Market Highlights - Week 2

It’s good to be home again after 3 weeks away. I'm getting this out a bit late so some trades are already live.

LIVE TRADES

GOLD

So I got short Gold last week as intended and it’s still in progress. I quite liked the mirrors washing the ledge right beforehand, and we have since started to make lower lows and lower highs. I really want see one of those minor swing lows on the way up get broken (marked with short thick black lines).

FTSE100

Perhaps far too aggressive an entry on FTSE here. Price will often form a pivot when it reaches a ML, as is taught in the Andrews action reaction course. (My trading bible of choice).

Rule #6. The other reversal rule is that prices tend to reverse at or near any ML, as well as at any extension of each ML. And also at any MLH or extensions of MLH.

We can see that price has technically zoomed the black ML, however it looks pretty weak and my gut tells me the bears are taking back control. I don’t generally put much faith in “gut” indicators but I am curious to start accumulating data on this metric. Over time the numbers will teach me something.

USDJPY

I placed an order to short this market earlier today which has now been triggered. Price has yet to reach the daily ML, and there’s some nice rejection at the top of the visible chart. I’m comfortable risking 1% here to see if price can make it’s way back down a bit.

WATCHING

GBPAUD

There’s something about this chart. It’s not really showing me anything yet, but I really like the way we can capture frequency here. The sellers marked in yellow need to be taken out before I’d think about any longs, and then of course a stop needs to be hidden behind an appropriate structure. I’ll be keeping an eye on it during the week to come and see what develops.

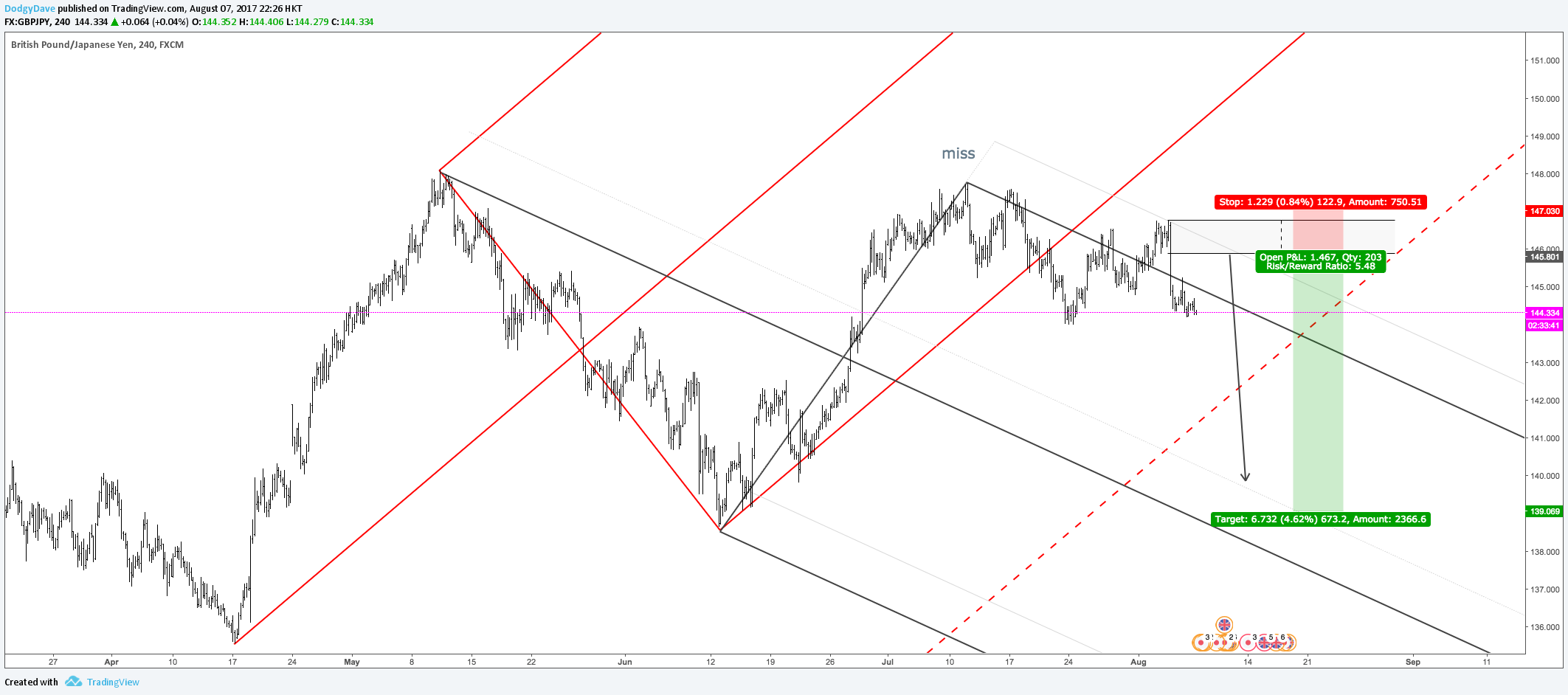

GBPJPY

If price can make it’s way back up to visit Bob (break out bar) I’ll be happy risking another 1% on this trade.

Andrews teaches us that:

Rule #8. Price Failure Rule; When prices fail to reach the ML as shown by a space between the P of reversal and the ML, the probability is that this price reversal will go further than it did on it's approach toward the ML.

In this example we can see that price failed to reach the red ML and has now started making lower highs. If I get the opportunity I’ll hide a stop behind the previous swing high and short to a double bottom area.

The red warning line could get in the way. I’ll consider moving to break even before reaching that.

DAX

The DAX is looking interesting for both longs and shorts. Wut? Bear with me.

The Long

I like the black fork. It has a nice center line, it’s A/B points are at major pivots and it’s C point now has a test and we are breaking minor pivots. If price can make it’s way down towards the C point and offer a tight stop I’ll be considering going long. Break even before the blue MPL (multi pivot line).

The Short

Whether or not I get the opportunity to take the long trade described above, I’ll be looking to go short around the black ML. Depending on time, price could reach the ML at close to the same levels as the wide range bar (WRB) that zoomed the blue MPL. Considering the trend is now down, I’ll be comfortable acquiring some risk with a stop behind the WRB.

Final Thoughts

It’s Monday today, and so far it’s been largely smaller timeframes catching my eye. If that trend continues I expect the Trading Report I write this weekend will have a few more trades for us to get into.

If you appreciate this post please give that upvote button a click. It encourages me to keep doing this. Of course please leave a comment sharing your own thoughts. Markets are fascinating and I welcome any and all discussion on them.

How long have you been trading forex? Any tips for first timers who are interested in it?

About a year ago I made trading a serious focus in my life. I've been dabbling for nearly a decade on and off though, so it's hard to gauge.

Tips for first timers? Understand that trading is probably one of the hardest thing you'll attempt in your life. You should be intimidated.

Great. Thank you for the candid response. I'm sufficiently intimidated now. lol

haha.

Trading is more about risk and personal management than about reading indicators. Hunt down Andrew's Action Reaction Course. It's pretty ancient and available for free online. Then Dig through all the Market Geometry blog posts and free videos.

Learn your workflow with a demo trading account and once you have a good idea about what you should be doing, throw a thousand dollars at a broker and start practicing for real.