Theory trendline John Hill - A new Price Action

This theory comes from John Hill

This theory is based on the trendline, a tool used to analyze basic techniques that traders must grasp.

The author marks the swing high, swing low points, and draw a trend line connecting these points to the trade.

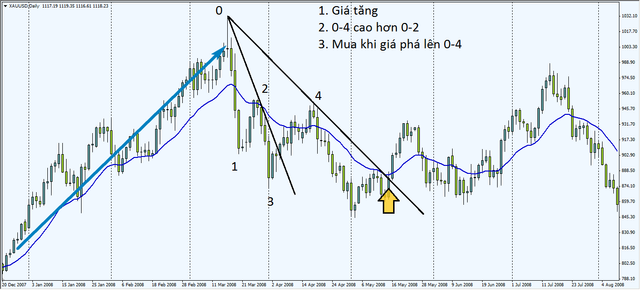

Illustrate how to trade:

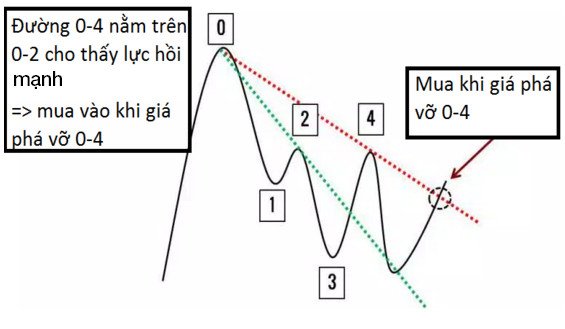

Where you buy into:

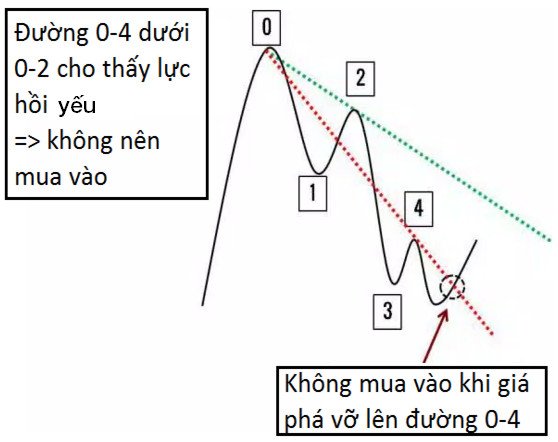

Where you do not buy on:

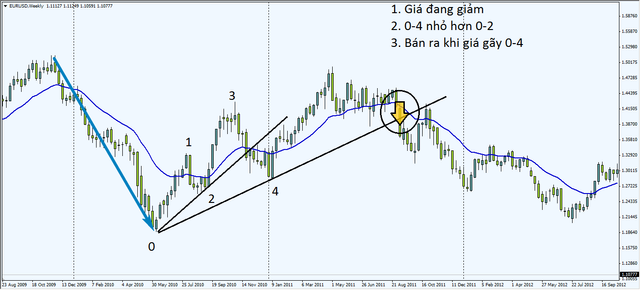

Sell out the reverse.

The basic principle of this trendline method is based on the power of waves to determine whether to enter or not. In the above two illustrations, in case of not buying, the wave can be 3-4 weak and therefore, should not go when it breaks the up trendline, because at this moment the buying power is no longer. Conversely, in the case of buying, the 3-4 wave is stronger than 1-2, so we "swing" is reasonable.

In summary:

BUY INTO:

Price increases

Road 0-4 is higher than road 0-2

Buy when price breaks up to 0-4

SOLD OUT:

Price decreases

Road 0-4 is lower than 0-2

Sell when prices break down to 0-4

Summary:

In an uptrend, prices need to break to 0-4 to buy

In downtrend, the price should break down to 0-4 for sell

Some examples from forex:

Note about having to trend before creating adjustments. If there is no trend, then it will not work

This is a complex pullback, which is a harmonic or elliott wave, even a price action.

Any method can cause a loss, even serious. Find out thoroughly and demo before trade real.

Good luck.