US Dollar under pressure

US Dollar under pressure, testing 97 handle as political turmoil continues.

The US Dollar Index, which tracks the greenback against a basket of peers, is staying under pressure, testing the 97 handle for the first time since Trump's election victory.

A recent report by the Washington Post claimed that the law enforcement investigation into possible ties between the Trump campaign and Russia identified a new person of interest, a current White House official, whose identity is not revealed. After the report, U.S. Treasury bond yields gave back their daily earning and the equity indexes started to ease from their daily highs, suggesting another wave of risk aversion is impacting the markets.

On the other hand, the demand for the greenback was also damaged by the dovish comments from Fed's Bullard, who suggested that the Fed doesn't need to raise the rates aggressively. Although the odds of a June rate hike rose back above the 70% mark, the investors are hesitant to price the probability of more rate hikes. The CME Group shows that the chances of a rate hike in September or November are around 25%.

CME Group FedWatch's June hike probability settles above 70%

Fed's Bullard: Would not object to June hike

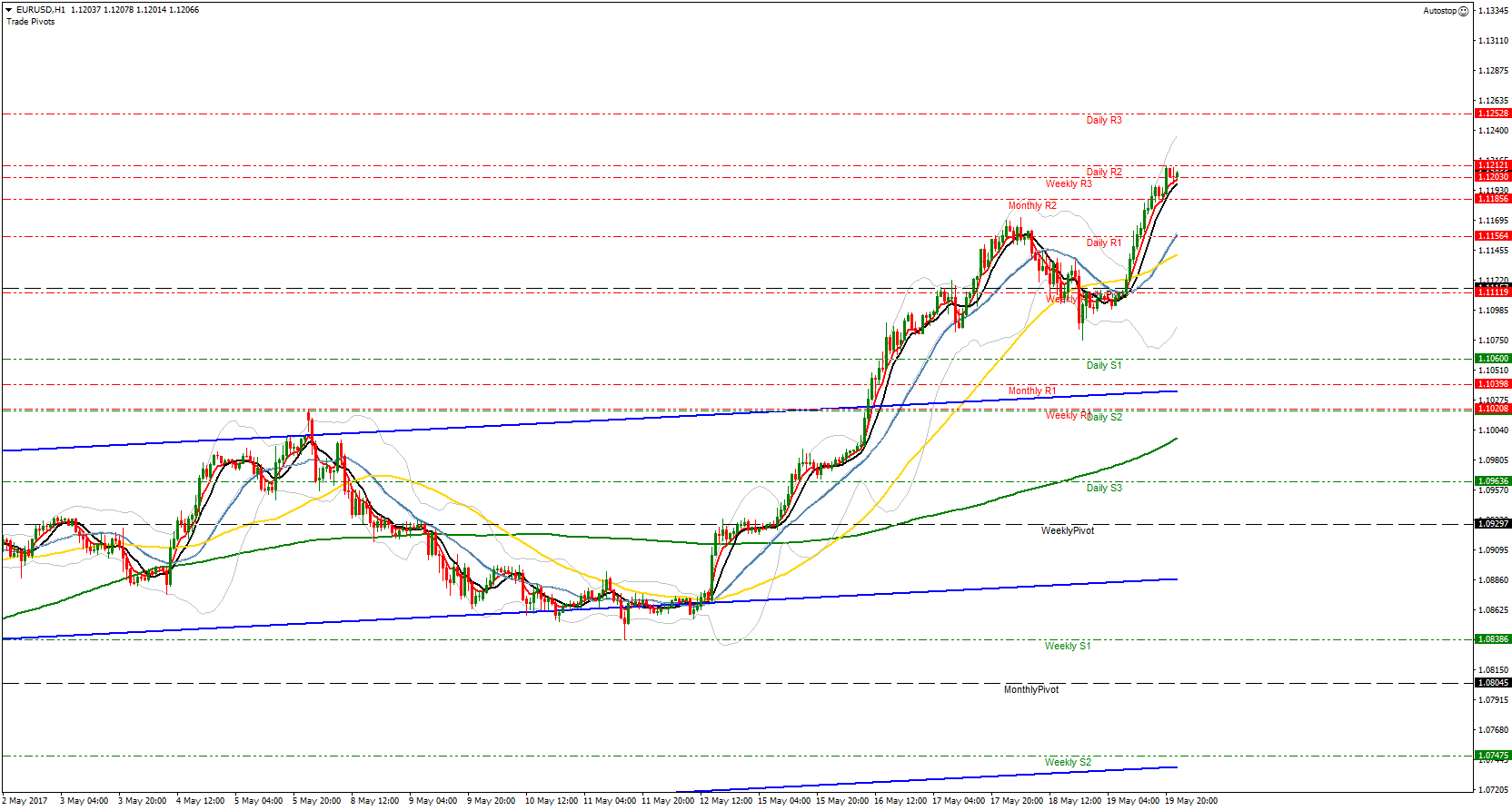

Technical outlook

The index might struggle to make a clean break below 97 (daily low) as the volume is thinning out towards the end of the week. Below that level, the next targets could be seen at 96.40 (Oct. 7 low) and 96 (psychological level). On the upside, the initial hurdle aligns at 97.75 (daily high) ahead of 98 (May 18 high/psychological level) and 98.75 (May 16 high).

Citi - expands the window for dollar weakening over the course of the coming summer

Congratulations @forexnews! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!