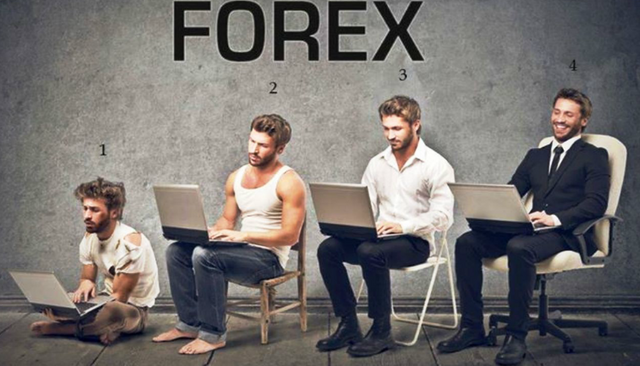

First step of a Forex Trader

Increased volatility leads many traders to seeing an increase in trading opportunities. The huge market swings trigger thoughts of monumental upside, but also for potential loss especially if traders do not take the necessary precautions. During times of volatility, traders need to adjust their strategy to compensate for erratic market. When trading during these market conditions, traders should follow the rules below.

1. Be More Selective Before Placing Trades

Wanting to take advantage of all the trading opportunities that present themselves in volatile markets, traders are tempted to place an increase number of trades. This temptation should be avoided. It is important to remember that in volatile times, losses are likely to be big. Before placing a trading, assess risk tolerance levels. Determine the level of risk that is acceptable for the trader both psychologically and financially before placing any trades.

2. Use Less Leverage

During high market volatility, losses can be traumatic. With the average trading range increased in volatile times traders should be considering how leverage will affect trades. At a one percent or even a half percent margin, investors should be mindful of how much leverage or even the size position being traded can affect their portfolio. In normal market conditions, placing a 2 lot position is fine when you are looking to make about 50-100 pips. During a more volatile time, when the potential loss is 100-200 pips, it stops being an effective risk to reward ratio. To compensate traders should look to taking on smaller trading positions, in this case only one lot as opposed to the average 2 lot position.

3. Trade with More Discipline

Traders should always follow their predetermined trading strategy regardless of market condition. During volatile markets, this is even more important to use that same level of restraint. Traders must adhere to any set stops, contingency plans or risk management benchmarks without hesitation. This will help to define how much risk is taken should price action be uncontrollable. Without this level of discipline and self control losses can be great.

4. Tighten Stops

Many traders are hesitant to use tighter stops in volatile markets because they see the large swings increasing the likelihood that the position will be taken out. Having tighter stops can also provide great risk managers in times of extreme volatility. For example, on a EURUSD trade, rather than setting an 80 pip stop to protect your position, consider placing a 50-60 pip stop. This will insure the protection of your currency position and if the stop is broken, there is a high likelihood that the trend will continue lower and the stop took you out before you could potentially lose more money.

The width of the stop being set does depend on the currency pair being trading as some pairs have wider ranges. In a Yen cross like the GBPJPY or AUDJPY, traders may be more likely to have wider stops as their average daily range is 50% more than that of the EUR/USD. With that said, stops during volatile market conditions should not as wide as before. Instead of a stop 100 pips below entry, traders may consider a 25 pip reduction and have a 75 pip stop. Below is a chart showing the EURUSD and the GBPJPY on the same very volatile day in the forex market. The EURUSD had an impressive range of nearly 600 pips! The GBPJPY far dominated though with nearly a 2000 pip trading range.

5. Be Prepared

It also helps a trader to know what is causing the current spate of volatility in the markets in order to be prepared for the unexpected. As such, an investor can accommodate their strategy to the market environment and not just the currency pair being traded. The first of these considerations is accounting for emotions in a market: is fear currently driving the market lower? Or is it buyer's mania that is keeping the bullish tone alive? Traders' overreaction and emotion tend to push markets to overextended targets. This fact alone creates volatility through simple supply and demand.

Volatility can also, and more than likely will, be sparked by economic events. In this instance, market participants may interpret fundamental data differently and not as cut and dry as the more novice trader. A perfect example of this is usually monthly manufacturing reports that are released in pretty much all industrial economies. The classic scenario has the market honed in on a particular number for the month. However, traders young and old will sometimes wonder why the market sold off if manufacturing showed positive growth. The answer is simple. The market had a different interpretation and positions were violently reshaped and shifted. These tend to create great opportunities for some and horrible memories for others. Below is an hourly chart of the EUR/USD during ISM Manufacturing for October 1, 2008. Here we can see the huge price gap that occurred due to market volatility as well as the resulting trend.

Panic and erratic momentum can additionally be found in certain market environments. Not to be confused with fear or greed, panic selling and buying can create very choppy and relatively untradeable markets. These conditions will lead some to flip flop their positions while leaving others gaping at the fact that the position was right, only to be stopped out prematurely. These two common examples will create further panic and volatility as traders abandon their own individual strategy for the possibility of instant profits or stoppage revenge. As a result, a vicious cycle of volatility ensues until a definitive market direction can be established.

The simple rules above, and a task of getting to know the current trading environment, can empower every trader through the ranks. Although some relate volatility with difficult and untouchable markets, opportunities continue to remain abound in these less than attractive conditions to those focused and fortunate.

By following these five simple steps, trading in volatile market conditions should be a little simpler. Don't forget to adjust leverage based on volatility, follow your trading plan, tighten your stops and know why you are getting into a trade before you place it.Being a successful Forex trader takes more then just having money, time and desire. The more you realize it, the better are your chances of making it big in this wonderful business.

1. Your psychological state of mind is more important than your dollars.

Yes, that is correct. For example, entering a trade when you know you should not enter it and ultimately losing money on it will cause you a financial loss which hurts but can be recovered in the next trade or two. However, it will also cause you a psychological loss in the form of future fear and insecurity. This, will take more than one or two trades to recover!

2. This one is simple but you would not believe how many traders do not follow it.

In bear markets sell the markets that show most weakness. Don’t try to outsmart the market. If the market is telling you "I am weak" don’t argue and just follow! If the market tells you "I am strong", BUY and continue BUYING!

3. Don't ever try to pick absolute tops and bottoms.

I know of traders that have an addiction with this. They always look to pick the absolute bottom or top and ride the market on the reversal. They succeed one or twice but eventually suffer a big hit. If you can't help it and you want to try and look for those huge turning points in the market at least use some sort of confirmation. Don't just guess "this is the top" or "this is the bottom".

4. Trading runs in cycles. There are good day and bad days, there are good weeks and bad weeks, there are good months and bad months. Don’t let a bad day, week, or month put you down. Learn not to measure results in the very short term. Many traders give up after having three or four bad days. Don’t! Know that its part of the business. Hang in there, manage your money well, be persistent and I promise you it will pay off!

5. Remember what type of trader you are and follow the rules of that specific method of trading.

For example, if you are a day trader it would be wise to ignore the fundamental picture. It would also be wise to analyze and trade with the appropriate time frames. Also, select a broker that offers tight spreads, provides good order fills and guaranteed stop losses (all important for effective day trading). If you are a swing trader it is important you look at the much bigger picture. Sometimes fundamental market data can come in handy (although I personally prefer to look at the technical picture alone). Learn to be patient, both in terms of your profit target being reached and entering trades (for swing traders it can be weeks with no trade signals).

6. KEEP IT SIMPLE!

Don't think that the more indicators and patterns you use the more profitable you will be. My trading strategies are simple BUT original. I learned through time that the true gems in the market originate from simplicity. This is an important concept, don’t dismiss it.

7. Never ever add to a losing position.

I think this is one of the biggest "diseases" traders have. A stop loss is like a red light, it's not a suggestion. It tells you to get out of the market not to add more money to the trade. It simply makes me angry to see people adding money to a losing position. It has no justification except one. HOPE! They don’t say "gee, I was wrong and should have exited in my stop loss level", they say "I am correct about the direction of the market, it's just that my stop loss was placed to close to my entry. If I hang in there and add more money the trade will surely go my way and I will not only make for the loss but I will make much more since now I am adding to my position at a much better price!".

8. Be patient with your profit targets.

I know it is very tempting to grab the profits in a winning position before the profit objective is reached. There is a fear the market will turn around and the trade will become a loser. Be disciplined. There is a reason your profit objective is where it is. You did your homework before entering the trade and the profit objective you decided on justifies the trade in terms of risk/reward. Frequently take profits before the profit objectives are reached will destroy your whole risk/reward ratio and will finally be the difference between success and failure.

9. 95% of traders are not disciplined and that is why they do not succeed.

They always know better than their system, they always know better then what the market is telling them. Be amongst the 5% disciplined traders and I guarantee you will be light years ahead of the crowd.

10. Think, analyze, and create BEFORE the trade.

During the trade only follow what you though, analyzed and created before the trade. Before you enter the trade you are cool and balanced, you are thinking logically. During the trade you are under fire since money is involved. You are under pressure. What makes you think that you can make better decisions under intense fire then when you are calm and balanced? You can't. That is why you planned the trade before hand. Follow your plan!

11. Don’t favor sides.

Trading is about recognizing long and short opportunities. Many people have the problem of shorting. They have the problem of profiting when the market is going down. They are taught through life that you make money when markets go up. As a currency trader you don't care if the currency market is going up or down, if there is an opportunity to make money you take it, that’s your job.

12. Trade a method that fits your personality.

If you are like me and like hearing the cash register ring often then use day trading strategies. If you don’t mind waiting for profits to accumulate over time then consider using swing trading strategies. This is very important. Trade with what best suits your character. Be true with yourself and recognize what are your needs. My need is the gratification that frequent profits provide, no matter how small. It keeps me going.

13. As forex traders we can never know what price is to "low" and what price is to "high".

Don’t be afraid to join a trend. I know that psychologically this can be difficult sometimes. You are always afraid that you will be entering the trend at it's end. This rule is important but must not be followed blindly but rather smartly. Suppose you are day trading the EUR/USD. You know that the average daily range of the pair is 90 or 100 pips. If your system is telling you to go long at a point where the market has already moved 80 pips and place a profit objective of 50 pips, would that be a smart move? Obviously not.

14. Know the personality of the currency you are trading.

Each currency pair has its own individual "personality". This can be in terms of volatility, spread, average daily range, liquidity, specific patterns etc. Use trading strategies that go hand in hand with the characteristics of the currency pair.

Remember, 95% of traders don’t follow these rules. Be amongst the unique that do and use a good trading method/system. Your success will come faster than you think.

Congratulations @carelesstrader! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPYou write that?

Congratulations @carelesstrader! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP