AUD/USD Rolling Over During Wednesday's Asian Session

Remember how we spoke about DXY support coming into play and brought up the idea of playing AUD/USD from the short side to take advantage of it?

Here's a little refresher extract from the blog I've linked to above:

If we're taking this as support holding, or at least looking like holding, then shorting the majors comes into play.

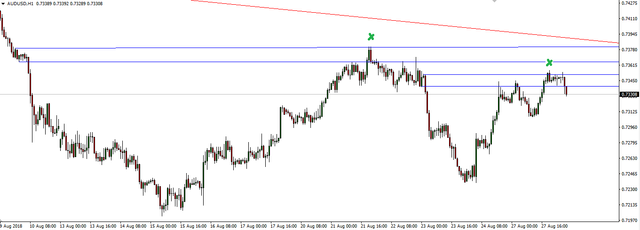

Taking a quick look at where each pair is sitting, it's the Aussie that caught my attention the most. Check out these intraday areas of previous support turned resistance that price has been reacting around:

That latest one is pretty nice. Let's see what sort of follow through we can get here, because if the DXY goes through support at the London open, it's just as likely to ping back, but for now it looks a good setup.

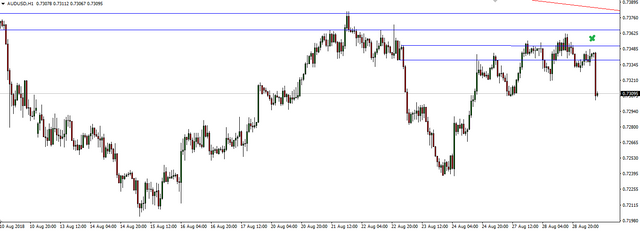

Well after hovering around at resistance for the last 24 hours, the Aussie has just rolled over. Take a look at the updated hourly chart below:

We're sitting at about 1:1 right now so manage your trade according to your own risk management profile.

It looks like we can put the drop down to Westpac hiking mortgage rates independently of the RBA. Something that is sure to go over well with borrowers...

It's now likely that the other Big 4 banks will follow suit and that the RBA most likely wont touch the official cash rate as a result.

The RBA asleep at the wheel it seems.

Best of probabilities to you.

@danewilliams | Steemit Blog

Market Analysis

Twitter: @danewilliamsau