules for the Bearish Butterfly Forex Harmonic Pattern for a SELL trade. In the figure below you can see an actual SELL trade example. You can do this using the Bearish Butterfly Forex Harmonic Pattern.

Take a look: